Trending Project: Dopex (DPX) 📈

- Ticker: DPX

- Sector: DeFi - Options

- Network: Arbitum

- FDV: $259.5M

- Hotness Rating: 🔥🔥🔥🔥

The Arbitrum-native options protocol has been red hot.

- Dopex is an options protocol currently deployed on Arbitrum with $36.3M in TVL across its products. Dopex offers a suite of different products such as Single-Sided-Options Vaults (SSOVs), interest rate vaults, and straddles.

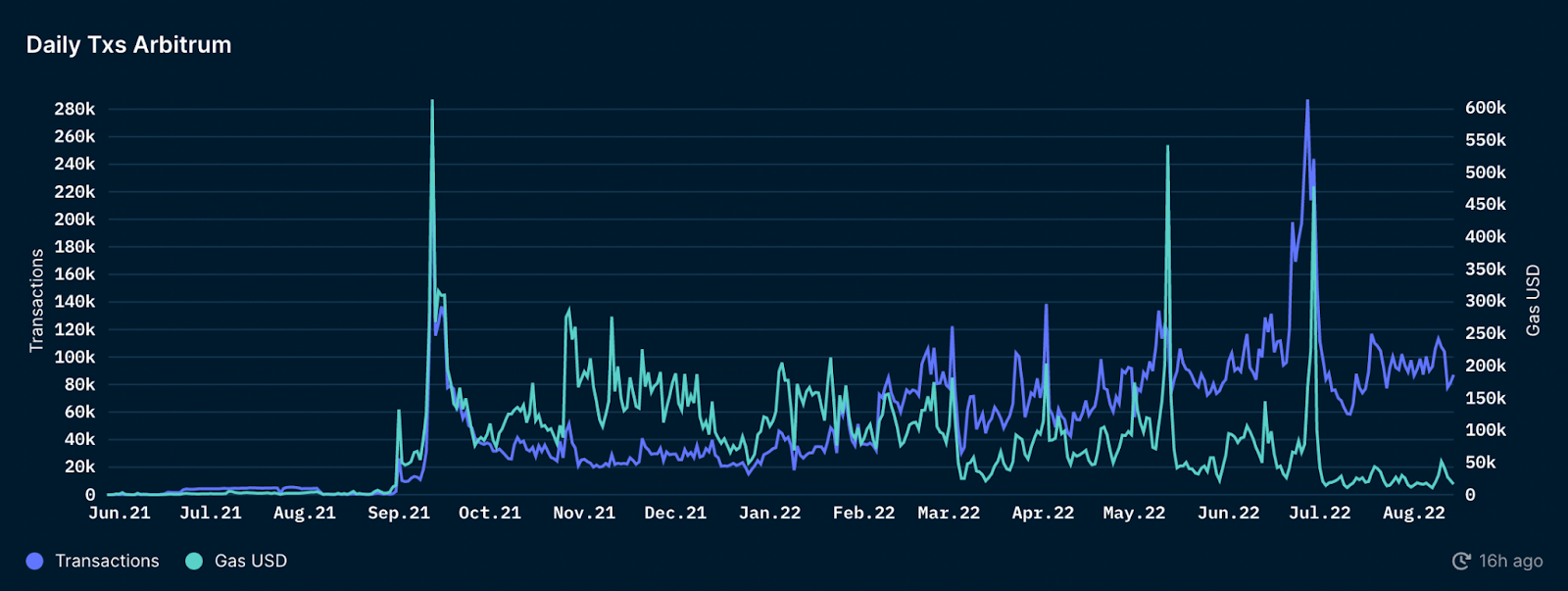

- The price of DPX has soared 123.9% in the past two weeks. This rise can likely be attributed to several factors, with one being the upcoming launch of Arbitrum Nitro on August 31. Nitro is an upgrade that will increase capacity on the rollup and lead to the resumption of Arbitrum Odyssey, a program designed to encourage the usage and adoption of protocols built on Arbitrum. Given the significant spike in activity during the initial launch of Odyssey that caused it to be postponed until after the launch of Nitro, it is likely that the event will bring in a significant influx of users and liquidity onto the network. As one of the largest protocols on Arbitrum, Dopex, along with other Arbitrum projects, is likely to benefit.

- Another reason for the recent outperformance of DPX is the August 8 launch of Atlantic Straddles, an options strategy that allows users to speculate on a token’s volatility. Atlantic Straddles are built using Dopex’s Atlantic Options, a unique primitive that allows the underlying collateral locked in options contracts to be borrowed and utilized by an options holder. Although straddles have only been rolled out in a limited state, there is currently just one ETH deployed vault, the market may be reacting positively to the successful demonstration of a use case for Atlantics.

Hotness Rating (🔥🔥🔥🔥/5): Dopex is poised to benefit from the upcoming surge in activity on Arbitrum as a result of Nitro and Odyssey. The protocol also has numerous catalysts on the horizon, such as the increased usage of Atlantic’s as well as their upcoming dpxUSD stablecoin. Because of this, investors looking to get exposure to Arbitrum should have DPX on their radar.