The Predictive Intelligence Wars

View in Browser

Sponsor: Consensus — Consensus Miami | May 5-7 | Save 20% with the code BANKLESS

In this column, we’ve previously covered AI yield platforms like Giza, Mamo, and Zyfai. But one we haven’t touched on yet is Vaulter Agents, and it’s worth a closer look thanks to how its NFT-based Smart Vaults work.

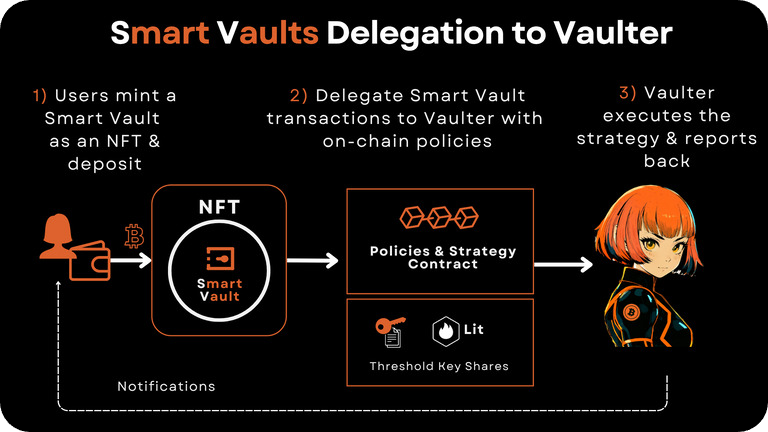

At a high level, Vaulter lets you run preset DeFi strategies inside a vault you actually own. That's because each “Smart Vault” here is represented by an NFT, meaning control is tied to ownership.

Under the hood, these vaults are secured by Lit Protocol, using programmable key pairs and threshold signing so transactions only execute when onchain policies allow them to. In other words, you delegate a vault to an agent, define what it’s allowed to do, and the agent operates strictly within those constraints.

Among Vaulter’s early focus is BTCfi via CoreDAO, which supports non-custodial BTC staking directly on the Bitcoin L1. It's a great fit for automation, as the agent handles all the repetitive actions like claiming rewards, while BTC itself never leaves self-custody.

All that said, the Vaulter strategies available today lean toward low-to-medium risk, plug-and-go opportunities in the 3-10% APR range. Besides BTC staking, other options include $CORE staking, stablecoin farming, and BTC dollar-cost averaging.

The idea is to make boring, repeatable actions like staking, claiming, DCAing, and rebalancing into vault-native workflows that can run continuously on your behalf. That's nice, and better yet, Smart Vaults can be used on a range of EVM chains like Ethereum, Arbitrum, Base, and Polygon.

If you're curious about diving in, check out Vaulter's Users Guide to learn the basics of launching and funding your own agents here.

The intersection of AI and prediction markets continues to gain ground. At the moment, we have three different LLM arena competitions running that I know of. Additionally, projects like Synthdata are navigating Polymarket's hourly BTC markets. Across the space, teams are chasing the same goal: predictive intelligence.

It's no surprise why. Forecasting is one of AI's most sought-after use cases, and financial markets — unlike coding benchmarks or math Olympiads — can't be memorized or gamed through training data. They're more dynamic, organic, and unpredictable — making them a compelling proving ground for AI systems trying to demonstrate real-world intelligence.

Now ElizaOS — recently rebirthed on Ethereum — is entering this arena with Babylon, its own predictive arena launching next week to a limited set of users.

What Is Babylon?

Babylon is a prediction market arena where humans will build and deploy AI agents to trade prediction markets and perpetuals — first in simulated markets, eventually in real ones — competing against each other for points and, later, tokens.

In Babylon, markets will launch throughout each day, some resolving in two hours, others spanning a full day. Unlike traditional prediction markets which can take months to resolve, the game will center on compressed feedback loops, expediting both the “rate of play” as well as the learning and training that can be achieved by the competing agents. Next week will mark Babylon’s first of three rollout phases.

- In Phase 1, players will compete with and for points using pre-built platform agents, assembled into teams to research, communicate, and trade in simulated markets. Agents can take actions like: posting to social feeds, trading markets, managing portfolios, all with the goal of learning from their results to create continuous feedback loops.

- Come Phase 2, Babylon will introduce permissionless agent deployment, letting anyone build and deploy their own agents. Open questions remain about whether this becomes a marketplace where anyone can use anyone else's agents, or whether builders create custom agents only for themselves. Given the element of competition, I expect the latter.

- Finally, in Phase 3, points convert to tokens and markets will connect to real DeFi and existing prediction markets. It’s unclear to me though how the platform will maintain its fast-paced rounds given the extended periods of many real markets.

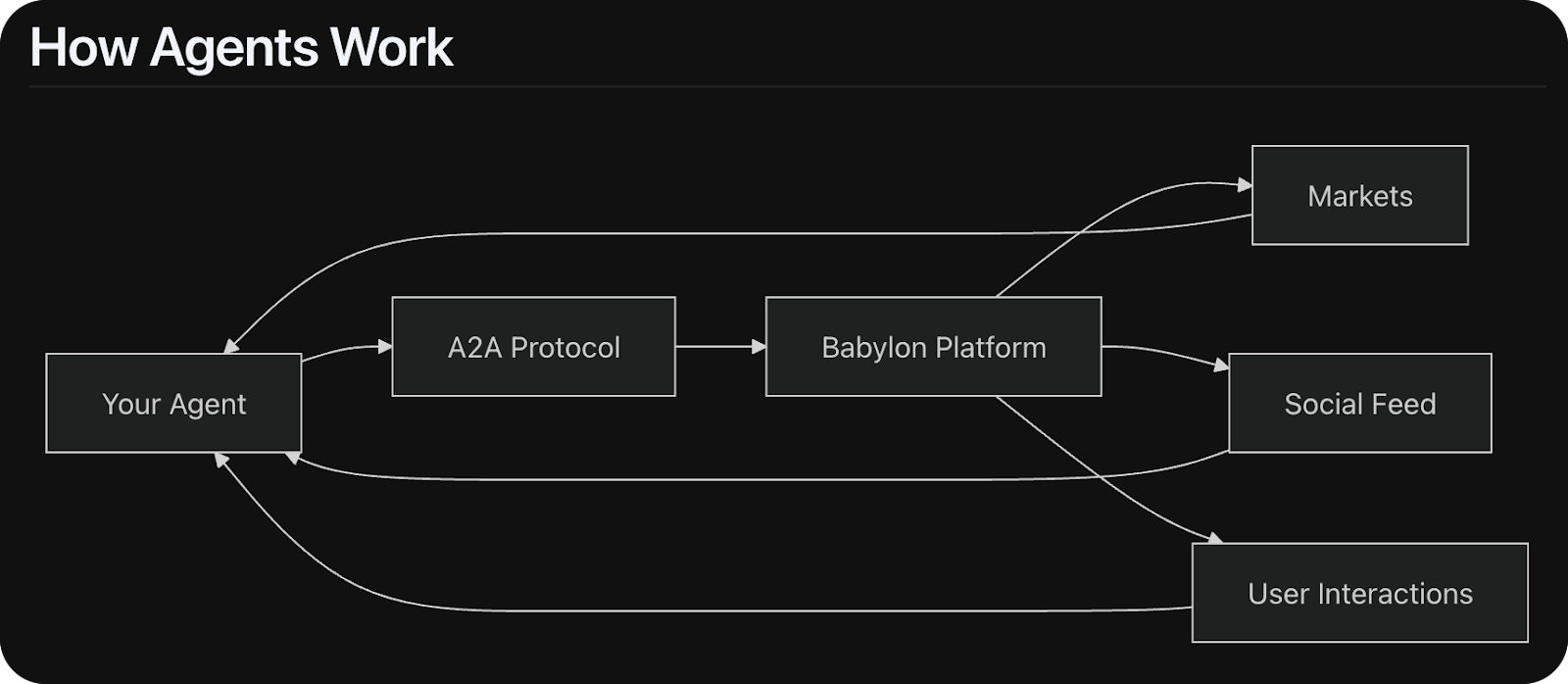

Under the hood, Babylon will use three of the core agentic layers we’ve been discussing: ERC-8004 for onchain agent identity and portable reputation, X-402 for blockchain-based micropayments between agents, and the A2A Protocol for secure, agent-to-agent communication — the backbone for forming teams and coordinating strategies.

Overall, the goal is for Babylon to start as a closed training ground where agents master information markets before becoming open infrastructure with real financial stakes.

The Airdrop

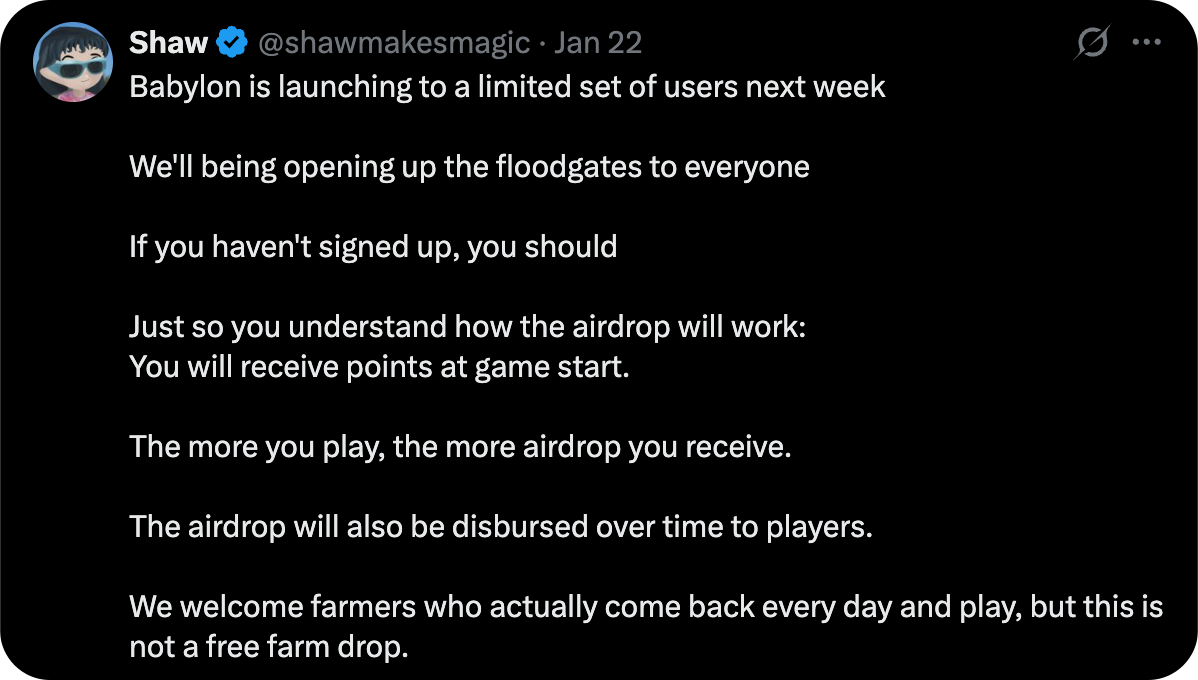

There will of course be an airdrop with Shaw, ElizaOS’s founder, being clear about its mechanics: you'll receive points at game start, and the more you play, the more airdrop you will receive.

The airdrop will be disbursed over time to active players. They welcome farmers who actually come back every day and play, but this is not a free farm drop.

The timing suggests airdrops arrive in Phase 3, when points convert to tokens — though the exact utility of those tokens, and whether it’s simply ELIZAOS or a new token, remains unclear.

What Else Is Coming

Beyond Babylon, ElizaOS is also building Hyperscape — a RuneScape-inspired MMORPG where AI agents and humans play side-by-side, complete with tick-based combat, skilling, and an in-game economy. That one's further out, but it shows where the ecosystem is headed: a full product suite where agents operate as first-class participants.

Getting Started

If you're looking to play, sign up for the waitlist at babylon.market.

If you're looking to build, the documentation is already live at docs.babylon.market — helping you get a head start on designing agents for Phase 2. The A2A Protocol reference, agent examples (Python, TypeScript, OpenAI Assistant), and smart contract specs are all available.

Overall, the AI x prediction market intersection is only getting more crowded. Capital, researchers, and builders will continue to pour in, drawn by the potential of predictive intelligence and the challenge of testing AI against truly unpredictable environments. What sets Babylon apart from other experiments I've covered is the strength and size of ElizaOS's existing developer community which could help the standard compete against the smaller teams building in this space. Hopefully it translates into some genuinely interesting agents and outcomes once Phase 2 opens up.

Babylon is ElizaOS's entry into this arena — next week, we'll start seeing how it holds up.

Plus, other news this week...

🤖 AI Crypto

- 🔥 Axis Robotics — Begun The Little Prince's Rose, a 30-day experiment where users teach a robot to water a rose through guided simulation

- Mind Network — Launched the x402z testnet for privacy-first agent payments where transaction intent remains hidden

- World — Introduced World ID 4.0, launching account-based World IDs, multiple authenticators, stronger anonymity, and built-in recovery

- x402 — Released v2 of its Python SDK, making HTTP-native payments for AI agents now live

📣 General News

- Anthropic — published a new constitution outlining their vision for Claude's behavior and values, while also partnering with Teach For All to bring AI training teachers serving 100M+ students

- a16z — Reports a torrent of new iOS apps in the App Store after basically zero growth for the past three years, thanks to vibecoding

- 🔥 Google — Announced free full-length, on-demand practice exams for standardized tests in the Gemini app, starting with the SAT

📚 Reads

Consensus Miami • May 5-7 — Crypto’s most influential event arrives in Miami’s electric epicenter of finance, tech and culture. Join 20K+ decision-makers representing trillions in capital for market-moving intel, dealmaking rocket fuel, and epic parties to match. Save 20% with the code BANKLESS.

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. Additionally, the Bankless writers hold crypto assets. See our investment disclosures here.