The Political Minefield of CBDCs

Dear Bankless Nation,

While a "digital dollar" may sound harmless enough, the adoption of a so-called central bank digital currency (CBDC) could have massive ramifications, and you may be hearing all about them from a politician near you 🔜.

Today, we dig into CBDCs and how you should be thinking about them.

- Bankless team

Bankless Writer: Donovan Choy

While Republican politicians in the U.S. have been disproportionately supportive of crypto compared to Democrats, there also seems to be increasing hostility among them toward the idea of creating a CBDC in the Unites States.

This week, Florida's Republican governor (and likely future Presidential candidate) Ron DeSantis effectively banned the use of CBDCs in his state. While DeSantis's political positioning makes this particularly noteworthy, he is far from the only politician to speak out.

The state of North Carolina similarly voted in May to ban government agencies from accepting payments in CBDCs. South Dakota governor Kristi Noem recently blocked a bill supporting CBDCs and there are similar calls on North Dakota's governor to do the same. Meanwhile Texas Senator Ted Cruz says he wants to block the Fed entirely from creating a CBDC. There's a lot going on.

A digital dollar is assuredly firmly on the radar of the Fed, but does not seem imminent... though the prospect of a major foreign power beating America to the punch seems like it could push up timelines.

CBDCs are sometimes lumped together with “crypto” like BTC and ETH, but while the technologies powering both may hold similarities, the philosophies of decentralization and CBDCs could not be more different. A CBDC will not be governed by the people, but will exist on a centralized ledger controlled by a small group of policymakers.

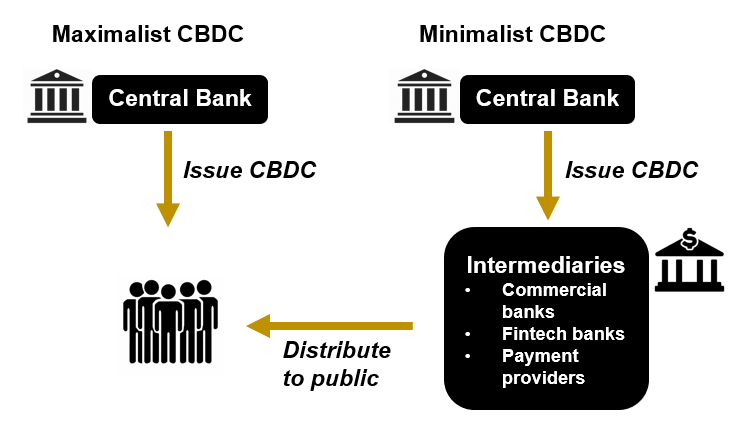

CBDCs can come in two broad varieties: maximalist or minimalist.

A maximalist CBDC is issued directly to the public within deposit accounts that are managed by the central bank. A minimalist CBDC is issued to selected private sector intermediaries, which then distribute it to the public.

No explanation is needed for the potential Orwellian consequences of a maximalist CBDC. A government that wants to curtail the economic freedoms of Americans for whatever reason will find it frightfully easy to do so. Stomping out politically undesirable transactions would be as simple as clicking an “undo” button on a FedAccount.

You don't need to be a paranoid conspiracy theorist to believe that CBDCs will be weaponized towards nefarious, political ends. This year, we have already witnessed how state actors can bypass the rule of law and subvert politically undesirable activity by cracking down on the private sector – just look at Gary Gensler’s so-called “regulation by enforcement" during Operation Chokepoint 2.0.

But what about a minimalist CBDC?

Since the deposit accounts of a minimalist CBDC are under the “ownership” of a private sector firm, that might help safeguard against some potential political abuses. Private companies could resist a central bank’s tyrannical overreach via lawsuits, legal appeals or whistleblowing. But that’s not much of an assurance.

A minimalist CBDC would intertwine central banks and private banking into an even larger rent-seeking monstrosity than exists today. The Fed could tell banks to steer its CBDCs away from “undesirable” pornographic sites, or censor transactions going to gambling or gun companies. No court orders would be necessary to verify that these policies were carried out accordingly; it would all be transparent down to the cent on the Fed’s blockchain ledger. Failure to comply could mean the erasure of CBDC capital on the bank’s financial assets – or worse, termination of its regulatory license. To remain competitive (or in business at all), banks would likely strive for compliance at all costs.

The very attributes of cryptocurrencies that make them exciting or revolutionary to many today – immutability, privacy transparency, decentralization or scarcity – are everything a CBDC is not.

This is not to say that CBDCs wouldn't offer plenty of less nefarious benefits to the U.S. government. Many CBDC proponents genuinely see it as a tool to help the 7.1 million unbanked Americans who are priced out of the traditional financial system due to banking fees. They believe it can minimize criminal activity, since the government can easily trace the movements and origin of every dollar. There might also be improvements made possible for the horrendous cross-border payments system today that slaps fee after fee on poor immigrants making remittances. These are all benefits that are entirely possible.

But good public policy is the product of serious cost-benefit analysis, which is what most pro-CBDC arguments lack. They fixate on the potential benefits while willfully glossing over potential costs, taking a blindly optimistic perspective that public-serving technocrats will be wielding the insights allowed to achieve those precise policy ends and nothing else.

In reality, a CBDC will be more akin to a wrecking ball. You may get what you wish for, but a lot more with it.

While a CBDC may offer plenty of improvements over the paper dollar, a more widely accessible crypto ecosystem still can offer plenty of the desired efficiency gains without the headaches associated with launching a privacy-hostile digital dollar and igniting a political firestorm.

For one, the existing $130 billion stablecoin market already serves to mitigate the problems of unbanked Americans or cross-border payments. Meanwhile, crypto companies like Chainalysis and Coinbase seem to be highly cooperative in aiding law enforcement with deterring criminal activity in the crypto space.

When all is said and done, some form of a CBDC may be politically inevitable, but if the government must create a CBDC, then it should exist on its own technological merit. Alternative modes of payment such as cash and crypto should be allowed to coexist alongside the Fed-issued currency. Americans should absolutely not be forced to adopt it. Preserving this freedom of entry and exit for taxpayers would ultimately be the biggest protection against a "digital dollar" going south.