The NFL Crypto Betting Surge

NFL football is back, and so are prediction markets.

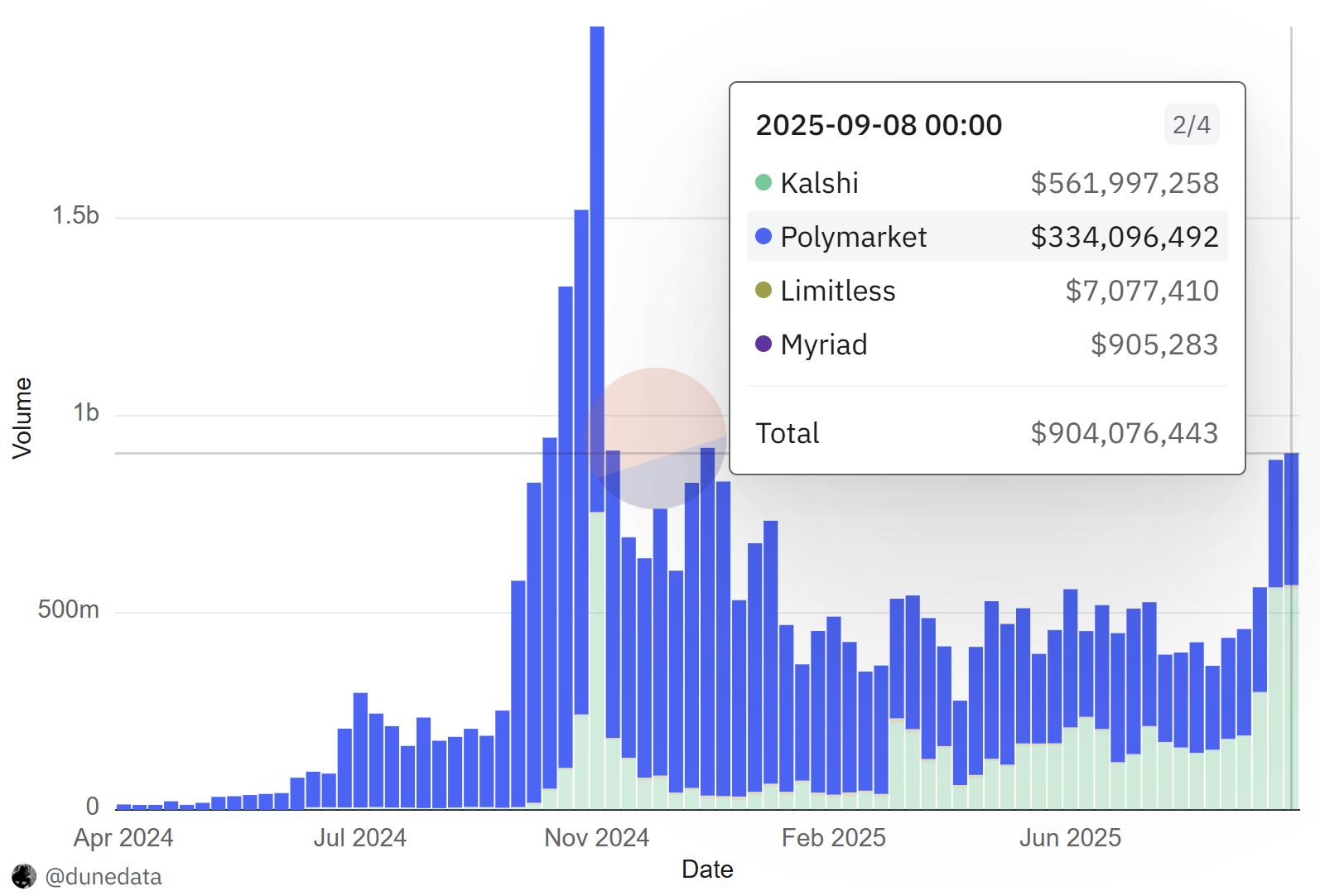

The return of televised professional football in America has been a godsend for prediction markets, which had seen trading volumes slow and open interest fall off considerably from the U.S. presidential election highs.

Prediction market trading volumes have doubled in the month of September, and rumors are now circulating about eleven-figure valuations for the resilient platforms at the center of the mania.

Today, we’re discussing the force driving this resurgence and unpacking what it means for the future of prediction markets. 👇

🏈 Prediction Market Mania

Prediction markets are an all-or-nothing game. Shareholders of the winning outcome receive $1 per share, meanwhile, all other players see their bets vanish into the ether, sacrificed to the gods of chance.

The “event contracts” powering prediction markets are regulated at the federal level by the Commodity Futures Trading Commission (CFTC) and pay out based on a specific outcome, which can be anything from a Fed interest rate decision to the result of a sporting contest.

Today, @SECPaulSAtkins and I announced that is it truly a new day in America. @CFTC and @SECGov are launching harmonization efforts to provide regulatory clarity and unleash innovation. We will host a joint roundtable on Sept 29. Together we will win! 🇺🇸🤝 https://t.co/TF2QraoyrP

— Caroline D. Pham (@CarolineDPham) September 5, 2025

While flexible enough to accommodate all manner of niche subjects, successful prediction markets require mass appeal to generate sufficient betting interest, which in turn facilitates larger order sizes without moving market prices.

Prediction markets (particularly the stablecoin-settled variety offered by Polymarket on the Polygon blockchain) became a breakout use case for crypto technology in the run-up to the 2024 U.S. general election as speculators around the world spent hundreds of millions in an attempt to monetize the results.

Unsurprisingly, volumes across top prediction platforms fell sharply in the immediate aftermath of the election's resolution.

One year later, NFL football is showing up to fill the void.

The kickoff of the NFL season has sent sector trading volumes soaring to year-to-date highs, bolstered by an increased number of integrations among mainstream trading platforms, improved user familiarity with prediction markets, and clarity from U.S. regulators.

Although activity on prediction market mainstay Polymarket jumped on the debut of football markets, upstart Kalshi has emerged as the biggest beneficiary of the swelling momentum; its weekly trading volumes are exceeding those of Polymarket for the first time ever.

Kalshi, which offers a proprietary prediction marketplace in addition to event contracts through retail-accessible brokerages Robinhood and Webull, reported $441M of trading volumes during NFL kickoff weekend alone.

Sports betting now dominates Kalshi, with the segment commanding a 95% share of platform trading volume and American football accounting for the bulk of activity.

Sunday Kalshi data dump:

— Dustin Gouker (@DustinGouker) September 15, 2025

-$182 million in volume

-95% of volume was sports, 75% of total volume was NFL moneylines

-NFL moneyline volume down WoW $158M-->$135M

-Top 10 markets: pic.twitter.com/lnB6icpZyU

🤔 The Competition

Compared to traditional state-regulated sportsbooks, like those offered by online gambling service DraftKings, prediction markets offer greater simplicity for non-aficionados, and potentially better pricing.

While sportsbooks can offer greater upside than prediction markets through “parlays,” a form of leveraged bet that links multiple wagers into a single ticket that only pays out if all bets hit, they also employ “moneyline” odds. Unfamiliar bettors may find these platforms challenging to navigate compared with simplistic probability-based prediction markets.

Additionally, a single centralized operator plays the role of the house for a sportsbook. They act as counterparty to all bets placed and build a spread or “vig” into pricing to ensure profitability. Conversely, prediction marketplaces match users at market-assigned probabilities and can take optional fees for their service.

prediction markets are 19.4% of traditional sportsbooks

— MovieTime (@MovieTimeDev) September 13, 2025

soon prediction markets will dominate

-better spreads

-deeper liquidity

-transparency on whos winning and losing pic.twitter.com/cLPPHP1wW8

Despite demonstrated demand, growing dominance, and undeniable benefits, sports-based prediction markets continue to operate in somewhat of a legal gray area.

Under the Biden Administration, the CFTC attempted to outlaw event contracts based on elections and sports betting, claiming they constituted “gaming” markets, which are prohibited by Commodity Exchange Act.

While regulatory pressure has cooled under the Trump Administration, numerous state gambling commissions have issued cease-and-desist orders to prediction marketplaces. They argue that prediction markets are operating unlicensed sports gambling in violation of their respective state laws.

Prediction markets counter that there is no need to comply with state gambling regulations, as their event contracts are approved at the federal level, and the U.S. Constitution’s supremacy clause gives precedence to federal law when it conflicts against local law.

The Third Circuit is hearing argument right now from @Kalshi and NJ on whether the @CFTC has “exclusive jurisdiction” to regulate trading in contracts that predict the outcome of sports events. If I could, I'd buy the position on an affirmance that the answer is "yes." 1/3

— paulgrewal.eth (@iampaulgrewal) September 10, 2025

The NFL itself has voiced concern about sports event contracts, claiming that prediction markets “could be susceptible to manipulation or price distortion” without proper state regulation.

The longevity of sports-centric event contracts remains unknown amid a backdrop of legal uncertainty, but one thing is clear: prediction markets are eager to cash in on the craze.

Kalshi is reportedly raising at a $5B valuation as Polymarket investors contemplate new term sheets that would value the company at $9-10B, a stunning increase from its $1B valuation earlier this summer.

Double scoop! Investors are betting big on betting markets. Kalshi is finalizing a $5B valuation round while Polymarket is considering a term sheet would raise its valuation to $9 billion! https://t.co/3txdkZD7op

— Katie Roof (@Katie_Roof) September 12, 2025