- Ticker: GRAIL (Token not yet live)

- Sector: DeFi - DEX

- Network: Arbitrum

- FDV: n/a

- Hotness Rating: 🔥🔥🔥

Tl;dr: A new DEX has launched on Arbitrum.

Camelot is a decentralized exchange on Arbitrum, and supports trading over Uniswap-V2 or stableswap bonding curves. Camelot has several unique features, such as directional swap fees (trading fees that differ based on buys or sells) LP positions where users can lock their liquidity to receive boosted rewards, and “Nitro Pools” which are fixed-duration pools that allow for highly customizable rewards programs.

Camelot is governed by the GRAIL token. GRAIL can be staked for xGRAIL, a non-transferrable token that entitles holders to 22.5% of protocol revenue and the right to allocate emissions to different pools on the DEX. The GRAIL token is not yet live, but the protocol will be distributing 15% of its supply via a public sale on November 29.

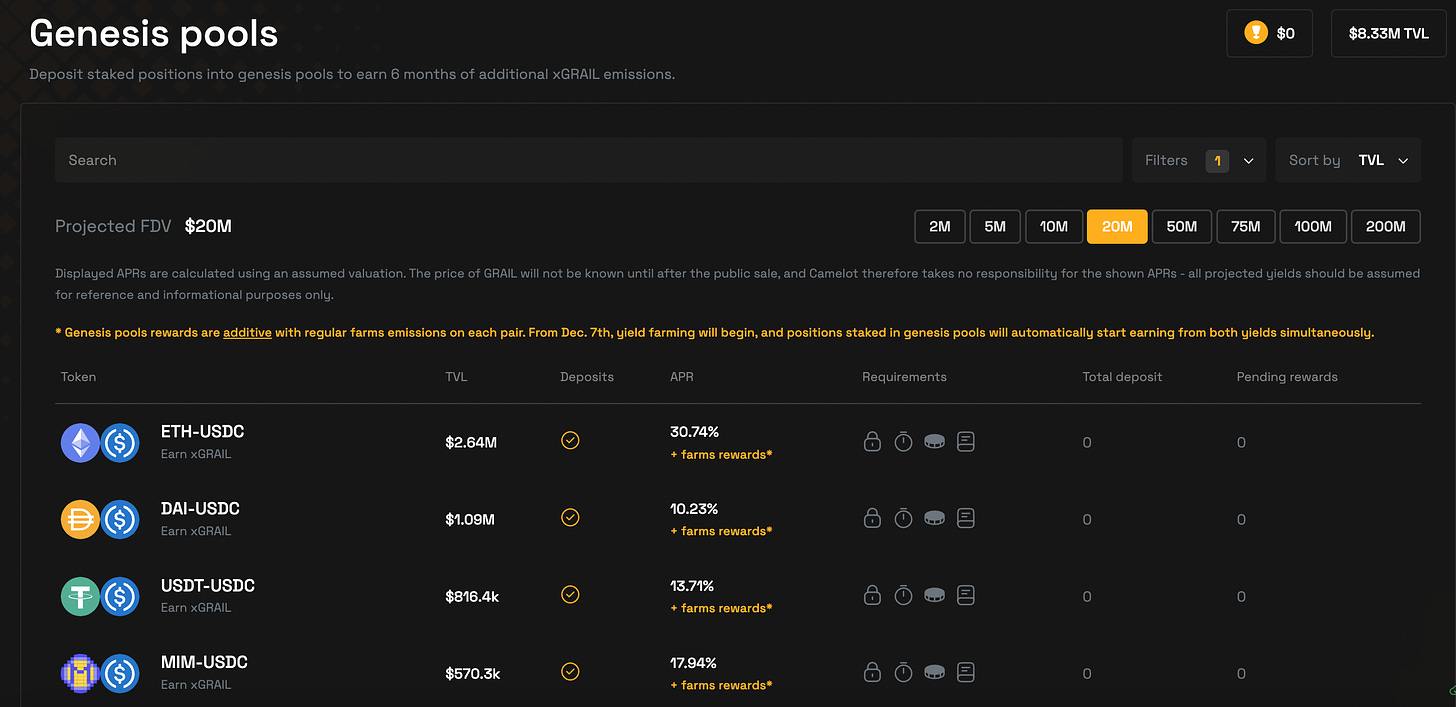

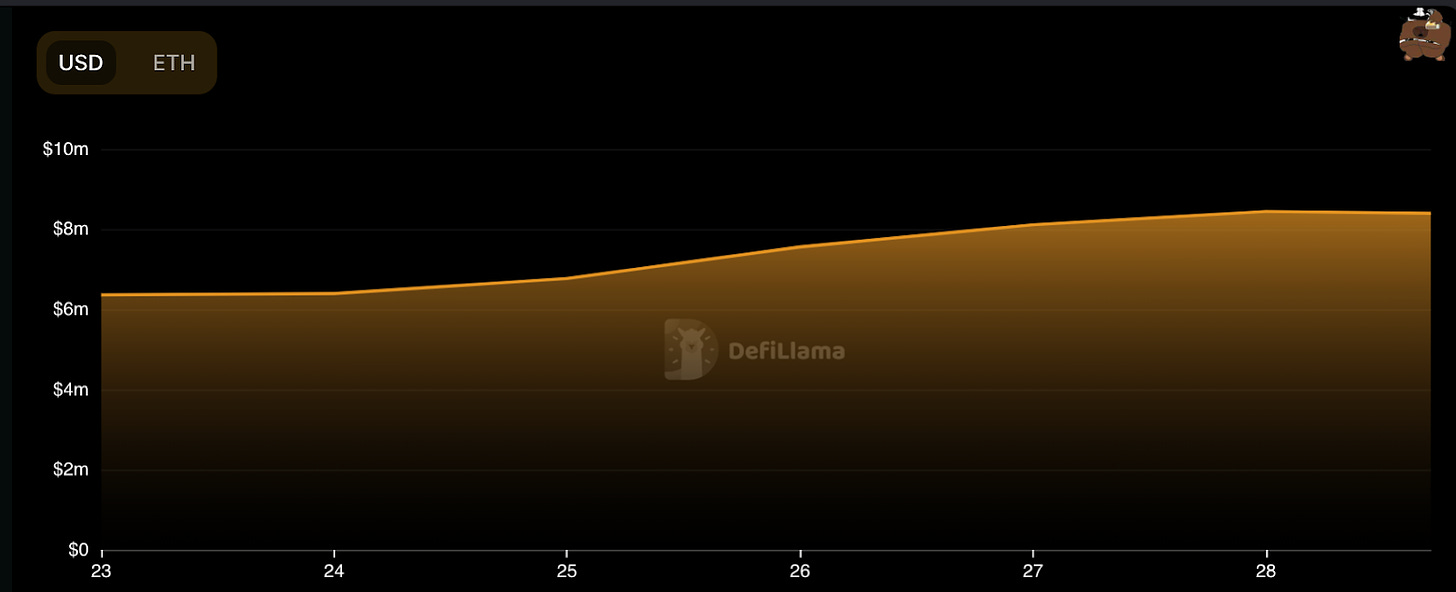

Camelot has attracted $8.5M in TVL since launching its Genesis pools on November 22. These pools are designed to bootstrap liquidity for tokens of several Arbitrum native projects such as GMX, Umami Finance, and Jones DAO as well as key trading pairs such as ETH-USDC and USDC-USDT. 5% of the total GRAIL supply will be allocated to Genesis Pool farmers, with users able to enter the pools until December 2. The rewards for the pool will be paid out in xGRAIL, which will vest over six months.

Despite launching less than a week ago, Camelot is currently the largest Arbitrum-native spot DEX by TVL, with more than double that of its closest competitor, 3xCaliber ($3.8M).

Native DEXs on new L1s and L2s have proven to be able to attract tens, and at times hundreds, of millions in liquidity, with Velodrome on Optimism (a network that has roughly 1/2 the TVL of Arbitrum) boasting a TVL of $67.8M. This means that should it maintain market share, Camelot has the opportunity to significantly grow its TVL, particularly after the resumption of Arbitrum Odyssey and the launch of the Arbitrum token, as these two events are poised to drive liquidity inflows into the L2.

Hotness Rating (🔥🔥🔥/5):

Although it's early days, Camelot was the early favorite to win the “Arbitrum-Native DEX Wars.” Given the large TAM of native-DEXs, Camelot could be an attractive “farm and accumulate” opportunity for risk-tolerant users seeking to gain exposure to the Arbitrum ecosystem. However, in the long-run, it's likely that the protocol remains a niche competitor to exchanges with a more capital efficient architecture such as Uniswap V3. Although the protocol has been audited, please do your own due diligence before aping!