Trending Project: BitDAO

- Ticker: BIT

- Sector: DeFi - Investment DAOs

- Network: Ethereum

- FDV: $3.5B

- Hotness Rating: 🔥🔥

Tl;dr: BitDAO is about to launch a major buyback program.

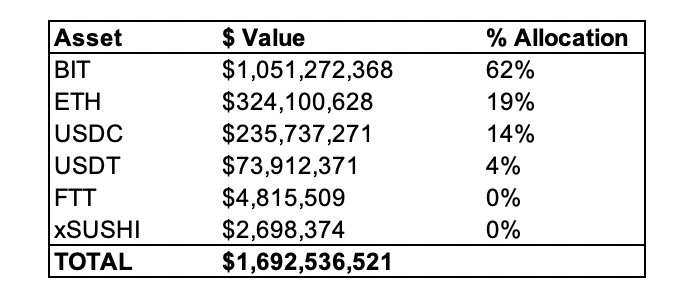

- BitDAO is a decentralized investment DAO governed by the BIT token. BitDAO has accumulated stakes in various projects through investments or token swaps, such as SUSHI and FTT (more on that later). The BitDAO treasury is among the largest of any DAO, with a NAV of $1.7B and $644.3M of non-BIT assets. The DAO has close ties to ByBit, with the CEX pledging to contribute 0.025% of futures trading volume to the BitDAO treasury.

- BitDAO recently passed a governance proposal (BIP-18) to initiate a $100M BIT buyback program as a means of returning some capital to tokenholders due to a lack of investment opportunities. The program will see the DAO purchase ~$2M of BIT for 50 consecutive days from January 1 - February 20, 2023, and at current prices would account for 26.7% and 2.9% of the tokens circulating and total supply respectively. BIP-18 passed with near-unanimous support, with 184M BIT voting in favor of the proposal compared to just 5 BIT against.

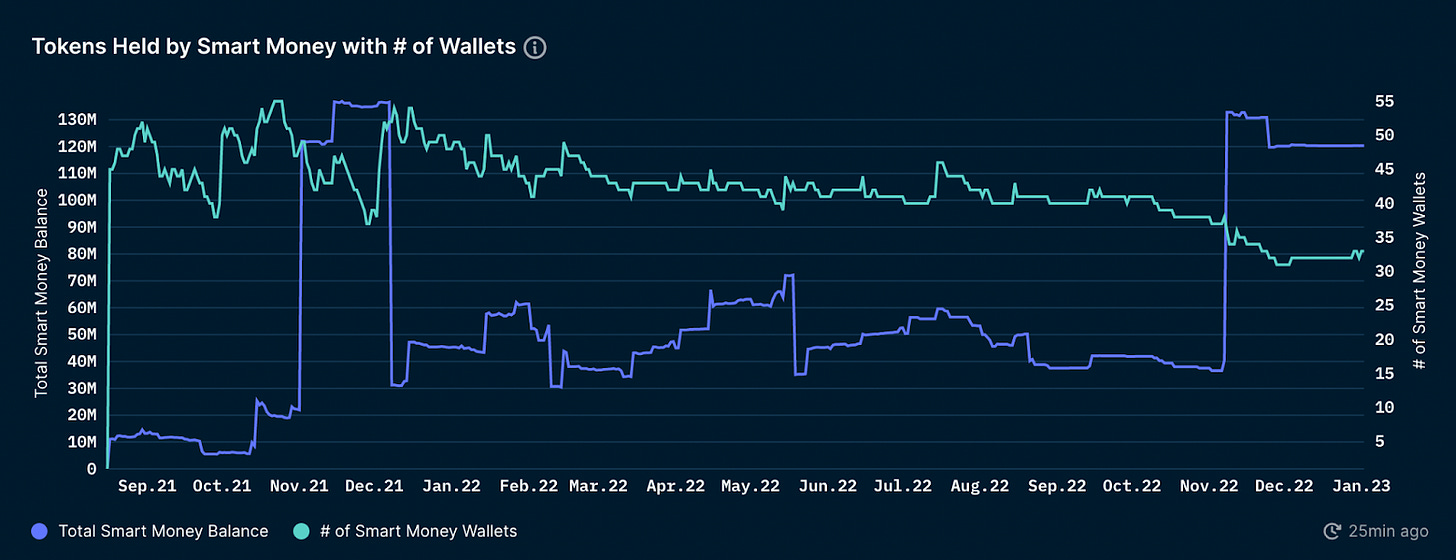

- The price of BIT has jumped 22.0% against USD and 23.8% against ETH since the BIP-18 vote began on December 23. Despite this, it does not appear as if “smart money” has been aping the news, with Nansen Smart Money balances having increased just 0.07% since the 23rd.

Hotness Rating (🔥🔥/5):

BitDAO is about to begin a major buyback program. While the perpetual buy-pressure over the next several weeks may help keep the price of BIT afloat, the DAO having telegraphed their intent may lead, or have already led, to traders pricing some of the move by front-running the purchases. In addition, BIT faces potential headwinds from Alameda Research’s $34.9M (100.2M BIT) position, which the now bankrupt hedge fund acquired via a 2021 token swap. This accounts for 1.04% of the total BIT supply and while Alameda pledged that they would not sell their tokens for 3-years, it seems unlikely that they will stick to their word. Because of these factors, traders may want to exercise caution if they are looking to capitalize on the BIT buyback.