The Two Sides of ETH

Dear Bankless Nation,

As you might have noticed, I have been a bit more tempered in my stance on $ETH lately. The decline of ETH’s relative valuation has caused it to lose investor confidence, and when ETH aspires to be internet money, confidence is key.

The reasons behind ETH’s lagging performance have been the subject of debate for years now. Many of these issues plaguing ETH's relative valuation have been outside of its control – Gary Gensler, Michael Saylor, etc. (Gensler is gone, and ETH treasury companies have finally arrived; some external problems will just fix themselves.)

But today, I want to shine a light on the challenges that are firmly under the Ethereum community’s control, because Ethereum has plenty of agency over many of the reasons why it has lagged the market for 3+ years. These are the problems we should focus our energies upon to reinvigorate potential ETH buyers.

ETH's Value Capture Problem

Many of Ethereum's challenges boil down to a core theme: There is a broken value capture supply-chain between the utility of Ethereum and the value of ETH.

"I’m surprised by… the stablecoin usage that exists on Ethereum, Solana, Tron… does not seem to have produced more value for the holders of the L1 tokens upon which the stablecoins move." - Joe Weisenthal

In this episode, the CB squad went on to discuss how this is an Ethereum-specific problem, since SOL and TRX have reached new all-time highs, and Ethereum’s economic model is particularly leaky compared to its competitors, specifically due to the L2 model.

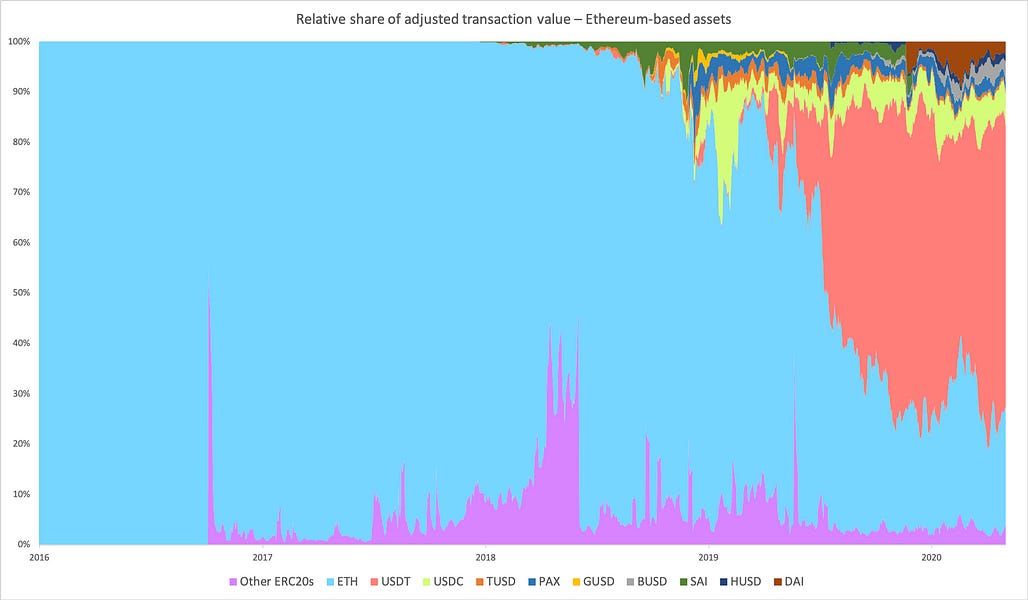

When it comes to stablecoins, concerns about the relationship between a chain’s stablecoin supply and the value capture for its L1 token dates back as early as the 2018-2019 bear market. Nic Carter wrote an article discussing this on Bankless back in 2020 – Crypto-fiat: Mutualistic or Parasitic?

Simply put, buyers and holders of stablecoins on the Ethereum L1 provide no value to ETH other than the ~$0.50 of gas fees they spend to acquire the stablecoins. If they do this on a L2, ETH value capture drops to below $0.01, even if it's billions of dollars' worth of stablecoins being purchased.

Ethereum's Narrative Momentum

Nevertheless, the adoption metrics of Ethereum are inarguably bullish.

The recent announcement of Robinhood Chain and the deployment of tokenized stocks on Ethereum is validation of Ethereum’s L2 roadmap and its position as a credibly neutral settlement layer for Wall Street's assets. With Robinhood Chain, the OG promise that blockchain technology will upgrade Wall Street's antiquated financial system to tokenize and trade everything is being realized.

This announcement is just one of many bull signals for the network:

- The Ethereum ecosystem maintains 50% dominance of stablecoin supply, and if you disregard the opaque Tron ecosystem, it's more like 75%.

- CRCL’s blockbuster IPO validates Ethereum specifically, as Ethereum holds 66% of all USDC.

- Coinbase, the crypto industry’s most trusted and respected brand, is building an Ethereum L2.

- Ethereum’s 100% uptime and prioritization of true decentralization with no counterparties resonates with Wall Street's needs and elevates its brand versus alternatives.

- ETH treasury companies are crescendoing in economic weight.

Corporate ETH grab is going parabolic:

— Eric Conner (@econoar) July 7, 2025

• SharpLink (SBET) now holds 188,478 ETH ($490mn)

• Bit Digital (BTBT) just flipped to 100,603 ETH ($260mn)

• Tom Lee’s BitMine ready to buy ~100,000 ETH ($250mn)

Total 388,000 ETH vs. only 70,000 ETH minted this month.

If you want to pitch a bullish narrative for ETH and Ethereum, it’s becoming increasingly easy to do so.

All of the hard work from Ethereum developers to maintain decentralization and credible neutrality has paid off in incredible adoption metrics from the gravitational center of the world's capital: Wall Street.

Scaling ETH’s Narratives

A lot of people see the above adoption and success stories, and see opportunity.

Tom Lee’s Bitmine treasury play is taking advantage of the weight of Ethereum’s narratives. The strategy is simple. Put ETH on the balance sheet, and then shill ETH to Wall Street. Ethereum has a lot of narrative kindling, and all ETH needs is someone with enough rizz to get Wall Street excited.

In order to effectively execute the @saylor @MicroStrategy playbook, you need to be good at two things

— David Hoffman (@TrustlessState) July 8, 2025

1. Shilling charisma

2. Financial engineering @fundstrat clearly has lots of both

Does he have enough to restore $ETH to previous levels of market confidence 🤔

We’re about to see exactly how undervalued ETH has become over the last 4 years. Is ETH’s poor price performance due to market irrationality? Or is its decline truly indicative of a deeper, more structural problem?

Tribalism vs. Social Scalability

Dig into the above and you gain a deeper understanding of the two sides of ETH.

On one side, there's a network with an L2 model that has severed a link in the supply chain of ETH value capture. But on the other side, you have this incredible success story where it seems like Wall Street is just a price pump away from FOMO-ing ETH to $10K.

Here’s how I think about that dichotomy:

If you add narrative firepower on top of an unresolved value capture supply chain, you get tribalism that is beloved by the in-tribe, and rejected by the out-tribe.

Let me give you the real comps for store of value reserve assets like ETH.

— RYAN SΞAN ADAMS - rsa.eth 🦄 (@RyanSAdams) June 12, 2025

Oil - $85T

Gold - $22T

Bonds - $141T

GDP - $106T

M2 - $93T

Take the average.

ETH - $89T

$740k per ETH is the long-term potential.

Simple math. pic.twitter.com/DSFIdoYC1B

Now, most people in Ethereum see Ryan’s call for $740k per ETH and get excited, while people outside of Ethereum may see the same thing and think it's delusional (just read the QTs).

But let's imagine an alt scenario where ETH’s superior value-capture supply chain becomes a central part of ETH’s narrative, as it did back in 2021. In this scenario, all Ethereum L2s become Native+Based Rollups and Ethereum’s blocktimes reduce to ~2 seconds (which is Ethereum’s long-term goal).

In this world:

- Rollups have synchronous composability, so network bridging is eliminated. Lower L1 blocktimes allow market makers to quote much tighter spreads, which brings more volume onchain. Price execution improves drastically.

- Ethereum’s robust MEV infrastructure can finally be leveraged to provide traders with optimal execution (on memecoins, etc), rather than the ~20% fleecing they find elsewhere.

- Cross-chain liquidity flows back to the L1, and Native+Based rollups can seamlessly access L1 liquidity. Trading volumes increase commensurately.

- Based+Native rollups are 10x-100x more gas-intensive than current L2s, while providing shared liquidity and composability, meaning that all this activity on rollups actually burns a meaningful amount of ETH.

- Tokenized assets on Rollups are accessible throughout the rest of Ethereum’s ecosystem. Ethereum becomes even more dominant as the place to issue and trade tokenized assets.

What I've laid out above is a future where the feedback loop between Ethereum’s utility and ETH value capture is restored.

Breaking the Narrative Out of Tribalism

In 2024, Bitcoin broke out from being an asset predominantly promoted by its tribal community, to an asset accepted as a ‘special snowflake’ by the world’s most powerful government. There is only a strategic bitcoin reserve. No other asset holds this.

Bitcoin’s fundamentals (21 million cap) have compelled non-tribal investors to own at least some bitcoin.

Ethereum needs to do the same thing.

While it’s great that Tom Lee and all of the other ETH treasury companies are spreading the gospel of ETH to Wall Street, it would be even better if they were able to stand on top of a coherent value capture story to use as leverage.

The Ethereum community has to fast track repairing the feedback loop between Ethereum utility and ETH value. We know the necessary inputs. We also know the stakeholders, including many who are already onboard with charging toward this vision and a few who might need to be convinced by the rest of the community. We know we can get there.

What's at stake? An even more effective growth story for Ethereum that we can sell the world on – one that would finally enable exactly what the ETH tribe wants ETH to do: Go to $10k and beyond.