Treasury Company Cooldown?

View in Browser

gm Bankless Nation,

While crypto prices have undoubtedly had a tough summer, digital asset treasury companies seem to be faring even worse.

Today's Issue ⬇️

- ☀️ Need to Know: UNI's Moment

Uniswap Labs takes long-awaited step. - 🗣️ Analysis: Treasury Cooldown

Why are DATs down bad? - 🎧 Premium Feed: Base Layer for Rollups?

Espresso on the missing piece for cross-chain interop.

Sponsor: Frax — Fraxtal Ecosystem: Where DeFi Meets AI.

- 🦄 Uniswap's Hayden Adams Proposes Activating Protocol Fee Switch. The 'UNIfication' proposal would combine Uniswap Labs and the Foundation while flipping on the long-debated fee switch.

- 💰 Ethereum Perps DEX Lighter Raises $68M at $1.5B Valuation. The fast-rising trading protocol has captured the attention of Peter Thiel's Founders Fund and VC heavyweight Ribbit Capital.

- ⛏️ Public Bitcoin Miner CleanSpark Plans $1B Raise. The firm plans to fund share repurchases, data center growth, and debt reduction with the offering.

| Prices as of 4pm ET | 24hr | 7d |

|

Crypto $3.46T | ↘ 3.0% | ↗ 3.3% |

|

BTC $102,907 | ↘ 2.5% | ↗ 2.7% |

|

ETH $3,439 | ↘ 3.0% | ↗ 7.9% |

Digital asset treasuries have been one of the breakout stories of this crypto cycle.

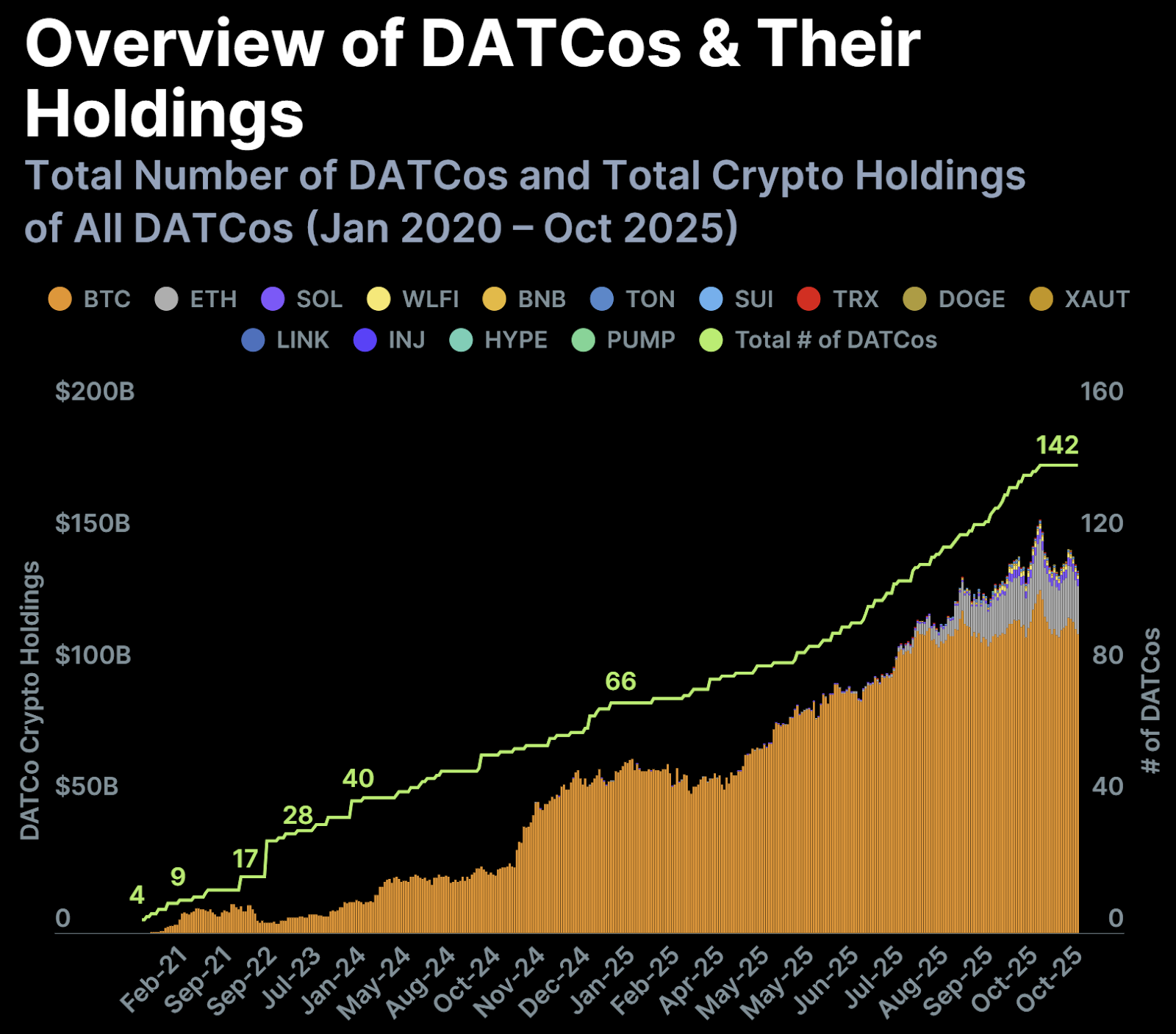

These publicly traded companies turned crypto accumulation into their single-minded focus and have piled billions of dollars into their digital assets of choice, from Bitcoin and Ethereum to Hyperliquid and even Tether tokenized gold! According to CoinGecko’s 2025 DATCo Report, 142 such companies existed at last count in October.

While DATs were all the rage earlier this year, increasing exponentially in count as new entrants glommed onto the trend using over a dozen different cryptocurrencies with hopes of replicating sizable share price pops, these stocks have largely since fallen to the wayside, particularly stunted by the weakness observed throughout crypto markets.

Today, we’re exploring why DATs continue to underperform and the dangers this class of publicly traded companies could pose if the tide turns. 👇

📉 DAT Slowdown?

It's no secret that crypto gains have had a muted 2025.

Although the industry had initially been inundated with slews of seemingly bullish headlines, as I highlighted last week, the total crypto market capitalization (TOTAL) is down against its stock market comparable (the S&P 500) on the year.

Majors Bitcoin and Ethereum are trading roughly at the same prices they were to start the year, meanwhile, many top altcoins have been indiscriminately rekt, with former favorites (including ATOM, ENA, PENGU, and WIF) down well over 50% year-to-date.

Yet, as crypto tokens repeatedly ran into sellers throughout the year, the DAT charts were largely up-only, both in terms of total number and the value of their crypto holdings.

For an extended period of time throughout the middle of 2025, pivoting to a DAT model seemed to be a no-brainer for sluggish public companies: share prices seemed to immediately rally after such announcements, creating multiples for company insiders overnight. In turn, the selected cryptocurrency unlocked a new source of price-insensitive demand from the DAT, which purchased as many tokens as accretively possible.

While this positive-sum relationship helped incentivize scores of companies to adopt DAT strategies in 2025, the mania appears to be cooling. Share prices for fresh DAT launches now predictably dump within days of launch, and some are even trading below pre-conversion prices...

For example, Bitcoin Magazine CEO David Bailey’s Nakamoto (a Bitcoin treasury company that trades under ticker symbol NAKA) is setting new all-time low prices just six months after becoming a DAT. This stock now trades 81% below its pre-conversion price after falling ~99% off its all-time high, which was set a mere ten days after its DAT announcement.

More recently, Forward Industries (a Solana treasury company launched in early September that was directly supported by the blockchain’s largest institutional investors including Multicoin Capital, Galaxy Digital, and Jump Crypto) is already 33% below its pre-conversion price after falling 75% off its all-time high, which was set just seven days after its DAT announcement.

DAT disillusionment appears to be evident in the numbers across assets, with the exclusivity premium ascribed to blue-chip Strategy (MSTR) seeming to fade alongside younger commoditized DATs.

💀 DAT Dangers

Shares in DATs can be compared to call options on the cryptocurrencies they custody; token price must be above a specific threshold on a specified future date, otherwise shares represent nothing as reserves must be liquidated to repay debts.

Fresh DAT launches have so far remained insulated from the widespread apathy afflicting liquid crypto markets. Nevertheless, persistent stagnation in crypto prices has started causing trouble for valuations across the innately time-sensitive sector.

DATs borrow money to amplify the potential returns they can offer shareholders. While this strategy makes sense when token prices outperform dollars, leverage quickly becomes dangerous to shareholder returns when the opposite is true.

Technically speaking, it is impossible to “liquidate” a DAT, as their leverage is created through the issuance of term debt, which does not need to be repaid until a specified date in the future. However, this does not mean that DATs cannot sell their cryptocurrency reserves.

Peter Thiel-backed ETHZilla offloaded $40 million of Ether reserves late last month to repurchase shares from investors. Likewise, Swan-sponsored Sequans sold 970 BTC just last week to prematurely pay off debt, marking the first time a BTC DAT has ever liquidated its reserves.

Additionally, although the current management teams for many DATs have expressed no intention to sell their cryptocurrency reserves, DATs (as public companies whose shareholders have rights) could be forced to entirely offload their treasuries in the event of a hostile takeover.

Crypto-natives are no stranger to similar “risk-free value” treasury raids, in which a majority stake in a struggling DeFi protocol is acquired with the intention of liquidating its treasury for more value than the protocol itself.

Should the hundred-plus DATs you’ve never heard of begin trading at extreme discounts to NAV as existing shareholders reject hopes of profit, other investors could step in, this time hopeful to turn a quick buck by liquidating the treasury and potentially further dragging down the underlying token price in their wake.

The Fraxtal ecosystem is expanding at lightning speed—this month’s biggest highlight is IQAI.com, the newest Agent Tokenization platform from IQ and Frax. IQ is building autonomous, intelligent, tokenized agents launching on Fraxtal in Q1. Empower on-chain agents with built-in wallets, tokenized ownership, and decentralized governance—all within a fast-growing Fraxtal ecosystem.

Ben Fisch and Jill Gunter from Espresso Systems join us to unpack how Espresso is building a new kind of base layer designed specifically for rollups.

Dive into why fast finality is the missing piece for cross-chain interoperability, how Espresso complements Ethereum rather than competes with it, and what a world of truly composable, instant Web3 apps could look like.

Listen to the full episode 👇

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. Additionally, the Bankless writers hold crypto assets. See our investment disclosures here.