The Trade War Arrives

View in Browser

Sponsor: Mantle — Mantle is building the largest sustainable hub for onchain finance.

1️⃣ Market Reels from Trump Tariffs

Crypto markets took a sharp hit this week after President Trump unveiled sweeping “Liberation Day” tariffs, triggering a wave of risk-off sentiment across global financial markets.

The policy imposed a baseline 10% tax on most imports—with some countries, like China, facing levies over 50%—and has fueled growing fears of a global trade war.

Bitcoin fell below $82k, while other majors like ETH and SOL dropped over 10% and 16% respectively this week. Stocks also fared poorly, with the S&P 500 posting its worst single-day loss since 2020. Major crypto-exposed equities like Coinbase and MicroStrategy saw steep drawdowns, too.

Prediction markets have reacted swiftly. Both Polymarket and Kalshi now show over a 50% probability the U.S. will enter a recession in 2025. Still, some see opportunity—some analysts argue that economic uncertainty and dovish expectations for Fed rate cuts could ultimately drive renewed flows into crypto as a store of value.

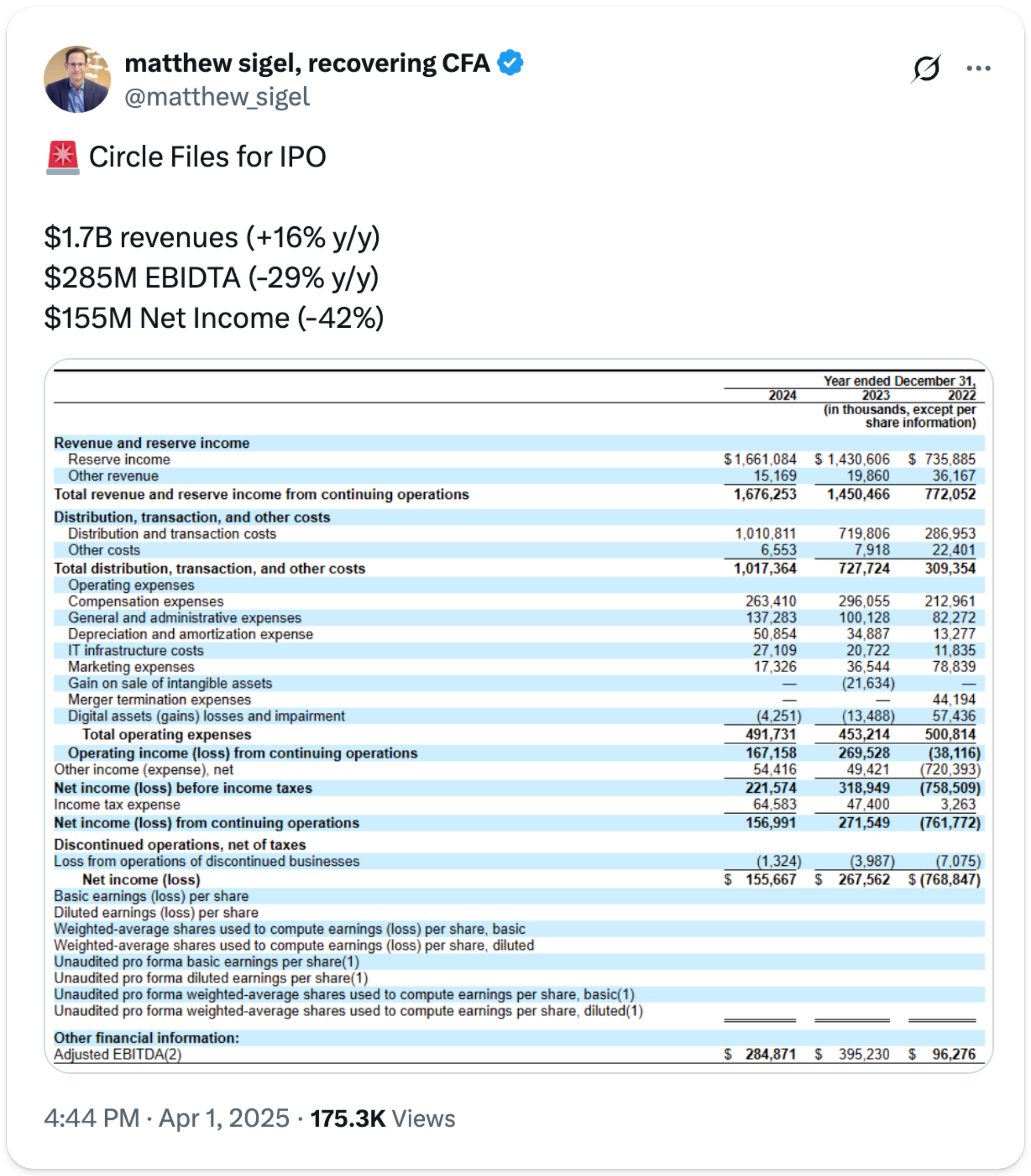

2️⃣ Circle Files for IPO

USDC stablecoin giant Circle has officially filed a prospectus with the SEC for its long-awaited initial public offering, enlisting Wall Street heavyweights JPMorgan and Citi as lead underwriters.

The filing follows years of delays and failed attempts, including a scrapped SPAC deal in 2021 and a confidential filing in 2024. In the prospectus, Circle revealed it had paid $210M in stock to acquire Coinbase’s 50% stake in the now-dissolved Centre Consortium, making Circle the sole issuer of USDC.

CEO Jeremy Allaire framed the IPO as a move to “operate with the greatest transparency and accountability possible,” noting USDC has facilitated over $25 trillion in onchain transactions since its 2018 launch. While details like share count and pricing remain under wraps, Circle’s financials show a bounce from a $768M net loss in 2022 to $155M in net income last year.

Circle joins a wave of firms like Kraken and BitGo eyeing public markets in 2025, but will tariff-fueled recession fears derail their plans?

3️⃣ CoinList Returns to U.S.

After a five-year departure, the token launch platform CoinList is back in the U.S. markets and bull-posting the future of the industry under Trump's crypto-friendly administration.

The platform is relaunching stateside with a token sale for U.S. accredited investors of the crypto infrastructure team DoubleZero Foundation's 2Z token.

4️⃣ GameStop Stacked More BTC

GameStop wants to follow in the steps of Strategy and stack bitcoin on its balance sheet. This week, it closed a $1.5 billion capital raise with aims to use the new funding to invest directly in BTC.

News of the offering led to a substantial sell-off last week, but stock prices managed to buck market trends and surge this week as GME Chairman Ryan Cohen announced he was increasing his stake in the company and had purchased 500,000 shares on the open market.

5️⃣ SEC Pick Moves Toward Confirmation

Trump's pick to run the SEC is well on his way to confirmation as Republicans vote him through while outnumbered Democrats voice their opposition. On Thursday, the Senate Banking Panel voted to advance Paul Atkins to run the agency. Next up is Senate confirmation.

Atkins was already an SEC commissioner under George W. Bush between 2002-2008 and founded the consulting firm Patomak Global Partners which has advised numerous crypto firms since its founding.

Experience the next generation of onchain finance with Mantle—where blockchain meets everyday banking. Powered by a $4B treasury, Mantle Network and mETH Protocol, Mantle is launching three innovation pillars: Enhanced Index Fund for optimized crypto exposure, Mantle Banking for blockchain-powered banking, and MantleX for AI-driven innovation. Stay tuned and enter the future of on-chain finance with Mantle.

📰 Articles:

📺 Shows:

Thoughts on how to make Bankless even better? Tweet me!

🧑💻 Lucas Matney, Bankless Editor