The SEC's 'Project Crypto' Is Uniquely Bullish Ethereum

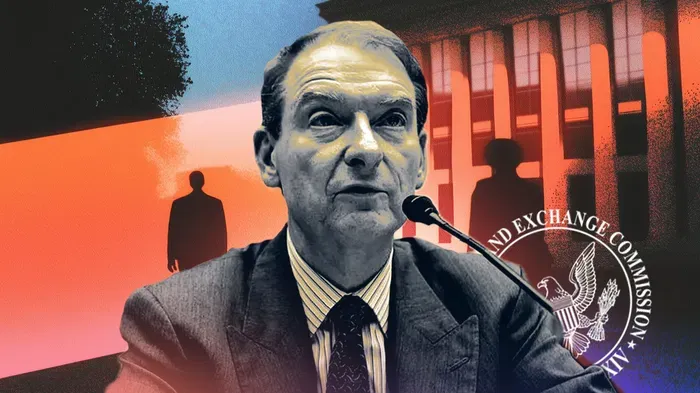

Yesterday, the new SEC Chair Paul Atkins gave a speech that delivered what was probably the single most bullish statement made by a U.S. regulator.

The tl;dr? The SEC wants to move America’s financial markets onchain.

In his announcement, Atkins specifically points to five things he wants the SEC to do for the crypto industry, in order to pursue that end:

- Onshoring Crypto: Allow token issuance and crypto capital formation to happen in onshore LLCs rather than convoluted ‘Foundations’

- Self-Custody + Maximizing Custody Provider Choice: Basically a full end to chokepoint 2.0; allow the market to choose who can custody crypto, including the individual.

- Reducing Licensing Burdens: Allow a more simple registration process so that more competition can come into the market. A single permissive license to rule them all?

- Welcoming Service Providers Onchain: Allow onchain software – centralized and decentralized alike – to be leveraged by centralized services.

- Allowing Startup Experimentation: Provide a regulatory sandbox for startups to build and issue tokens.

Each one of these topics could warrant an entire discussion by themselves, and frankly more clarity here would be welcome (Paul Atkins on the podcast soon?).

When you read Atkins' introduction to this latest statement, he emphasizes the costs when the regulations and technology around markets lags behind modern demands. He discusses how the pre-electronification of financial markets led to a disaster in market confidence because antiquated technology could not keep up with the market.

“In the 1960s…—Wall Street was riding a bull market. But behind the scenes, our market machinery was straining to keep up….Rising stacks of paper stock certificates had to be physically delivered by clerks wheeling carts up and down Wall Street and in other financial districts all across America… The breakdown over an antiquated system was described by the SEC chairman at the time as ‘the most prolonged and severe crisis in the securities industry in 40 years…’”

Why is Chair Atkins including this historical anecdote? In my opinion, it's because he wants to emphasize the importance of proactively, rather than reactively, getting America’s financial markets upgraded into the blockchain technology era.

Paul later adds explicitly:

“To achieve President Trump’s vision of making America the crypto capital of the world, the SEC must holistically consider the potential benefits and risks of moving our markets from an off-chain environment to an on-chain one.”

Paul Atkins wants to put America’s Financial Markets onchain.

But which chain??

Paul and the SEC have no bias toward particular chains in the statement. From the perspective of the SEC, which chain benefits from America’s financial markets moving onchain is up to the market.

So, what does the market want?

I’ll make a few claims here:

- The incredibly successful Circle IPO was Ethereum-coded. USDC was born on Ethereum. USDC found growth and maintains healthy dominance on Ethereum. Ethereum is known as the stablecoin chain.

- Coinbase, crypto’s largest publicly traded company, is Ethereum-coded. It’s scaling an L2 on Ethereum. Coinbase is directly contributing to EVM development.

- Robinhood is building an Ethereum L2

- BlackRock prefers Ethereum as the primary location of tokenized RWAs

- ‘Tokenization’ itself is Ethereum-coded. The word spawned from the emergence of tokens on Ethereum in the first place.

Mike from Blockworks broadly agrees:

I can’t help but view the SEC’s “Project Crypto” as Ethereum coded.

— Mippo 🟪 (@MikeIppolito_) July 31, 2025

TradFi is finally jumping in with both feet into tokenization and DeFi in a BIG way.

Everything Wall Street is excited about (stablecoins, private credit, tokenized MMFs) is happening on the blue chain.

Yes, tokenized assets can go on any chain. Do centralized issuers need Ethereum’s level of WWIII-resistant blockspace? Perhaps not? Does Ethereum’s 10 years of uptime matter when asset ownership is actually determined by offchain processes?

Anatoly, the founder of Solana, says security doesn’t matter. I think that’s midcurving it.

Are you guys dense? Tron is good enough to handle 70b of usdt. RWAs only need the issuer to run their own full node, that’s it. The issuer can implement a cross chain protocol between any chain they let’s the issuer run a full node. The economic security doesn’t matter, nor…

— toly 🇺🇸 (@aeyakovenko) August 1, 2025

Ethereum’s brand of security and decentralization is huge, and in Wall Street, brand matters.

Blockchains like Solana or Avalanche, both of which have had multiple hours of downtime in the last 1.5 years, today still look far too much like corpo-chains than decentralized ecosystems.

Yes, I am certain that some RWAs and other Wall Street action will find itself on juiced Alt-L1s like Solana or Avalanche. But the bulk of America’s financial markets will find themselves on the one chain that doesn’t have a counter-party.

Ethereum.