Dear Bankless Nation,

The Merge is coming, and it’s going to be Ethereum’s biggest level-up yet.

How will this major tech shift affect Ethereum’s teeming NFT ecosystem, though?

It’s hard to say this early on, but there are definitely some big ideas to keep an eye toward. Let’s walk through a few of them for today’s Metaversal.

-WMP

NFTs in the time of The Merge

First, what is The Merge?

Up until this year, Ethereum has relied on the proof-of-work (PoW) consensus mechanism, which in the context of blockchains was first pioneered by Satoshi in Bitcoin.

PoW involves “mining,” a process where miners use specialized hardware to compete to solve math puzzles. The winners earn the right to order transactions into a block, and this process maintains the current state of a blockchain.

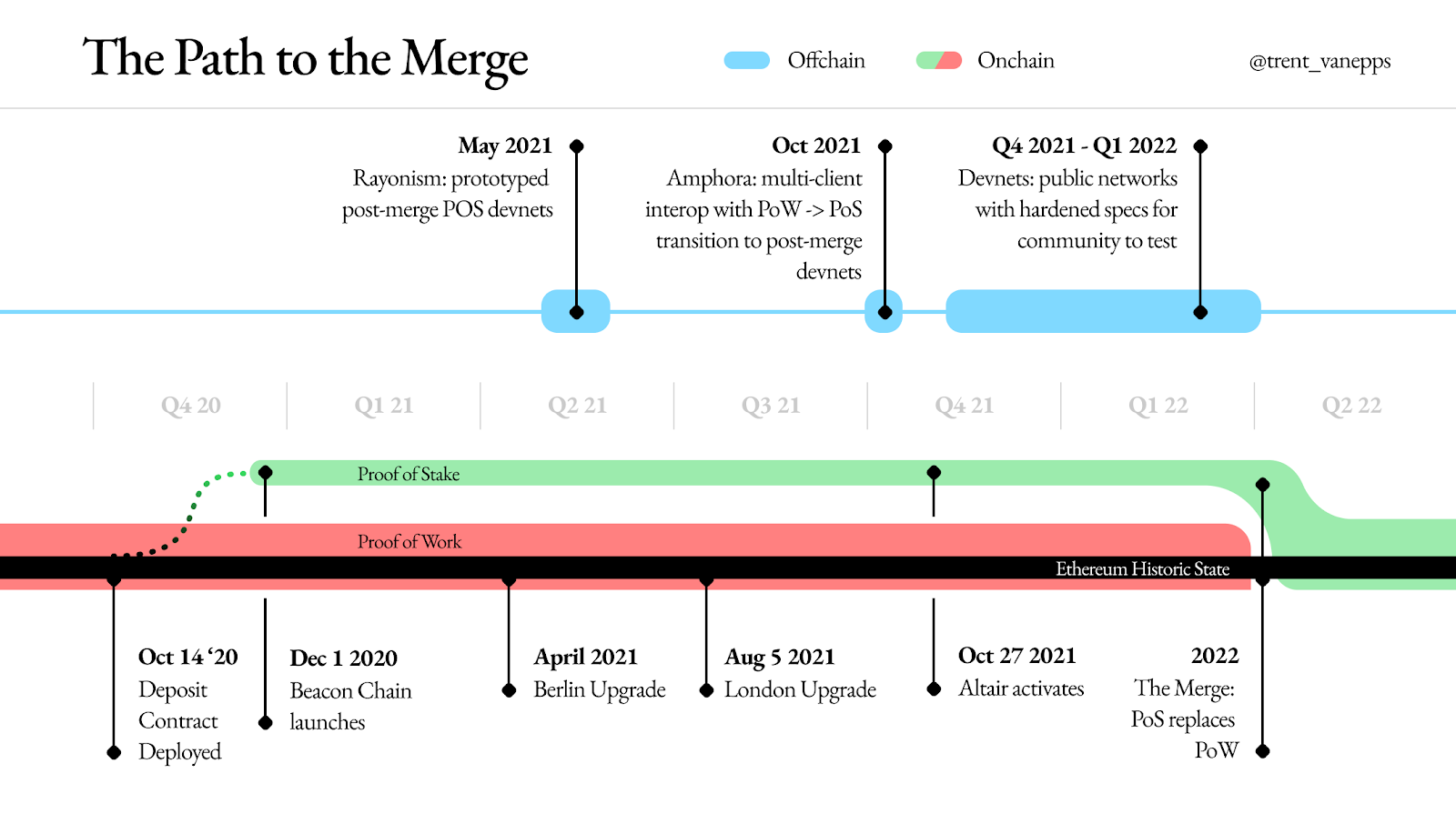

However, among other things PoW is energy-intensive and inefficient, so Ethereum core developers have been planning to migrate Ethereum to a proof-of-stake (PoS) consensus mechanism since 2016. PoS involves “staking,” which for Ethereum entails users making special ETH deposits in order to participate in, and earn from, the block creation process.

Ethereum took a major leap toward this migration in December 2020, when the PoS “Beacon Chain” was launched. Since then, the Beacon Chain’s deposit contract has racked up nearly 13M ETH and paved the way for The Merge, which will see the current Ethereum PoW “execution layer” merged into the PoS Beacon Chain “consensus layer” later this year.

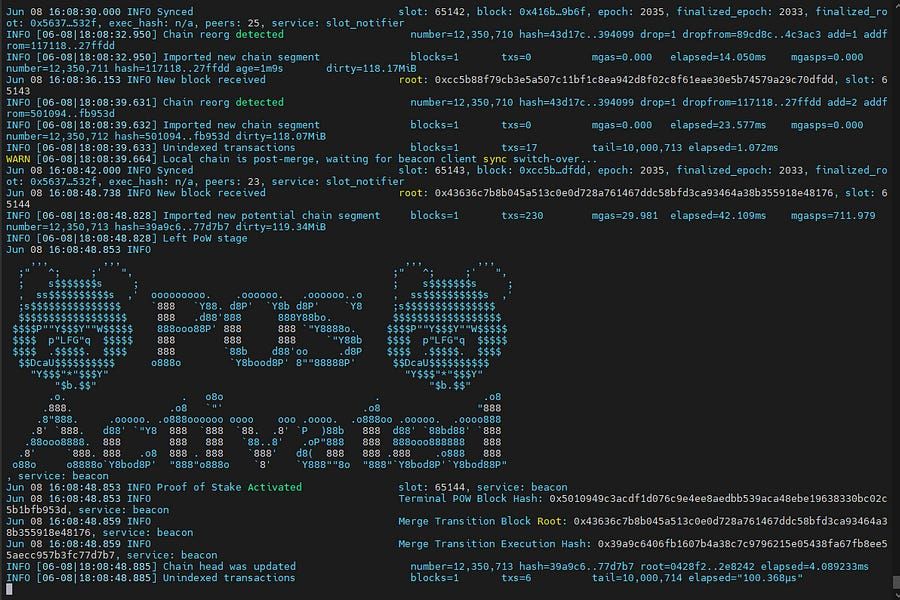

This decisive pivot to PoS will make Ethereum more energy efficient, more decentralized, and more crypto-economically secure. We received our first glimpse of what this migration will look like on June 8th, 2022, when Ethereum’s Ropsten testnet underwent a trial Merge event. Accordingly, mainnet Ethereum is now on course to undergo the official Merge later this summer or in the early fall.

The greenification effect

ASIC and GPU devices are used in PoW mining operations, and many of these operations are very large and use vast amounts of energy.

As such, the shift to PoS will lower Ethereum’s energy consumption over 99% by largely “dephysicalizing” the consensus process. Instead of relying on huge ASIC and GPU farms that often draw on lots of fossil fuel energy and that routinely physically deprecate, PoS is a virtual mechanism based on staked deposits within the Ethereum Virtual Machine (EVM).

Going forward, then, this greenification of Ethereum will do wonders for public perceptions of the network. For example, Ethereum has dominated the NFT ecosystem hitherto, but what market share the smart contract platform has lost over the past two years has been driven in no small part by environmental concerns, e.g. the Polygon and Tezos NFT surges. The migration from PoW will undercut this problem once and for all, and this should position Ethereum and its L2s to facilitate deeper mainstream NFT embraces and more NFT activity than ever accordingly.

From one era to the next

For Ethereum end users, e.g. NFT traders, The Merge should prove to be a rather imperceptible experience besides all the community celebrations that will pop off. In other words, dapps will continue to operate normally, no chain disruptions are expected, etc.

What will be different, though, is the introduction of a considerable historical distinction. There will be PoW-era NFTs, and there will be PoS-era NFTs, and The Merge will be the demarcation event that separates these two periods.

Of course, it’s too early to tell how perceptions around this historical distinction will play out. In the Twitter poll above from Nouns DAO co-founder 4156, 60% of respondents voted “No” in guessing whether the last PoW-era or the first PoS-era Noun auctions would end up commanding premiums. So maybe the distinction may not pan out as very relevant, or maybe it will prove to be a big milestone for future archeologists. Only time will tell for now.

Deflationary veblen money-good?

Notably, The Merge is expected to drop Ethereum’s ETH issuance rate by ~90%. If you then factor in Ethereum fee burns, The Merge is currently poised to remove millions of dollars’ worth of ETH sell pressure and replace it with millions of dollars’ worth ETH buy pressure on a daily basis.

So let’s say this major demand shift really does support a noticeable uptrend in the ETH price, then what? We’ll see, but in the context of NFTs a rising ETH price could catalyze major new waves of ecosystem activity.

For instance, Vance Spencer of Framework Ventures appeared on the Bankless podcast this week, and at one point he made a really interesting comment about ETH being a “veblen money-good” in observing that people tend to spend ETH more when its price rises.

So you see where I’m going with this … a post-Merge ETH rally may lead to the NFT ecosystem’s next big rally. Whether that’ll play out so cleanly remains to be seen, but the possibility appears to be coming into focus.

Action steps

- 🔁 Check out New Merge Updates with Tim Beiko on Bankless:

- 🆓 Read my previous post Free-to-Mint NFTs if you missed it!