Dear Bankless Nation,

The metaverse is eating up an awful lot of funds, for both crypto investors and the tech mega-corps trying to bring people there.

For our weekly recap, we dig into:

- Metaverse money pit

- Worldcoin hype and controversy

- Prosecutors want SBF jailed pre-trial

- Flashbots raises $$$

- Quantstamp gets SEC'd

- Bankless team

📅 Weekly Recap

1. Metaverse money pit

Meta posted its quarterly earnings this week and the metaverse continues to be a rather huge money pit for the company – even as their fortunes improve elsewhere.

Since the start of 2022, Meta has posted $21 billion in metaverse-related losses. That's almost as much as the total funds raised by crypto VCs during that time. Now, plenty of Meta's investments are on the hardware/ VR goggles side of things which is obviously quite capital intensive, but even that investment is a means to an end to capture a multi-platform metaverse opportunity.

And sure, we don't actually want a centralized tech giant like Meta to own the infrastructural rails of the metaverse, but seeing what a tough time they're having going mainstream with effectively unlimited resources shows what a challenge it could be for web3 companies trying to reach a mass audience.

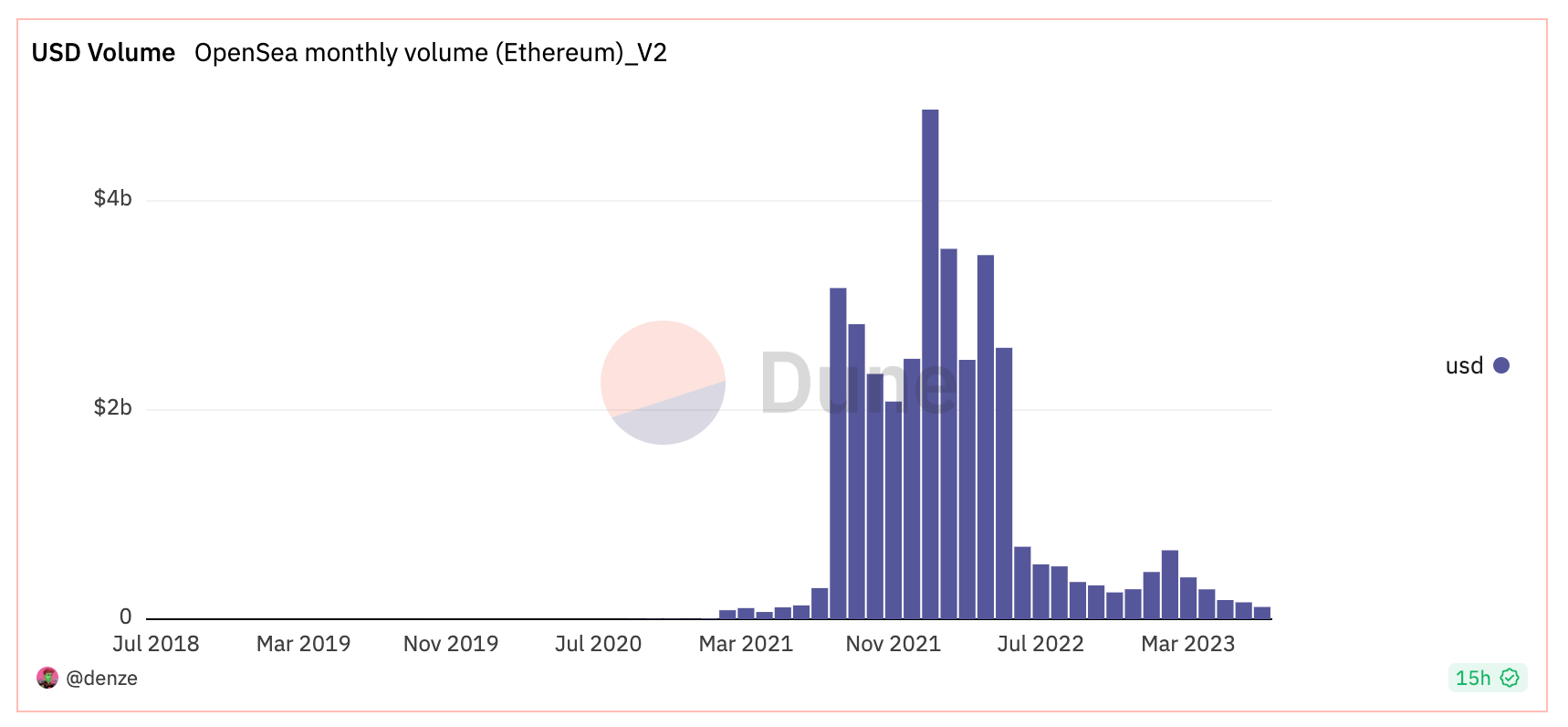

In crypto, the metaverse is hitting a rough patch as well with metaverse tokens down across the board near all-time-lows as NFT volumes continue to pull down to mid-2021 levels. With just a couple days left in the month, OpenSea has done $117 million in NFT volume in July 😔

2. Worldcoin hype and controversy

The biggest news in crypto this week was probably the launch of OpenAI founder Sam Altman's crypto project Worldcoin, which aims to build a network of verified humans by scanning everyone's eyes 👀

We interviewed the founders of Worldcoin to hear from them directly.

We also chronicled much of the criticism surrounding the project here.

3. Prosecutors want SBF jailed pre-trial

Prosecutors are pretttty pissed at Sam Bankman-Fried these days and they're not satisfied with his house arrest, they want him in jail.

Prosecutors say SBF is trying to intimidate witnesses and influence their testimony after he talked with journalists and shared documents with an NYT reporter who published them in the story Inside the Private Writings of Caroline Ellison, Star Witness in the FTX Case, where Ellison discussed that she felt she was in over her head at Alameda.

SBF's lawyers say he has a right to defend himself publicly, let's see what the judge has to say...

4. Flashbots raises $$$

Big venture rounds are few and far between these days despite ample idle funds for venture investors. This week, a big, interesting raise was announced from Flashbots – a research startup that's one of the more heavily relied upon in the Ethereum community thanks to its products tackling MEV.

The $60 million round raised from Paradigm will help the firm continue to scale up its product offering including its SUAVE platform for "intra-block applications".

5. Quantstamp gets SEC'd

The SEC had a quieter July after their very loud June where they name-dropped several major tokens as securities while suing both Binance and Coinbase. They just dropped another settlement judgment, this time with Quantstamp over its 2017 ICO which raised $28 million.

Quantstamp will be directly on the hook for about $3.5 million in penalties according to the announcement:

The SEC’s order finds that Quantstamp violated the registration provisions of the federal securities laws. Without admitting or denying the SEC’s findings, Quantstamp agreed to a cease-and-desist order and to pay disgorgement of $1,979,201, prejudgment interest of $494,314, and a civil penalty of $1 million.

Quantstamp hit with settlement for non-compliant Reg D / Reg S token sale.

— _gabrielShapir0 (@lex_node) July 26, 2023

Did not confirm buyers: accr. investor/ non-US person status (relied on reps alone)

No post sale xfer/flowback restrictions as required by Reg D / Reg S

soft-rugged by raising VC and nerfing the tokens pic.twitter.com/n0KLicoxSD

📺 Bankless Weekly Roll-Up

Other news:

- Worldcoin Hype Causes Optimism to Leapfrog Arbitrum in Daily Transactions

- Tokenization Firm Securitize Kicks Off European Campaign in Spain

- DOJ Doesn't 'Intend to Proceed' With Campaign Finance Charge Against Sam Bankman-Fried

- Disgraced U.S. Congressman George Santos Involved Crypto in Nigerian Prince-Like Scheme: NYT

- RFK Jr. Confirms Recent Bitcoin Purchases

- Reddit Launches More Polygon NFTs—After Already Minting 18 Million Avatars