Trending Project: Chainlink 📈

Analyst: Lucas Campbell

- Name: Chainlink

- Sector: Infrastructure

- Network: Ethereum

- FDV: $6B

- Hotness Rating: 🔥🔥🔥

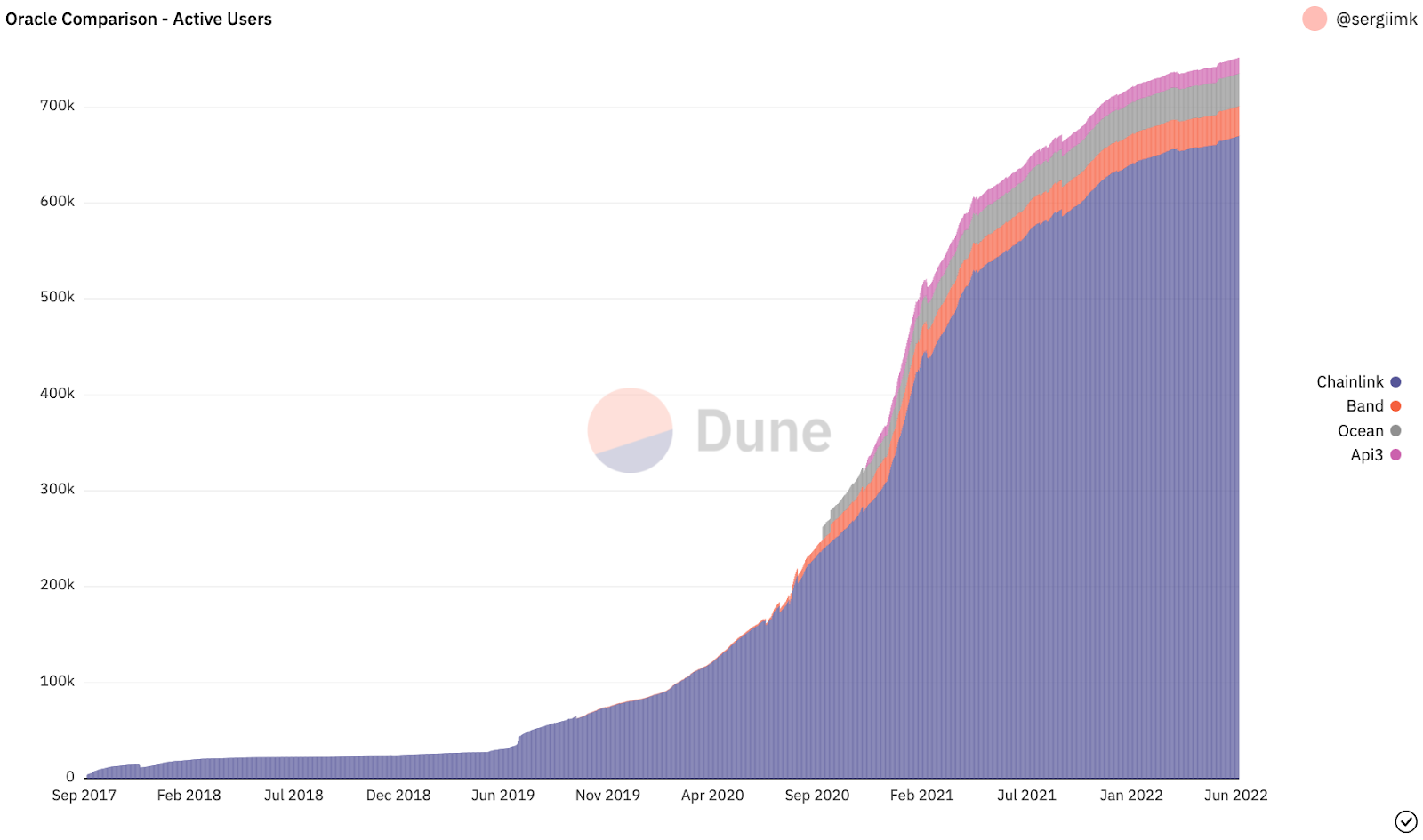

Chainlink is a decentralized oracle network providing critical infrastructure for smart contract platforms. This includes data feeds (like assets prices) and Verified Random Functions (VRFs) for applications that rely on a randomly generated outcomes. The protocol is by far the market leader in the oracle sector, securing tens of billions of dollars in value across the ecosystem.

Last week, Chainlink released their roadmap for staking and improving token economics. The roadmap outlines their phased approach to introduce LINK staking for node operators, LINK emissions for node operators, revenue sharing for stakers, and more. This will all be released on a phase approach–similar to previous Chainlink product launches–as outlined in the graphic below.

Staking brings a handful of benefits to the Chainlink ecosystem. This includes (1) High user assurances from node operators as that node operators who don’t fulfill their oracle service agreement have the potential to get LINK slashed. (2) Increased community participation as node operators and community members can stake and delegate their LINK. (3) Earn a revenue share for providing a service on top of the targeted 5% rewards rate from emissions.

Overall, LINK’s token economics have been one of the leading reasons behind its bearish sentiment. Prior to the introduction of staking, LINK tokens were onlyu used as a payment mechanism to node operators. The addition of staking for node operators as well as the broader community, and embuing the token with economic rights, should bode well for the project moving forward.

Conclusion (🔥🔥🔥/5):

Chainlink is the leading provider for one of the most important pieces of infrastructure in the crypto economy. Given the project’s dominance on a fundamental level and the revamped token economic model, LINK is poised for a more positive future. It’s also worth noting that LINK was one of the top outperformers in the last cycle bear market in 2018-2020, where the token increased by ~1800% against BTC from January 1st, 2019 to the top in August 2020. Will we see a repeat?