Dear Bankless Nation,

Regulators are champing at the bit to bring crypto down, but the market don’t care.

For our weekly recap, we dig into:

- Regulators go after BUSD

- Wen U.S. regulation?

- Blur chases OpenSea

- zkEVM wars are heating up

- Cryptovillain updates

- Bankless Team

📅 Weekly Recap

Here’s a recap of the biggest crypto news from the second week of January.

1. Regulators go after BUSD

After the crackdown on Kraken last week, the SEC is turning its attention to the BUSD stablecoin.

Branded under Binance but issued by Paxos, a New York regulated company, BUSD is the third largest stablecoin in DeFi at a ~$15B market cap, behind USDT (~$70B) and USDC (~$41B).

The SEC is threatening to sue Paxos for failure to register BUSD as a security under federal securities laws.

Why is a stable-value asset being targeted as a security anyway? Paxos issued a press release February 13th disagreeing with SEC’s stance, and reiterated that BUSD is fully backed 1:1 by $16B of US dollar-denominated reserves and segregated in bankruptcy accounts.

New York financial regulators are saying that BUSD was “left open to use by bad actors” and ordered Paxos to stop all minting of BUSD. Paxos is complying with the regulatory action.

Binance CEO CZ is now distancing itself from BUSD. In a Twitter Spaces, CZ reiterated that BUSD was merely branded but not created by Binance, and they would likely begin working with other stablecoin issuers USDC and USDT.

2/ We were informed by Paxos they have been directed to cease minting new BUSD by the New York Department of Financial Services (NYDFS).

— CZ 🔶 Binance (@cz_binance) February 13, 2023

Paxos is regulated by NYDFS.

BUSD is a stablecoin wholly owned and managed by Paxos.

Binance is even reportedly considering delisting all US-based cryptocurrencies, as reported by Bloomberg — though CZ denied it.

As BUSD starts to wind down, market concentration in stablecoins is likely to increase and become less competitive. Not only has the SEC stifled existing market competition in favor of incumbents, it has also led potential competitors like PayPal to halt work on their own stablecoins.

2. Wen U.S. regulation?

The SEC still hasn’t laid down any clear rules for crypto, but it is creating targeted, discriminatory rules by enforcement that present plenty of roadblocks for the industry. The SEC is in the midst of passing a new law that disqualifies crypto trading and lending platforms as “qualified custodians” of crypto, unlike chartered banks, or financial institutions registered under the SEC or CFTC.

Today, the SEC proposed changes to the investment adviser custody rule that seem designed to prohibit US firms from investing in US crypto companies.

— Jake Chervinsky (@jchervinsky) February 15, 2023

This proposal would flagrantly violate the SEC's mission by making investors *less* safe and by *discouraging* capital formation.

To understand why the SEC is pushing for strong crypto custodian rules for Registered Investment Advisers (RIAs), consider the plight of Galois Capital 1/n

— Danny Nelson (@realDannyNelson) February 17, 2023

“We should have come up with a working regulatory framework by now,” says, former SEC counsel TuongVy Le.

Agreed. I was at the SEC and started working in crypto in 2017. Everyone was trying to wrap their heads around it then, including going after outright scams. It is now 2023. We should have come up with a working regulatory framework by now. https://t.co/lBEU4ZIMS0

— TuongVy Le 🗽🍎 (@TuongvyLe12) February 12, 2023

Meanwhile, Hong Kong is making regulatory progress. By June 1 2023, Hong Kong will officially legalize crypto purchasing and trading for all citizens.

America risks losing it's status as a financial hub long term, with no clear regs on crypto, and a hostile environment from regulators.

— Brian Armstrong (@brian_armstrong) February 16, 2023

Congress should act soon to pass clear legislation. Crypto is open to everyone in the world and others are leading. The EU, the UK, and now HK. https://t.co/i9WeUZ7K6H

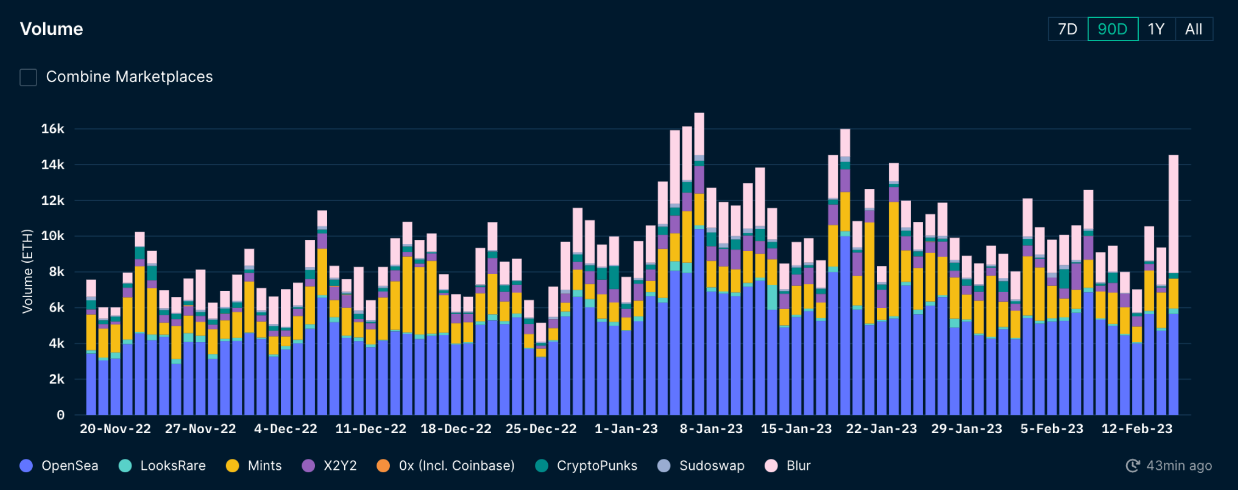

3. Blur chases OpenSea

OpenSea’s current most formidable competitor Blur finally dropped its BLUR token Tuesday.

$BLUR is now LIVE

— Blur (@blur_io) February 14, 2023

All traders across all marketplaces in the last 3 months, Care Package holders, and Creators are eligible for the airdrop.

You have 60 days to claim your BLUR ⏰ pic.twitter.com/AZynnHeIhz

360M BLUR (12% of total supply) were distributed to holders. Over 50% of BLUR was claimed in the first hour, and gas fees rocketed to ~581 gwei on that day. BLUR started trading at $5, plummeted to $0.70 and has since straddled around $1.20.

The third largest recorded claim got 2.5M BLUR (~$1.6M).

The current 3rd highest claimer of $BLUR (0x9e91F274F175388dd1950799Fa69e00d699ae2ee) only funded their wallet 111 days ago and got 2.5M tokens (~$1.6M) at a cost of under 30e. Incredible pic.twitter.com/6MpAi1EMvh

— mannion.eth (@MannionNFT) February 14, 2023

Can Blur kill OpenSea? Blur’s trading volumes momentarily exceed OpenSea’s on the day of the airdrop, but it remains to be seen if this is sustainable.

In a blog post, Blur founder Pacman is recommending that Blur enforces full royalties on collections for creators that block trades on OpenSea at the smart contract level.

In response, OpenSea is dropping fees to 0%, implementing a 0.5% minimum creator earnings model, removing the blocklist on Blur.

We’re making some big changes today:

— OpenSea (@opensea) February 17, 2023

1) OpenSea fee → 0% for a limited time

2) Moving to optional creator earnings (0.5% min) for all collections without on-chain enforcement (old & new)

3) Marketplaces with the same policies will not be blocked by the operator filter

For more insights, see How Blur Can Win on the Bankless newsletter and our podcast interview with Pacman.

🚨LIVESTREAM:$BLUR is LIVE, and so are we@PacmanBlur, Founder of @blur_io, joins the show to talk about the NFT marketplace's long-awaited token airdrop!

— Bankless (@BanklessHQ) February 14, 2023

Show starts at 4:00pm PT / 7:00pm ET

👇Set a reminder👇 pic.twitter.com/DWfhCXkzrX

4. zkEVM wars are heating up

The EVM (Ethereum Virtual Machine) is great because it’s the most proven blockchain infrastructure in terms of network effects and uptime. And zero-knowledge rollups are great because they’re the one piece of tech that’s poised to greatly scale crypto without making a centralized tradeoff.

Put EVM and zk-rollups together, and you have what everyone's been raging about for the past half-year: the zkEVM.

The race to the first zkEVM is heating up. After more than a year of R&D, Polygon has an official launch date for its zkEVM on March 27th.

For the week of February 3rd, Polygon’s zkEVM testnet reached ~297K transactions, deployed 5.7K contracts, and generated 75K proofs. For all the data, check out the tweet below.

The testnet *nearly* reached 300k transactions, a milestone for the future of scaling Ethereum, and a testament to the maturity of Polygon #zkEVM.

— Polygon ZK (@0xPolygonZK) February 13, 2023

Other BIG NEWS is coming soon. Until then, a quick rundown of all Polygon zkEVM metrics for last week, showing continued momentum 📈 pic.twitter.com/lMpYATtGfe

Following closely behind is zkSync’s zkEVM “Era”. Over the past four months, Era reached ~9 million transactions and deployed 30K contracts over 497K active addresses.

The wait is over.

— zkSync∎ (@zksync) February 16, 2023

All aboard zkSync Era∎ Mainnet!

Today, Ethereum's first zkEVM is:

• Opening mainnet to builders 🥳

• Adopting a brand new name 🎈

• Open-sourcing its entire codebase 🎆https://t.co/PoZeliPU8t

1/8

Projects can apply to deploy now and test their dapps on zkSync Era.

5. Cryptovillain updates

Sam Bankman-Fried was released on $250M bail in December. The identities of his bond guarantors were revealed this week to be Larry Kramer, dean emeritus at Stanford Law School, and Andreas Paepcke, a senior research scientist at Stanford University.

Sam’s parents Joe Bankman and Barbara Fried also hold positions on Stanford’s faculty. Looks like it wasn’t Mr. Wonderful after all.

BREAKING: The two signers of Sam Bankman-Fried's bond have been court order released. They are ANDREAS PAEPCKE (Stanford research scientist) and LARRY KRAMER (Former dean of Stanford law school) Source: @innercitypress pic.twitter.com/YdcubRtsiM

— Autism Capital 🧩 (@AutismCapital) February 15, 2023

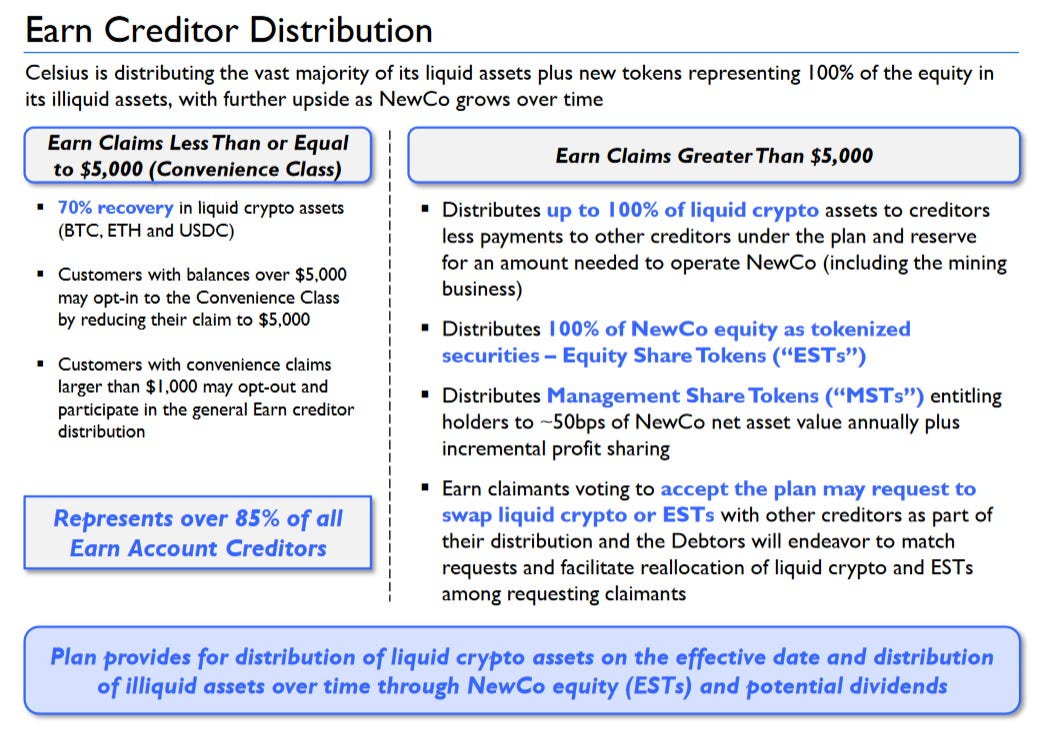

Celsius is reaching a sale plan for small debtors (below 5K) to recover 70% of their funds back, while larger debtors will receive 30-40%.

1-Last night Celsius (with UCC support) selected NovaWulf to sponsor a reorganization plan that will distribute liquid crypto to all account holders, as well as create a litigation trust and provide creditors with common equity in a NewCo holding illiquid assets like mining.

— Celsius Official Committee of Unsecured Creditors (@CelsiusUcc) February 15, 2023

Finally, remember Terra? The SEC is charging its figureheads.

In the SEC’s words: “Terraform and Kwon raised billions of dollars from investors by offering and selling an inter-connected suite of crypto asset securities, many in unregistered transactions”.

These “securities” include tokens that mirrored US stocks on the Mirror protocol, the UST algorithmic stablecoin, and the Anchor lending market for advertising UST as a yield-bearing stablecoin. Terraform and Kwon also “misled investors about the stability of UST”.

The SEC also alleges that an unidentified U.S. trading firm helped rescue the peg of UST when it depegged in 2021. That firm is now being revealed to be Jump Trading.

EXCLUSIVE ON THE BLOCK PRO: Jump is the unnamed 'U.S. trading firm' in SEC complaint against Do Kwonhttps://t.co/sZ8k2MKIBo pic.twitter.com/kfENiQBj5z

— The Block (@TheBlock__) February 17, 2023

Other news:

- Tornado Cash developer Alexey Pertsev to remain in jail

- Kraken supports ETH deposits and withdrawals on Arbitrum

- Shopfiy integrates sign-in with Ethereum

- Token Terminal releases financial statements for DAOs

- Bitcoin Punks NFTs climbs in value

- Ordinals gain momentum with 76,000 NFTs minted

- Ethereum blocks going through non-censoring relays drop to 47%

- Prysm releases v3.2.1 for upcoming Capella/Shanghai network upgrade

- Geth releases Annos Basin v1.11.0