- Ticker: dAMM

- Sector: DeFi - Credit

- Network: Etheruem

- FDV: $60.1M

- Hotness Rating: 🔥🔥🔥

TL;DR: A new credit protocol breaks onto the scene.

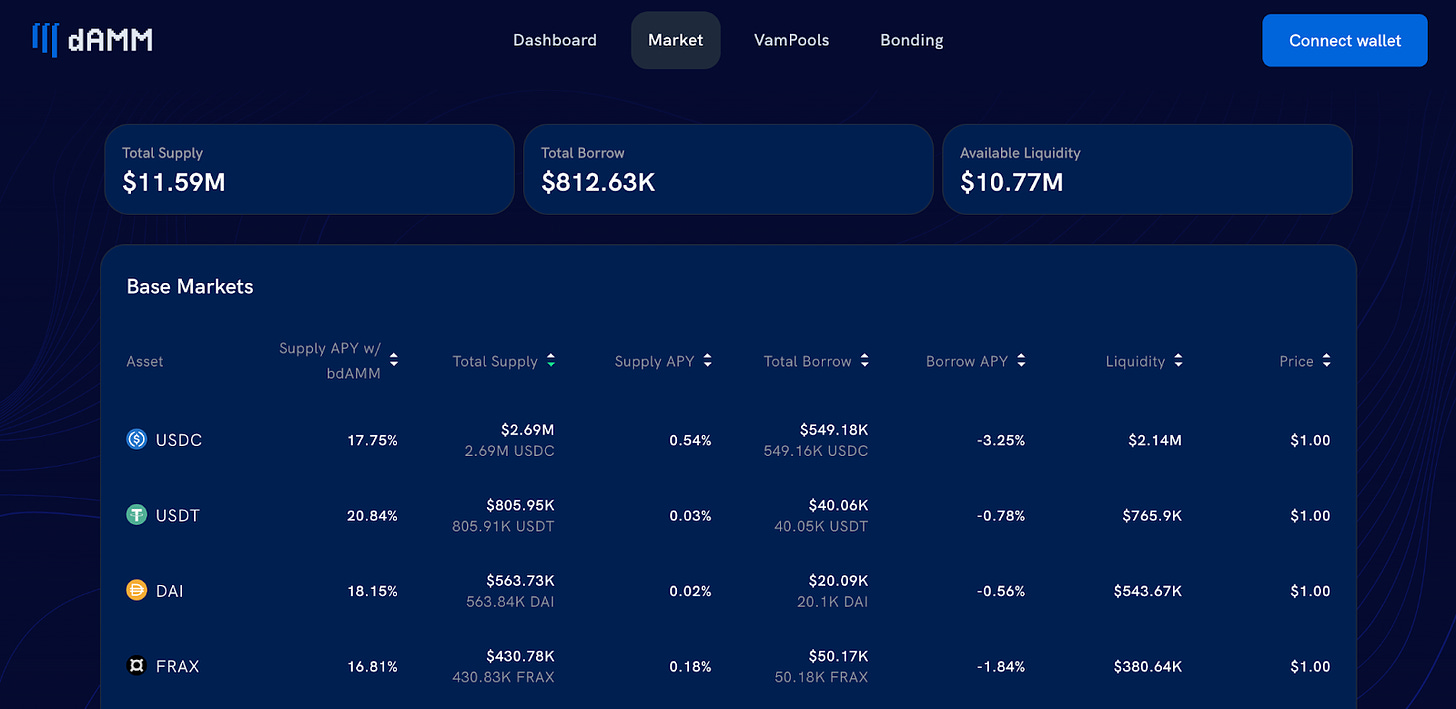

dAMM Finance is a credit protocol. On dAMM, whitelisted institutions can take out under-collateralized loans to be used for purposes such as market making. The protocol differentiates itself from competitors Maple, Clearpool, and TruFi in that it offers borrowing for the long-tail of assets, rather than a single one like ETH or USDC, with interest rates determined algorithmically based on pool utilization (like Compound and Aave). Another notable difference is that, borrower creditworthiness is determined by the dAMM Foundation, rather than by pre-selected, individual pool managers. dAMM is governed by the DAMM token, which is used to incentivize liquidity and will accrue revenue from the protocol’s cut of lending interest.

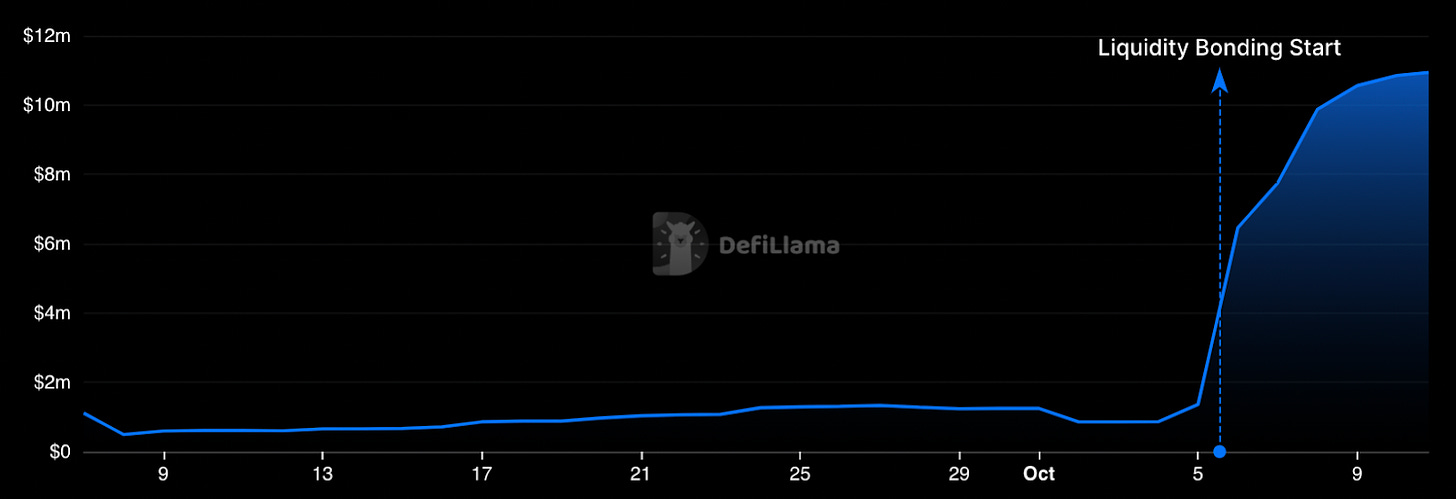

dAMM has attracted $11.5M in deposits to date across its base pools (pools that accept standard tokens deposits) as well as through VAMP pools, which are ones where users can deposit aTokens from Aave or cTokens from Compound. This growth has likely been fueled by the launch of token incentives via dAMM’s unique reward mechanism known as liquidity bonding. Liquidity bonding is similar to Olympus Bonds in that the protocol itself is able to accumulate assets by paying out rewards to yield farmers via discounted tokens in the form of BDAMM (bonded dAMM). Currently, yields on dAMM for USD and ETH currently range between 10-35% depending on specific stablecoin and pool.

Following an initial spike to $0.75 following the launch of liquidity bonding on October 5, the price of bDAMM has since fallen ~68% to $0.24. This is likely due to sell-pressure from yield farmers harvesting token rewards, as the protocol is offering boosted farming rewards during the month of October.

Hotness Rating (🔥🔥🔥/5):

dAMM is an intriguing new entrant in the fast growing DeFi credit sector. Although earning high yields on the protocol requires taking on the commensurately high risk that comes with making undercollateralized loans to off-chain entities, dAMM could be an intriguing farm and accumulate opportunity for risk-hungry degens.