Trending Project: Frax Finance (FXS)

- Ticker: FXS

- Sector: DeFi - Stablecoins

- Network: Ethereum

- FDV: $600M

- Hotness Rating: 🔥🔥🔥

Tl;dr: Frax Finance’s FXS spikes on the back of new liquid staking + lending products

Frax Finance is a hybrid stablecoin protocol that leverages both collateralization and algorithmic mechanisms to maintain its peg. The project is in the limelight due to the launch of two new products in recent weeks: a liquid staking asset (frxETH) and a lending platform (FraxLend).

frxETH is an ETH-backed stablecoin meant to act as Frax’s ETH stablecoin, fully backed 1:1 by the AMO and staked ETH. With it, there’s also sfrxETH which is the staked version of the asset, which accrues all of the validator rewards, including MEV. The other major product launch – FraxLend – happened last month. FraxLend is meant to act as the protocol’s native lending and borrowing platform where users can deposit a range of assets and borrow FRAX at low rates.

The through-line here is that Frax Finance is building towards owning the entire DeFi stack. They now have a stablecoin, lending and borrowing platform, an exchange, and soon, a liquid staked ETH derivative. All of these products generate revenue to the protocol while driving adoption of the protocol’s native stablecoin, FRAX.

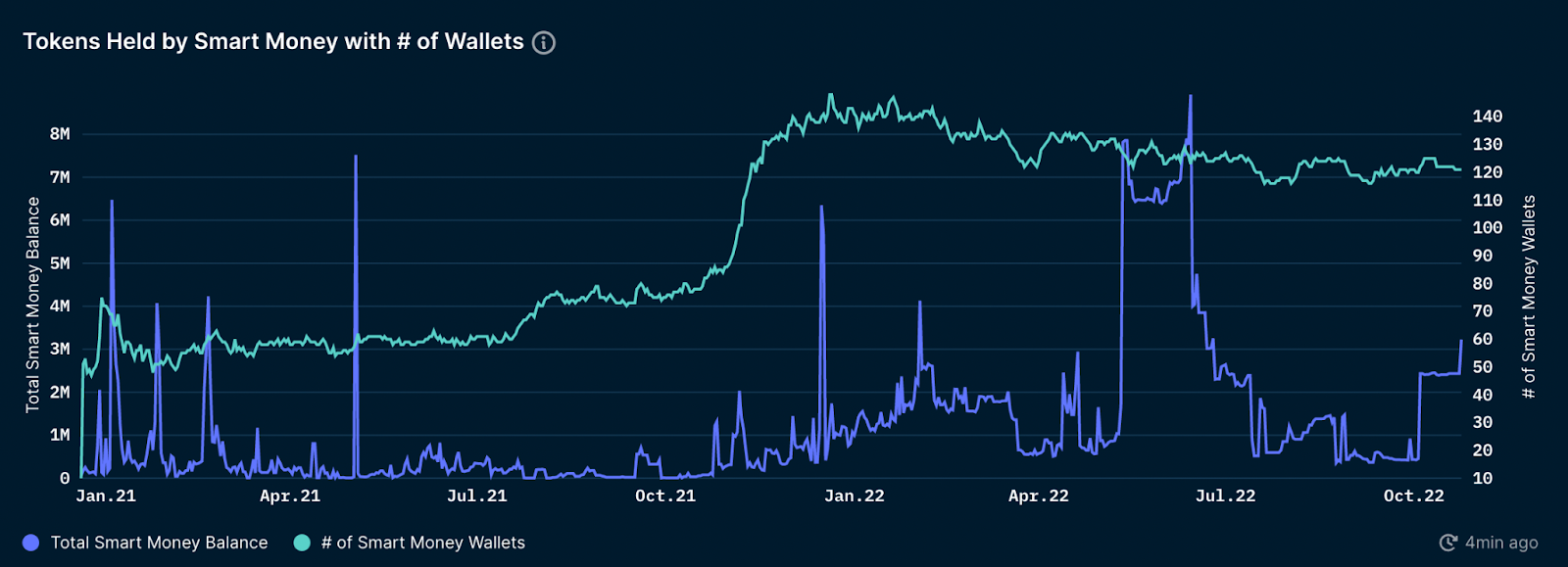

The strategy is beginning to work. In the last 30 days, we’ve seen a $4.3M increase in FRAX held by smart money — a jump from $500K earlier this month.

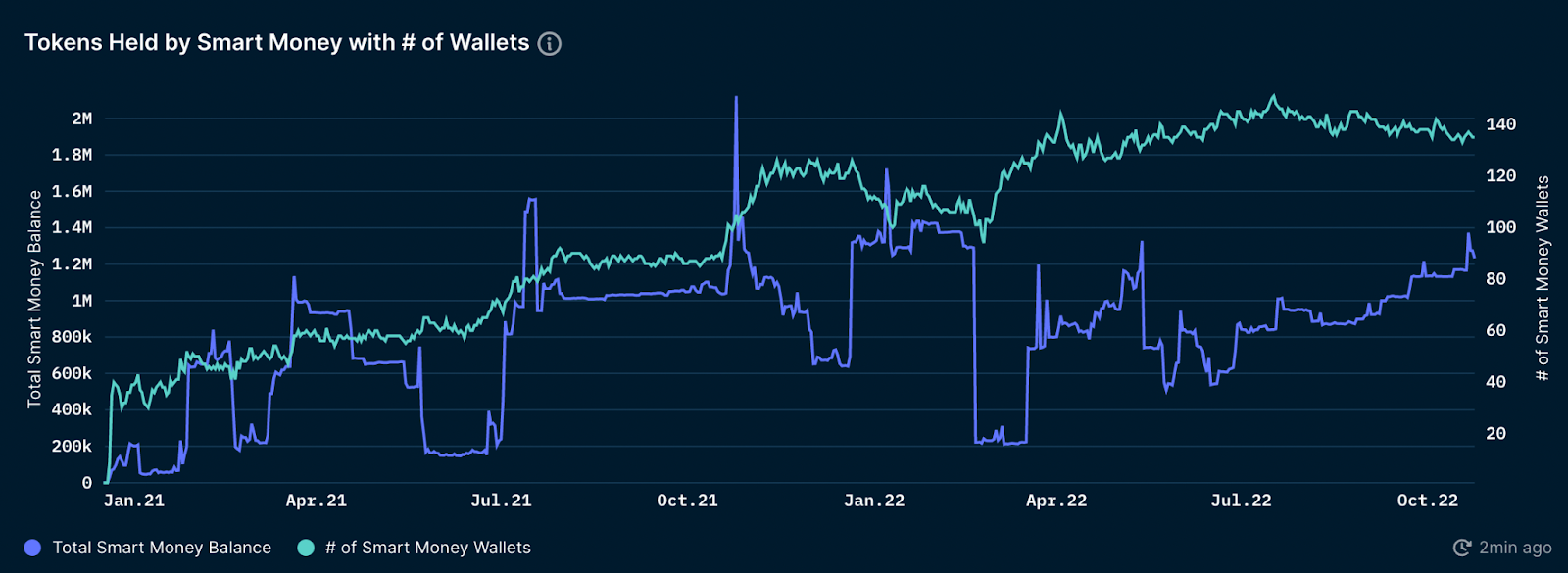

Chart from Nansen There’s also been a 47% increase in FXS held by smart money, rising from 880K to 1.3M FXS.

Chart from Nansen As a result, the price of FXS has increased by ~40% in the past month as smart money flows in and the community prices in the new product launches. Frax Finance is definitely building in the bear market, but how these products will perform and how it drives adoption/revenue to the protocol is yet to be seen.

Price chart from Messari