Dear Bankless nation,

Here’s a recap of the biggest crypto news in the final week of November.

1. SBF has more to say

Sam Bankman-Fried’s unstoppable desire to both speak at length about what went wrong at FTX while also not directly answering any of the questions his customers want to know has been… a bit of a trip.

His bloviating has been so cinematic that Marvel filmmakers will soon make an Amazon miniseries out of the FTX fiasco. No, this is not a joke.

This week, we witnessed Sam give a full hour-long interview at the NYT’s annual Dealbook Summit with journalist Andrew Ross Sorkin and a rather friendly audience that presumably did not lose many funds in FTX. The interview is being pretty widely derided as a tone-deaf attempt by Sam to explain himself (poorly) without showing much genuine remorse for his actions.

THE CROWD ERUPTED IN APPLAUSE AS INTERVIEWER THANKS SAM BANKMAN FRIED FOR COMING ON... uhhhhhhh wut. this man is a psychopath criminal who just lied for an hr straight. pic.twitter.com/Y8deKwbc9a

— Coffeezilla (@coffeebreak_YT) November 30, 2022

Here are some of the excerpts from the interview.

When Sorkin read letters to Sam showcasing the financial pain that many FTX users were now in as a result of FTX, he didn’t give many answers to their questions.

Andrew Ross Sorkin reads a letter to SBF:

— Greg Price (@greg_price11) November 30, 2022

Sorkin: "Can you please ask SBF why he decided to steal my life savings?"

SBF: "Yeah. Um, I mean, I’m deeply sorry about what happened." pic.twitter.com/p8ujlpD7sA

When asked about the co-mingling of funds between FTX and Alameda, Sam denies that it was intentional and attributed the problem to mismanagement of funds:

"I did not knowingly co-mingle funds. One piece of this was margin trading where customers were borrowing from each other. I was frankly surprised by how big Alameda's position was which points to another failure of oversight on my part and failure to appoint someone to be chiefly in charge of that but I wasn’t trying to co-mingle funds… I also frankly made a mistake that I feel pretty embarrassed to have made. I substantially underestimate what the scale of market crash could look like and what the speed of it could look like and how correlated it would be.”

When asked if his lawyers approved of his public appearances, Sam said “No, they are very much not. I don't see what good is accomplished by me just sitting locked in a room pretending the outside world doesn't exist”.

Ross Sorkin: "What are your lawyers telling you right now? Are they suggesting this is a good idea for you to be speaking?"

— Greg Price (@greg_price11) November 30, 2022

SBF: "No. They are very much not." pic.twitter.com/cl5KDTVRpf

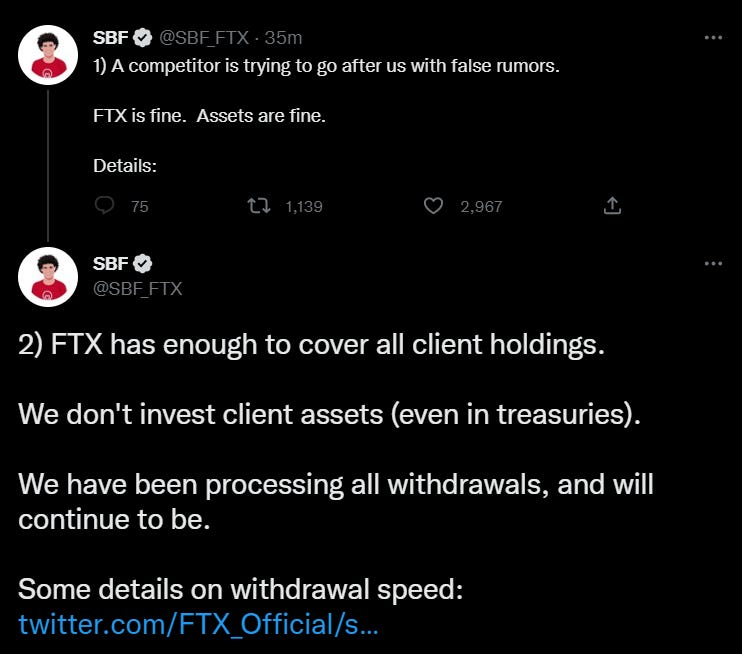

When asked about why he deleted the following tweet on November 7th:

“Things were changing fast. On November 6th I was feeling nervous but I felt like things were probably going to end up okay, we still had assets way larger than liabilities… By the end of November 7th, I felt fairly different… I no longer believed it was a reasonable representation of where my mind was at and I don't remember exactly when I deleted but I remember at some points like it shouldn't be there.”

When asked about his leaked private messages with a Vox reporter claiming his charity work was indeed a sham:

“Yes, we all did. FTX did as well. There are things I felt like we needed to do for the business… I wish the world did not work this way. I wish that these weren't relevant to your ability to get regulated and get bank accounts but they were and we had promotional campaigns and marketing slogans. We thought of ourselves as legitimately trying to do good but we also thought about what we could do uh to uh make sure that our image reflected that."

When asked about the $515 million that was transferred out of FTX’s wallets after its bankruptcy filing:

"I think the US team took actions to seize some of the assets and put it in custody. At that point, I was being cut off from systems. It's been announced that the Bahamian regulators took some of the assets into safekeeping as well around that same time. In addition to both of those, there was some improper access of assets on the exchange. I don't know the details of that. I don't have the resources to trace through exactly what happened there. I don't know who is behind that third-party."

The crypto community didn’t think much of Sam’s public posturing, especially after the interview was followed by an on-air sit-down with ABC’s George Stephanopoulos, a lengthy Twitter Spaces call, and an extensive Bloomberg feature.

For many, they were just more excuses from a guy who should just shut up.

I’ve been trying to articulate what exactly Sam appears to be lying about, and to my read it’s this:

— Eric Wall (@ercwl) December 1, 2022

Sam appears to be saying that Alameda had the right to become a massive counterparty to margin positions on FTX with bullshit collateral.

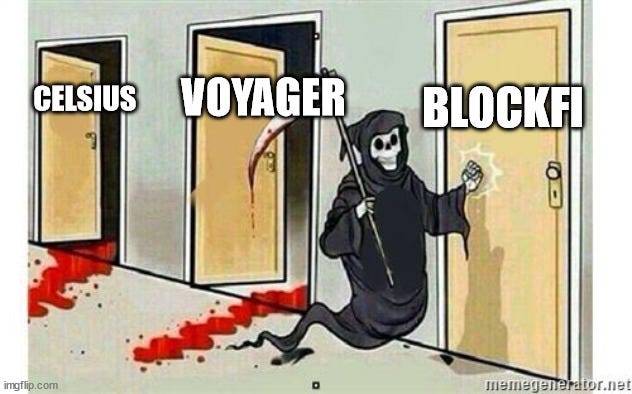

2. BlockFi is bankrupt

Back in July, FTX extended a $400M line of credit to BlockFi, with an option to buy out at $240M. With FTX gone, BlockFi is unsurprisingly toppling over. This week, BlockFi is filing Chapter 11 bankruptcy. You can read the full press release here.

BlockFi owes between $1 billion and $10 billion in both assets and liabilities to more than 100,000 creditors, of which one of them is FTX US. The distressed crypto lender has reportedly $257M in cash liquidity on hand.

BlockFi is also suing an FTX holding company Emergent Fidelity Technologies for Robinhood (HOOD) shares that it pledged as collateral.

So BlockFi is a creditor to FTX that lent to Alameda that lent to Emergent which is a shell company owned by SBF that bought Robinhood shares that were pledged as collateral to guarantee to BlockFi the loan to FTX that was used to bailout BlockFi itself

— ayko2718 (@ayko2718) November 29, 2022

3. Are Bitcoin miners okay?

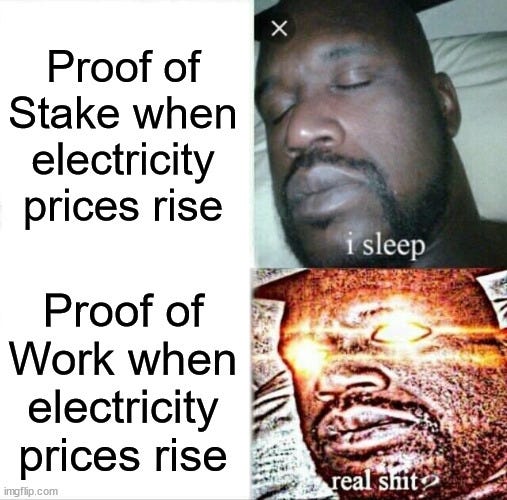

The basic business model of an Ethereum staker is: Purchase a hardware node like Avado that costs $1000-2000, stake 32 ETH, don’t get slashed and earn rewards.

And the business model of a Bitcoin miner is basically energy arbitrage: borrow millions of dollars to buy ASIC mining rigs, mine Bitcoin, pay electricity costs (a whopping 80% of a miner’s operating costs), sell Bitcoin on the market, service their loans, and reap the leftover in profits.

Unfortunately, that business model is proving unsustainable for many Bitcoin miners. Rising electricity costs, the large influx of Ethereum miners pre-Merge (leading to increased mining difficulties), and depressed Bitcoin prices in a bear market are bringing many miners close to capitulation as they become unable to service their loans.

The past few months has seen an onslaught of bad news for Bitcoin miners. The largest US publicly-traded Bitcoin mining company Core Scientific posted losses of $1.7B last week and warned in October that it may be filing bankruptcy soon.

November was a remarkably shit month for mining. pic.twitter.com/LrF3BafLyL

— Zack Voell (@zackvoell) December 1, 2022

The Antminer S19j Pro – considered to be the most energy-efficient Bitcoin mining machine – is currently cash flow negative at current electricity prices.

The result: miners are selling aggressively and Bitcoin hash rates are at a decline.

Bitcoin miners have been selling relatively aggressively.

— Will Clemente (@WClementeIII) November 28, 2022

Combined with the hash rate decline and thus today's hash ribbon bearish cross, this indicates we are indeed in a period of miner capitulation. pic.twitter.com/vVnqetYbn9

4. MetaMask controversy

ConsenSys owns both MetaMask and the RPC provider Infura. To a lot of people’s ire, ConsenSys updated its privacy policy on Thursday, stating that it collected user data from MetaMask users. Because most MetaMask users connect to Infura by default, it lets Infura collect the user’s IP address and wallet address in order to process transactions.

Dan Finlay of MetaMask claims that MetaMask is doing nothing different from any other crypto wallet.

We have literally no desire to store more data than we need to. We just happen to have the most assertively transparent privacy policy in web3, and we're more self critical about how our current web infrastructure works than others are admitting. https://t.co/X0VIOmaX6Z

— Dan Finlay 🦊💙 (@danfinlay) November 25, 2022

And while ConsenSys said that concerned users could still always point their wallets away from Infura, some users noted that wasn’t the easiest process.

So MetaMask says "Just don't use Infura" - so let's see how easy MetaMask makes it to "not use Infura".

— Chase Wright (mysticryuujin.eth 🦇🔊) (@mysticryuujin) November 25, 2022

Part 1 - Installation:

The first two screens are straight forward here. They seem to provide a clear privacy policy, that's good. pic.twitter.com/9HqLo4h18U

5. Layer-2s are boomin’

FTX is going down, but DeFi isn’t. And the Layer-2 ecosystem on Ethereum has the numbers to prove it. Arbitrum’s number of unique contracts and wallets are increasing exponentially.

The number of unique contracts & unique wallets deploying contracts on Arbitrum is going vertical.

— Aylo (@alpha_pls) November 26, 2022

More protocols, more tokens, more NFTs.

More things for people to do.

More opportunities for value creation. pic.twitter.com/8GJV8LCAlO

- Avalanche’s largest DEX Trader Joe is launching on Arbitrum!

- The decentralized exchange GMX on Arbitrum raked in more daily fees than Uniswap on November 28 for the first time.

Yesterday, @GMX_IO had more daily fees than @Uniswap for the first time since $GMX's inception. pic.twitter.com/Y9kCREZym9

— Delphi Digital (@Delphi_Digital) November 29, 2022

- L2 rollups are spending 4% of total gas used to settle transactions on Ethereum mainnet.

- The trustless bridge Hop Protocol bridged $158M in November, a 60% increase over October.