Trending Project: Aave (AAVE)

- Name: Aave

- Sector: DeFi - Lending

- Network: Ethereum, Optimism, Arbitrum, Polygon, Fantom, Avalanche, Harmony

- FDV: $1.24B

- Hotness Rating: 🔥🔥🔥

Aave breaks into the stablecoin game with the reveal of GHO.

Aave is a decentralized money market upon which users collateralize and borrow against their assets. The protocol is the largest in its sector, currently holding more than $5.84B in value-locked across both its V2 and V3 deployments.

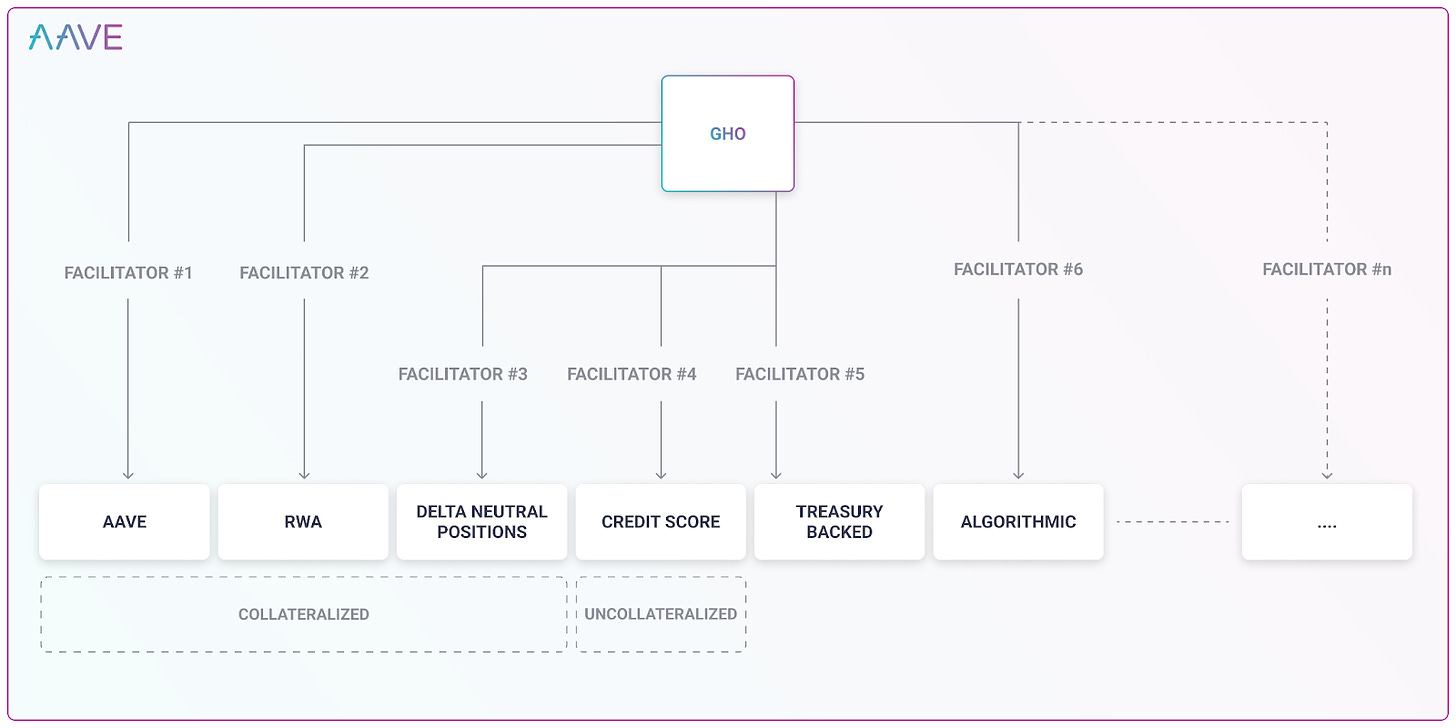

On July 7, Aave Companies proposed its plan on the protocol’s governance forum to launch GHO, a USD-pegged stablecoin. GHO will be fully-backed, with users able to mint the stablecoin directly into Aave from a select basket of collateral assets. In the future, GHO can also be minted through other means by entities known as facilitators.

Risk parameters for GHO will be controlled via governance, with AAVE holders able to vote on the stablecoins borrow rate, (and earn a discount on that rate themselves) as well as on the onboarding of new facilitators. All revenues from GHO will accrue to the Aave DAO.

AAVE has risen more 20.3% since the GHO forum post went live on July 7, compared to a 3.1% decline in the broader market. This outperformance suggests the market was receptive to the news, as GHO represents an opportunity for Aave to leverage their platform and user base to take share in the stablecoin sector, a $153.84B market with a long-term TAM in the trillions, as well as create an additional source of revenue for the DAO.

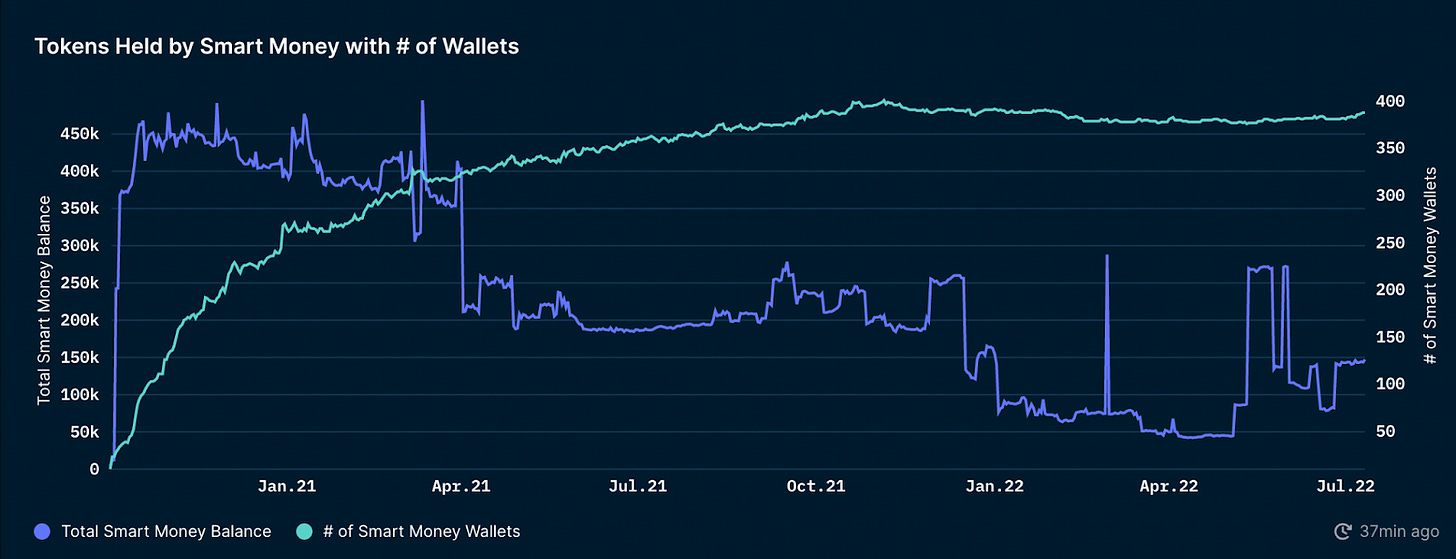

AAVE has also been the target of on-chain capital both before and after the GHO announcement, with balances of Nansen smart money addresses increasing by $349k in the past week and $5.13M over the last 30 days. This is the seventh and fifth largest increase of any asset other than BTC, ETH, or USD over these respective periods.

Hotness Rating (🔥🔥🔥/5):

The announcement of GHO represents yet another expansion for Aave as it breaks into the stablecoin market. Given the platform’s behemoth status in lending — as well as the ability via governance to offer highly competitive rates to borrow GHO on Aave — it seems highly likely that the stablecoin will be able to gain market share, as well as grow and diversify the protocol's revenues. Because of this, investors should keep Aave on their radar despite the bear market.