Tokenized Treasury Trailblazers

Dear Bankless Nation,

With the outlook for the global economy still on uncertain footing, more crypto investors are looking at onchain Treasury exposure to bring some security to their portfolio. Today, we dig into a few of the DeFi players tackling this flavor of RWA.

- Bankless team

DeFi Protocols Betting on US Treasuries

Bankless Writer: Jack Inabinet | Disclosures

Crypto Twitter has found itself divided on real world assets (RWAs) as of late; with unanswered questions surrounding the legality of RWA instruments and some investors turned off by their innate opacity compared to natively onchain assets, so it's no wonder that many hold doubts about the sector…

Regardless of your feelings towards RWAs, one thing remains true: the US national debt is spiraling out of control.

America now finds itself partially bankrolling two separate geopolitical skirmishes as it adds billions of dollars in debt to the national deficit daily, meaning yields are once again under pressure. Ensuing higher-for-longer rate dynamics threaten to drag down the prices of risk assets, like crypto tokens and equities. 😨

Despite risks to broader markets, one crypto niche is positioned to outperform all others in such an environment! Protocols that tap into US Treasuries are the only ones that stand to benefit from these hikes, as the income they earn scales with increases in interest rates.

While there are no guarantees that capital sticks around in these protocols should interest rates further increase – especially seeing as it evaporated from the crypto industry during the first part of the Federal Reserve’s hiking cycle – the protocols utilizing US Treasuries are undoubtedly best positioned to succeed in such a situation.

Today, we’re discussing four crypto tokens you can invest in to expose yourself to the burgeoning onchain US Treasury narrative and protect your crypto portfolio from the next round of rate increases! The insights below are for paying subscribers only!👇

🏦 Maker

Website | Twitter

Ticker: MKR

TVL: $4.4B

Maker started putting idle USDC sitting in its peg stability module (PSM) to work with the introduction of the Monetalis Clydesdale vault, which earns yield by investing in liquid US Treasury exchange-traded funds. This vault was quickly followed up by the BlockTower Andromeda vault, a similar investment vehicle, and the Coinbase Custody vault, which helps return a portion of the yield earned on the US Treasuries reserving Maker’s USDC.

The introduction of these vaults, in particular, has finally allowed Maker to put idle stablecoins to work by deploying to RWAs in size, and their highly liquid nature allows Maker to manage duration like a traditional financial entity by scaling in and out of positions as stablecoin reserves build and dwindle.

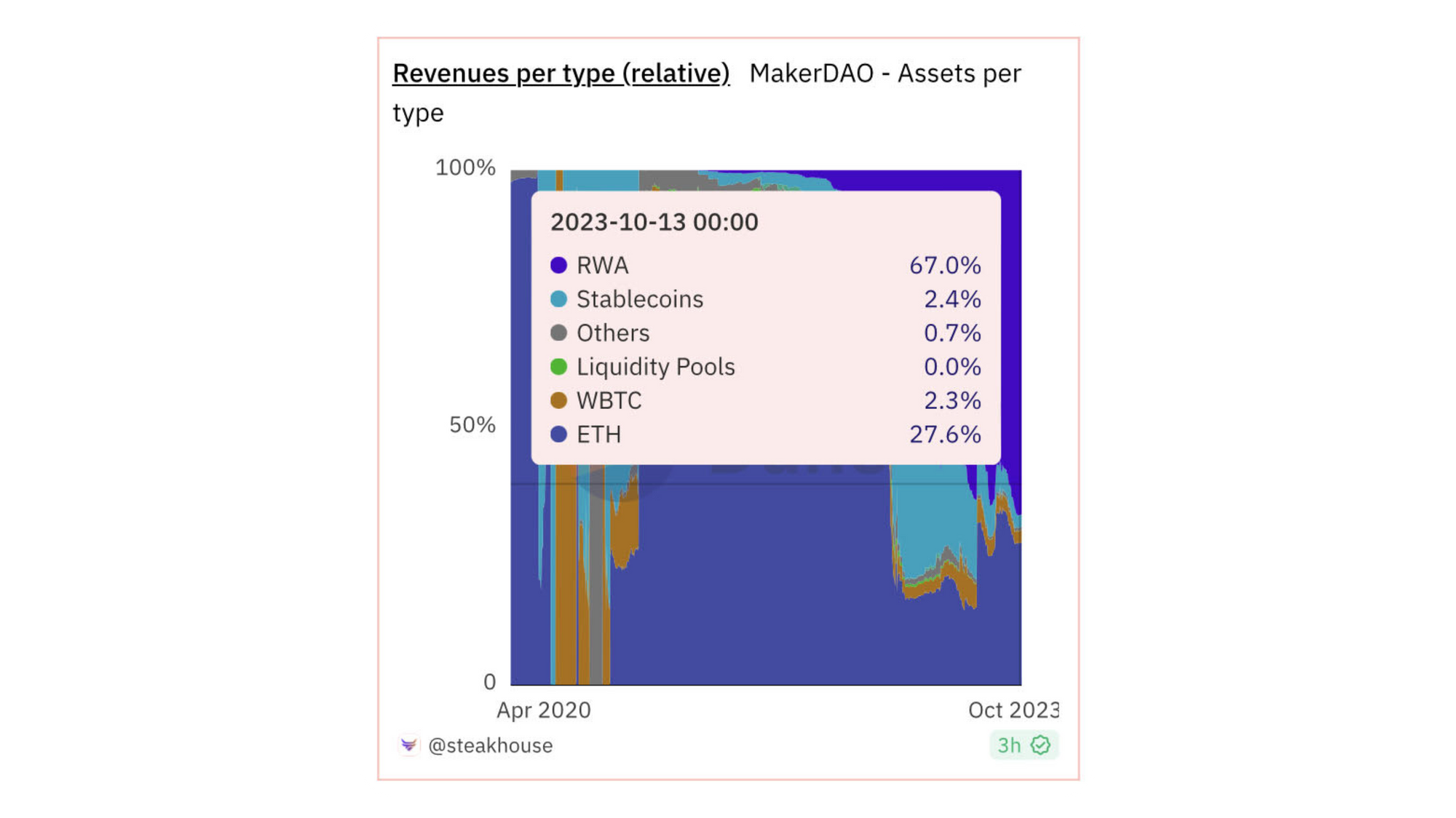

Today, nearly 60% of the DAI outstanding is collateralized by RWAs, and these vaults comprise 67% of Maker’s revenue generation. Empowered by tremendous revenue inflows from RWAs during 2023, Maker has been able to provide benefits back to MKR and DAI HODLers by restarting the MKR burn and increasing the DAI Savings Rate (DSR)!

🪙 Frax

Website | Twitter

Ticker: FXS

TVL: $680.4M

With the recent introduction of its V3, the Frax ecosystem is making its foray into the land of RWAs and demonstrating that it has the potential to become a significant player in the sector!

Frax will utilize its Algorithmic Market Operations (AMOs) to maintain the stability of the FRAX peg and to generate yield. When the Interest on Reserve Balances (IORB) paid by the Federal Reserve is greater than the yield that can be generated by onchain AMOs, the Frax Protocol will invest in US Treasury bills, reverse repo contracts, and other risk-free securities paying out IORB-equivalent yields.

With the introduction of RWAs as collateral, Frax will be able to offer two products that take advantage of this newfound yield stream. Staked FRAX (sFRAX) is a liquid staked version of FRAX that offers depositors rates as high as (if not higher than) the IORB, and Frax Bonds (FXBs) will be fixed-maturity zero coupon bonds that can be redeemed for FRAX at maturity and offer competitive rates with similar TradFi instruments, enabling investors to lock in their interest rate for a fixed period.

While FXBs were not live at the time of analysis, sFRAX had launched and was yielding 6.58% APY, significantly higher than the 5% offered by Maker on sDAI or the 5.4% paid out by the Fed on reserve balances.

🐸 Canto

Website | Twitter

Ticker: CANTO

TVL: $55.4M

In mid-September, the Canto team announced they would abandon the Cosmos app chain model and migrate to Ethereum as a Layer 2 built on top of the Polygon Chain Development Kit (CDK).

Canto's pivot to Ethereum will be accompanied by its adoption of "neofinance." While essentially just an RWA rebrand, neofinance will allow Canto to natively support offchain assets, providing an infinitely scalable source of high-quality yield-bearing collateral to reserve against its stablecoin, NOTE. Integration of RWAs at the baselayer may be the competitive advantage that will set Canto apart and help the chain emerge victorious from the L2 wars.

We're thrilled to announce Canto is building with @0xPolygonLabs to migrate to a ZK L2 on Ethereum– powered by Polygon Chain Development Kit (CDK).

— Canto Public (@CantoPublic) September 18, 2023

This ZK chain will be dedicated to Real World Assets in support of the next wave of application-layer adoption via neofinance. pic.twitter.com/x04dMIHsg7

🍁 Maple

Website | Twitter

Ticker: MPL

TVL: $55.9M

While Maple is one of the OG players in the RWA space, until recently, it had only operated in the boutique credit sector. The arrival of Cash Management Pools, launched in April, introduced US Treasuries into the Maple equation!

The product offers accredited investors and entities (US and non-US) onchain exposure to US Treasuries and provides next-day liquidity. Cash Management Pools pass through yield sourced from US Treasury bills and reverse repo agreements, targeting a net APY equivalent to the Secured Overnight Funding Rate (SOFR) less a 0.5% annualized expense fee.

Action steps

Kraken is one of the largest and most secure crypto platforms in the world. They've been in the crypto game for over a decade, and now they're inviting us all on a journey to see what crypto can be.