Dear Bankless Nation,

It's one of those days. It kind of feels like the post-Luna crash.

I don’t know about y’all but I'm personally very frustrated. It’s like... why the F do we have this whole DeFi thing if we’re just going to hop from centralized exchange to centralized exchange and get rugged every step of the way?

Anyways... I hope you all will join us for our livestream right now giving a 24-hour update on the FTX situation. I think we want to have an open conversation and hear all of your thoughts and perspectives. The industry could use some venting and catharsis, so tune in below now.

Today’s newsletter by Donovan recaps our livestream yesterday and all of the events that got us to where we are now.

- David Hoffman

2022 is having its own Mt. Gox moment.

FTX, the second largest crypto exchange in the world, went from 100 to nearly zero real quick — within the span of around 48 hours.

Yesterday, Ryan and David went live chronicling the uncomfortable events of the past week while hearing from special guests like Coinbase’s Brian Armstrong and investor Erik Voorhees for their live takes. Watch below for our recorded livestream, where the Bankless team digs into one central question: How the hell did this happen?

Context: The players involved

FTX was founded by Sam Bankman-Fried (SBF) in April 2019. The 2021 bull market saw FTX rise to prominence to become the second largest exchange in the world, overtaking earlier established competitors like Gemini, Coinbase and Kraken.

Earlier in November 2017, SBF also founded the hedge fund Alameda Research. While FTX and Alameda are not formally under the same corporate entity, both firms are affiliated informally with the latter being a huge market maker on FTX, with huge holdings of FTT on its balance sheets.

FTT is FTX’s pseudo-equity token that is generally associated with the value of the crypto exchange. If you’re trading on FTX, FTT gives you discounts on trading fees, commissions and other rewards, similar to the BNB token on Binance.

In the wake of crypto banks going down in July 2022, FTX was widely seen to have cemented its leadership, launching offers to bail out entities like Voyager, Celsius and BlockFi. Meanwhile, SBF became a full-on media darling.

November 2nd Wednesday: CoinDesk pokes around

[Editor’s note: The author of this piece is on Singapore Standard Time and the timeline follows along as such]

The beginning of this particularly volatile saga starts on November 2nd when CoinDesk reported details from a “private document” dated June 30th, revealing Alameda’s balance sheet was disproportionately full of FTT.

According to CoinDesk, $5.8 billion of Alameda’s total assets ($14.6 billion) were dangerously held in illiquid FTT collateral that had a mere market cap of ~$3.35 billion. This indicated a worrisome position as FTT’s price would plummet if Alameda tried to sell FTT for liquidity. In short, Alameda was using FTT as collateral to backstop their loans.

This also suggested massive commingling of assets between FTX and Alameda, affirming longstanding industry concerns about a conflict of interest between the two entities.

November 6th Sunday: Alameda does PR and CZ enters the fray

By November 6th, the rumor mill was spinning in full effect. The chatter prompted Alameda CEO Caroline Ellison to step in to assuage industry concerns over the fund’s solvency. She tweeted that over $10 billion of assets aren’t reflected on the CoinDesk report.

A few notes on the balance sheet info that has been circulating recently:

— Caroline (@carolinecapital) November 6, 2022

- that specific balance sheet is for a subset of our corporate entities, we have > $10b of assets that aren’t reflected there

Just an hour later, Binance CEO CZ announced that they were liquidating $2.1 billion worth of FTT. Binance was given the large amount of FTT following their exit last year from being an equity holder in FTX. The tweet was framed in diplomatic terms with Binance performing business as usual “responsibly”. Yet, the sheer timing and public nature of the announcement only served to dump gasoline on the burning rumors and investor concerns.

As part of Binance’s exit from FTX equity last year, Binance received roughly $2.1 billion USD equivalent in cash (BUSD and FTT). Due to recent revelations that have came to light, we have decided to liquidate any remaining FTT on our books. 1/4

— CZ 🔶 Binance (@cz_binance) November 6, 2022

November 7 Monday: The drama starts

Almost immediately in response, Ellison tweeted her retort, publicly offering to buy the FTT from CZ at $22. At this point, FTT was still well in the $23-25 price range.

@cz_binance if you're looking to minimize the market impact on your FTT sales, Alameda will happily buy it all from you today at $22!

— Caroline (@carolinecapital) November 6, 2022

And in case anyone doubted CZ, he doubled down by confirming a wallet transaction from an automated Twitter Bot announcing $23 million (~580M USD) of FTT. This sent FTT’s price toppling, dropping ~15%.

Yes, this is part of it. https://t.co/TnMSqRTutr

— CZ 🔶 Binance (@cz_binance) November 6, 2022

Everyone wants more transparency in our industry, right? My tweets were simple. There were questions about a large ($580m) FTT deposit to Binance, and we were transparent about the fact that we are closing our FTT position. 2/4

— CZ 🔶 Binance (@cz_binance) November 7, 2022

Was CZ “attacking” its main competitor? No, claims CZ – this is just Binance performing standard “post-exit risk management, learning from LUNA”. Except that the next tweet strongly departed in tone from his previous.

By invoking “LUNA”, FTT was damned by comparison to the now-vilified Terra coin.

CZ also made a veiled threat against FTX, claiming it was not in Binance’s repertoire to “pretend to make love after divorce” and not “support people who lobby against other industry players behind their backs” – a reference to SBF’s active crypto lobbying with American regulators.

Liquidating our FTT is just post-exit risk management, learning from LUNA. We gave support before, but we won't pretend to make love after divorce. We are not against anyone. But we won't support people who lobby against other industry players behind their backs. Onwards.

— CZ 🔶 Binance (@cz_binance) November 6, 2022

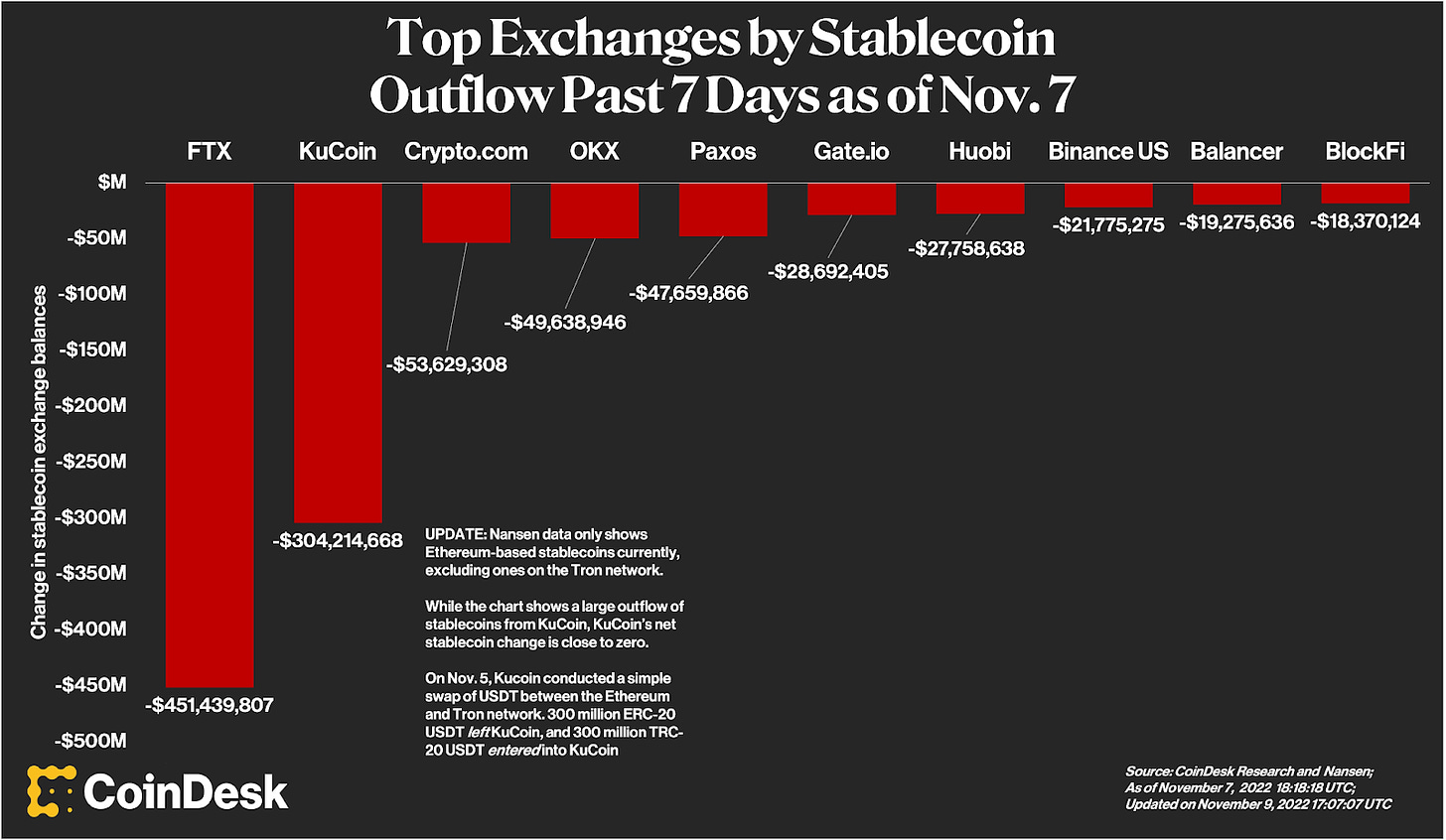

At this point any sane investor had to take the rumors seriously, even if they didn’t believe them before. FTX users rushed to withdraw their funds, as evidenced by massive stablecoin outflows from the exchange, with $451 million over the past seven days.

Institutional traders followed suit. At the same time, on-chain wallet activity showed FTX receiving ~$321 million in stablecoins from Alameda, presumably to facilitate user withdrawals.

At this point, SBF tried to calm the market in a now-deleted tweet:

A competitor is trying to go after us with false rumors. FTX is fine. Assets are fine. FTX has enough to cover all client holdings. We don’t invest client assets (even in treasuries). We have been processing all withdrawals, and will continue to be… It’s heavily regulated, even when that slows us down. We have GAAP audits, with > $1b excess cash. We have a long history of safeguarding client assets and that remains true today. I’d love it, CZ, if we could work together for the ecosystem.

November 8 Tuesday: Shit hits the fan

By Tuesday, FTT had plummeted well below the $22 threshold that Alameda CEO Caroline offered to buy FTT at, sinking down to ~$15. If Alameda’s balance sheets were accurate as alleged in CoinDesk, the fund is most certainly insolvent by now due to its large FTT holdings.

There was a deafening silence from FTX at this point.

If your funds were stuck in FTX, you’d be sitting in cold sweat by now. If you weren’t, well, Crypto Twitter’s meme machine was running nonstop and churning out the memes.

@RyanSAdams @BanklessHQ @TrustlessState SIR DO YOUR THING AND RETWEET THIS pic.twitter.com/wFpa2R2RZv

— Cookie-Monster.eth (@ThetaMentality) November 8, 2022

November 9 Wednesday: FTX gives up

After more than 30 hours of radio silence, SBF emerged again, seemingly giving up.

The Information reported that SBF “sent a message he never thought he would send”. He reached out to CZ for rescue. Sure enough, SBF announced the next day that Binance had agreed to acquire them, assuring customers will be protected and all assets will be covered 1:1.

1) Hey all: I have a few announcements to make.

— SBF (@SBF_FTX) November 8, 2022

Things have come full circle, and https://t.co/DWPOotRHcX’s first, and last, investors are the same: we have come to an agreement on a strategic transaction with Binance for https://t.co/DWPOotRHcX (pending DD etc.).

Just six minutes later, CZ confirmed that they were lending FTX assistance, having signed a nonbinding letter of intent (LOI) to support FTX’s liquidity crunch. This means that Binance could purchase FTX, but could however pull out the deal at any time.

This afternoon, FTX asked for our help. There is a significant liquidity crunch. To protect users, we signed a non-binding LOI, intending to fully acquire https://t.co/BGtFlCmLXB and help cover the liquidity crunch. We will be conducting a full DD in the coming days.

— CZ 🔶 Binance (@cz_binance) November 8, 2022

A Semafor article reported that FTX had scouted TradFi for a lifeline of $1 billion just hours before that deal.

Hours later, Sam Trabucco, former CEO of Alameda waves the white flag.

Much love to everyone -- I'm sure the past few days have been dark for many and I hope the road ahead is brighter.

— Sam Trabucco (@AlamedaTrabucco) November 8, 2022

Comedy hour

When there’s smoke in crypto, there’s usually fire. And the fire has brought some familiar faces out the woodwork. In an UpOnly livestream, Do Kwon emerged alongside Martin Shkreli with the latter providing an affectionate reminder that “jail’s not that bad”.

Martin Shkreli telling Do Kwon that "jail isn't that bad" live on @UpOnlyTV was not on my crypto bingo card. pic.twitter.com/eQOma3dbfy

— Kolten (@0xKolten) November 8, 2022

As Do Kwon was softly mocked on stream about being on-the-run, he turned to Twitter to do the same.

https://t.co/zBKU98Nmef pic.twitter.com/S1PyYnqpBx

— Do Kwon 🌕 (@stablekwon) November 8, 2022

Implications and open questions

That was a lot of information, but what is there to make of all of this?

Does the contagion spread beyond Alameda and FTX?

Exchanges like KuCoin and Crypto.com have reportedly paused withdrawals. VCs like Multicoin Capital and Galaxy Digital are already impacted by FTX, the latter revealing a “$76.8 million exposure to FTX, of which $47.5 million is currently in the withdrawal process”.

📢Calling all researchers! 🧵 Incoming but this is the contagion we know so far. Please provide info in the replies if you know of others so I can compile & share.

— CryptoCondom (@crypto_condom) November 9, 2022

Thoughts 💭:

✅ALOT more contagion WILL come out

✅Entities w/FTX & Alameda exposure will be short targets pic.twitter.com/J48l6onwba

Is FTX in major legal trouble for sending customer deposits to Alameda?

Reportedly, FTX’s legal and compliance teams have already called it quits.

And they call *me* a criminal. https://t.co/7Gw8JK16Nv

— Edward Snowden (@Snowden) November 9, 2022

SBF was a heavy investor in SOL and upcoming L1s like Aptos and Sui – what are the implications for these L1s and DeFi broadly?

Should we be worried that Binance has amassed a monopoly in the crypto game?

Not only is Binance’s top position now even more entrenched as the biggest crypto exchange, they also issue the third largest stablecoin BUSD and run the second biggest L1 chain by TVL.

But perhaps most importantly, what are the regulatory implications of this?

As reported by Bloomberg, regulators are already descending on FTX. Ryan Selkis of Messari who briefly joined the Bankless livestream added that this could mean a nail in the coffin for the DCCPA legislative bill that was championed by FTX. On the regulatory front, crypto is likely taking a big L as regulator scrutiny is sure to intensify.

Coinbase CEO Brian Armstrong also joined the stream and affirmed that view, anticipating this fiasco to accelerate Washington’s increased skepticism for crypto. For Armstrong, the biggest stateside setback is the lack of regulatory clarity which has forced much of crypto trading offshore. Armstrong even concedes that SBF’s regulatory strategy had much to be admired.

2/ Second, Coinbase doesn't have any material exposure to FTX or FTT (and no exposure to Alameda).

— Brian Armstrong (@brian_armstrong) November 8, 2022

This saga is evolving and almost as volatile as broader crypto prices this week, but don’t worry, we’ll be tracking all of the latest updates. More to come as Ben tackles some on-chain analysis of this event in tomorrow’s Bankless newsletter.

I leave readers with this open letter from CZ:

In the spirit of transparency, might as well share the actual note, sent to all Binance team globally a few hours ago.https://t.co/IUNkPcLC8T pic.twitter.com/XGlIJB7EV5

— CZ 🔶 Binance (@cz_binance) November 9, 2022