Dear Bankless Nation,

Across the NFT market, we've seen a bit of mint fatigue over the past few months as new projects selling new promises have had mixed success finding an audience. As the market slows, it's worth taking a beat to reflect on the promises of Web3 and some of the critiques around it.

Has the seemingly endless monetization of Web3 awakened something new in modern society?

- Bankless team

Bankless Writer: Donovan Choy

Crypto offers the tools to monetize every facet of culture. Anything you can imagine under the sun can exist as a tokenized form of tradable money on the blockchain. Your home, your music collection, proof of an event you attended, even your relationships -- but is this a good thing?

In an era of rising anti-consumerism, the popular answer would probably be no. These digital flexes and liquid-traded anythings likely represent the kind of crass commercialization that both the political Left and Right find offensive. More monetization, more commercialization, more accumulation. Is nothing sacred in our new economy!?

The famed economic anthropologist Karl Polanyi made a similar observation some 80 years before Bored Apes.

In his magnum opus The Great Transformation, Polanyi reminisced on a time past where “society” was untainted by the pervasive commercial culture of the post-Industrial-Revolution world. For Polanyi, the idea of attaching market prices to land, labor, and capital was abhorrent and unheard of for most of human history. He blamed this commodification for the “annihilation” of the social norms of “reciprocity, redistribution and householding” that pre-modern society was based on. Before market society, exchange and trade were actions for fulfilling needs of survival or doing nice things for your neighbor.

Today, we seem engaged in an endless arms race of consumption.

Polanyi’s thesis was highly influential in its time. It cut against a staple wisdom of every Econ 101 syllabus, the common Smithian wisdom of the natural propensity of individuals “to truck, barter and exchange." Polanyi argued that markets were an ideological construct foisted on modern society by the market fundamentalists of its day. It was the great anti-consumerism diatribe for a pre-digital age and one that continues to influence the likes of famous left-wing figures like Thomas Piketty or Naomi Klein today.

There is voluminous evidence to show that, contra Polanyi, “consumerism” is not an exclusively modern phenomenon, which existed long before the Industrial Revolution. In her book Worldly Goods, the historian Lisa Jardine writes of the “bravura consumerism” that pervaded the 15th century European Renaissance. The aristocracy and merchant princes of its day engaged in a vicious international trade that sought to endlessly acquire lavish, luxury goods like tapestry art, carpets and precious stones, to consumer goods like silks, ink pigments and spices, all in a bid to outdo their social peers.

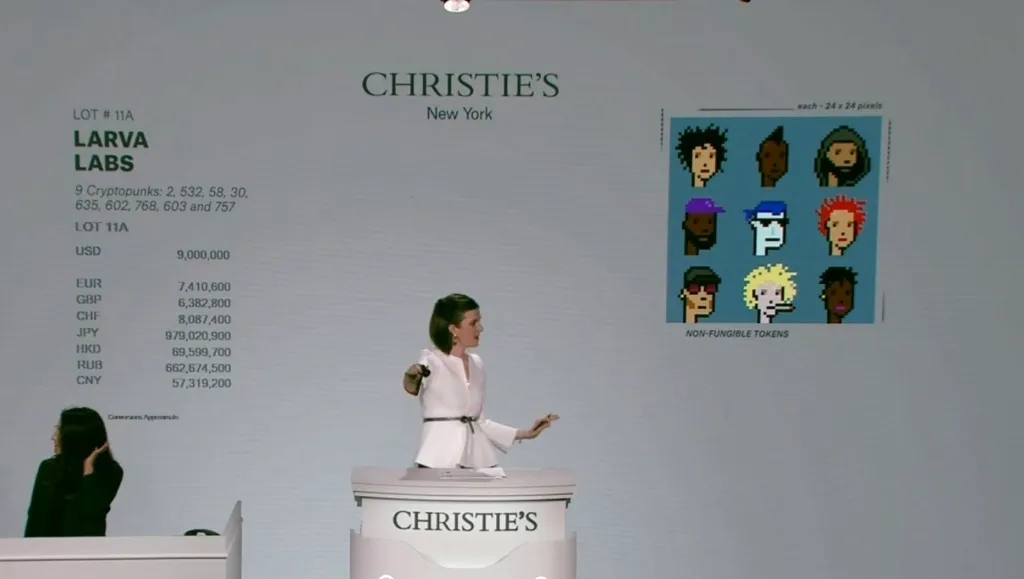

There is perhaps a striking parallel to be drawn here with the uber rich in crypto. With the boom of NFTs in 2021, it became a mark of social prestige in digital culture to flex thousand-dollar JPEGs on your social media profile. This was much more shocking to circles outside of crypto, but blockchain technology did not create this desire.

Conspicuous materialism always existed, except it remained an elite luxury. What modern capitalism introduced was a "Great Enabling" of the masses to realize these desires. With the Industrial Revolution, material consumption that was previously only accessible to kings and royalty became available much more widely. As our lives grow increasingly online, it only makes sense that we are networking our relative desire for objects and networking the objects themselves.

With Web3 today, we are witnessing the nascent signs of a second “Great Enabling”. The internet was the great connector of social relationships, but it lacked a viable business model to create property rights around social relations. Absent property rights, internet businesses had to turn to indirect sources of revenue like corporate advertisements that rarely returned profits to the people creating value on their platforms.

Blockchain technology unlocks novel kinds of ownership that allow anyone to own and monetize their social capital. Li Jin of Variant Fund calls this the ownership economy, where creators and users can own their content in ways that previously wasn’t possible. Artists can issue their works in the forms of NFTs, allowing them to tap their small community of true fans for a source of revenue. Decentralized social media protocols like Lens and DeSo are experimenting with tokenized collection of posts and tipping, a kind of commercialized social clout.

The idea of pinning a dollar amount to a social posting or a piece of artistic expression may feel perverse to those weary of rampant commodification, but this increasing rush to tokenize everything may be showcasing how this value was indeed always visible to someone just not accessible to all.

Polanyi feared the commodification of land and labor, but more than a hundred years of commercial culture has taught us that growing economies that uplift standards of living require markets to efficiently allocate scarce resources. This progress hasn't been without its hiccups.

And to be sure, not everything that is being tokenized will work as intended. Early governance experiments in DeFi are fraught with such examples where one-token-one-vote systems inevitably end up in a kind of a mini-plutocracy where whales can amass huge token positions to manipulate protocols. But failure is the cost of progress. Before we can know what works, we need to discover what will not. That requires allowing people to tinker around before we find sustainable equilibrium.

Action Steps:

- 📺 Watch the Bankless podcast with Tim Urban on Power Games in the 21st Century