The World Needs Crypto

Dear Bankless Nation,

Banks in emerging markets are terrible too.

The people in these countries fight rampant inflation, regulatory hurdles, slow payments, and insanely high transaction costs.

If a population can’t access basic financial services, how can they thrive?

Crypto is fixing this.

Slowly at first…then all at once. And it’s already starting.

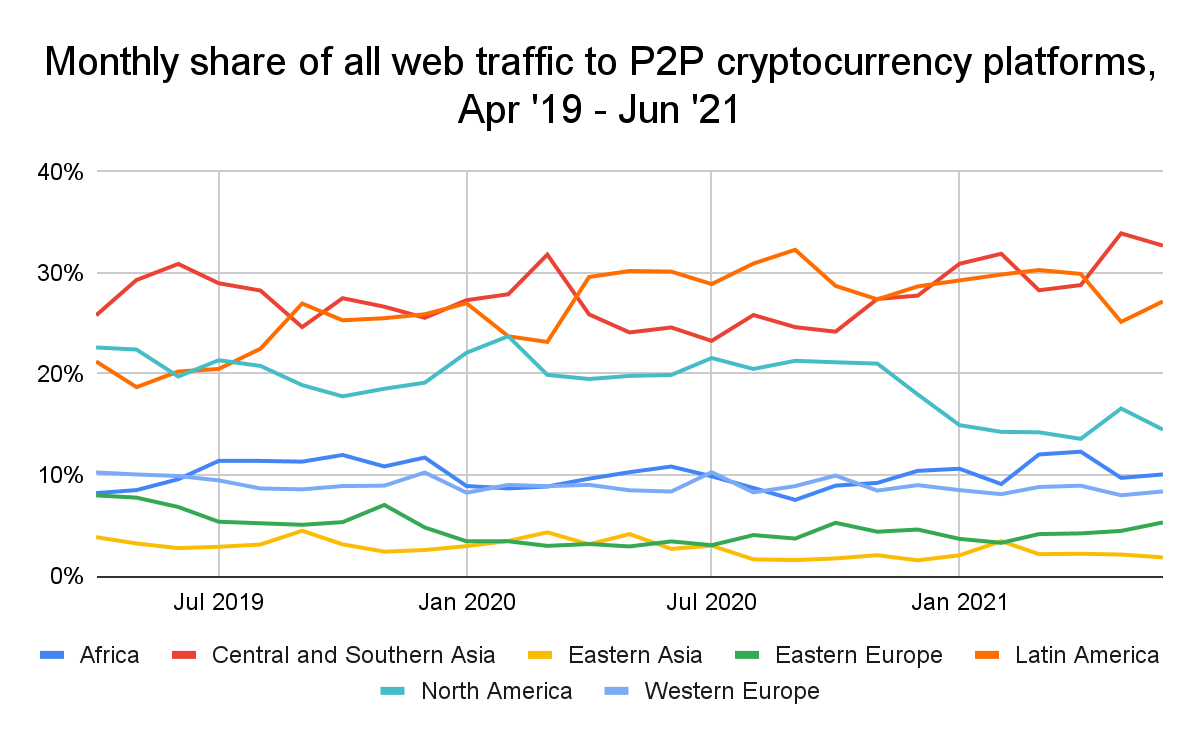

For one, Asia and Latin America have higher web traffic to crypto platforms than those in the U.S. and other western countries.

Why? Because crypto is becoming the best available choice.

This doesn’t mean every citizen will open their own Ethereum address right away. I believe much of this early adoption will happen through crypto-enabled FinTech companies focused on specific populations and market niches.

They’ll help with onboarding.

Vance Spencer called this vertically integrated DeFi, and I expect it to be a major growth area for crypto. (See also the DeFi Mullet thesis.)

The writer of today’s piece happens to be from one such crypto-enabled FinTech that focuses on Latin America.

So will crypto be the financial solution for emerging markets?

Read on to find out.

- RSA

P.S. We’re partnering with BlockWorks to host Permissionless, the biggest DeFi conference ever! 250 tickets just opened up. They will not last. Get in now!!! Premium subs get 30% off.

The Financial Solution for Emerging Markets

Crypto Fights Against Inflation, Red-Tape, Slow Payments, High Fees

In the U.S. and many other established financial markets, crypto assets are viewed as speculative investments—revolutionary, frivolous, or fake depending on the source—but profitable nonetheless.

In emerging markets, however, crypto is taking on a far more consequential role in day-to-day financial exchanges. Driven by concerns over the health of their national economies, individuals and businesses in emerging markets of Latin America, Africa, and Southeast Asia are turning to bitcoin, ether, stablecoins, and a host of other crypto assets.

In fact, according to Chainanalysis’ “2021 Global Crypto Adoption Index,” peer to peer (P2P) crypto platforms are attracting more web traffic from individuals in emerging markets of Latin America and Central and Southern Asia than larger economies, such as Western Europe and Eastern Asia. These individuals are using digital currencies as a safeguard against inflation, a low-cost alternative for cross-border payments, an entryway into online financial transactions, and a transparent method of performing financial exchanges.

The Rise of Crypto in Latin America

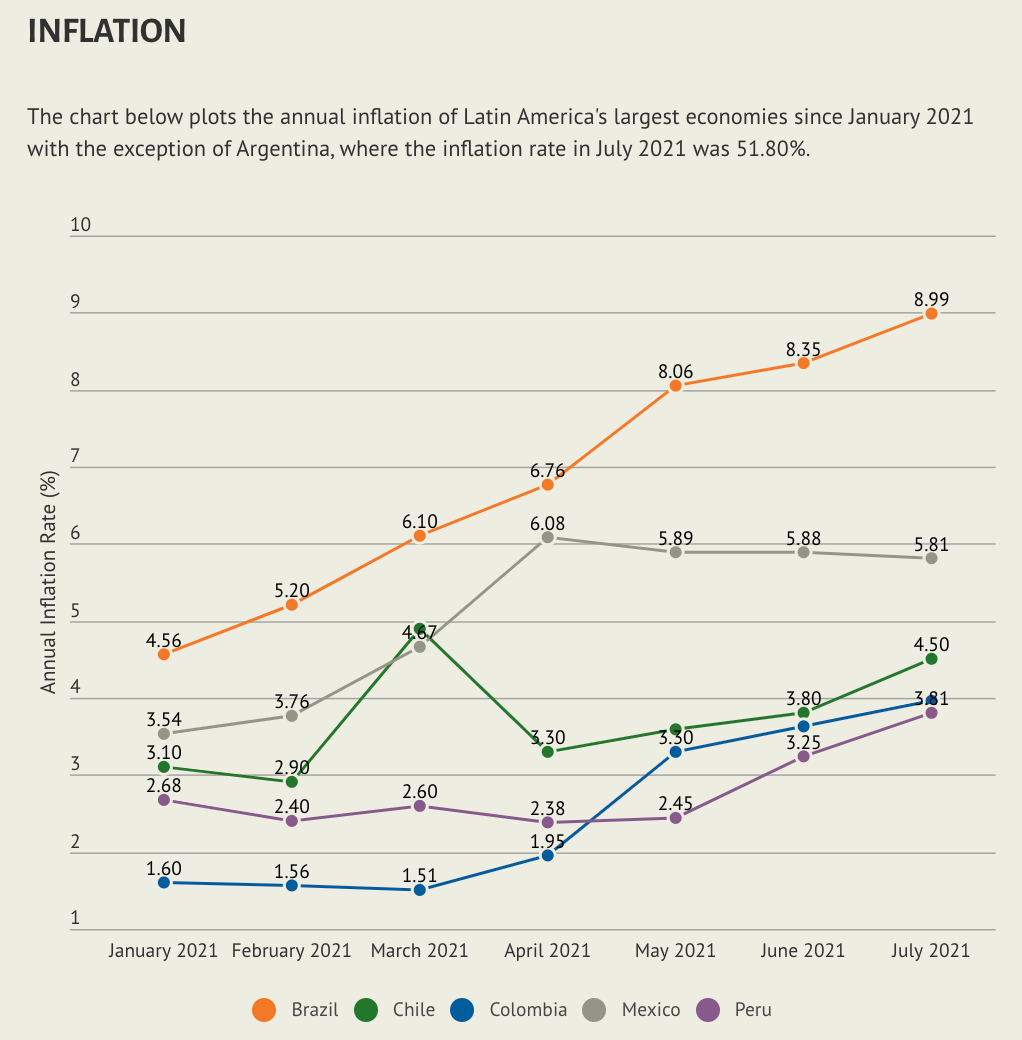

In Latin America—where countries like Brazil, Chile, Colombia, Mexico, and Peru are experiencing a surge in inflation—a new middle class is emerging with outsized needs for consumer goods, services, housing, and mobility. In certain markets, this emerging middle class often lacks access to traditional banking systems and the funds to perform large-scale cross-border transactions.

This is where crypto comes in.

Crypto offers a hedge against inflation, an alternative or additive to traditional banking, and a cheaper method of cross-border payments to individuals and businesses across the region.

In Mexico, Bitcoin has gained traction as an add-on to traditional financial services, offering a low-cost alternative for cross-border payments. Last year, migrant workers sent over USD $40 billion back to their families in Mexico, 2.5-3% ($1.2 billion) of which was processed by Bitso, the country’s major cryptocurrency platform.

Of course, we also have El Salvador, which is the first country in the world to adopt bitcoin as a legal tender. The move to make bitcoin a legal tender was spurred by limited access to traditional financial services in El Salvador, where more than 70% of the population does not have a bank account. In several small communities, bitcoin became the solution to banklessness, and the rest of the country is following suit.

Now, as Chile enters into an unpredictable presidential race with an economy still recovering from the impacts of COVID and inflation reaching the highest levels since 2016, we can expect to see crypto’s role in Chile grow as well.

At the end of 2020, Cuba also saw rampant inflation paired with financial censorship and limited access to foreign currencies due to COVID and U.S. sanctions. When Western Union ended money transfers from the U.S. to Cuba, bitcoin offered a solution for many Cubans; a mode through which Cubans could receive money from family members abroad and preserve their savings in the face of rampant inflation.

Now, Cuba’s central bank is both recognizing and regulating Bitcoin and other cryptocurrencies, and establishing new rules for how to deal with digital currencies.

A Tool for Small Businesses in Latin America

Cryptocurrencies have already infiltrated peer-to-peer financial exchanges in Latin America, and it’s time for businesses to take the hint.

As population growth fuels demand for unprecedented investment into infrastructure and large corporations reap the profits, small and medium businesses (SMBs) can find it challenging to access necessary financial tools in rapidly expanding economies.

These SMBs in Latin America and other emerging markets often lack protections against ever-threatening inflation, access to funds that finance cross-border payments, and traditional banking services.

Once again… cue crypto.

Thwarting Inflation

In countries where fears of inflation are ever-present, crypto provides SMBs the opportunity to store their funds as stablecoins—tokens with values pegged to other currencies, such as USD or gold—helping them avoid the volatility associated with more traditional cryptocurrencies while skirting inflation of local fiat currencies.

Cross-Border Payments

Those stablecoins provide an extra function for those SMBs that have access to traditional banking but lack the necessary funds to cover the costs of payment rails and cross-border payments.

By converting payments to stablecoins, SMBs can send money anywhere in the world in minutes rather than days, without paying third-party fees, and without fears of inflation. This allows them to grow their businesses more efficiently than traditional payment rails would allow.

Banking the Unbanked

Then, of course, there are SMBs without access to traditional banks. With the invention of blockchain technology, SMBs can store their funds as cryptocurrencies in a wallet. To create a wallet, businesses need nothing more than an internet connection and a connectible device.

There’s no minimum deposit or red-tape-ridden approval process, meaning crypto removes a large sum of obstacles that traditionally prevent SMBs from performing virtual transactions.

Accessing Loans

In addition to hedging against inflation, offering a cheaper and faster alternative to traditional payment rails, and helping to bank the unbanked, a fourth and perhaps even more innovative benefit is rapidly emerging in the crypto space: undercollateralized lending.

For SMBs with limited collateral and little to no access to traditional banking systems, accessing loans can be cumbersome, despite their necessity. Now, many crypto platforms involved in decentralized finance (DeFi) are hard at work creating undercollateralized lending offerings, which are creating new avenues for SMBs to access much-needed loans.

Start Small, Dream Big: FinTechs are just the beginning

It’s a tall order to suggest that all Latin American SMBs should adopt cryptocurrency immediately — knowledge of basic technology (no less blockchain technology), access to the internet, and customer needs can all act as limiting factors to crypto adoption.

Until more people can get onboard, we’ll have to slowly onramp with financial technology (FinTech).

FinTech SMBs face many of the same challenges as other SMBs: inflation threatens their reserves. Their access to traditional bank accounts, loans, and credit cards is often limited. And cross-border payments and other payment rails are slow and expensive. In fact, compared with SMBs that function primarily in person, FinTechs — whose customers can be anywhere — are that much more likely to deal regularly with slow and expensive international payments.

Unlike more traditional SMBs, however, FinTech SMBs already have basic technical knowledge and internet access due to the nature of their companies; they even have an online consumer base, meaning online financial exchanges are a natural part of their structure.

Eventually, crypto can help all SMBs around the world solve challenges with inflation, payment rails, and cross-border payments, particularly in emerging markets like Latin America, the Middle East, and Southeast Asia. So let’s start with FinTech and, then, go for the world.

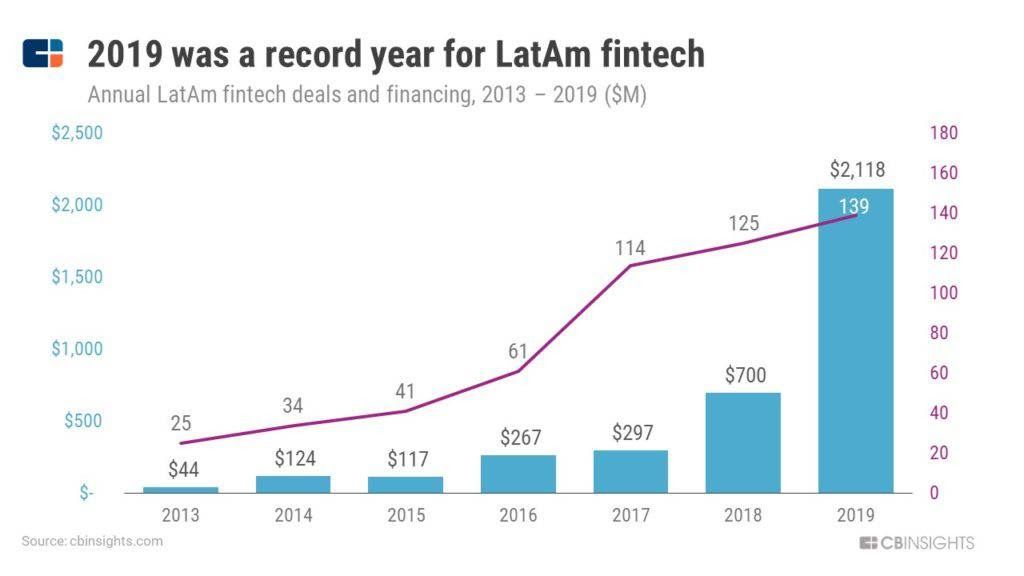

FinTechs’ technical knowledge, internet access, and payment systems lend themselves to an easy transition to crypto; Let’s start with SMBs, who are predominantly impacted by inflation, expensive payment rails, and barriers to entry in traditional banking structures; And let’s start in Latin America, where FinTech funding grew from $44 million in 2013 to $7.6 billion in 2021.

In the coming years, crypto could help SMBs everywhere flourish.

For now, new crypto projects should seek opportunities to enter the LatAm market, and FinTech SMBs should consider how crypto could revolutionize the way they transact by offering protection against inflation, creating new avenues for online transactions free from third-party banks, and providing a cheaper, faster alternative to traditional payment rails.

There’s only money to be made, by all sides.

Action steps

🤔 Consider the value of crypto in emerging markets & its path to adoption

📚 Bonus Reading: