The NFT Shazam Effect

Dear Bankless Nation,

Ever heard of the Shazam Effect?

It’s a phenomenon in which creators start homogenizing around successful industry strategies.

We’ve been seeing some Shazam’ing in the NFT ecosystem lately as popular projects like CryptoPunks and Bored Ape Yacht Club have provided compelling go-to-market templates for newcomer projects.

Is this a good thing, a bad thing, or ultimately a mixed bag? I break it down in today’s Metaversal 👇

-WMP

The NFT Shazam Effect?

Last month I came across an interesting Twitter thread from Derek Thompson, a writer at The Atlantic. Therein, Thompson made the case that the entertainment factor of professional baseball had become too uniform courtesy of what he calls the Shazam Effect.

Thompson said:

“What does the Shazam Effect have to do with baseball?

Well, when a handful of cultural producers get ‘smart’ about what works in their industry, the formula gets shared widely, and as strategies homogenize, the entertainment product becomes more boring.”

Of course, Thompson didn’t have NFTs directly in mind when he wrote that thread. And what constitutes boring is subjective and can be endlessly debated, to be sure. Yet what struck me about the passage above was that notion of “the formula that works getting shared widely.”

When it comes to the NFT ecosystem we’ve seen plenty of this dynamic via projects emulating or taking considerable inspiration from CryptoPunks, Ethereum’s most celebrated NFT project. Indeed, launching series of 10,000 collectibles has become something of a schelling point for many upstart NFT collectibles projects.

More recently, we’ve seen this NFT Shazam Effect starting to pick up around the Bored Ape Yacht Club, a NFT collectibles and membership project that’s boomed in popularity in recent weeks.

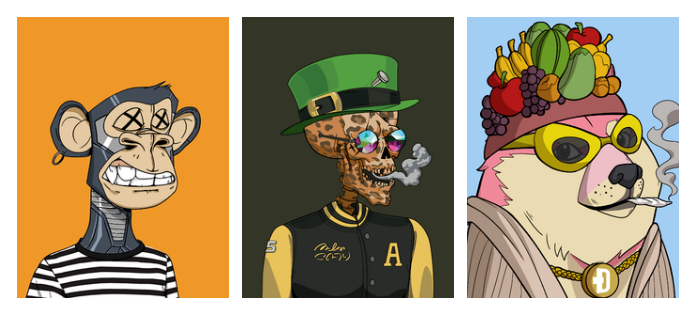

With BAYC’s formula now acutely proven, a spate of new projects have launched that have more or less copied BAYC’s smart contracts and website and essentially made only aesthetic adjustments to them. Examples include Wicked Craniums and Slumdoge Billionaires.

On the one hand, some people will find this homogenizing to be uninteresting and to be leading to oversaturation. Conversely, laissez-faire folks are having fun hopping into these new projects as they come, and plenty more of us are somewhere in the interesting middle between these two sides.

I will say this, though. As more upstart NFT projects “take the formula that work” instead of really pushing out innovative and evergreen products, we’ll likely see a number of these smaller plays not amount to much down the road as saturation increasingly comes into effect. That is, if these projects don’t considerably evolve from here.

Wherever you stand on the NFT Shazam Effect, the reality is it’s here to stay for now. The projects and tastes of the day may change, and evergreen releases will continue to stream in as well, but with incentives as they are some builders won’t veer too far from what’s already worked well. That much is clear.

Action steps

- 🔎 Inspect the ETH price floors of BAYC, Wicked Craniums, and Slumdoge Billionaires. What’s your takeaway? Sound off in the comments below.