The Liquidity Singularity

Dear Bankless Nation,

DeFi runs on liquidity.

DEXs need it to facilitate token swaps, money market protocols like Aave or Compound need it for lending and borrowing activity, and more.

But there’s a problem. Liquidity is fragile. It can be mercenary.

There’s two ways young token projects can solve liquidity issues right now: (1) pay for centralized market makers or (2) launch a liquidity mining program.

Both options are expensive. Centralized market makers usually require the DAO to front the tokens and pay a retainer in cash. And a liquidity mining program requires a protocol to dilute its existing supply.

Is there a better option?

That’s what Tokemak is trying to solve. Tokemak is a new DeFi protocol aiming to build sustainable infrastructure for liquidity—for everyone.

A unique protocol. An important problem to solve.

Could this be the answer for DeFi liquidity?

Ben explores.

- RSA

The Liquidity Singularity

DeFi runs on liquidity. Whether it’s decentralized exchanges, money markets, or stablecoins, liquidity is the fuel necessary to power these applications.

Despite its importance, liquidity can be a fickle resource within the crypto economy. Acquiring and retaining liquidity is costly, capital is mercenary, and market-making is largely centralized in the hands of whales and institutions. It’s inherently inefficient and unsustainable.

This is a problem. If we want DeFi to maximize its potential, it’s one that needs to be solved. This is where Tokemak comes in.

A protocol for decentralized market making, Tokemak is a novel DeFi primitive aiming to create a liquidity infrastructure layer to be utilized by DAOs, new DeFi projects, market makers, exchanges, and power users.

It’s a tall order, to say the least. Can it live up to its expectations?

Let’s find out.

The Liquidity Problem

Before we dive into Tokemak itself, let’s take a moment to better understand the nature of liquidity within DeFi. As mentioned above, liquidity is both essential, and problematic. It’s expensive, mercenary, and concentrated within the hands of a few entities.

Few things are more emblematic of this relationship than liquidity mining.

While it has been an effective tactic in bootstrapping the growth for the entire DeFi ecosystem, where TVL in Ethereum DeFi increased from $1.15 billion at the start of Compound’s program in June 2020 to $114 billion today, liquidity mining comes at an immense cost for protocols.

For example, since launching its program, Compound has increased its value locked from $597 million to $10.81 billion. This growth has enabled the protocol to do its job better: An increase in liquidity means that Compound is able to facilitate a greater volume of borrows for its depositors.

However, to provide the incentive to attract this liquidity, Compound has distributed more than $271 million worth of COMP tokens. This is compared to the $29.1 million in protocol revenue earned over this same period (all of which is currently allocated to reserves), meaning it can be argued Compound has essentially been operating at a loss over this period. The program has also come at the expense of placing downward pressure on the COMP price, as the rewards coming into the market are often sold by yield farmers.

In addition to its costliness, liquidity is also mercenary. Capital is in a perpetual search for the highest risk-adjusted yield, and because the source of many high-yields is attributable in large part to token rewards, and when they decrease or end, capital leaves to chase the next opportunity.

A prominent example of this mercenary nature in action is Uniswap. After the conclusion of its two-month liquidity mining program that ran between September-November 2020 and in which LPs were incentivized with UNI rewards, the protocols TVL fell by nearly 49.5%.

How Tokemak Works

Now that we understand the nature of liquidity problem within DeFi, we can dive into Tokemak itself. The protocol is complex, so let’s go through the key components and participants within the system and see how they interoperate together.

Token Reactors

Each individual asset supported by Tokemak has its own Token Reactor. Reactors are the hubs through which deposits of a given asset are pooled, forming the connection between liquidity providers (LPs), the depositors, and liquidity directors (LDs), who allocate their staked TOKE to a reactor to decide where those assets are deployed (more on both below).

Reactors are intended to be “balanced,” or have as close to a 1:1 ratio as possible between the value of liquidity provider deposits, and the TOKE staked by liquidity directors. To incentivize this, the protocol algorithmically adjusts the interest rate paid out to LPs and LDs (both are currently paid via TOKE rewards). When the value of assets within a reactor is greater than that of the TOKE staked to it, LD yields will increase in order to attract more TOKE and balance the reactor. The opposite holds true when reactors are overcollateralized, as LP yields will adjust upwards to incentivize a greater amount of liquidity provider deposits.

While reactors are not yet live, their creation will initially be determined via a governance vote from TOKE holders. In the future, the team intends to eventually support permissionless reactor creation.

Liquidity Providers

As mentioned above, liquidity providers are the participants that deposit assets into the protocol through the reactors. The concept is similar to providing liquidity to a DEX, but rather than go through a front-end that interfaces with the protocol, users are instead depositing directly into Tokemak, who then routes their liquidity for them, abstracting away the complexities of being an LP.

Liquidity providers earn their yield in the form of TOKE rewards, and upon provision receive a “tAsset” which, like Compound, Aave, or Yearn, represents a 1:1, tokenized claim on their underlying deposits.

A distinguishing feature of liquidity provision through Tokemak is that LP deposits are single-sided. Like Bancor, this is different from “traditional” provision via a DEX like Uniswap or Sushiswap, where LPs are required to deposit both assets of a given pair. As with Bancor, liquidity providers are also shielded from impermanent loss, with the risk transferred instead to liquidity directors.

Liquidity Directors

Liquidity directors (LDs) determine where liquidity is allocated. To participate, LDs stake TOKE into the protocol. From there, they can then choose to allocate their staked TOKE to one, multiple, or, on a pro-rata basis, all reactors within the system.

After deciding on a reactor(s), LDs can then use their TOKE to vote for which exchange they would like to see liquidity allocated for. The LDs voting power is proportional to their share of the total TOKE staked to a given reactor. At maturity, liquidity is directed to a venue for one-week intervals known as cycles.

Initially, the protocol plans to support liquidity direction to Uniswap V2, SushiSwap, 0x, and Balancer. In the future, the project plans to expand liquidity direction to include more venues such as Uniswap V3, and will have the capability to allocate to exchanges across other blockchains and layer 2s.

Like LPs, LDs are compensated in the form of TOKE rewards. However, liquidity directors face considerably more risk than providers because, as previously mentioned, they are the participants in the system that are exposed to impermanent loss.

Despite Tokemak abstracting away the complexities of providing liquidity, the protocol cannot remove the risk of impermanent loss.

Rather, it’s transferred from liquidity providers to liquidity directors.

If assets are exposed to impermanent loss, and liquidity providers cannot withdraw the full value of their deposits, the protocol will first draw on asset reserves from the reactor in question. If that is insufficient, the TOKE rewards paid out to the reactor's LDs will then be reallocated to LPs. Should the reactor still be undercollateralized, like Aave, the staked TOKE allocated to a reactor would be slashed, using it as a final backstop to make LPs whole.

Tying It Together

With these concepts in mind, we can understand how the system works.

💡What’s the tl;dr? Liquidity providers deposit assets into token reactors, with liquidity directors then staking TOKE in order to choose where the liquidity is directed.

Bootstrapping Tokemak: Cycle Zero

While Tokemak has a unique design, its launch has been similarly interesting. The bootstrapping of the protocol on both a financial and community level is being conducted through a series of novel mechanisms known collectively as “Cycle Zero”, which ultimately involve the distribution of 5 million TOKE (5% of the total supply) to participants.

There are three distinct events within Cycle Zero:

1. Degenesis

The first event of Cycle Zero, Degenesis was a fair-launch event that lasted one week where participants were able to commit ETH or USDC in exchange for TOKE. This allowed Tokemak to begin to build out its reserve of protocol-controlled assets (PCA) and acquire commonly used ‘base-assets' to be paired with reactor assets when liquidity is directed to an exchange.

🧠 To read more about the mechanics of the event, click here

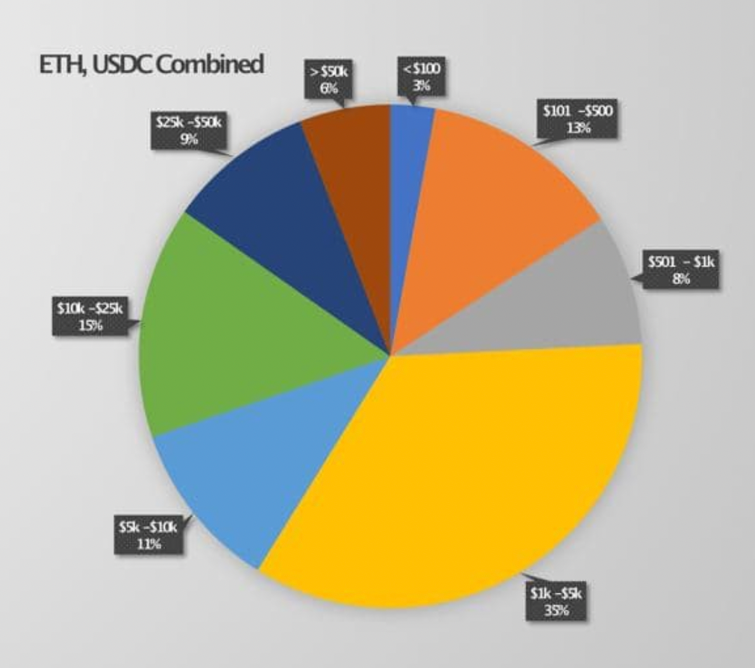

Degenesis proved successful at attracting a balance of small and large users, as 65% of combined ETH and USDC commitments were $5000 or less.

2. Farming

The second stage in Cycle Zero is farming. This serves as another mechanism for the protocol to accumulate base assets, and allow it to build up liquidity for TOKE itself. Tokemak is currently incentivizing three single-asset pools, ETH, USDC, and TOKE, along with the TOKE/ETH pair on Uniswap V2 and SushiSwap with TOKE rewards.

The yield is currently between 20-25% on the ETH and USDC pools, around 100% on the TOKE pool, and 525% on the TOKE/ETH pairs. For the first two weeks of farming, the ETH and USDC pools were “private” in that they were only available for use by Degenesis participants.

3. Collateralization of Reactors Event (C.O.R.E)

The third and final stage of Cycle Zero involves bringing the first reactors online through the Collateralization of Reactors Event (C.O.R.E). The event consists of a week-long vote in which token holders will select the first five reactors to be supported by the protocol.

Adoption & Integrations

Despite its nascency, Tokemak has already begun to see significant traction.

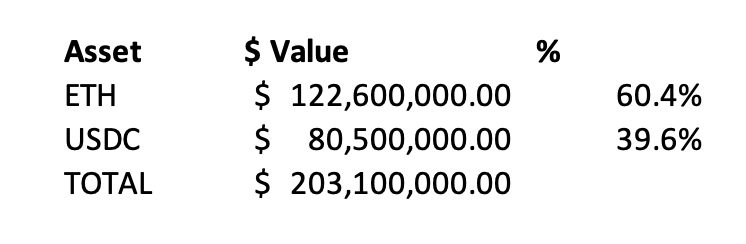

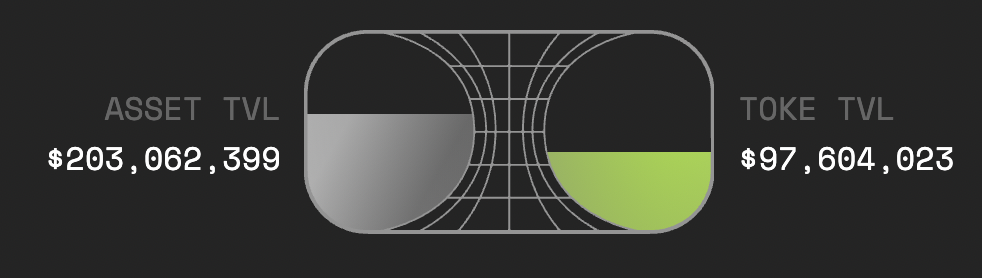

The protocol has accumulated $203.1 million in PCA from Degenesis and the Genesis Pools, consisting of $122.6 million worth of ETH (60%), and $80.5 million in USDC (40%).

In addition to building up its PCA stockpile, Tokamak has also managed to attract significant liquidity for TOKE. There is currently $96 million worth of TOKE within the staking pool, and the TOKE/ETH pairs on Uniswap V2 and SushiSwap.

This means that if the protocol were live in its entirety today, the total balance of PCA to TOKE would be about 2:1 skewed in favor of the former.

Tokemak has also begun to integrate itself across other DeFi protocols. The TOKE/ETH pair on SushiSwap is a part of the exchanges Onsen farms and is being incentivized with TOKE and SUSHI rewards. Although just $353,000 worth of LP tokens is staked on SushiSwap, as the yields are “just 297%” compared to 523% on the Tokemak interface, it does indicate that there is a strong relationship between the two protocols.

In addition, TOKE has been accepted as collateral on Rari Capital’s “Token Mass Injection” pool on Fuse, an isolated money market protocol. This allows holders to unlock the value of their TOKE by borrowing against it.

A New Paradigm in Token Economics and Liquidity Provision

Tokemak is a fascinating protocol, with paradigm-shifting implications on several different levels.

For starters, Tokemak democratizes the process of liquidity provision and market-making. With single-sided deposits and protection from impermanent loss, Tokemak creates a simplified, risk-minimized way for everyday users to provide liquidity. In addition, through liquidity direction via TOKE, users can also access market-making opportunities that otherwise would not be available.

Another fascinating dimension of Tokemak is TOKE itself. As we know, TOKE plays many different roles within the protocol, including:

- Governance over the Tokemak DAO

- Incentives for LPs, LDs, and asset deposits

- Protocol backstop in the event of extreme impermanent loss

- Liquidity direction or tokenized liquidity

This final point is particularly interesting due to the ability of holders to direct liquidity for an asset and to a destination of their choosing, TOKE can be thought of as tokenized liquidity. This means that TOKE is not just a governance or work token, but also a unique, digital commodity.

Moreover, by owning TOKE, a holder or entity owns the right to plug into the liquidity within the system, making the token a highly valuable resource for a variety of different entities and turning liquidity into an infrastructure layer that anyone can tap into.

For instance, DAOs, who the team feels will be the ultimate user of the protocol, could hold TOKE in their treasuries in order to secure and direct liquidity to their token, rather than launching an inflationary liquidity mining program.

Given its scarcity, there are only 100,000,000 total TOKE in existence, it’s also been posited that we could see something along the lines of “TOKE wars” in the future where protocols compete to acquire TOKE.

Does he who controls the TOKE control the liquidity in DeFi?

Conclusion

Tokemak is an intriguing new protocol. With an innovative design, unique launch, and an important target market, Tokemak could be poised to become an important piece of liquidity infrastructure for the broader crypto ecosystem.

It’s still early for this emerging protocol as they’ve yet to fully launch on mainnet, however, it’s worth keeping an eye out as they continue to build out this infrastructure.

Action steps

- Research TokeMak and its protocol for liquidity infrastructure

- Consider depositing into some of the farms available (APYs looking 🔥)