Time to Ditch Meme Stocks? ($)

View in Browser

Sponsor: Puffer Finance — Supercharge your ETH Staking on the First-Ever Decentralized Liquid Restaking Protocol.

- 🔵 Base Overtakes OP Mainnet in TVL. Onchain Summer is already in full effect for Base's DeFi scene.

Read more on Bankless.com - 💰 BlackRock's Bitcoin ETF Holds Over 300K BTC. IBIT now has $21B worth of BTC under management.

Read more on Bankless.com - 🔻 Friday Dump Sends BTC Below $70K. The selloff triggered $450 million in liquidations.

Read more on Bankless.com

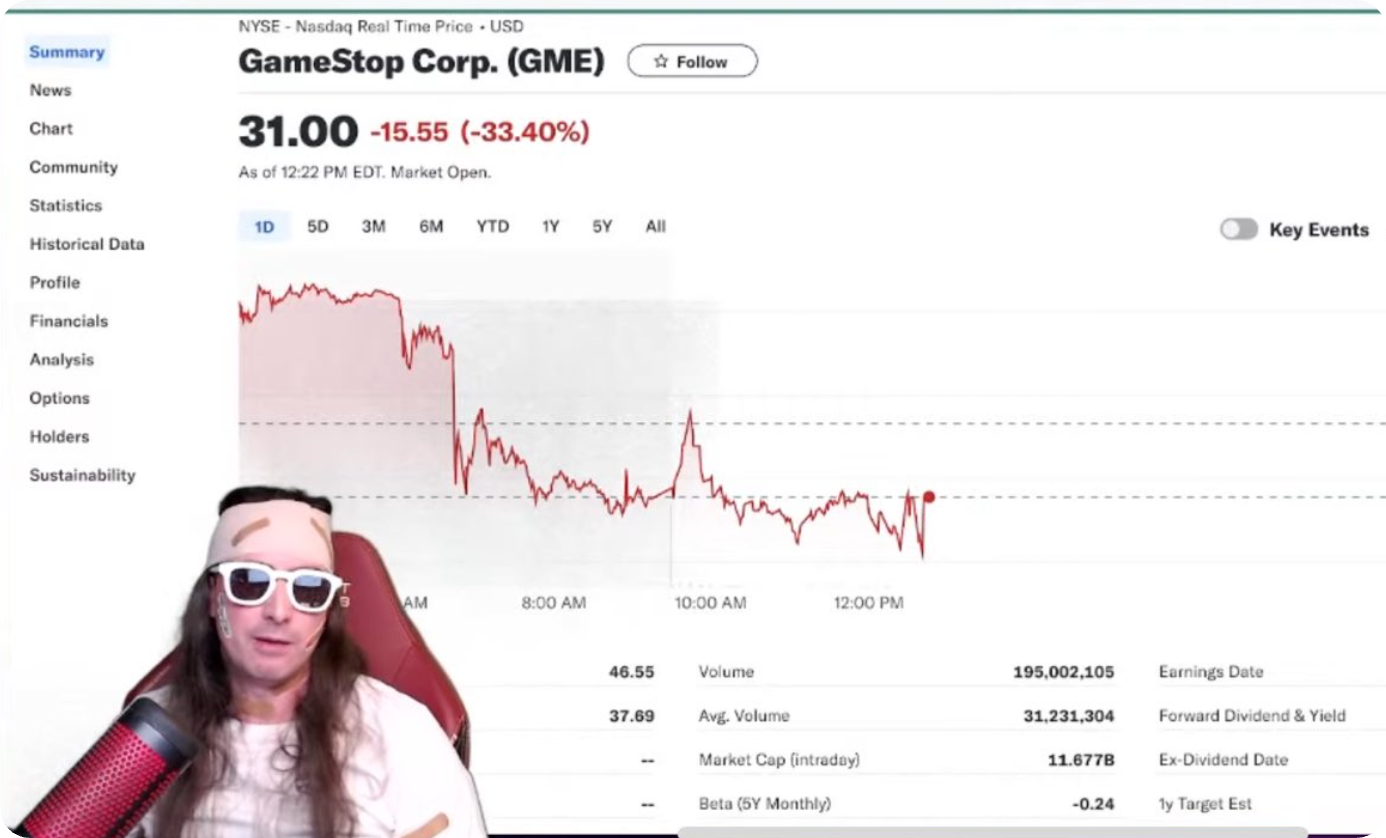

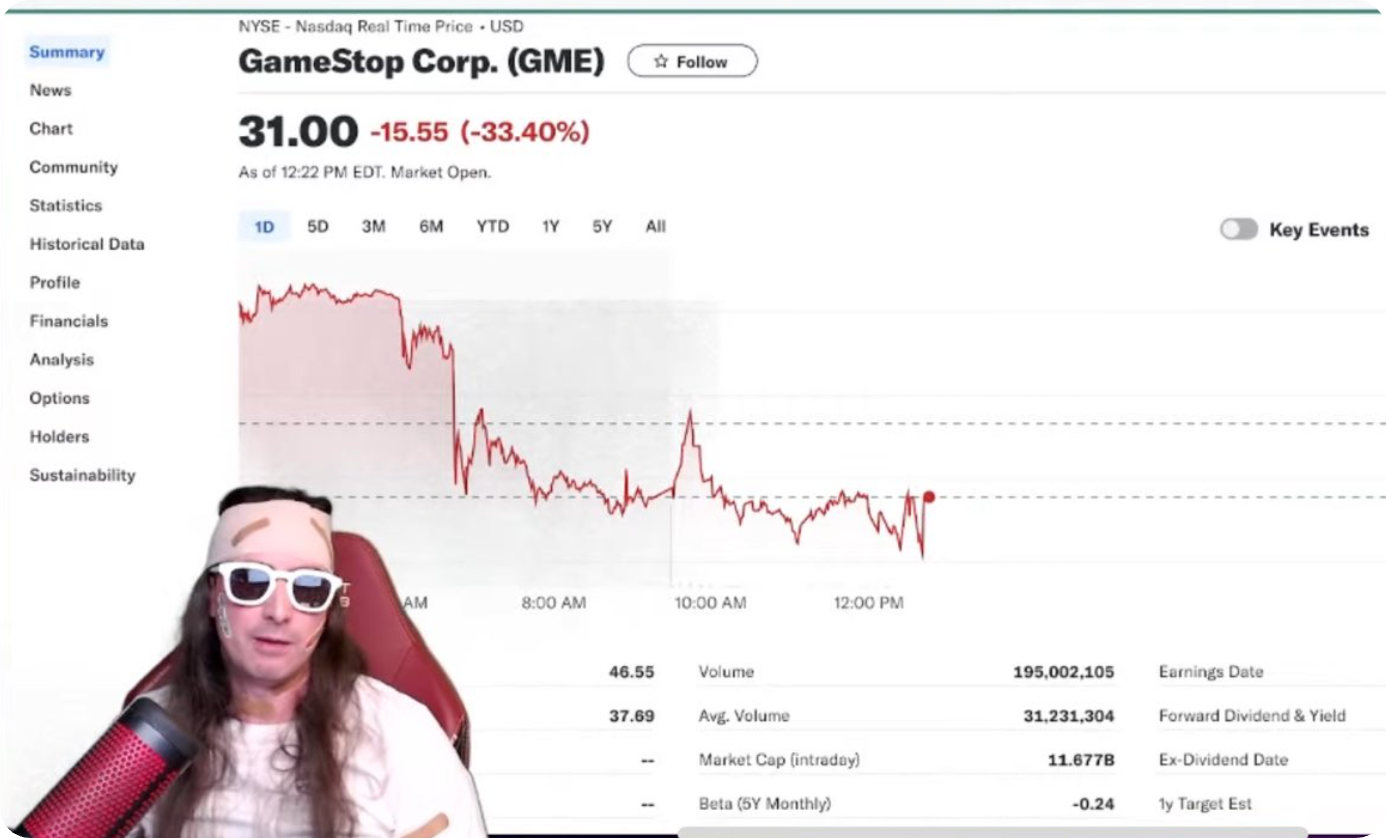

📊 Meme Dilution? GameStop bull “Roaring Kitty” was briefly a billionaire on paper last night after the price of GME surged to nearly $70, but a stock split announcement this morning reversed his fortunes and those of retail traders following his bet! How much abuse will investors take until they turn to crypto?

| Prices as of 4pm ET | 24hr | 7d |

|

Crypto $2.54T | ↘ 2.5% | ↗ 0.8% |

|

BTC $69,016 | ↘ 1.9% | ↗ 2.1% |

|

ETH $3,673 | ↘ 2.8% | ↘ 2.8% |

Still trying to get a handle on the essential crypto networks?

Bankless Guides has you covered with nearly 40 dedicated free guides to the ecosystems that matter most in Crypto. Today, we've just updated the Bankless Guide to EigenLayer so you can stay up to date on all things restaking.

See our full collection 👇

Stake your ETH with Puffer on Ethereum and unlock enhanced rewards with native Liquid Restaking Tokens (nLRTs) in Chapter 4 of the Crunchy Carrot Quest. Enjoy boosted Puffer & EigenLayer points, exclusive partner project airdrops, staking yield, and boosted DeFi integrations. Empower your ETH staking now!

Fragmented liquidity across L2s is one of the Ethereum ecosystem's pressing problems, but builders are tirelessly working toward solutions.

In this episode, Brendan Farmer & Ben Fisch explore the synergies between the Polygon AggLayer and the Espresso shared sequencing marketplace, discussing their role in the rollup-centric roadmap for Ethereum.

Get the full rundown in this Citizen-only episode 👇

🧑🌾 Farming Alpha: Fixed yields on Pendle, particularly for longer-dated swaps, continue to compress as they have in past weeks but still rank among the most attractive yield opportunities for depositors.

Avantis is a first-time inclusion to the yield opportunity list this week, offering best-in-class yields for users who lock USDC liquidity into its junior risk vault, meanwhile Gauntlet is offering a high-yielding Morpho vault that primarily lends against wstETH and MKR. As per usual, Fraxlend remains the best venue for bluechip BTC lending.

Top Opps:

- 🟠 BTC: 11% APY with Fraxlend’s WBTC pool on Ethereum

- 🔵 ETH: 21% APY with Pendle eETH (Karak) PT on Ethereum

- 🔵 ETH: 10% APY with Pendle’s eETH PT on Arbitrum

- 🟢 USD: 53% APR with Avantis’s locked USDC junior tranche on Base

- 🟢 USD: 45% APY with Pendle’s sUSDe (Karak) PT on Ethereum

- 🟢 USD: 37% APY with Pendle’s USDe PT on Mantle

- 🟢 USD: 28% APY with Gauntlet’s USDC Morpho vault on Ethereum

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. Additionally, the Bankless writers hold crypto assets. See our investment disclosures here.