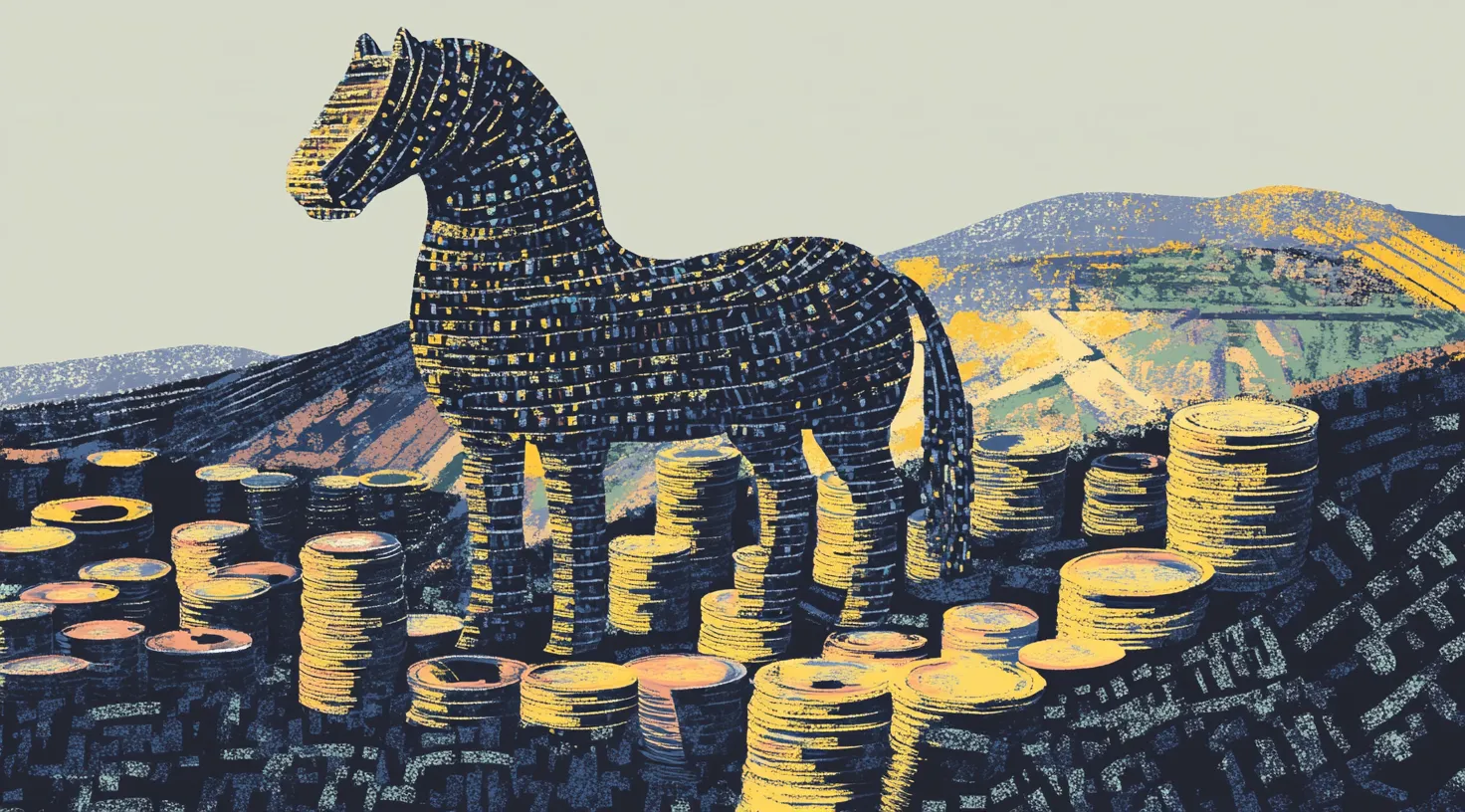

Perhaps unsurprisingly, when we look back at the year, one token category outperformed all others — memecoins.

Fueled initially by growing critique and disillusionment with token launches that entered the market at high fully diluted valuations, memecoins shone brightly in 2024. Drawn by their simpler narratives, (often) reduced insider allocations, and low-cost trading fees, many traders gravitated toward memecoins, making them a core pillar of crypto's 2024 growth.

Let's examine how memecoins gained this momentum, explore the role of Solana and Pump.fun in accelerating their growth, discuss their evolution and implications on token value, and analyze their influence on AI agents in this evolving landscape. 👇

Solana’s Meme Pump

Alongside its positioning as the year of memes, 2024 will likely also be remembered as the year that Solana's position in the space solidified.

Solana's rise and memecoin proliferation were very much connected trends, with Solana emerging as a primary hub for memecoin activity due to low costs, fast transaction speeds, and superior meme infrastructure in the form of Pump.fun.

Pump.fun first came online in January 2024, shaking up the space by enabling anyone to create and trade new tokens with minimal or no-cost launches. Nearly 5 million tokens have been launched since, a volume which managed to send trading volumes on Solana-based decentralized exchanges soaring, leading to capital influxes that juiced activity across the chain, all while enshrining Solana as the de facto home for speculation this cycle.

Turning token deployment into a quick, user-friendly no-code action fostered the rapid creation of memecoins with any vague promise of cultural relevance, no matter how fleeting.

New Meme Trends

In 2024, we saw a celebrity memecoin run kick off in extraordinary fashion. Since Caitlyn Jenner dropped her token, we have seen an outpouring of interest in the quick gains of memecoin riches paving the way for waves of celebrity-backed, “down-only” projects.

We also saw the minute-to-minute transformation of pop culture references into fresh tokens, where memecoins themed around everyone’s favorite baby hippo (MOODENG) or slain squirrel (PNUT) rocketed to multi-billion market caps — encapsulating crypto’s long-held thesis that “everything will be tokenized.”

The speed and scale of launches proved incredibly lucrative for Solana, helping it overtake Ethereum across a slew of fundamental metrics like daily decentralized exchange volumes, active users, or even revenue at periods. While Ethereum also saw blue-chip memes achieve massive premiums while degen activity sparked up on Base, the degens largely found their home on Solana.

Critics saw plenty of reasons to question the longevity of these new trends, with opaque webs of memecoin cabals and deep centralization of many memecoin holdings seeming to offer an intractable venue for bad actors.

But despite no shortage of rug pulls, botched launches, and onchain crime, the free-flowing nature of Solana’s token environment consistently drew participants seeking fast-paced opportunities. By year’s end, Pump.fun accounted for most onchain transactions in the Solana ecosystem, making it a defining force in reshaping the network’s identity around memes and “crypto-nativeness.”

What Memecoins Showed Us

While many memecoins have been “here today, gone tomorrow,” those that manage to form strong, engaged communities—sometimes described lovingly within Crypto Twitter as “cults”—have prompted deeper analysis of a broader “Memecoin Supercycle.”

Popularized by CT native Murad, this phrase highlights how memecoins invite us to reconsider how token value can emerge from shared identity or camaraderie and how it can evolve. In contrast to “tech alts” that hinge on staking or complex governance for engagement, memecoins capitalize on the internet’s core social behaviors like creating, sharing, and enjoying memes, using these methods to maintain mindshare and form communities.

Given that maintaining mindshare often directly equates to price in crypto, if these tokens can form unique, clear, fun senses of identity, they can provide strong price appreciation as users become part of the meme. Further, by starting with a token that has zero promise or expectation of “real utility,” these tokens and their holders can build the foundations themselves, gradually launching grassroots products tied to the token. Whether it's BONK with Bonkbot and bonkSOL; MOTHER, with its integration in Motherland, there are nascent examples of upstart development within meme communities.

This model could offer a new path to product-market fit in crypto, one that starts with the formation of a strong identity and social belonging instead of upfront technology, defining a clear user base in the process, and then building products to serve that community.

AI Agent Tokens Expand Ambitions

Over the past several months, AI agent memes have entered the scene, showing how a token can progress from a simple meme to one having meaningful fundamentals.

The trend began with GOAT, a token autonomously adopted by the Twitter-based agent, Terminal of Truths, whose rapid price appreciation demonstrated an opportunity at the intersection of AI agents and memecoins.

Since then, other agents and their corresponding tokens have launched, gaining mindshare through different novel capabilities before layering on more substantial features or use cases. For example, FXN, ZEREBRO, and AI16Z have all announced plans to launch AI infrastructure that uses their tokens, which have already been fairly launched, as is the standard with memes. This pattern echoes the broader memecoin approach — rally a community first, capturing a target user, then add the products or revenue streams that drive utility.

Deep diving into tokenomics and formed a working group among ai16z partners—more details soon 💹 pic.twitter.com/tkCjawFJMi

— ai16z (@ai16zdao) December 20, 2024

A Banner Year for Memes

As the year winds down, memecoins have clearly demonstrated their influence on crypto’s direction.

Solana’s low fees and rapid throughput, anchored by Pump.fun, gave rise to a hyperactive launch environment where memes flourished and, once in a while, evolved into lasting communities. These memecoin successes, in turn, spotlighted a fresh approach to product-market fit: build an identity first, then add functionality for a user base that already trusts the project. AI agent tokens now build upon this model, showing that even highly experimental technology can benefit from starting with a lean, meme-driven foundation.

As we look ahead, it’s clear that cultivating active communities, rather than promising immediate technical utility amid predatory tokenomics, is emerging as a powerful way to foster adoption and sustain growth in crypto. By uniting strong social identity with targeted development, these meme-driven ecosystems offer a new path toward genuine product market fit — a model that, if it can outlast short-lived speculation, can ultimately shape a more user-focused future for digital assets.