The SEC's Crypto 180

1️⃣ SEC Unveils “Project Crypto”

On Thursday, Securities and Exchange Commission (SEC) Chair Paul Atkins established “Project Crypto” as the agency’s north star to aid President Trump in establishing America as the “crypto capital of the world.”

Led by Crypto-Mom, Commissioner Hester Peirce, Project Crypto directs SEC staff to draft clear and simple rules of the road for crypto asset distributions, custody, and trading for public notice and comment. The plan invigorated the crypto industry with its call for a “Commission wide initiative to modernize the securities rules and regulations to enable America’s financial markets to move on-chain.”

In line with a recent President’s Working Group on Digital Asset Markets report, the SEC aims to: bring crypto asset distributions back to America, provide maximum choice for crypto asset custody and trading, support innovative “super-apps,” and unleash the potential of blockchain systems in securities markets.

Thank you, @A1Policy, for hosting me today to discuss “Project Crypto,” which will be the SEC’s north star in aiding the President in his efforts to make America the “crypto capital of the world.”

— Paul Atkins (@SECPaulSAtkins) July 31, 2025

Thread 🧵⬇️

2️⃣ Crypto Earnings Results

Numerous notable crypto companies announced Q2 earnings results this week, including Coinbase, Strategy, Robinhood, and Tether.

Robinhood results came in on Wednesday and managed to outpace Wall Street’s earnings expectations on the back of increased crypto trading and strong overall revenue performance, up 45% from one year ago.

Tether’s reserve attestations released Thursday showed it earned an eye-watering net profit of $4.9B in Q2 and has become one of the largest U.S. debt holders with $127B of U.S. Treasury exposure backing its 157B USDT. Somewhat concerningly, Tether holdings of non-cash equivalent increased during the quarter; they now comprise 20% of overall Tether reserves.

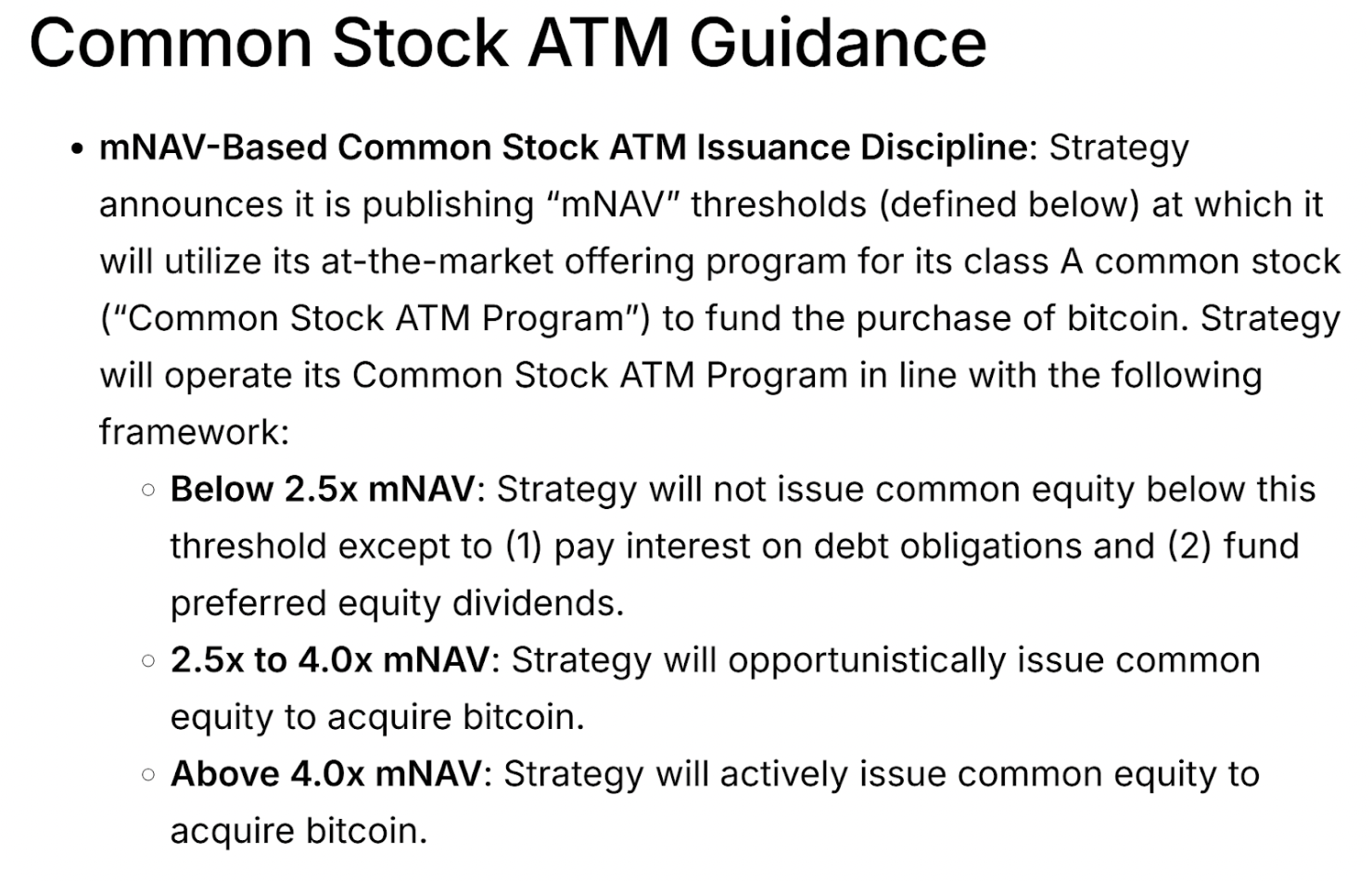

After the closing bell on Thursday, both Coinbase and Strategy disappointed their holders. The former undershoot quarterly revenue expectations of $1.59B by 5.7%, and the latter published share dilution guidelines that prohibit sales when the stock trades below a 2.5x multiple to its net asset value.

With MSTR trading at an mNAV of 1.46x at the time of writing, this development effectively caps share sales for the foreseeable future, yet the firm remains able to raise capital through its exotic fixed income and equity offerings: STRK, STRF, STRD, and STRC.

3️⃣ Storm Case Nears Completion

Embattled “Tornado Cash” developer Roman Storm appeared in court this week for the crypto trial of the ages; the outcome will set precedent for all blockchain-based projects in existence and going forward.

Storm stands accused by the Department of Justice for conspiracy to commit money laundering, transmission of funds derived from criminal activity, and criminal sanctions violations in relation to his deployment of Tornado Cash smart contracts and operation of the Tornado Cash frontend.

In their closing remarks, prosecutors urged jurors to convict, stating “Tornado Cash was a fancy online money launderer” in the business of “privacy for criminals.” The Storm jury adjourned late Thursday, and a final verdict in this case could arrive as soon as Monday.

If you aren't holding your breath waiting for the verdict in the Storm case are you even in crypto?

— Jake Chervinsky (@jchervinsky) July 31, 2025

4️⃣ Big Jobs Revisions

On Friday, the United States Bureau of Labor released its monthly “nonfarm payroll” jobs report, which indicated the U.S. economy added 73k jobs in the month of July and moderately underperformed analyst expectations for 110k added payrolls.

Shockingly, this release sharply lowered highly celebrated May and June payroll prints that were received as proof of a strong labor market. It eliminated a total of 258k job gains from the two months, slashing the results to 19k and 14k payrolls, respectively.

Although some financial commentators speculated that the reduction in payrolls was politically motivated in light of the Trump Administration’s pressure campaign on the Federal Reserve to reduce interest rates, the revisions may signal profound economic weakness has already developed.

On Truth Social, President Trump subsequently rebuked Biden-era DOL Commissioner of Labor Statistics Dr. Erika McEntarfer, claiming labor data is being manipulated for political purposes and that his economy is “BOOMING.” Trump concluded his remarks by professing that Fed Chair Jerome Powell should be put “out to pasture.”

Excluding the COVID catastrophe of 2020, payroll growth during the past three months is now at its weakest point since 2010 (the immediate aftermath of the Great Recession), meanwhile, this month’s downward revisions rank as the largest since at least 1979.

May-June-July is the weakest 3-month period of job growth since COVID. If you throw out 2020, it's the weakest 3-month period since 2010 and the aftermath of the Great Recession. pic.twitter.com/O4D8cWH45m

— Jamie Dupree (@jamiedupree) August 1, 2025

5️⃣ JP Morgan x Coinbase Partnership

Also, this week, banking titan JP Morgan Chase inked a strategic partnership with Coinbase to “set a new standard for customer choice and security in the innovation economy.”

The initial phase of this partnership commences this fall and allows Coinbase users to fund their accounts with Chase credit cards. Beginning in 2026, Chase users can link bank accounts with Coinbase wallets through JP Morgan’s secure API and redeem 100 Chase credit card reward points for $1 of Coinbase spending power.

Although JP Morgan CEO Jamie Dimon has been a frequent detractor of the crypto industry, his company is actively exploring tokenized deposits on Coinbase’s Base L2. Additionally, Dimon positioned himself as a believer in stablecoins and blockchain technology during a CNBC interview on Thursday.

🚨JPM & Coinbase Ink Deal to Link Users' Bank & Crypto Accounts

— matthew sigel, recovering CFA (@matthew_sigel) July 30, 2025

>Will enable direct Bank-to-Wallet connection.

>Customers will be able to transfer Chase rewards to Coinbase account

>And use Chase Credit Cards to fund $COIN balances for the first time. pic.twitter.com/5i6auciHK0