Dear Bankless Nation,

The SEC is showing all of its cards. Gary Gensler doesn't want the crypto industry to exist at all. After yesterday's Binance suit, the SEC is going after Coinbase too.

This is not a time to squabble over individual actors, this is the time to fight for the right of our industry to exist in America.

- Bankless team

Bankless Writer: Donovan Choy

The SEC sued Binance yesterday. They levied accusations, called out a few major tokens as securities, and scared crypto investors. But Gary Gensler wants your full and undivided attention. And just in case he hasn’t gotten it, the SEC is bringing a lawsuit against Coinbase this morning, name-dropping even more tokens as securities.

If this feels coordinated, it's because it is. If this feels like an all-out attack on crypto in America, it's because it is.

What’s the SEC’s beef with Coinbase? The same, regulatory FUD that Washington has played since day one.

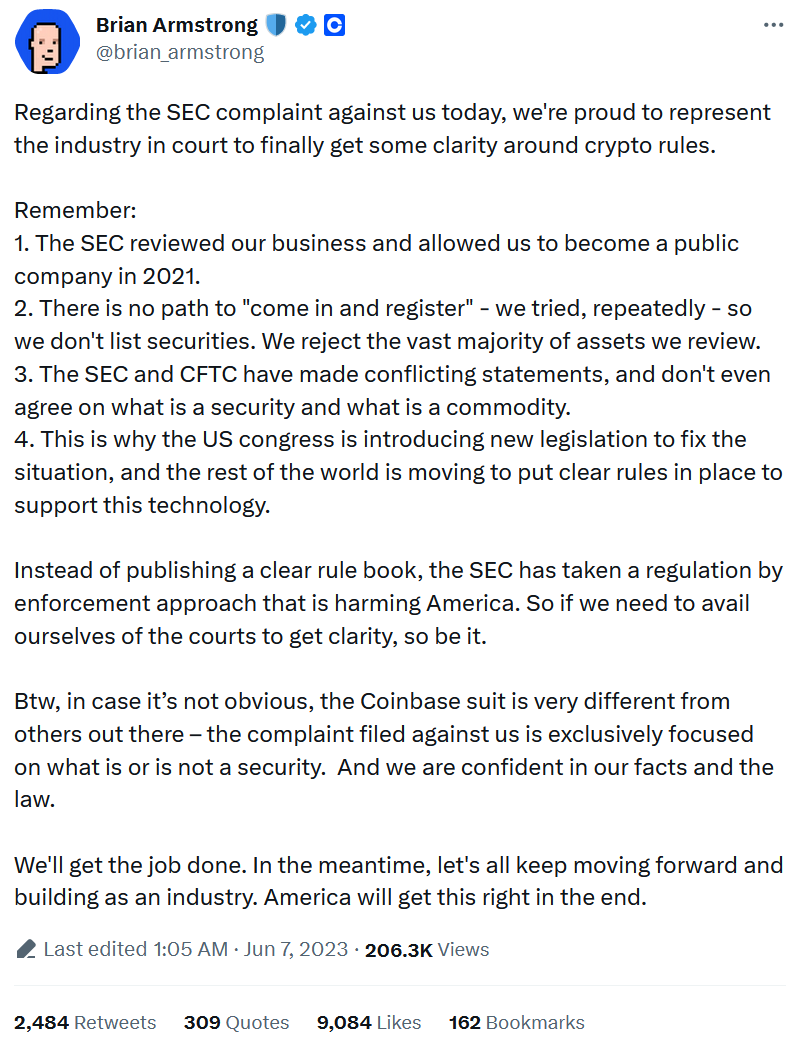

The SEC’s complaint is arguing that Coinbase – whose IPO it approved in 2021 – has been unlawfully facilitating the trading of securities since 2019, including a laundry list of tokens. Coinbase’s staking-as-a-service program is also being singled out as a “securities offering” and "investment contract" that they failed to register.

Gary Gensler is bad for business

In a post-FTX world, yes, there are real and legitimate concerns with centralized crypto exchanges that regulators could be helping with.

But it’s hard to see how the SEC is acting in the interests of the average American investor. After all, no single crypto company has managed to successfully register under the SEC to-date, despite Coinbase’s efforts to cooperate. This hasn't been helpful to any U.S. investor using Coinbase's services, including, yes, the United States government.

No clear principles or pieces of legislation have been laid out for what exactly constitutes a crypto token as a “security”. Remember when Gensler bent over backwards to evade the question of whether ETH was a security or commodity?

As of this morning on CNBC, Gensler even abandoned the pretense of “investor protection” for going after crypto, now questioning the root of crypto’s utility to begin with:

“We don’t need more digital currency, we have digital currency. It’s called the US dollar. It’s called the Euro. It’s called the Yen. They’re all digital right now.”

This is not a good faith regulator.

Washington’s contempt for crypto was never really a secret, and this week’s attacks on the industry may not be surprising, but their concerted release confirms that the SEC was never even trying to work with crypto businesses.

If ever there was a DEFCON alarm for crypto that needed sounding, if ever there was a time for the industry to put aside its petty, internal squabbles and unite against a common adversary, this is it.

The rogue regulators are here.

🥊 Fighting back

So, what can the industry do? And what can you do? Like, right now, today?

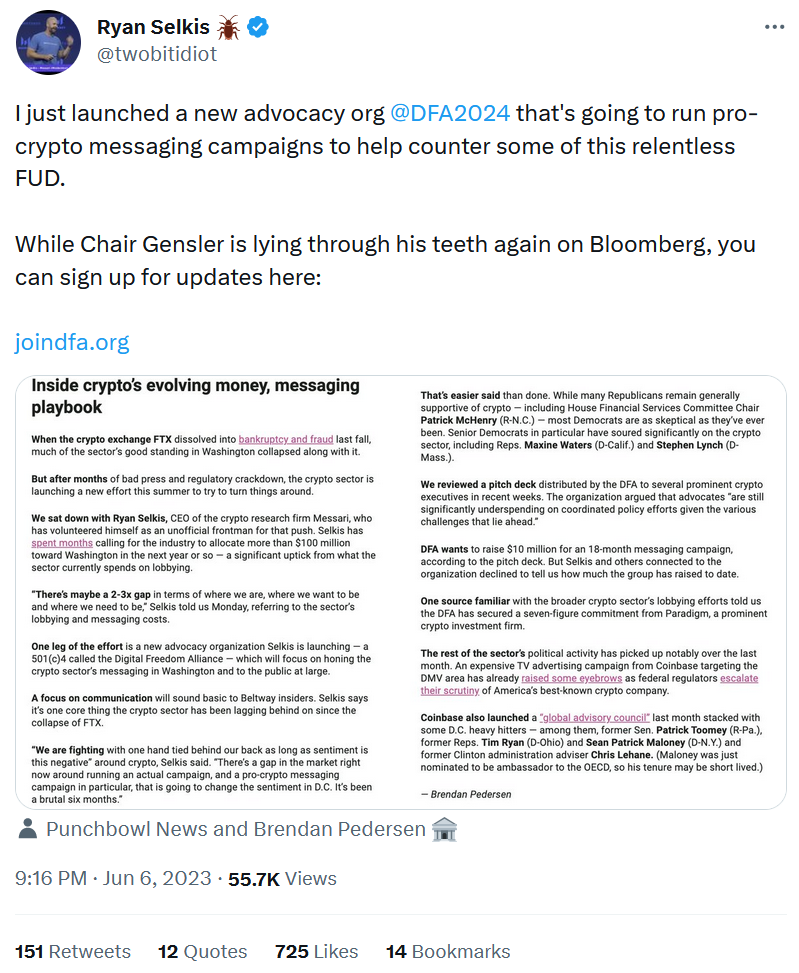

For one, you can make sure that crypto advocacy groups like Coin Center, Coinbase and Digital Freedom Alliance have the funding to fight the good fight. Donate!

You can and should also reach out to your local Congressional leaders to express your concerns about the anti-crypto regulatory climate. Identify your reps on the official U.S. House of Representatives website, research their crypto policy positions, and mail them.

To join the fight against Gensler’s war on crypto, see the Bankless article on How to Fight for Crypto.

Act now, before it’s too late.