The Tornado Cash Chilling Effect

Dear Bankless Nation,

As we all know by now, last week the Office of Foreign Assets Control (OFAC), an agency under the U.S. Treasury blacklisted the crypto mixer Tornado Cash and added a set of Ethereum addresses to its sanction list.

This has triggered a slurry of conversation, controversy, and chaos.

Let’s call this for what it plainly is: FUD.

A borderline acceptable crypto regulation would’ve been non-discriminatory, sourced feedback from the industry beforehand and provided plenty of room for builders in the space to anticipate and plan compliance accordingly. This was arbitrary, sudden and — because it singled out one dapp — highly discriminatory, and now sowing the seeds of FUD into DeFi.

As an industry, we should pause for a moment, take a deep breath, and take stock of the state of things, to make sure we don’t do anything unnecessary.

Calling it what it is

First off, let’s plant a big flag in the ground.

The law is on our side. Adding a neutral piece of software, one without agency or intent, is in violation of the First Amendment.

I am not a lawyer, of course, and this claim will have to be fought in court in order to restore our access to Tornado Cash, but there is plenty of precedence that supports this.

While the OFAC sanctions on Tornado Cash represents a new page for the regulation of cryptocurrency, the institution of cryptography has already fought a very similar fight in the past against draconian Nation State laws, and won.

Just this morning, Coin Center produced a fantastically thorough analysis on this. Also useful is this summary tweet thread from Seth Hertlein and Mirror article from Luke Ethwalker.

This was not done on a whim

Treasury did not wake up last Monday and say “I think I’ll ban Tornado Cash today”. Treasury has been building the case against Tornado Cash for almost a year now, if not longer.

It’s likely that every single address on the OFAC SDN list has a legal case behind it, to support the ban by OFAC.

OFAC was able to go after Tornado Cash because of how easy it was to produce a legal argument for its banning.

At the time of its ban, 35% of Tornado Cash TVL came from stolen funds from hacks or exploits, which I suspect the majority of which is North Korea. And that’s just with a basic Nansen search; the actual number may be higher. Based on its lifetime usage since 2019, Chainalysis estimates that 10.5% of crypto received through Tornado Cash is tied up with stolen funds.

It’s hard to defend Tornado Cash based on the facts and circumstances. It was clearly full of illicit funds from entities.

This message goes out to all the other teams working on crypto privacy. Tornado Cash was targeted because North Korea and other actors were trying to escape from state-level sight.

Tornado Cash was not banned based on its principles, it was banned due to how it was being used, and who was using it. The legal argument to restore our access to Tornado Cash will likely be one that argues for the rights of individuals, and not about the specific circumstances of how, yes, Tornado Cash is a useful tool for North Korea.

If you’re working on the domain of privacy in crypto, the U.S. Treasury is probably not coming after you until after North Korea starts using your app. Again, not a lawyer, and you should definitely have one.

Chilling Effect

The sanctions has sent DeFi scurrying all over in a frenzy.

The Aave front-end is blocking addresses that have interacted with Tornado Cash, post-sanctions (including those receiving the ‘dusting’, WHICH IS ME)

Read this thread for info on DeFi front-ends and OFAC compliance.

We have people surfacing the possible scenarios of Coinbase, Lido, Kraken doing protocol-level censorship with their customer’s staked-ETH.

Bitcoin addresses have been on the OFAC SDN list for years, and have never had protocol-level censorship, and no one has cared about that at all. Why is this any different?

People making unfounded claims that Metamask is adding KYC rules.

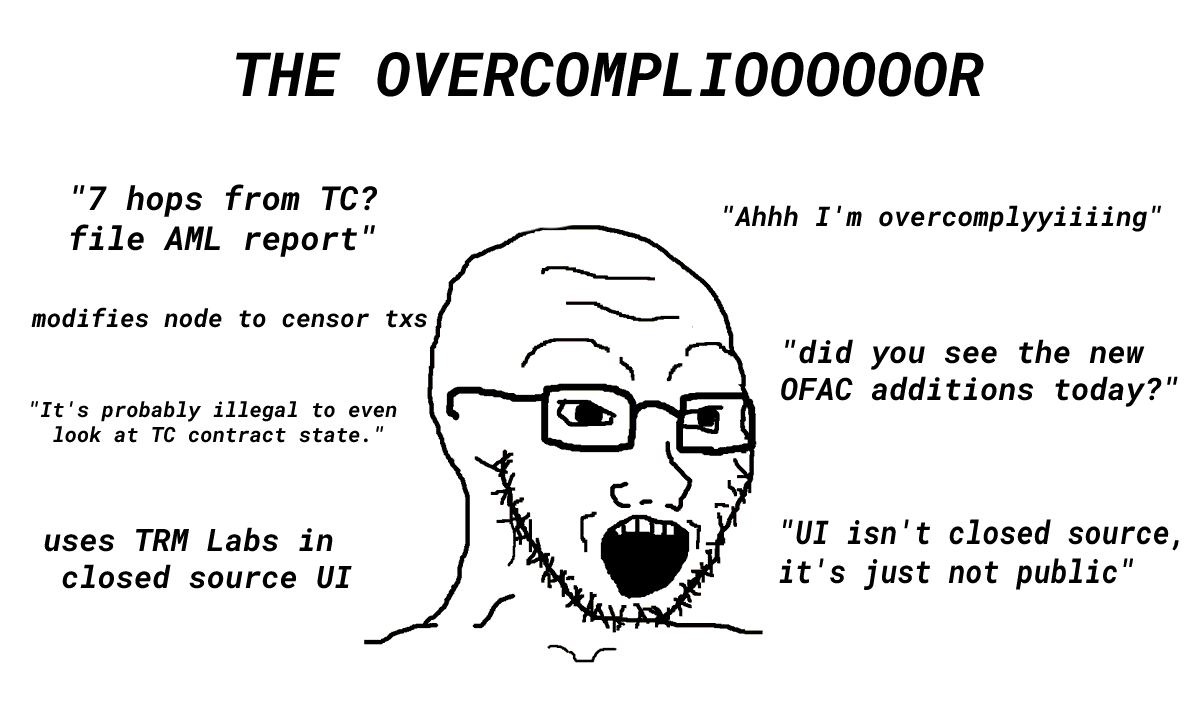

Memes like these being made.

In summary, the DeFi ecosystem is rightfully asking itself: “How far do these implications go? Am I at risk?”

Some reactions, like front-end censorship, are expected. They give DeFi apps a moment to breath, reflect, and make a calculated next move. Other reactions, like protocol-level censorship, are completely unfounded and would represent a huge ‘own goal’ if implemented.

This is all an example of a ‘chilling effect’: The concept of deterring free speech and association rights protected by the First Amendment as a result of government laws or actions that appear to target expression.

There’s the banning of Tornado Cash… and then there’s the many different reactions and responses done by DeFi apps as a result.

First, some of these reactions are totally justified and acceptable. Front-end censorship to comply with OFAC is much more reasonable because it is temporary. It gives dapps time to think and reflect until they make a decision, as its trivially easy to remove the front-end censorship once they feel comfortable.

Other reactions are just totally ludicrous, like protocol-level censorship. Sadly, a doomsday path towards protocol-level censorship (that is, not processing blocks that contain sanctioned address transactions in them) is now becoming more visible as a result of the Tornado Ban, but that is not what is being asked of today. Especially anyone calling for protocol-level censorship of block production.

From Coin Center’s article today:

As the Supreme Court in Broadrick v. Oklahoma found, sometimes “the possible harm to society in permitting some unprotected speech to go unpunished is outweighed by the possibility that protected speech of others may be muted and perceived grievances left to fester because of the possible inhibitory effects of overly broad statutes.”

Don’t overreact!

Crypto’s goal was to build something that lies credibly in the control of the people, and that would imply being specifically outside the purview of Nation States. It’s not going to be easy, but that is the goal. Producing anything less that a fully independent financial system that is superior to the laws and rules of Nation States is an incomplete expression of the power of crypto.

I’ll return back to the start of this piece.

The OFAC banning of Tornado Cash is unconstitutional, and we, as an industry, are going to band together to restore our access to privacy. OFAC will have to figure out a different way to sanction North Korea, but it’s going to be in a way that doesn’t also strip U.S. citizens of their right to privacy-enhancing utilities.

Bankless Nation, this is what we’ve been training for.

- David