Tokenized Treasuries and an RWA Revolution

Dear Bankless Nation,

While TradFi recovers, crypto is still in the depths of its bear market, leading some to ponder whether there's a way to capture that upside. Today, we dig into the world of Real World Assets (RWAs) and talk about the potential of tokenized US Treasuries to push more adoption towards crypto!

-Bankless team

BlackRock CEO Larry Fink has boldly labeled this crypto sector as “the next generation for markets,” while Boston Consulting Group projected that in just seven short years, the size of this opportunity will be 42x larger than the current TVL of DeFi.

Which crypto phenomena is TradFi fangirling over? Tokenized assets, of course! Enthusiasts of real-world assets (RWA) have long heralded the impending arrival of a tokenization-lead bull market, yet, until recently, the sector struggled to gain traction within crypto.

While protocols like RealT and Centrifuge have successfully managed to create onchain representations of real world assets, they have struggled to attract markets of meaningful size. TradFi institutions that possess the competencies to underwrite these deals are hesitant to lend because of regulatory uncertainties, and the opaque offchain nature (and relatively low returns) on these types of products have deterred crypto natives from participating in these markets.

For too long, tokenization has progressed at a snail's pace, but thankfully one asset class is emerging as a champion capable of triggering mass adoption: US Treasuries!

Today, we’ll use MakerDAO as a case study to validate the bullish thesis behind onchaining US Treasuries, uncover why upcycling Uncle Sam’s debt into financial products will spur the next wave of RWA adoption, and ponder what comes next for tokenization.

🏦 MakerDAO’s RWA Journey

MakerDAO is no stranger to real world assets. Its stablecoin, DAI, has been at least partially collateralized by RWAs since April 2021.

Early on, Maker sourced RWAs through bespoke credit agreements, however, the Protocol quickly realized the limitations of such facilities. Bespoke credit is extremely difficult to scale and carries a high degree of risk; each loan requires a time-consuming due diligence process and is collateralized by fairly illiquid assets (i.e.; a home deed or trade receivable).

In the pursuit of scale and in order to mitigate risks, Maker chose to circumvent the difficulties of bespoke credit altogether by becoming a lender to the United States government!

First, came Maker’s Monetalis Clydesdale vault, which earns yield by investing in liquid US Treasury exchange-traded funds. It was quickly followed up by the BlockTower Andromeda vault, a similar investment vehicle, and the Coinbase Custody vault, which helps pass back a portion of the yield earned on the US Treasuries reserving Maker’s USDC.

The introduction of these vaults in particular have finally allowed Maker to put idle stablecoins to work by deploying to RWAs in size, and their highly liquid nature allows Maker to manage duration like a traditional financial entity by scaling in and out of positions as stablecoin reserves build and dwindle.

While a meager 2% of DAI was collateralized by RWAs in October 2022 prior to the launch of Monetalis Clydesdale, the composition of Maker’s balance sheet has shifted radically in the 10 months since the paradigm shift created by its introduction.

Currently, 47% of DAI outstanding is collateralized by RWAs and these vaults generate 58% of Maker’s revenues 🤯

Empowered by tremendous revenue inflows from RWAs during 2023, Maker been able to provide benefits back to MKR and DAI HODLers by restarting the MKR burn and increasing the DAI Savings Rate (DSR)!

Marginal MKR buyback pressure created by the burn has no doubt played some role in helping the token post an impressive 40% rally against ETH since it began on July 19th.

Juiced DSR yields have been unsuccessful in combating the decline in DAI outstanding – a fate that has tragically befallen the supply of practically every stablecoin except USDT – but they have certainly incentivized usage of Maker’s money market, Spark Protocol.

TVL of Spark Protocol has climbed aggressively since DSR increases first went live and currently stands at nearly $450M.

Maker is the fifth best performing top 100 cryptocurrency year-to-date and the differentiator that has allowed it to stand out during 2023 has undoubtedly been the yield generation machine that is its RWA portfolio.

🧐 Why US Treasuries?

In TradFi, US Treasuries are the preeminent collateral; adoption within the decentralized financial system (to some extent) seems only natural.

Unlike other types of securities, like corporate bonds or trade receivables, US Treasuries have virtually zero default risk and come with a “risk free” designation, as the government has the ability to print new money to cover old debts. In practice, this means that holding a portfolio of short-term US Treasuries exposes one to a similar risk profile as holding dollars while providing the added benefit of yield.

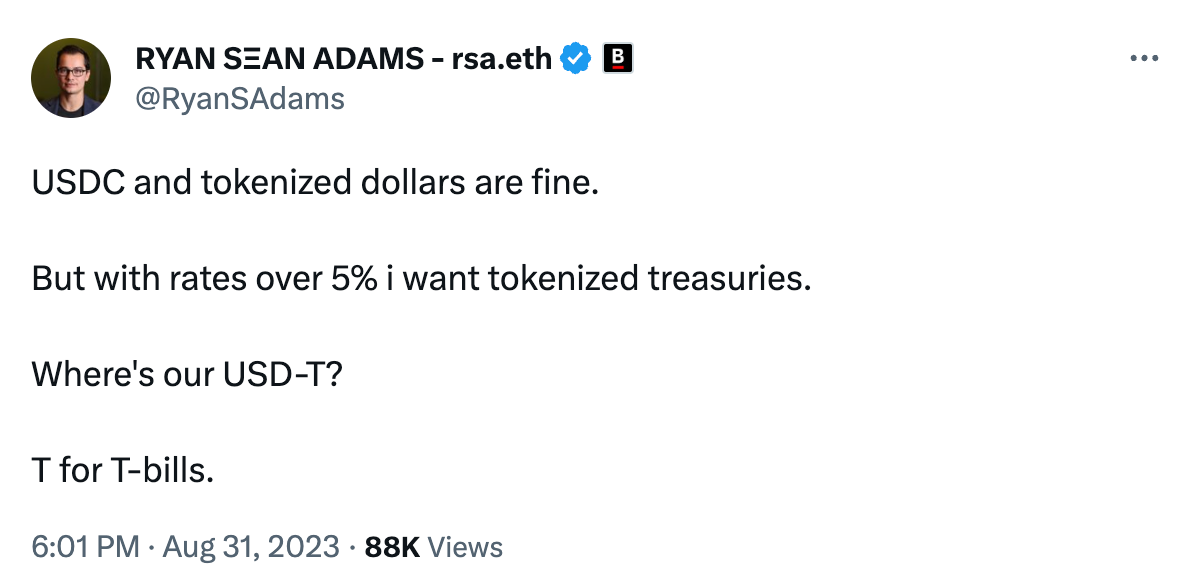

Tokenized stablecoins, like USDT, work well as instruments to settle payments, but the current stablecoin models are not viable for consumers with a thirst for return!

With TradFi yields at levels not seen in decades and crypto-native yields far off bull market highs, now is an opportune time for protocols to take advantage of RWAs; Maker is just one of the protocols attempting to extract a competitive advantage by employing US Treasuries as collateral.

Ondo Finance has attracted nearly $160M in deposits for its Ondo Short-Term US Government Bond Fund (OUSG). Ondo’s associated money market, Flux Finance, has a TVL just shy of $40M with $25M in loans outstanding and its fUSDC deposit receipt has even been composed in DeFi protocols like Pendle.

Credit-based RWA protocols are not shying away from the US Treasury tokenization game, either! Maple Finance recently launched its cash management pools, which puts capital to work by investing in US Treasury bills and reverse repurchase agreements, another form of extremely low risk security.

Frax Finance is yet another stablecoin issuer looking to expand its product offerings for V3 with the release of FraxBonds. A recent governance vote approved the onboarding of FinresPBC as a financial conduit for V3 that will provide access to US Treasuries, establishing a source of high-quality yield for FraxBonds and providing it with limitless scalability.

🪙 Tokenized Future

US Treasuries may be the starting point for the mass adoption of tokenization, but adoption of other forms of high-quality debt securities that would be accepted by a money market and require very little vetting or management, like AAA-rated mortgage bonds and certificates of deposit, is not far behind! Their safe yield streams can be easily transformed into all kinds of financial products that will help satiate market participants’ endless appetite for passive returns.

Undoubtedly, the largest barriers to a tokenized future is the current lack of regulation. Large financial institutions are simply waiting for further regulatory clarity on crypto before moving in and the success of tokenization is dependent on crypto’s outstanding regulatory and legal questions being settled.

A globally incoherent regulatory framework is also a major risk to tokenization. Crypto may be a global phenomenon, but regulations that vary from nation to nation will only serve to segregate markets. This will create immense difficulties for companies forced to navigate idiosyncrasies of different digital asset frameworks and prevent the formation of a truly global asset market, hamstringing the full potential of tokenization.

Once crypto ever receives the regulatory clarity that paves the way for institutions, our initial tokenized products will take hold of traditional financial markets, there will be no turning back!

Corporations love creating operational and cost efficiencies and they’ll quickly move everything onchain once they realize the savings that can be extracted from tokenization. Everyone will flee the traditional financial system in exchange for the liquidity of a global blockchain marketplace where they can receive instantaneous settlement and full transparency.

Despite regulatory hurdles, one certainty remains: tokenization is here to stay!

While we wait for clarity, just remember that the growing adoption of US Treasuries within crypto (along with select types of securities that would be accepted by a money market) is laying the foundation for an inevitable asset tokenization-led bull market 🚀

Here are four of the hottest RWA protocols that I'm tracking rn! Which one of your favs did I miss?

— Jack Inabinet ⚫️_⚫️ 🛡️ (@JackInabinet) September 6, 2023

Sound off in my comments below👇 https://t.co/7YIox9XCI8

Action steps

- 📗 Read Onchain-ing Everything with RWAs

- ⚡️ Check out our tactic on Spark Protocol