The Unified Architecture of Ethereum

From 2015 through 2017, Bitcoin went through a civil war known as the Blocksize War. This was a pivotal conflict in Bitcoin's history, with hardliners battling over what each saw as the correct scaling strategy for the Bitcoin network, one that would ensure it could scale over time to meet demand.

The two sides of the debate were known as Big Blockers and Small Blockers.

- Big Blockers advocated for increasing the raw size of Bitcoin blocks from 1 MB to 8 MB. This would allow for 8x more throughput on Bitcoin transactions, simultaneously lowering transaction costs.

- Small Blockers advocated for keeping the blocksize small, arguing that the increased blocksize would compromise Bitcoin’s decentralization by making the Bitcoin blockchain more challenging for average users to run and verify.

Small Blockers ultimately proposed an alternative path called SegWit (Segregated Witness) which would instead optimize the number of transactions that could fit inside a block, without directly increasing the blocksize. SegWit would also open up doors for scaling solutions outside of the core Bitcoin protocol, aka Layer 2 scaling.

Just to fully emphasize these points, Small Blockers wanted to scale in two ways:

- Increasing block density, allowing more transactions to fit inside the same space

- Opening the door to a layered scaling strategy, creating room for functional offchain scaling solutions

So this was the debate: Do we increase the size of blocks? Or do we keep blocks constrained, and force scaling to higher layers?

Modern Day Big vs. Small Blockers

The blocksize debate has echoed throughout the halls of crypto history, and still persists to this day.

We don’t call these tribes Big Blockers or Small Blockers anymore; nowadays people find more modern tribes to identify with, typically defined by a particular L1. Nonetheless, the different philosophies expressed by these two camps are found inside the culture and belief-systems of every L1 tribe, whether they know it or not.

In modern times, the Small Blocker versus Big Blocker debate manifests in the Ethereum vs Solana debate.

🟣 The Solana camp says that Ethereum is too expensive and slow to get the world onchain. Consumers aren’t going to use crypto until transactions are instant and free, and we need to engineer as much capacity as possible into the L1.

🔵 The Ethereum camp says this is a fundamental compromise on decentralization and credible neutrality, creates an enshrined set of winners and losers, and ultimately produces the same set of socio-financial stratifications that we are trying to get away from. Instead, we should focus on increasing the density and value of L1 blocks and force scaling to the L2s.

This debate is nothing new. The crypto landscape changes, adapts, and evolves, but the debate on small block versus big block philosophy stays the same.

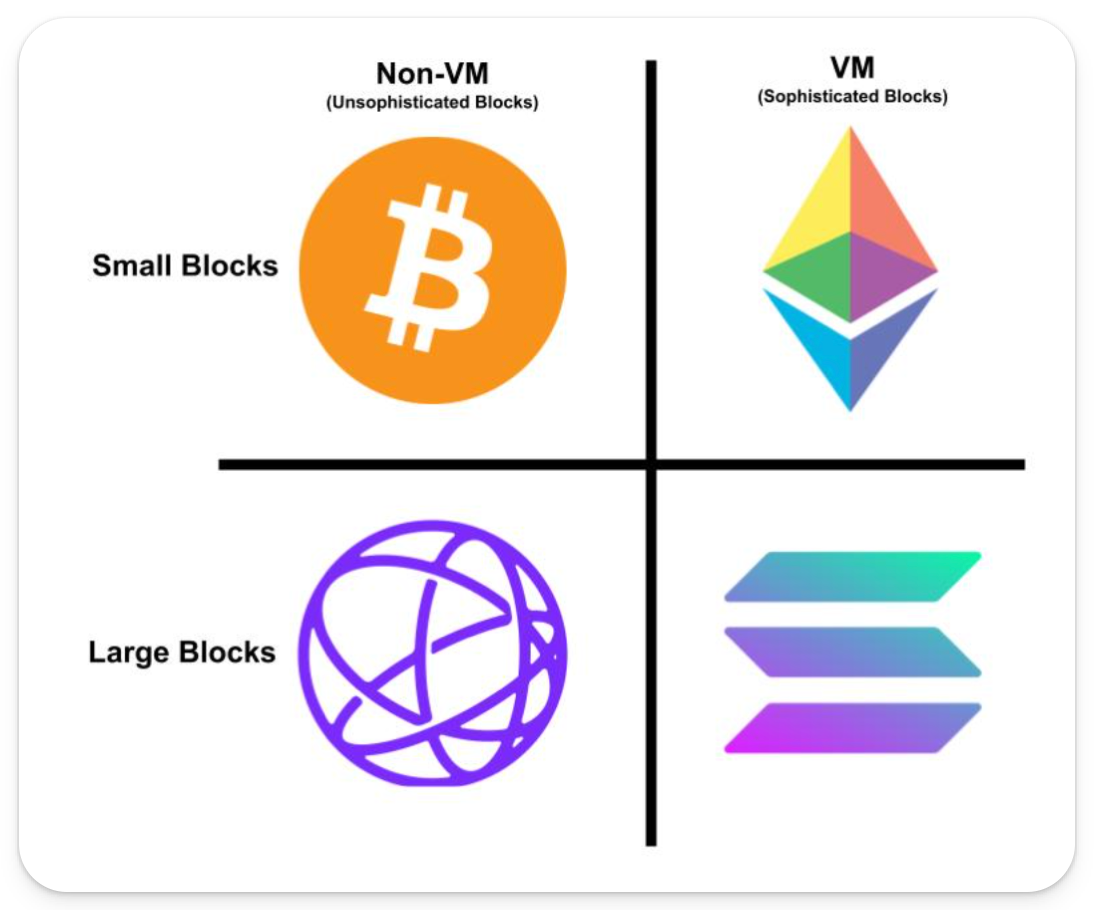

Sophisticated vs. Primitive Blocks

Ethereum’s big zero-to-one innovation was adding a virtual machine inside of a blockchain. All chains before Ethereum were missing this key element, and instead tried to add functionality as individual op-codes, rather than a fully expressive virtual machine.

Early Bitcoiner philosophy disagreed with this choice, as it added complexity and attack surface to the system, as well as increased the difficulty of block verification.

While Bitcoin and Ethereum were both “small block” philosophy chains, the increased scope of a virtual machine still created a massive wedge between these two communities. Fast forwarding to today, you can see a pretty clear axis of some of the largest tribes in modern blockchain philosophy.

While this take is at risk of being stuck in 2024, I see these four L1 blockchains as occupying four different types of valid logical conclusions in L1 architecture.

- Bitcoin is hyper-constrained, limiting the capability of the L1 at all costs.

- Ethereum is sufficiently constrained at the L1, but added L1 capability in order to create room for unconstrained block supply on the L2s.

- Celestia constrained the capability of its L1, but maximized its capacity, forcing even more features to be pushed to the L2, but giving them maximized space to build upon (hence the ‘Build Anything’ motto).

- Solana is hyper-unconstrained, maximizing the capacity and functionality of the L1, while constraining the ability to build higher layers

Functionality Escape Velocity

My crypto investment thesis is that the blockchain which incorporates both Small and Big Block philosophy in its design will ultimately win the crypto game of thrones.

Both Small Blockers and Big Blockers are correct. They both have valid points. There’s no point in arguing who’s right – the point is to build a system that maximizes both.

Bitcoin as an architecture was not able to fit both Big Blockers and Small Blockers. The Bitcoin Small Blockers claimed that scaling would happen on Layer 2s, and they pointed Big Blockers towards the Lightning Network as to where they could go and still be Bitcoiners in the Bitcoin system. But, because of the functional constraints of the Bitcoin L1, the lightning network could not gain traction, and the Bitcoin Big Blockers had nowhere to go.

A 2019 article from Vitalik titled Base Layers And Functionality Escape Velocity illustrates these same circumstances, and argues for minimally increasing the functionality of a L1 to be able to produce functional L2s.

“While layer 1 cannot be too powerful, as greater power implies greater complexity and hence greater brittleness, layer 1 must also be powerful enough for the layer 2 protocols-on-top that people want to build to actually be possible in the first place”

"Keep layer 1 simple, make up for it on layer 2" is NOT a universal answer to blockchain scalability and functionality problems, because it fails to take into account that layer 1 blockchains themselves must have a sufficient level of scalability and functionality for this ‘building on top’ to actually be possible”

My summary:

- We need to increase the scope of L1 blocks beyond ‘small block maximalism’, in order to ensure that L2s can achieve ‘functionality escape velocity’

- We need block sophistication

- We should not increase the scope of L1 blocks beyond the point of achieving ‘L2 functionality escape velocity’ because this unnecessarily compromises on L1 decentralization and credible neutrality. Any additional L1 utility can instead be pushed to L2s.

- We should maintain small block philosophy

This represents a compromise between both parties. Small blockers must be okay with their blocks becoming more sophisticated and (marginally) harder to verify, and big blockers must become okay with the layered scaling approach.

Once this compromise has been made, synergies blossom.

The Ethereum L1 – The Root of Trust

Ethereum is a Root of Trust.

The Ethereum L1 maintains its small block philosophy by leveraging advances in cryptography to produce functionality escape velocity at higher levels. By accepting fraud proofs and validity proofs from higher layers, Ethereum can compress effectively infinite transactions into an easy-to-verify bundle, which is then verified by a decentralized network of consumer hardware.

This design architecture preserves the fundamental commitments that the crypto industry makes to society. The average validating Joe can check the power of the experts and elites. Everyone has equal access to the system. No one is a privileged party. No one is enshrined.

Philosophical promises were made by the crypto industry, and Ethereum turned that philosophy into reality via cryptographic research and good ol’ fashioned engineering.

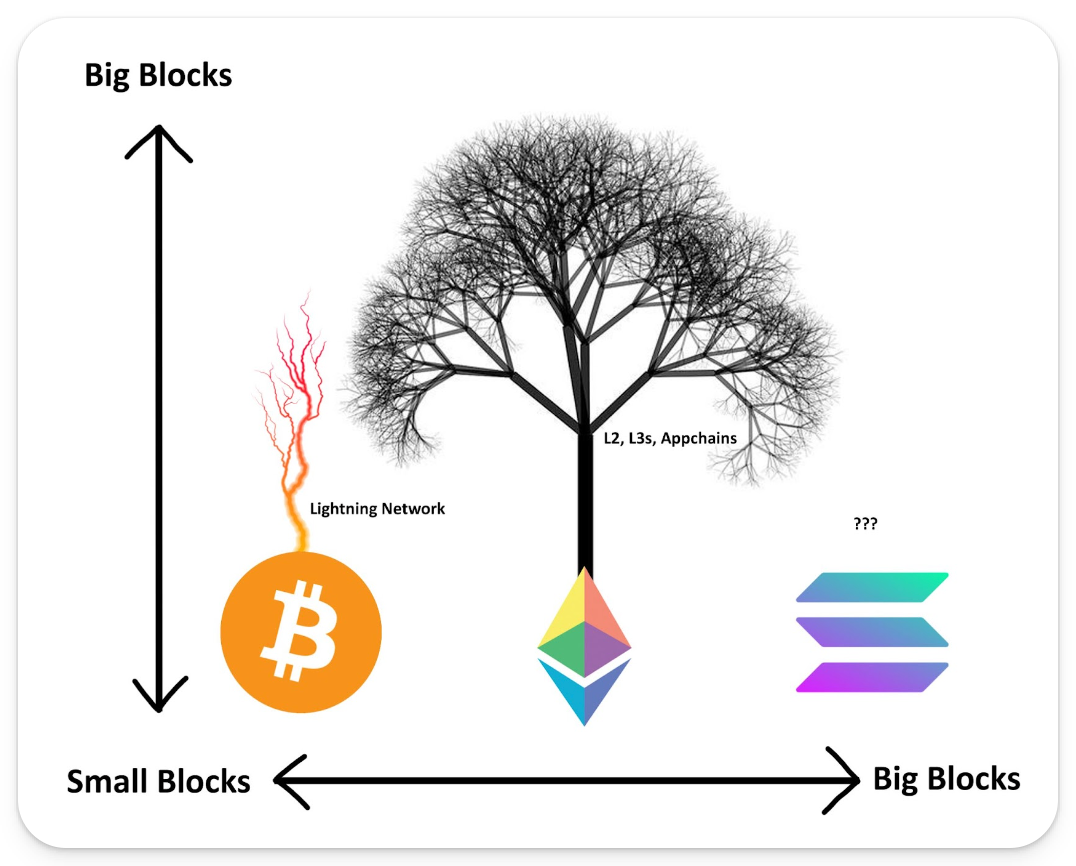

Think small blocks on the bottom and big blocks on top, i.e., decentralized, credibly neutral, consumer-verifiable blocks at the L1 with highly scalable, instant, cheap transactions on the L2s!

Rather than seeing the Small Block, Big Block continuum as a horizontal tradeoff spectrum, Ethereum vertically flips the continuum and builds big block structures on top of a secure and decentralized small block base.

Ethereum is the small block anchor for the big block universe.

Ethereum allows 1,000 big block networks to bloom, and synergies blossom from an ecosystem that stays coherent and composable, as opposed to the fragmentation of the many L1s.

Cosmos: The Lost Tribe

Okay, but where does Cosmos fit into this argument? Cosmos doesn’t adhere to any strict alignment with network design. There is no ‘Cosmos' network after all – Cosmos is just an idea.

That idea is an interconnected network of sovereign chains. Individual chains have maximum, un-compromised sovereignty, and through shared technological standards have been able to somewhat band together and somewhat abstract away their complexities.

Cosmos isn’t a technology or an ecosystem, it’s the choice to build a sovereign application that seeks to interoperate with others. The more sovereign your L2 the more you’ve embodied that choice to become a Cosmos app. https://t.co/pfxP7pRfEE

— Sam Hart (@hxrts) March 31, 2024

The problem with Cosmos is that it is so fundamentally committed to sovereignty, that Cosmos chains haven’t been able to coordinate and structure themselves well enough to share each other's successes. Overindexing on sovereignty creates too much chaos for the Cosmos idea to scale. Maximizing sovereignty accidentally optimized for anarchy. Without central coordinating structure, the Cosmos idea has remained a niche nerdsnipe.

Sovereignty Escape Velocity

Similar to Vitalik’s concept of "functionality escape velocity", I believe there’s also a “sovereignty escape velocity” phenomenon. In order for the Cosmos idea to truly take root and flourish, it needs to make a marginal compromise on network sovereignty in order to maximize its potential.

The Cosmos idea and Ethereum L2 vision are basically the same thing. A horizontal landscape of independent, sovereign chains that are free to choose their own destiny.

The core difference is that Ethereum L2s sacrifice some of their sovereignty to the Ethereum L1, by posting their state roots on their L1 bridge contract. This small change externalizes what was a previously internal operation, by choosing a central L1 for settlement of their native bridge.

By extending the security and settlement assurances of the L1 via cryptographic proofs, the infinite L2s that spawn from Ethereum’s base become functionally the same global settlement network. This is where the extraordinary synergies between small and big block philosophy blossom.

Synergy #1: Chain Security

L2 chains don’t have to pay for their own economic security, eliminating a large source of network inflation from their base asset, retaining 3-7% of yearly inflation inside the value of their respective token.

Take Optimism: at its $14 billion FDV and assuming a 5% yearly security budget, that’s effectively $700 million per year that’s not being paid to 3rd party external security providers. In reality, Optimism Mainnet paid Ethereum L1 $57 million in gas fees over the last year, a metric that was measured before 4844 came and reduced L2 fees by >95%!

The cost of economic security drops to zero, leaving behind DA as the only meaningful ongoing operational costs of L2 networks. Since DA cost is also approaching zero, the net cost of L2s is also approaching zero.

By creating sustainability for L2s, Ethereum can unleash as many chains as the market demands, creating far more total chain sovereignty than the Cosmos model could produce.

Synergy #2: Composability

The customer acquisition costs of L2s also become marginalized, as the settlement of cryptographic proofs to the L1 offers a credible link between all L2s. By preserving the settlement assurances of the L1, users can navigate the L2 landscape without having to ‘kick the tires’ of each chain they touch. Naturally, users won’t be doing this activity anyway, but instead service providers who offer chain abstraction services (bridges, intent fillers, shared sequencers, etc) can offer stronger services if they have uncompromising security guarantees about the foundations they’re building their business on.

Additionally, as many L2s come online, each attracts their own marginal user to the greater Ethereum ecosystem, creating a festival of the commons of users. Since all L2s add their users to the pile, the total ‘pile’ of Ethereum users becomes larger as the network grows, making it easier for the marginal L2 to find sufficient users.

Ethereum gets flak for it's fragmentation, but it's literally a network of composed chains

— DavidHoffman.eth/acc🦇🔊 (@TrustlessState) March 28, 2024

'Many L1s' is true fragmentation

Ethereum gets critiqued from being ‘fragmented’, which is ironically the exact opposite of what it is, since Ethereum is the only network that is stitching together other sovereign chains via cryptographic proofs. By contrast, the many-L1 space is complete and total fragmentation – whereas Ethereum’s L2 space is fragmented only by latency.

Synergy #3: Unit of Account

All of these benefits converge upon the Schelling point of ETH the asset. The more surrounding network effects around the Ethereum ecosystem, the stronger the tailwinds become for ETH as money.

ETH becomes the unit of account for all of its L2 networks, as each L2 network produces economies of scale through the centralization of security into the Ethereum L1.

Simply put, ETH becomes money as a function of the fractally growing settlement network of Ethereum.

Conclusion

The Ethereum project is in pursuit of a single unified piece of architecture that encompasses the broadest set of possible use cases. It is a network built to do it all.

The combination of small but powerful L1 is the foundation that is required to open up the grandest possible design-space at the L2s. An early Bitcoiner trope is “If it’s useful, it will eventually be built on Bitcoin.” I believe in this concept wholeheartedly, except with Ethereum as the network, as this is the purpose Ethereum has been optimized for.

Preserving the values of the crypto industry happens at the L1.

Decentralization, censorship resistance, permissionlessness, and credible neutrality. If these can be preserved at the L1, then they can be functionally extended to an infinite number of L2s that cryptographically bond themselves to the L1.

The central Ethereum investment thesis in crypto’s game of thrones is that any alternative L1 can either be built better as an L2, or integrated as a feature set in the L1.

- Do you want consensus at the speed of light? It’ll be faster as an L2.

- Do you want a fully private blockchain? It’ll be more effective as an L2.

- DA as a blockchain? What about just enshrined in the L1.

Eventually, everything becomes a branch on Ethereum’s tree.

Thanks to Sam Hart, Mike Ippolito, and Justin Drake for their review and improvements to this piece!