Dear Bankless Nation,

The L2 Wars are getting hot and Bankless is digging into the onchain metrics to show you who is winning.

We looked at Arbitrum last week, now let’s check out its closest competitor: Optimism.

- Bankless team

The L2 wars are heating up.

We already took a look at the state of Arbitrum last week, and now we’re turning our sights to its biggest rival: Optimism.

Optimism is an optimistic rollup, and alongside its aforementioned competitor, has emerged as one of Etheruem’s leading scaling solutions.

The L2 has been around for a while, but in recent months has become noteworthy for being the first generalized rollup to launch a token: OP.

OP has been one of the best performers to start 2023, rising 227% against USD and 135% against ETH. Optimism now trades at a fully-diluted valuation of $13.0B, on par with Layer-1s such as Solana.

This begs the question… is Optimism’s lofty valuation warranted?

Do the fundamentals back up the outperformance of OP?

Where does Optimism find itself within the competitive L2 landscape?

I’ll try and answer these questions by taking a look at three areas:

- Key Performance Indicators

- Popular Dapps on Optimism

- Upcoming growth catalysts and risk factors

Let’s dive into the state of Optimism and see whether there are reasons to be optimistic about the L2.

Key Performance Indicators

TVL

Optimism’s DeFi TVL currently sits at $786.8M. This places the rollup as the second largest L2 by TVL behind Arbitrum ($1.39B) and seventh largest of any network tracked by DeFi Llama.

Optimism has seen its overall TVL share soar over the past year, rising from 0.2% to 1.2%. Its share within L2s has also grown dramatically, increasing from 13.5% to 35.2% during this time.

This growth has likely been fueled by the launch of OP, the rollup’s governance token, in May 2022. Optimism, which airdropped OP to users of the platform, was the first of the “Big 4 L2s” (Optimism, Arbitrum, StarkWare, and ZkSync) to launch a token, which helped lead to liquidity inflows and TVL growth over the summer months.

Users

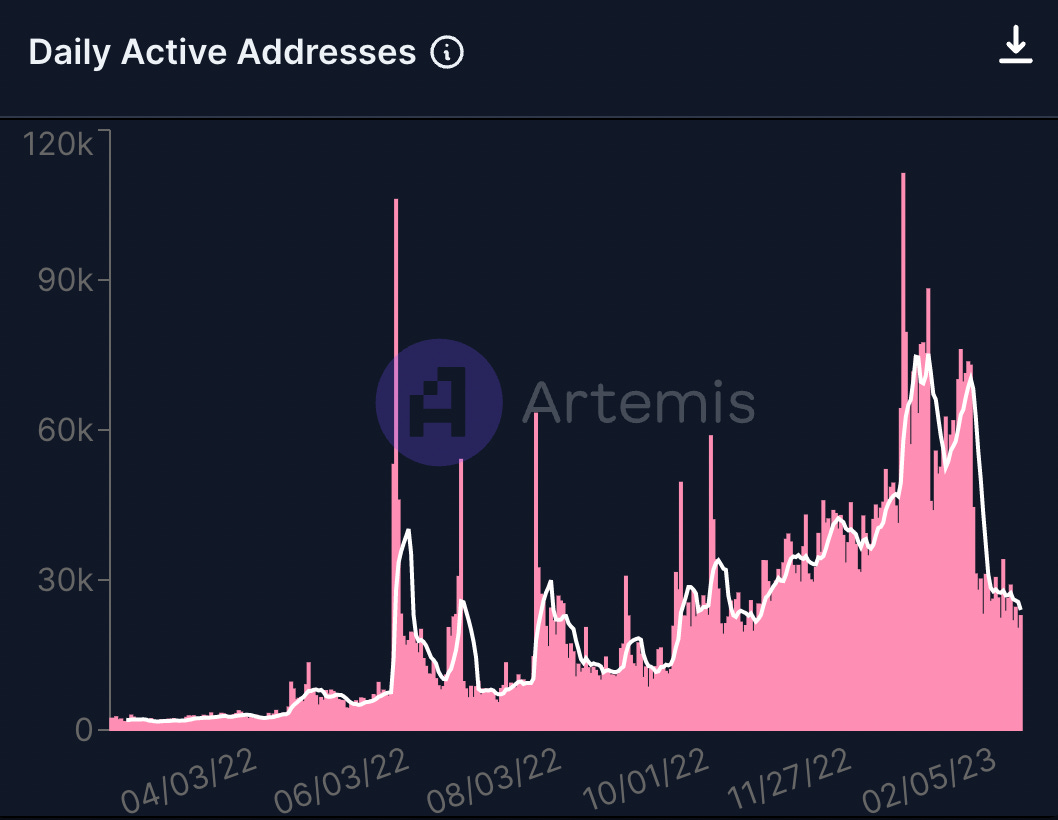

Optimism has experienced massive growth in active addresses in 2022, with total daily active addresses (DAA) in Q4 soaring 1768% when compared to Q1.

This growth can likely be attributed to both usage of dapps on the network, such as projects in the Synthetix ecosystem, as well as the aforementioned incentive programs.

Diving deeper, we can see that DAA surged to close the year, rising 152.7% Q/Q from Q3 to Q4. This spike in users is due in large part to Optimism Quests, a program similar to Arbitrum Odyssey where users earned NFTs in exchange for interacting with dapps on the network.

Now that this program has ended, Optimism's user count appears to be trending back towards pre-quest levels, with Q1 2023 transactions on pace to come in at a Q/Q decline of 7.2% when compared to Q4 2022.

Transactions

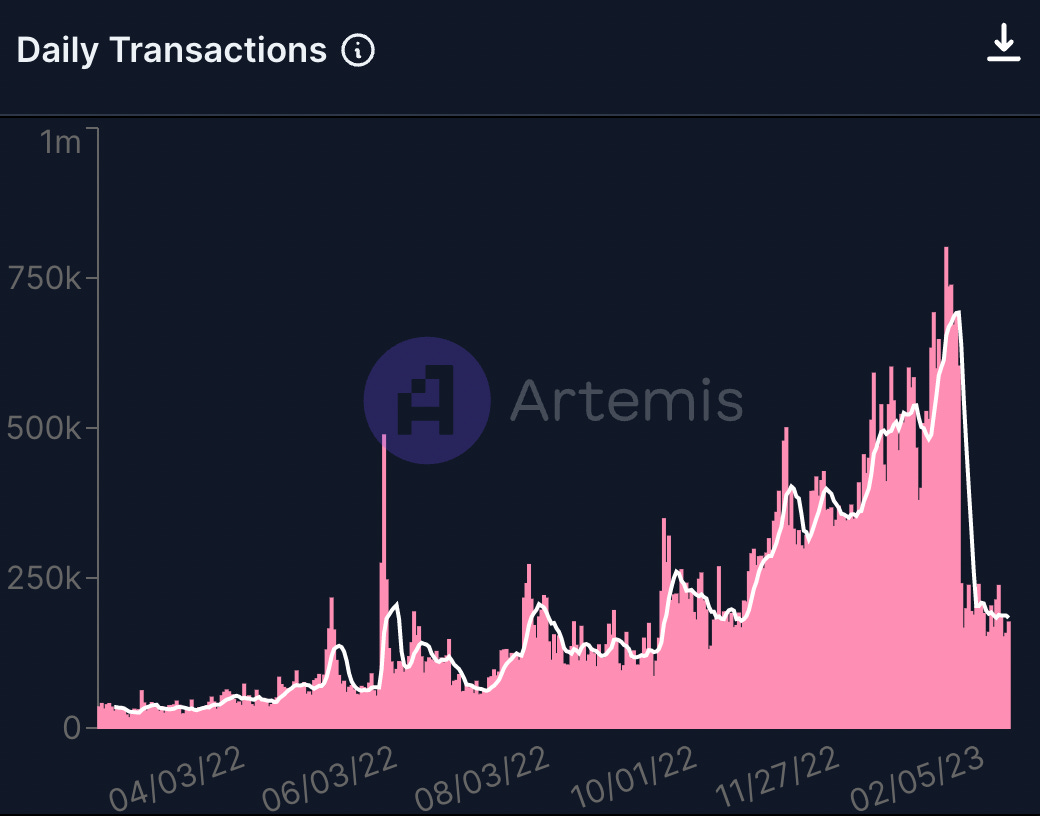

As with users, Optimism’s transaction count skyrocketed over the course of 2022, with total Q4 transactions increasing 851% relative to Q1. This growth came to a zenith in Q4, with transactions growing 144.8% Q/Q when compared to Q3.

While some of these transaction metrics can be attributed to dapp usage, like active addresses, this number appears to have been inflated by Optimism Quests. This is illustrated by the immediate drop-off in Q1 transactions immediately after the end of quests on January 18 and since then, daily transactions are falling at a pace that would net out to a 46.2% decline relative to Q1.

Popular Dapps

While not as expansive as other L2s like Arbitrum, Optimism has a growing cohort of dapps across multiple sectors on both its generalized and application-specific rollups built using the OP Stack (more on this shortly). Let’s touch on a few of the standouts below:

Velodrome

Velodrome is the largest dapp on Optimism by TVL at $178.1M. A Solidly fork, the DEX rose to prominence in July 2022 following an OP airdrop to veVELO lockers. veVELO lockers are VELO holders who lock their tokens for NFTs that provide them with the rights to allocate emissions on the platform.

Velodrome has found PMF on Optimism from protocols, such as stablecoin and LSD issuers, looking to control these emissions and incentivize liquidity for their tokens through the use of bribes, or payments to veVELO lockers. Currently, veVELO is yielding an annualized return of 52%+ to holders who max lock for four years.

Although the Solidly AMM architecture is not competitive with Uniswap V3 (which dwarfs the DEX in volumes), Velodrome appears to have nonetheless captured the heart of the community and carved out a niche as a liquidity hub.

Synthetix Ecosystem

Synthetix was not only one of the OG DeFi protocols on Ethereum, but was one of the first prominent ones to migrate to an L2, deploying on Optimism in July 2021.

There is currently more than $192.5M of SNX staked on Optimism, collateralizing an sUSD supply of $48.2M. Numerous protocols have leveraged this sUSD liquidity by building on top of Synthetix. This includes such as Kwenta, a perpetual exchange, Lyra, an options AMM, and Thales, a protocol for creating parimutuel markets.

Synthetix has faced numerous challenges over the past several months, most notably a precipitous decline in fee revenue, but has several notable catalysts on the horizon, such as the continued adoption of their V2 perps and the upcoming launch of Synthetix V3.

The Lattice Ecosystem

Lattice is a developer building on-chain games via the OP Stack. The OP Stack is a framework for creating custom, modular rollups that are composable with one another (if they use the same sequencer).

Lattice has developed two games: OPCraft, a Minecraft-like game, where users can build and create structures in an open world and Sky Strife, a battler.

OP Craft was only live for a two-week demo, but both it and Sky Strife, which is set to launch later in 2023, will run entirely on custom rollups built using the OP Stack. Given the appeal of games among crypto natives and normies alike, Lattice’s releases could serve as a significant funnel to bring users into the Optimism ecosystem.

Future Outlook

Growth Catalysts

Optimism has several catalysts on the horizon that should help sustain its growth over the next several months.

The first of these is an upcoming distribution of 10M OP (worth $30M at current prices) in February. This OP is going to be allocated to various stakeholders within the ecosystem through retroactive public goods funding (RPGF), which will be voted on by members of Optimism’s citizen house. The citizen house is one of two governance bodies within Optimism, and membership is conveyed through soulbound NFTs.

The OP distributed to projects through RPGF should serve as a reload for incentives, and — should markets continue to grind higher — help lead to an influx of users and liquidity on the network. In the long run, Optimism’s use of RPGF and experimental governance model could help attract idealistic, long-term oriented developers to the network.

Another catalyst on the horizon for Optimism is Bedrock. Bedrock is a major network upgrade that is set to reduce transaction costs, and increase transaction speeds. Bedrock will also help improve the modularity of Optimism by allowing the rollup to more easily transition from being an optimistic rollup to a zk-rollup. The approval to ship Bedrock is currently making its way through the L2’s governance process.

A third catalyst to spur further growth of OP is the growing adoption of the OP Stack. While games like OP Craft have been developed using the framework, other projects are beginning to leverage the tech. One example of this is decentralized options exchange Aevo, which is being developed by Ribbon. Aevo is an order-book based options exchange and is set to launch on its own, custom L2 in the coming months.

Risks

Optimism has certainly carved out a niche and has numerous growth catalysts on the horizon. Its ecosystem is growing, but it’s fair to question how they will stack up in the face of increasing competition.

Optimism’s incentives have proven successful at attracting users, liquidity, and applications to the network, but it’s fair to wonder whether they have allocated these incentives in a manner that will maximize their long-term ROI.

To date, Optimism has emitted $69.9M in incentives. After an initial bump around the launch of OP, Optimism’s TVL share among L2s has fallen from 46.6% to 35.5% since November ‘22.

This loss has been Arbitrum’s gain, as they, despite not having a token, have seen their market share increase from 49.8% to 62.1% during this time.

Plenty of dry powder remains in Optimism’s coffers. But it appears as though Optimism has distributed a significant amount of tokens at a time when no new users or capital are coming into crypto and still has not emerged as the dominant L2 when it comes to DeFi.

Competition in the L2 space is set to heat up as networks like StarkNet, Fuel, Polygon’s zkEVM, Scroll and of course Arbitrum, come online and/or launch tokens of their own. Victory in other use cases has yet to be determined, but it’s fair to wonder whether Optimism may be behind the DeFi 8-ball for good.

However, competition is not the biggest risk facing Optimism today.

Like Arbitrum and other L2s, the biggest threat to Optimism’s long-term success are network level centralization vectors. Per L2 beat, Optimism has several key centralization vectors in place, such as not yet supporting fraud proofs, having a centralized sequencer, utilizing upgradable contracts and having no mechanism to propose blocks in the event of a validator failure.

Most L2s have guardrails in place in order to minimize the risk of losing user funds. Though they have been live in production for several years, in the grand scheme of things rollups are still nascent tech.

However, it is absolutely critical that Optimism decentralizes as soon as it is safe to do so, as a loss of funds via one of these centralization vectors could have a catastrophic impact on the network's growth prospects.

The Prognosis

The Optimism ecosystem is growing, and there are numerous catalysts on the horizon that should help it remain on this trajectory. Although its FDV may be inflated in the near-term due to just ~5% of the OP supply having been released into circulation, Optimism’s usage seems to warrant a valuation on-par with other non-Ethereum L1 and L2 networks.

Yes, much of this usage can be attributed to incentives, but Optimism has managed to utilize these incentives to establish itself as clear leading L2 along with Arbitrum. However, with competition set to ramp up, it’s fair to wonder whether the rollup has deployed some of its ammo at an inopportune time for attracting the maximum number of users and liquidity.

Despite this, and centralization concerns, Optimism’s silver bullet may be the OP Stack. If the OP Stack becomes the standard for developing custom L3s, Optimism should benefit immensely from the composability between all the different rollups that use the framework.

So no, as of today Optimism does not appear to be the leading L2. But there are nonetheless plenty of reasons to be optimistic about its future growth prospects.