ETH's Top 5 Gas Guzzlers

Dear Bankless Nation,

Last week was particularly brutal for ETH gas prices. They're finally calming down, but today we're taking a look at who the big gas guzzlers have been and just why they were so voracious.

- Bankless team

Last Week's Biggest Gas Guzzlers

Bankless Writer: Jack Inabinet

Since the ICO Craze of 2017, the ability to permissionlessly create assets has been one of the most compelling use cases for smart contract platforms. Recently, this has come back into vogue on Ethereum with widespread memecoin fever.

While bluechips like Bitcoin and Ether plummeted off their respective bear market highs, hot money was flowing into memecoins like PEPE. After posting an impressive 1500% increase from April 26, PEPE topped out on May 5 and since has fallen from grace, down 50% off its highs.

Undeniably, FOMO fever for shitcoins has seemed to dissipate. Many Ethereum users will be relieved to see this given just how painful gas prices on the network were last week with the top gas guzzling sources of the surge related largely or partly to memecoin mania.

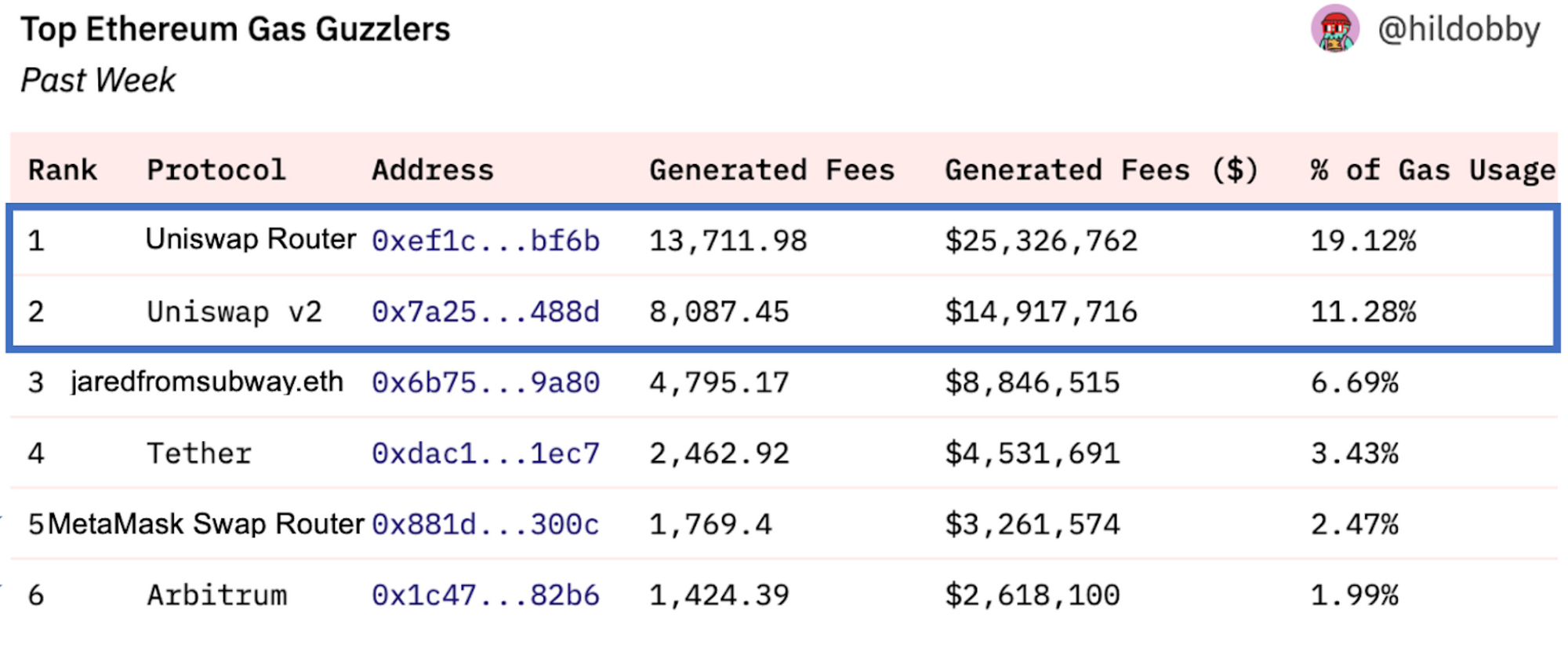

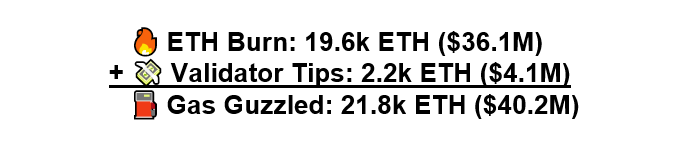

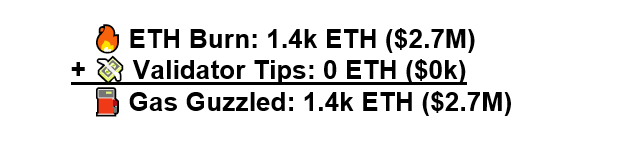

Combined, the above accounts generated 32.3k ($59.5M) in fees for the Ethereum network last week, of which 26.2k Ether has been burned, contributing towards deflation of Ether supply and returning value to holders.

Today, we’re diving into where Ethereum's top 5 gas guzzlers are coming from and exploring why shitcoining is pushing activity to concentrated pockets of the network.

🦄 Uniswap

Multiple Uniswap contracts exist, however, only two made it onto our list.

Uniswap’s Router, which aggregates trades across the protocol to improve order execution, and its full-range liquidity contract (V2) consumed a combined 30% of gas used on Ethereum over the past week. Unsurprisingly, increased speculation in the longest tail of tokens translates to increased DEX volumes.

But why Uniswap in particular?

Volume flows to where the liquidity lies and the deepest liquidity for all of the market’s favorite shitcoins has been on Uniswap. Take PEPE for example, where a vast majority of the token’s liquidity is sitting in Uniswap pools.

Memecoin liquidity found an initial home on V2, however, the tide has begun to turn for the most popular tickers, as professional market makers have entered the game. A majority of the volume for more established memecoins now flows through more capital efficient (and complicated) concentrated liquidity Uniswap V3 deployments.

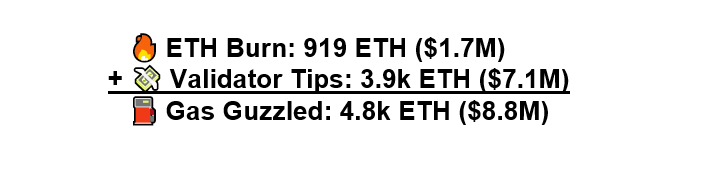

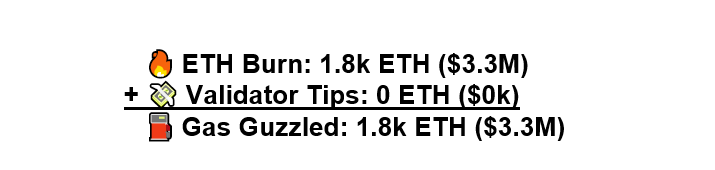

🥪 jaredfromsubway.eth

The comically named jaredfromsubway.eth has continued to attract an awful lot of attention as the MEV sandwich bot of unknown origin keeps aggressively guzzling gas.

Incepted in late February, jaredfromsubway.eth has stood out from the competition, vastly outperforming fellow MEV bots and netting a $6.3M profit in less than three months.

Sandwich attacks are a toxic form of MEV that frontruns user orderflow, worsening execution prices. They are especially profitable in low liquidity pools, a common characteristic of memecoins, as attackers can easily push prices with a relatively small amount of initial capital.

On April 17th, more than 60% of blocks contained transactions from jaredfromsubway.eth, leading an initial spike in fees that has persisted since.

jaredfromsubway.eth is a prolific sandwich bot who went viral a few weeks back

— @bertcmiller ⚡️🤖 (@bertcmiller) May 10, 2023

They famously were sandwiching a TON of $PEPE traders and are frequently one of the top consumers of gas on the network

Why are they dominating sandwiches? What's their edge?

Keep scrolling, anon.

These sandwich attacks are atomic, meaning that the entire transaction occurs within one block and the attacker is not taking risk on the transaction.

It is important to note, however, that sandwiching is still not entirely without risk: bots must hold inventory to initiate an attack, creating risk across blocks. For this reason, many sandwich bots exclusively hold ETH and stables, electing to avoid exposure to memecoin pricing. jaredfromsubway.eth has found success by concentrating efforts on the little exploited [meme coin → more stable currency] leg of the trade.

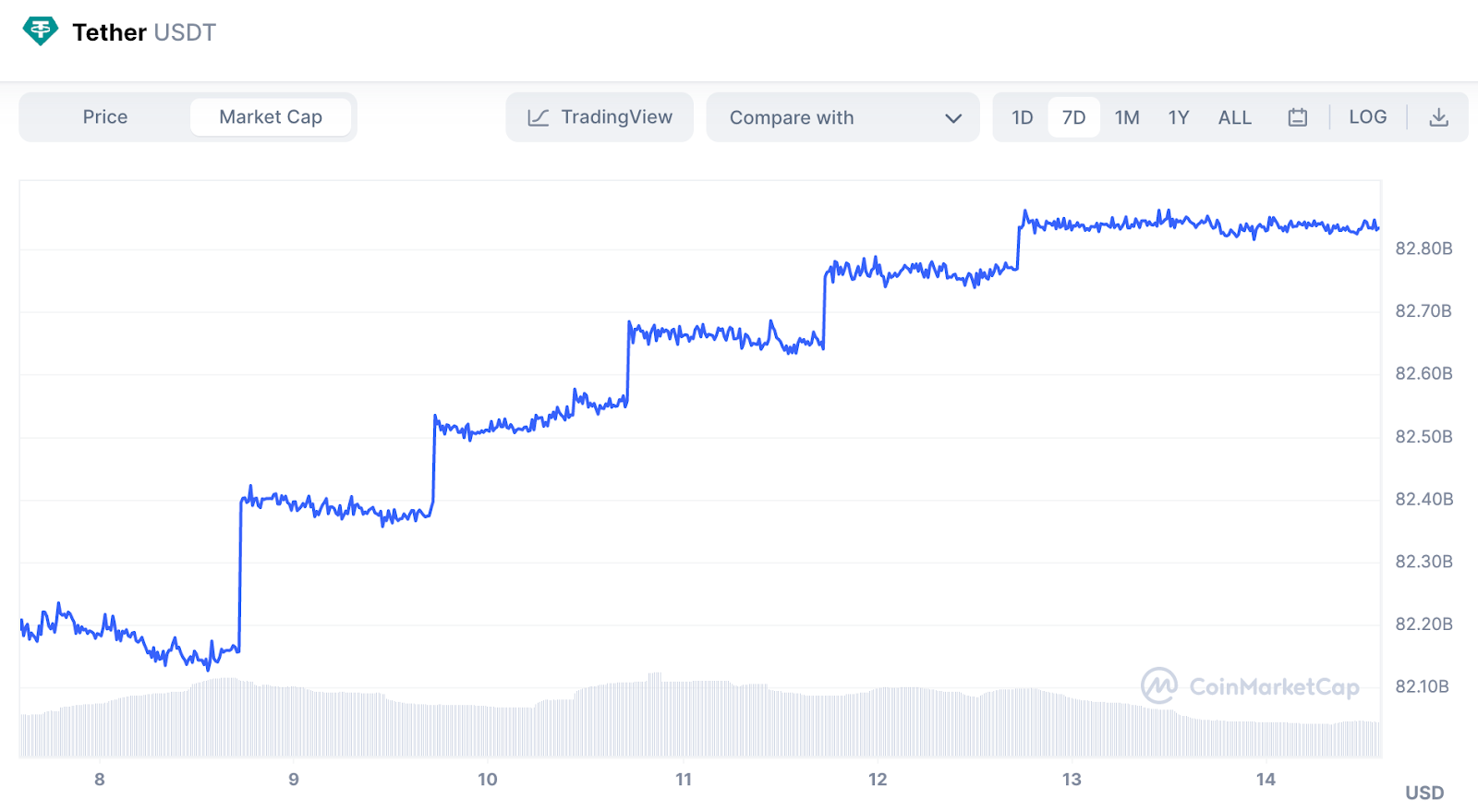

💰 Tether

USDT is about as far away from memecoins as one can venture on the crypto risk spectrum, yet Ethereum’s most prolific issuer has seen heavy activity throughout the rally. Potentially a signal of the broader crypto market's risk-off sentiment, USDT market cap has been on an upward grind, increasing by $64M (0.8%) over the past week.

Smart money addresses have continued to increase their net stablecoin exposure, up to 500 bps to 19.5% from April 17 lows, a date that not so coincidentally falls one day after peak local crypto prices.

Prolific usage of Tether’s contract has been a direct result of decreasing certainty in the future direction of crypto prices. With local tops of past cycles marred by the bodies of memecoin projects past, it is no wonder that many are getting cold feet and transitioning into stable assets.

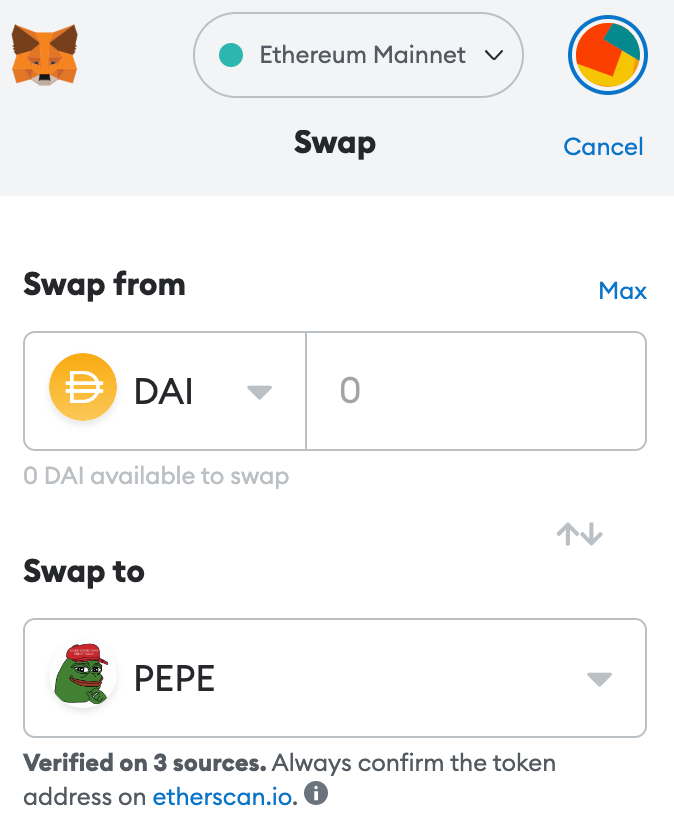

🦊 MetaMask

Web3 wallets have been on a push to better their UX. ETH gas consumed by the MetaMask swap router is testament to the progress being made on this frontier.

MetaMask Swap is an in-wallet exchange that aggregates data from decentralized exchange aggregators, market makers, and DEXs to ensure better prices and network fees, fewer token approvals, and slippage protection (an extremely useful tool in preventing sandwich attacks).

While a 0.875% service fee is charged on all orders, users have not been deterred from the feature. Perhaps the most obvious driver of MetaMask Swap’s success is the ease with which it facilitates speedy memecoin swaps.

Traditional crypto onboarding routes require users to go from CEX to wallet to DEX to acquire tokens. MetaMask is shortening this path and making a more frictionless onboarding process for prospective coin buyers.

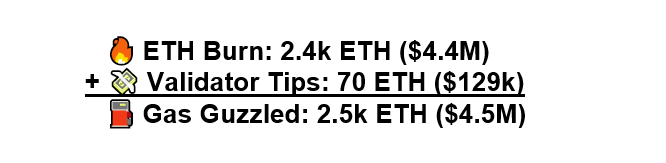

🔵 Arbitrum

When the L1 is congested, users flock to Ethereum’s rollups.

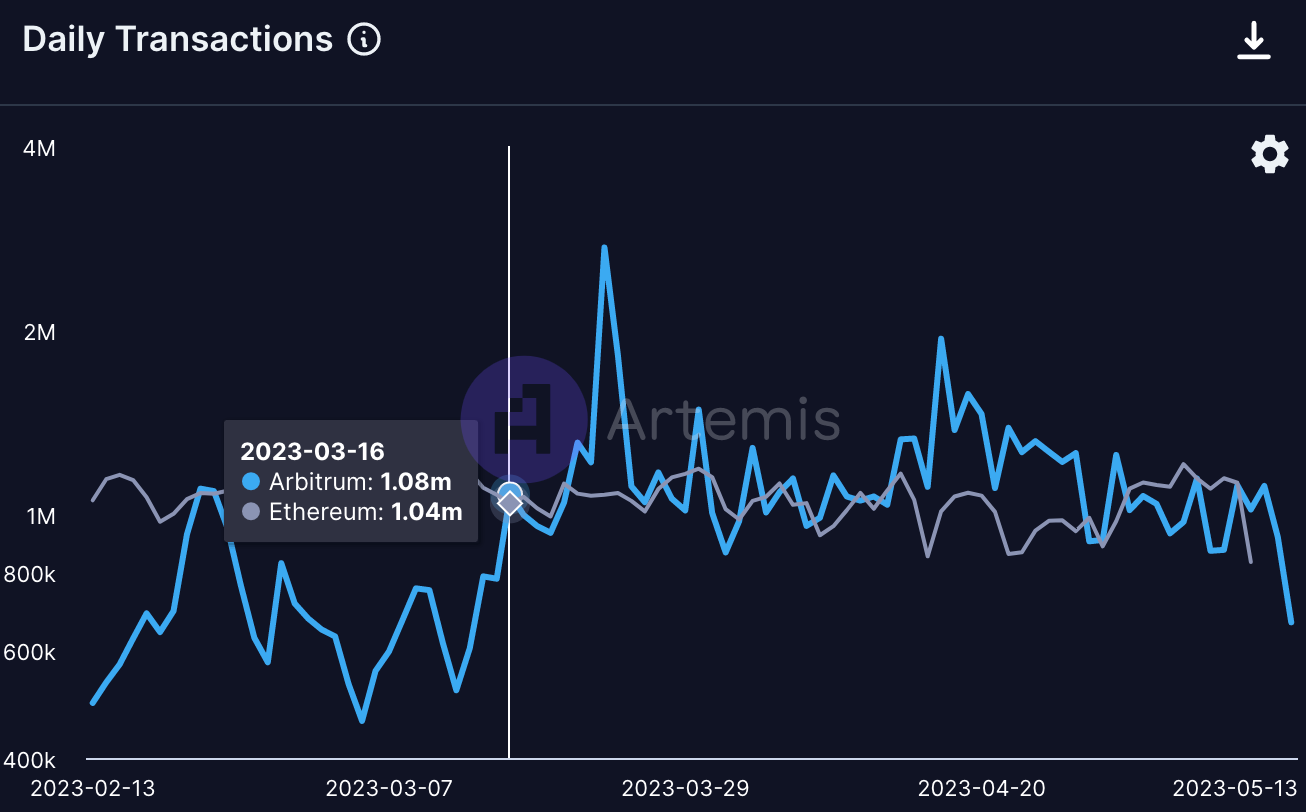

DeFi-centric Arbitrum has been a major beneficiary of the shift, seeing daily transactions keep pace with those on Ethereum itself since the ARB token announcement in mid-March.

Daily transactions on Arbitrum have since hovered close to the million mark and memecoin season has undeniably helped push an otherwise disproportionate amount of activity to the L2. The day PEPE truly began its rise to stardom (April 29), transactions on the chain increased by 342k (38%).

Despite not being a perfect correlation, the movement in the number of transactions on Arbitrum generally mimics that on Ethereum. With memecoin season beginning to bleed out, the need for users to transact on rollup solutions has lessened, as visible in the rapid declines in transaction count on Arbitrum. Should we see a return, it is likely that gas consumption by Arbitrum and rollups in general, will yet again increase.

The Bottom Line

Memecoin szn is often reduced to a simplistic, price-only conversation.

The ability for select tokens to stunningly materialize billions of dollars in market cap, seemingly overnight, can make it easy to overlook the widespread impacts that the frenzy has on the Ethereum landscape.

Whether we see a resumption of the mania is unclear, but the clear fact remains that even in a price-down environment, the memecoin corner of crypto can dominate gas consumption leaderboards and produce substantial demand for blockspace.

You can now stake your ETH through MetaMask with liquid staking providers, Lido and Rocket Pool. Head over to MetaMask Portfolio to get started! You can also view your assets in one place and discover other features such as Buy, Swap, and Bridge.

MARKET MONDAY:

Scan this section and dig into anything interesting

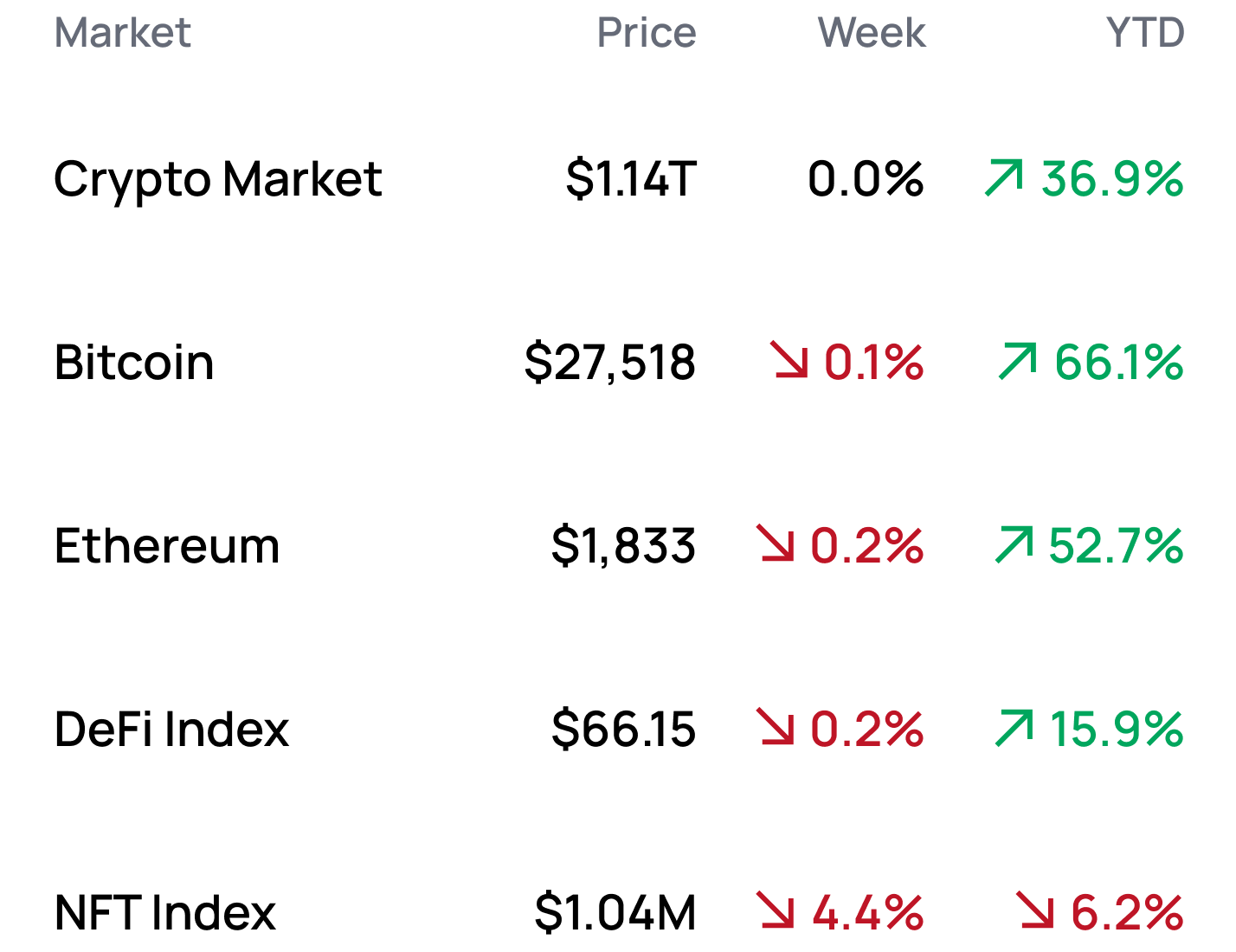

Market Numbers 📊

*Data from 5/15 2:00 pm EST (DeFi Index = $DPI, NFT Index = $Blue-Chip-10)

Market Opportunities 💰

- Test Spark Defense’s Multiplayer Alpha

- Use MakerDAO’s Spark Protocol on Ethereum

- Stake with Lido V2 on May 15

- Analyze token vesting schedules with DeFi Llama’s Unlocks dashboard

Yield Opportunities 🌾

- ETH: Earn 21% minting unshETH on Ethereum

- ETH: Earn 21% staking frxETH-alETH LP tokens in Convex on Ethereum

- BTC: Earn 4% lending wBTC in Gearbox on Ethereum

- USD: Earn 11% lending USDC in Sturdy Finance on Etheruem

- USD: Earn 9% lending USDT in Yama Finance on Arbitrum

What’s Hot 🔥

- Uniswap did more volume than Coinbase for the fourth consecutive month

- Worldcoin is launching on Optimism

- Arbitrum and Optimism’s combined TVL is now 11% of Ethereum’s

- The Chamber Of Commerce calls out the SEC

- BRC-20s (briefly) surpass $1B in total market-cap

Money reads 📚

- Jaredfromsubway.eth’s alpha and how to stop him - @bertcmiller

- There’s No Such Thing as High Fees on Bitcoin - Nic Carter

- Thread on Onchain Games and Autonomous Worlds - @pet3rpan

- Karakot: An Intro to the First Modular zkEVM - Elias Tazartes

- Web3 Games Don’t Need Tokens - Vader Research

Governance Alpha 🚨

- Arbitrum debates distributing fees to tokenholders

- Uniswap weighs turning on the fee-switch

- Olympus explores launching incentive programs on Arbitrum

- Treasure looks to allocate 2M ARB to current and future game partners

- Uniswap considers deploying onto Ontology EVM

Token Hub Update: FXS 📈

⚫ Frax Finance (FXS)

Type: Ratings Reiteration

Current Rating: Bullish

Risk Rating: Medium

Sector: DeFi

Current FDV: $667M

We are reiterating our Bullish rating on FXS.

Catalyst Overview:

FXS remains Bullish due to continued growth of frxETH.

frxETH remains one the fastest growing LSDs. The liquid staking solution has grown 38% in the past month, which is the highest rate of any protocol other than Swell (which has just 8300 ETH in deposits). frxETH is currently the 4th largest LSD and 14th largest staker on the Beacon Chain with 154,000 ETH, good for 0.8% market-share.

Potential Price Impact:

The success of frxETH should help increase Frax’s revenues, and in turn the yield paid out to veFXS stakers. This gravy train is likely to continue in the coming months as more ETH continues to be staked following the successful implementation of Shapella in April 2023. Furthermore, the success of frxETH is a strong indication that Frax is successfully executing on its vision to become a DeFi conglomerate, as the FRAX stablecoin is currently the seventh-largest by market-cap.

Analyst: Ben Giove

Meme of the Week 😂

— Eric Wall 🧙♂️ Taproot Wizard #2 (@ercwl) May 8, 2023