Tornado Cash Fights On

View in Browser

Sponsor: Uniswap Labs — Unichain is live! Bridge & swap with Uniswap Labs' web app or wallet.

1️⃣ Treasury Removes Tornado Cash Sanction

Early Friday morning, the U.S. Department of the Treasury announced it had removed smart contracts associated with crypto privacy and mixing service Tornado Cash from its Office of Foreign Assets Control sanctions list.

The August 2022 addition of Tornado Cash to this list spawned widespread crypto industry condemnation and resulted in a “chilling effect,” which led many crypto service providers to adopt draconian censorship policies to preclude interactions with addresses that had utilized the previously sanctioned mixing service.

While it now appears to be legal for individual Americans to interact with the Tornado Cash smart contracts in an end-user capacity, Treasury maintains that it is committed to enforcing sanctions violations against North Korea and “malicious cyber actors” who profit from criminal activity. Outstanding legal risks likely remain for Tornado Cash relay operators, TORN token holders, and the application’s founders.

2️⃣ SEC to Drop Ripple Case

XRP pumped 11% on Wednesday amid renewed hopes that the Securities and Exchange Commission (SEC) will drop all charges against ecosystem services provider Ripple Labs for selling XRP as an unregistered security.

In October 2023, the SEC appealed U.S. District Judge Analisa Torres’s landmark SEC v. Ripple decision from July of that year, which found that digital assets themselves are not securities.

Although the staff determination to drop the Ripple case remains subject to SEC Commission approval, Ripple Labs CEO Brad Garlinghouse positioned the outcome as a resounding victory for the broader crypto industry.

3️⃣ Donald’s DAS Speech

President Donald Trump made a virtual appearance at the Blockworks Digital Asset Summit (DAS) on Thursday.

In his brief two-minute address, President Trump promised that the United States will “dominate crypto and the next generation of financial technologies,” and highlighted the actions his administration had taken to support this goal.

While expectations were high for a “big announcement” regarding the Trump Administration's next crypto policy steps, the speech provided limited substance and was more akin to a crypto policy victory lap.

4️⃣ SEC Provides PoW Clarity

The Securities and Exchange Commission’s Division of Corporation Finance published a bulletin to provide greater clarity on the application of federal securities regulations for proof-of-work crypto mining operations.

According to the release, neither solo mining nor mining pool operations trigger the application of U.S. securities laws when computational resources are used to validate a blockchain for rewards, even when earnings flow indirectly through a centralized mining pool operator.

It is important to note that the statement only applies to “Covered Crypto Assets,” such as BTC, which lack intrinsic economic properties or rights.

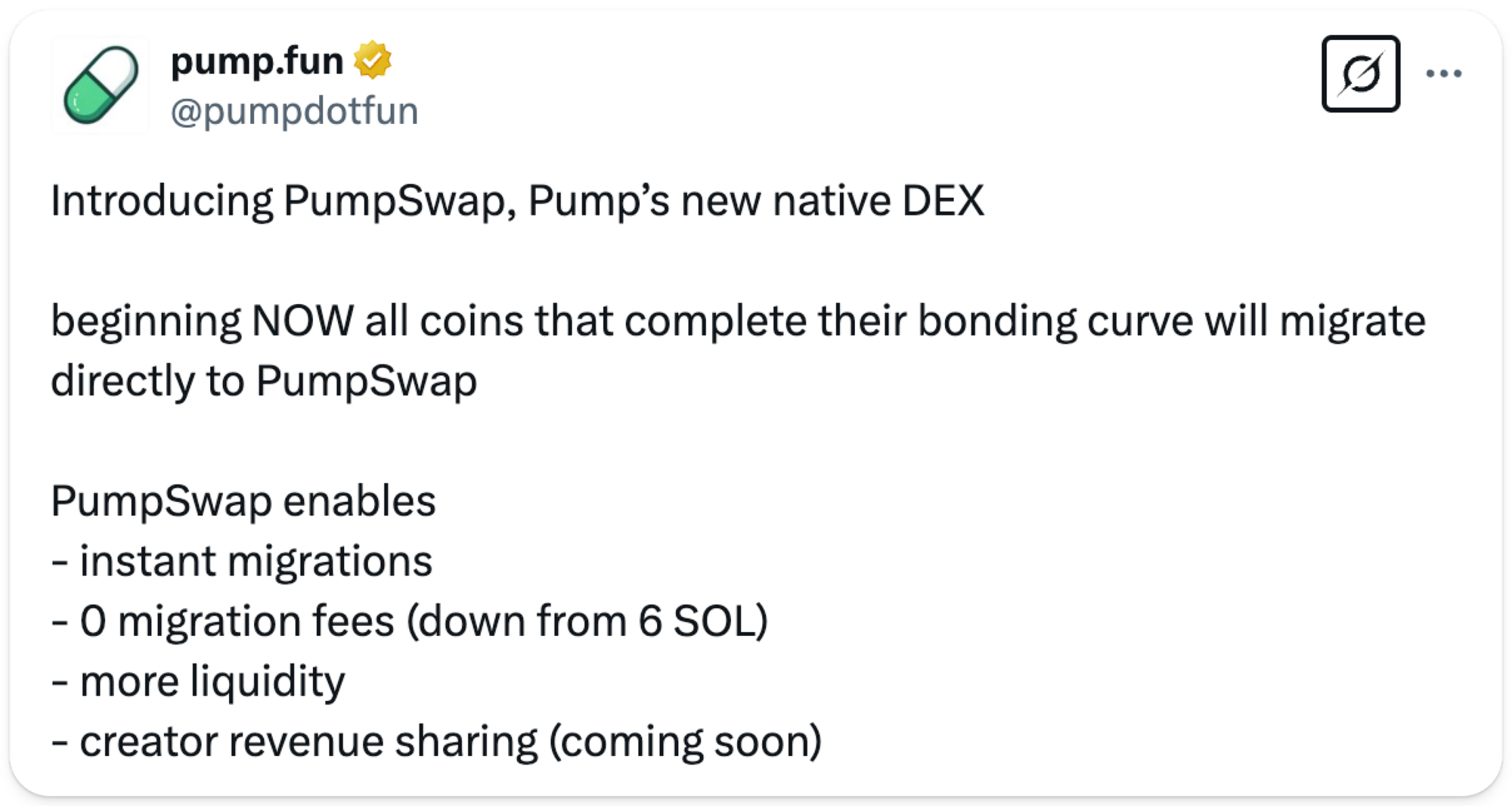

5️⃣ Pump.Fun Launches Native DEX

Solana’s premier memecoin launchpad introduced the PumpSwap exchange on Thursday; all pump.fun tokens that achieve their bonding curve are now being deployed to the platform. PumpSwap eliminates the previous memecoin migration fee of 6 SOL and promises to implement token creator revenue sharing at a later date.

Raydium, the decentralized exchange which previously hosted liquidity for graduated pump.fun tokens, has plummeted 60% from late February when rumors of a native pump.fun AMM first received publicity. Earlier this week, Raydium unveiled plans of its own to deploy a competitive memecoin launchpad.

Unlock the power of Unichain – a fast, decentralized Ethereum Layer 2 network built to be the home for DeFi and cross-chain liquidity. To bridge tokens to Unichain and start swapping today, get started with Uniswap Labs’ web app or mobile wallet.

This week, Anthony Sassano joins us to unpack Solana’s most controversial governance vote yet, Ethereum’s major leadership overhaul, and crypto markets wrestling with macro chaos despite promising policy shifts. Kraken makes waves with a massive $1.5B acquisition—but will it move the needle? We dive into all of this and so much more.

Tune into this week's rollup with Anthony Sassano 👇

📰 Articles:

📺 Shows:

Thoughts on how to make Bankless even better? Tweet me!

🧑💻 Lucas Matney, Bankless Editor