Trending Project: Euler Finance

- Ticker: EUL

- Sector: DeFi - Lending

- Network: Etheruem

- FDV: $166.03M

- Hotness Rating: 🔥🔥🔥

TL;DR - A new money market is challenging Aave and Compound.

Euler is a decentralized money market where users can collateralize and borrow against their assets. Euler utilizes a tiered system when listing new assets, where tokens are assigned either an isolation tier, cross-tier, or collateral tier rating. Any isolation or cross-tier asset can be lent or borrowed while only assets in the collateral tier can be used as collateral. This structure allows Euler to support borrowing the long-tail of assets, many of which are used to short or hedge yield farming positions, while not increasing the solvency risk for the protocol. Euler also has several other unique features, such as soft liquidations and built in UI support for entering different strategies such as long/short pair trades. The protocol generates revenue by taking a cut of the interest paid to lenders, and is governed by the EUL token, which is also used to vote on gauge emissions to different markets.

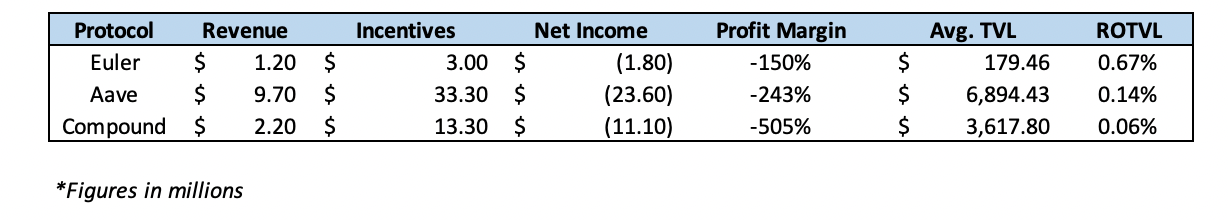

Euler has generated $1.2M in revenue over the past six-months, and grew its TVL 150.4% from $105.5M to $264.2M. The protocol spent $3.0M incentives over these two quarters, putting its bottom line at $-1.8M for the period.

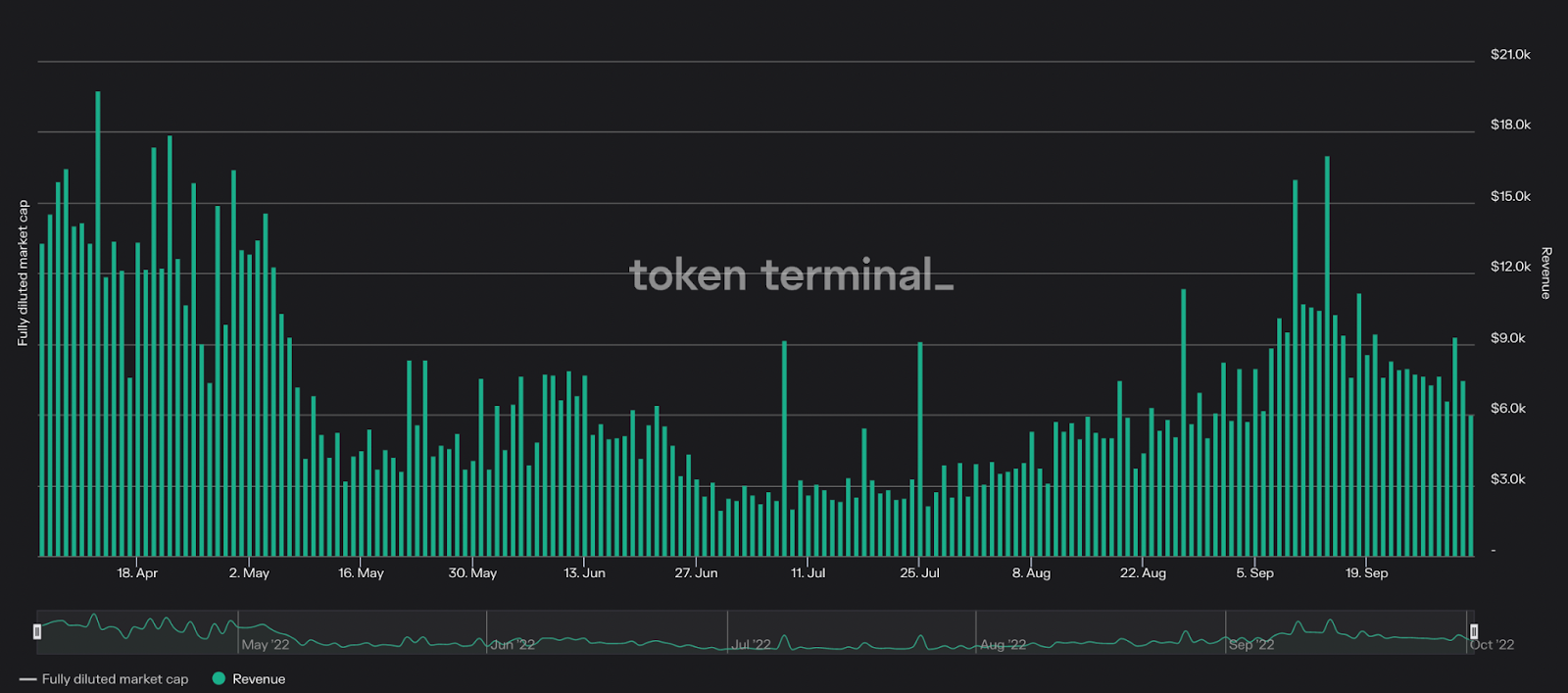

This growth has likely been fueled by new asset listings (Euler is currently the only platform where users can borrow stETH) as well as parameter changes that have increased competitiveness, such as raising the collateral and borrow factors for stETH to 0.87 and 0.91, which are the highest on the market. Euler revenues were also buoyed by lead-up to the merge, as the increased demand to borrow ETH to farm the PoW airdrop led to near-record high in daily revenues for the protocol.

Despite operating at a loss, Euler had stronger profitability metrics than its competitors, with a 6-month profit margin of -150% compared to -243% and -505% for Aave and Compound respectively. Euler was also able to monetize its TVL more efficiently than these rivals, as it generated a Return On TVL (ROTVL) of 0.67%, while Aave and Compound had an ROTVL of 0.14% and 0.06% respectively. This difference in per-unit profitability can be attributed to Euler’s focus on long-tail assets in which there is borrow demand, as this leads to higher utilization, and therefore higher interest rates and increased protocol revenues.

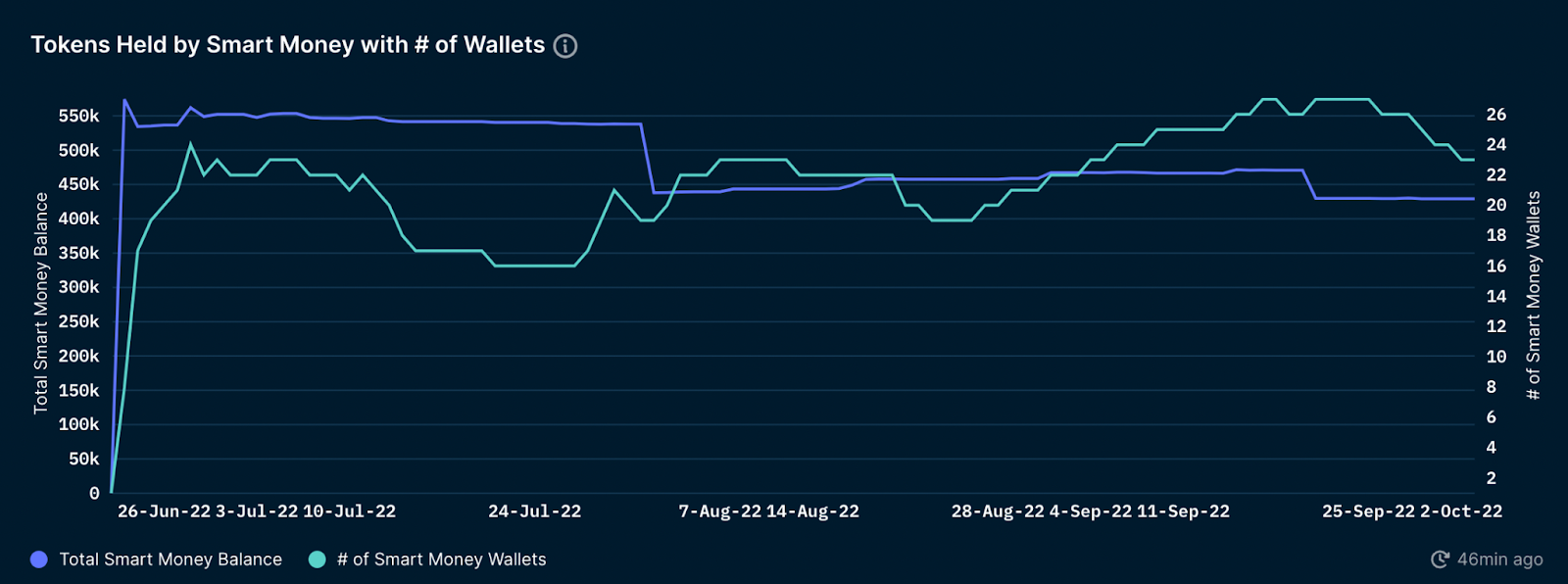

The price of EUL has risen 51.9% against USD and 33.3% against ETH over the past 90 days. Alongside strengthening fundamentals, this outperformance was also fueled by an August 2 EUL listing on Gemini, with the token soaring as much as 217% in the weeks following the announcement. Although Nansen Smart Money balances have decreased 27.5% since the listing, there are still some notable names within the EUL holderbase, such as Jump Capital, which holds $2.27M of EUL (1.45% of the total token supply) across two identified wallets and participated in a $32M funding round back in June.

Hotness Rating (🔥🔥🔥/5):

Euler is a unique, fast growing protocol that is, on a per-unit basis, more profitable than its larger competitors like Compound and Aave. Assuming its fundamentals continue to hold strong, the EUL token should be on investors radars moving forward.