US Treasury Sanctions Tornado Cash 🌪️

Dear Bankless nation,

Here’s a recap of the biggest crypto news in the second week of August.

Tornado Cash sanctions

Tornado Cash is a cryptocurrency mixer that lets users make transactions privately with zk-SNARK technology. Here’s how it works:

- I want to send you ETH privately

- I connect my wallet to Tornado Cash, and the platform standardizes all deposit transaction amounts for anonymity (e.g. 1, 10, or 100 ETH)

- I decide to deposit 10 ETH which goes into Tornado’s shared pool

- Upon deposit, Tornado gives me a key with a secret hash (called a “private note”) for later withdrawal

- I send you my private note

- You wait a day, then withdraw the 10 ETH with the private note to your wallet address

- A “relayer” charges you a small fee to send the 10 ETH to your wallet, then initiates the withdrawal pays the gas fee on your behalf

- You receive 10 ETH from me, and there is no on-chain link between both our wallets. Our transaction is completely private.

Tornado Cash is really useful if you value your privacy… or if you’re trying to conduct illegal (but not necessarily immoral) transactions.

For the latter reason, the US Treasury is slapping sanctions on Tornado Cash this week.

Actually, that’s not technically true. “Tornado Cash” is merely a bunch of open-source smart contracts running on a public blockchain. So the logic of sanctioning a smart contract is akin to sanctioning, say, a pool of water.

Our language obscures where the prohibitive burden of the sanction is falling on - it is individuals that are being forbidden from interacting with Tornado Cash, namely privacy-seeking Americans. If you mess with that smart contract, if you dip your toes in that water, you violate our political sanctions and go to jail, says the US Treasury.

In response, a swathe of platforms are quickly insulating themselves politically:

- Circle, the issuer of USDC, has moved to blacklist wallet addresses that interacted with the Tornado Cash contract. This is prompting discussions in the Maker community to reduce DAI’s reliance on USDC, and depeg the stablecoin altogether from the dollar.

- Github has removed Tornado Cash’s source code and banned source contributors (hence the need for decentralized alternatives like Radicle).

- Infura and Alchemy, centralized service providers that provide access to on-chain data, have blocked RPC requests to Tornado’s frontend. Even its decentralized alternative Pocket Network has similarly blocked the sanctioned list of wallet addresses from accessing its frontend Portal.

- dYdX are also blocking users whose wallet funds have directly interacted with Tornado.

The list (will) goes on.

The US Treasury points to illegal money laundering for slapping sanctions on Tornado Cash, citing the North Korean linked Lazarus Group hackers that has laundered about ~$561M through Tornado.

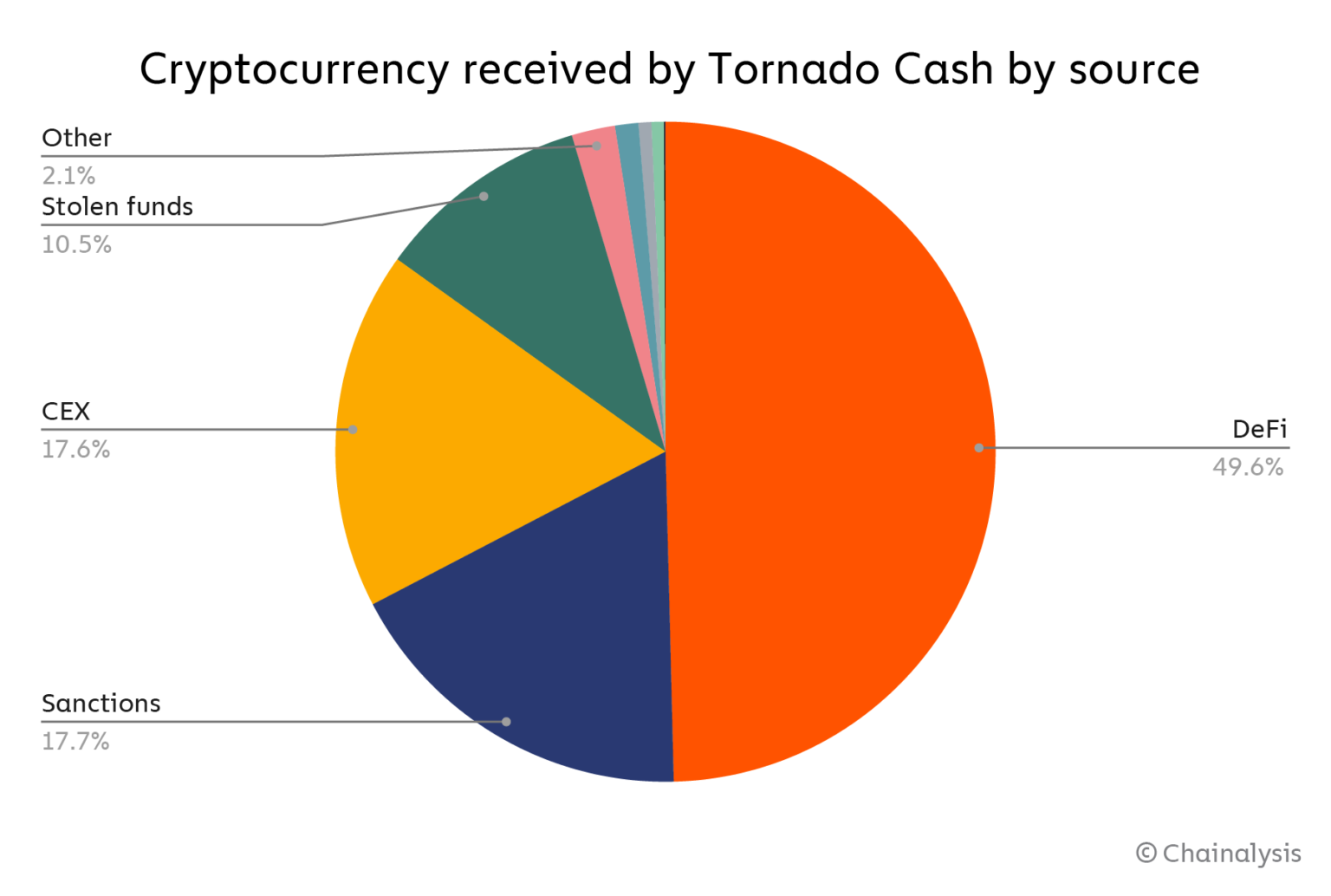

These numbers look so bad for Tornado when viewed in absolute terms. But can we have some context please? When we zoom in on Tornado’s activity since its launch in 2019, only a minority 10.5% of all its transactional volumes were tied to stolen funds.

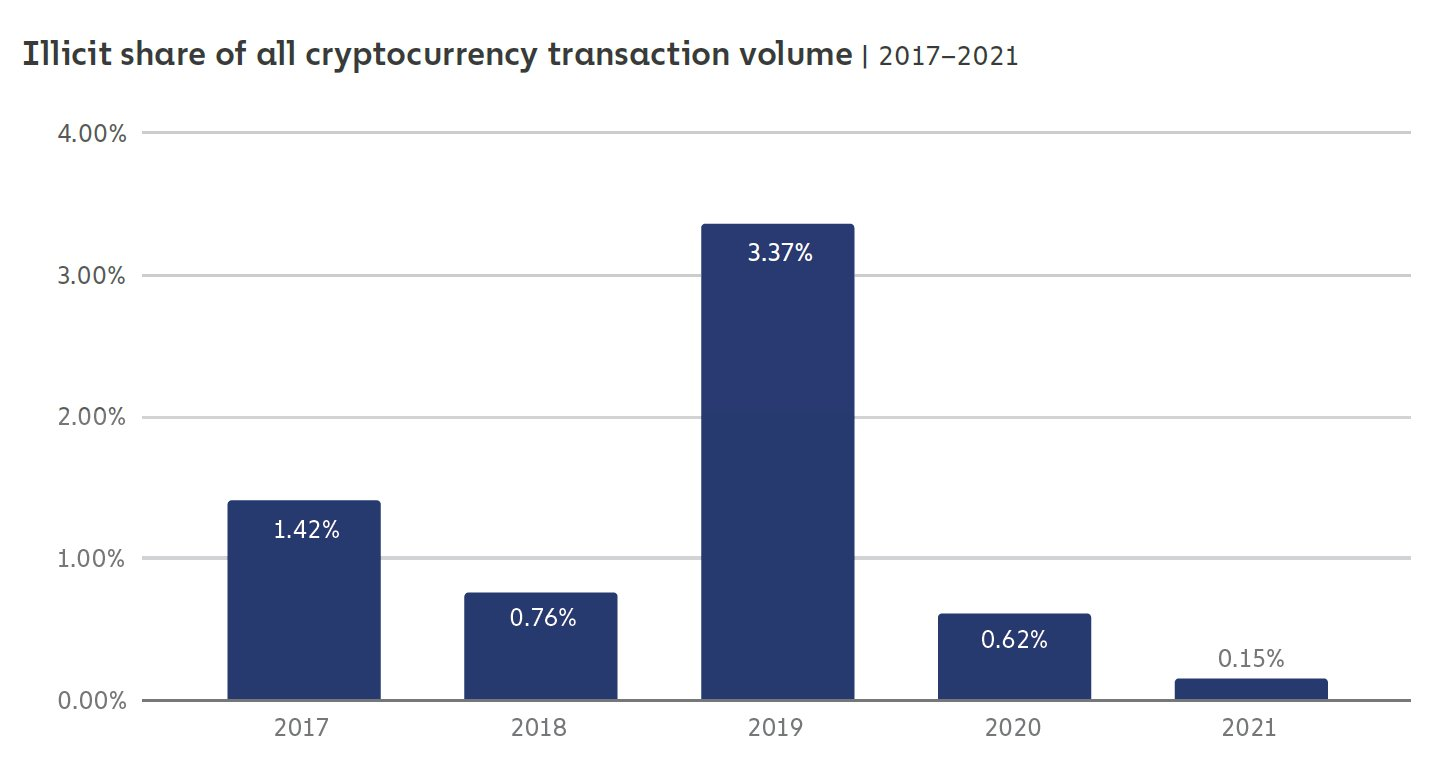

If you think 10.5% (~$700M+) is a lot, it isn’t. Chainalysis research shows that a minuscule 0.15% of total cryptocurrency volumes in the whole of 2021 (a boom market nonetheless) were tagged to “illicit” transactions. That’s how little crypto is used in criminal activity.

And that is a drop in the ocean compared to the amount of fiat that is laundered annually, which according to the UN, ranges between $800B-$2T.

If governments are worried about illegal money laundering, there are much bigger problems to worry about than a mixer like Tornado. Sound public policy is targeted at the median, not the margin, and illegal money laundering in Tornado is the result of bad apples at the fringe, rather than the norm. So the impetus for sanctioning a crypto mixer because it abets crime is a pretty flimsy justification.

As I write this, a 29-year-old developer of the Tornado Cash protocol has also apparently been arrested in Amsterdam. Jeez.

One way to respond to this shitshow is of course, to mock it. If any wallet receiving money via Tornado Cash is liable to violate sanctions, what happens when you use the platform to mass send crypto to thousands of recipients?

That is all fun and games and a good exercise in pointing out the sheer illogic of it all, but realistically, the US Treasury is not going to deploy the troops against Jimmy Fallon or anyone using Tornado for an ETH. Remember that while Tornado Cash’s frontend site can be taken down, those with the technical know-how can still access its protocol under the hood, and its code can (and probably will) be forked.

Goerli testnet success

Ethereum’s final test run - the Goerli testnet - is a simulation of the actual Merge next month. Goerli was pulled off successfully this past Wednesday. 🥳

There are various things that Ethereum developers look for to tell if the Merge was successful. For one, they look at participation rates of validators of at least a level of 66% continued participation to see if block validation proceeds as per normal.

The second way is to look at transaction activity, and whether users are filling up blocks. Blockchains sell blocks, remember?

If you missed it, we livestreamed the entire thing.

With the success of the third and final Goerli testnet, that officially schedules the Merge of the Ethereum mainnet and the proof of stake Beacon chain for about five weeks away on September 15-16.

Web3 News Roundup

Solana TVL inflation

A bombshell Coindesk article reports that two brothers, masquerading as several different pseudonymous identities, juked an astounding $7.5B of Solana’s $10.5 billion TVL at the chain’s peak, with most of that value being counted several times over between their protocols Saber Finance and Sunny Aggregator.

Oh, and they’re now moving onto the Aptos chain.

There are many problems with the popularly used total-value-locked metric. In a financial system where assets can be arbitrarily inflated and rehypothecated across multiple chains, TVL’s usage is limited. See this classic blog post by Coinmetrics for a thorough breakdown.

Arbitrum launches Nova

Arbitrum is on a roll lately. They’re launching a major network upgrade (Arbitrum Nitro) at the end of August, relaunching Arbitrum Odyssey, a user adoption campaign that was “too successful”, and today announced the launch of Arbitrum Nova, a wholly new AnyTrust public chain for gaming and social dapps.

Furthermore Reddit is also launching its community points system on Nova.

Other news:

Meta launches NFTs on the Flow blockchain; Voyager Digital gets ordered by the courts to return $270M to its customers; Optimism governance proposal by Polynya to pause all funding until sufficient decentralization achieved; Coinbase is partnering with the largest asset manager in TradFi BlackRock to provide a platform for institutional investing.

Here’s what we have lined up next week.

- Polynya joins us on the podcast to share his crypto thesis

- William is dropping a tactic on GMX perpetuals for Arbitrum

- Jordi Alexander is telling us what to watch out for post-Merge

- Donovan