Dear Bankless Nation,

Arbitrum launched their mainnet for developers on Friday. It’s hard to articulate the magnitude of this event as it relates to the overarching progress of Ethereum and cryptographic systems. (Tune in for our chat with the Arbitrum devs on SotN tomorrow!)

Since Day 1, it was known that Ethereum would need to scale. Both sharding and Layer 2s were identified as the logical conclusion of how Ethereum would scale, but there wasn’t much for specifics beyond that. At the time, how sharding would be built, and how layer 2s would be constructed was very much an open, unanswered research question.

Over time, and with a lot of iteration and returns to the drawing-board, those questions slowly got answered. From 2015 to 2018, we went from state channels to plasma, to rollups (where we are now).

The launch of Arbitrum’s mainnet is the culmination of 6 years of R&D in cryptographic systems, and Optimism isn’t too far behind.

It feels like we’re on the cusp of…

Layer 2 Summer 🏖️

Here’s how I’ve been thinking about this:

Ethereum is Disneyland in its early days. It’s one central hub and when you “go to Ethereum”, you’re going to the same spot as everyone else and everyone is trying to go to the same rides.

There’s only so many things you can do as the shear amount of congestion is limiting for what the park can do (think: Disneyland in 1955, but with 2020’s population). It’s a really fun place to be, but the FASTPASS lines are still too long because the whales keep on riding the same rides over and over again.

Ethereum-land needs more real estate. So what does it do?

It builds more parks!

Different teams have been building off of the main Ethereum hub, in order to establish a cool new park for all the main-chain visitors to go try out, and escape the congestion of the main rides and attractions.

Polygon launched a few months ago.

Arbitrum launched on Friday.

Optimism launching soon™!

The amount of new real estate that Ethereum-visitors are going to be able to access is insane.

Speculative Growth

Keeping the California theme going, one of the greatest migration events in human history was the great California Gold Rush.

Gold was discovered in California in 1848, and this news brought approximately 300,000 people to California from the rest of the United States and abroad. The sudden influx of gold into the money supply reinvigorated the American economy. It was one of the reasons that California has become one of the most established areas in the world.

Speculators learned that there were riches to be had, and the demand to score riches caused people to uproot their lives, move west, and speculate for gold.

This is what is about to happen (or already is!) with the launch of all these Layer 2s.

Except it’s going to happen twice:

- First for the developers.

- Second for the users.

Developer Land Grab

When Polygon, Arbitrum, Optimism, Hermes, or any other Ethereum L2 opens up, they are releasing free real estate to the world. But it’s just land. It’s fertile land, perhaps the most fertile land that has ever been created in the crypto-verse, but there’s nothing on this land.

The first competition is for DeFi apps to come and build infrastructure on this land! The DeFi apps are the new rides and attractions that will eventually come to entice people from the Ethereum main-park to come over to the Layer 2 and check out all the fun stuff going on.

Layer 2’s create the real estate, but the DeFi apps need to claim the real estate as theres!

The first gold rush is for DeFi apps. This is why Arbitrum didn’t allow any DeFi app to ‘get ahead’ of others.

Last Friday was the ‘Developer Mainnet’ for Arbitrum, and Arbitrum didn’t give any DeFi app early or privileged access to any DeFi app—they preserved credible neutrality and didn’t let any DeFi app start building infrastructure before any others.

Now that Arbitrum is open for developers, they have all rushed into this new land in order to build their DeFi app as-fast-as-possible.

The Layer 2 Gold Rush

Here’s where the fun comes in, and why I’m speculating that a DeFi Summer: Layer 2 Edition is around the corner.

DeFi apps want you to come use their app on the new Layer 2. They just built your favorite rides that you use on the Ethereum main-park, but now they have their apps with no transaction times and barely any fees. They want you to come use their DeFi app, and not their competitors because they want to grab as much real estate as possible.

So what are they going to do? Issue tokens!

Liquidity mining! Yield farming! They’re going to do what DeFi apps do best, which is to incentivize usage via the issuance of their tokens.

We’re already seeing this play out on Polygon, with an insane amount of success. Here’s all the $SUSHI AND $MATIC rewards you can get for providing liquidity to SushiSwap on top of Polygon.

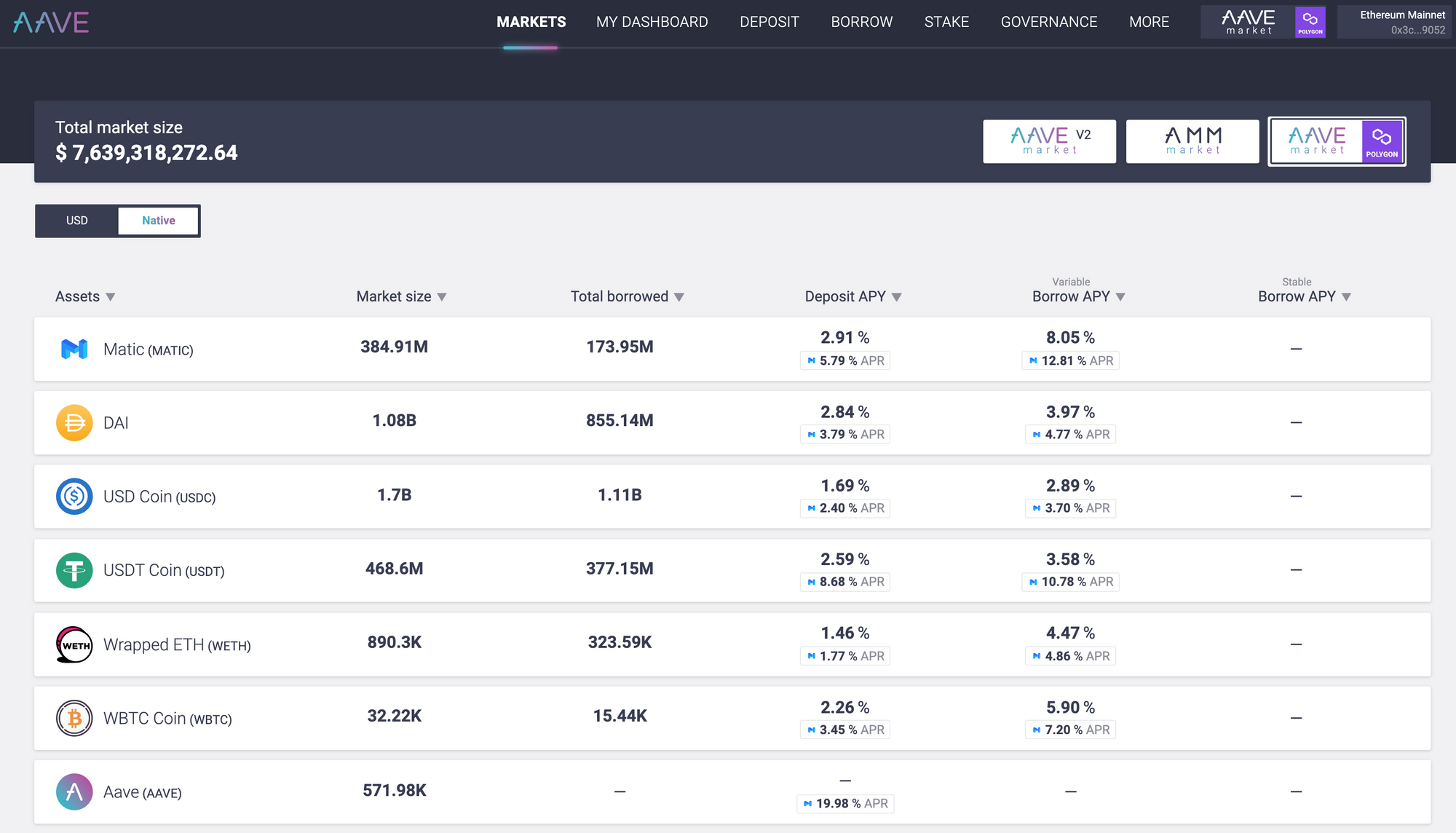

I personally have been farming MATIC tokens on Aave’s Polygon deployment, and it’s been a good time :)

Not Just DeFi App Tokens

I have no idea if this is true, but it would fall in line with everything I know about projects on Ethereum.

Arbitrum and Optimism and all the other Layer 2s are totally going to have tokens. Tokens are a way to distribute power and control over valuable systems, and it’s inside of Ethereum’s ethos to decentralize power.

When DeFi apps begin liquidity mining on top of Layer 2’s, it’s highly likely that the Layer 2 teams add their own tokens into the farming opportunities. Earn SUSHI rewards and Arbitrum tokens.

How else are these teams going to do what literally every other project in Ethereum is doing, which is handing over governance to the community.

Polygon has already been doing this with MATIC, to much success.

- Deposit or Borrow from Aave on Polygon, and you’ll earn MATIC tokens.

- Swap, provide liquidity, lend and borrow on SushiSwap, to earn MATIC

- Use PoolTogether on Polygon, to earn MATIC

The Layer 2’s need to compete for users just as much as DeFi apps do! They also need to distribute their tokens to a wide user base too. How are they going to do this?

Tokens. Yield Farming. Liquidity Mining.

DeFi Summer: Layer 2 Edition

So that’s the through line.

Ethereum is opening up many different Layer 2 spokes off of its main hub. The main hub is so incredibly congested that people are dying to emigrate to Ethereum suburbs.

DeFi apps are rushing to claim real estate on these new fertile grounds. Once they’re ready, they’re going to open up to users. Users are going to come to save on fees, but DeFi apps are going to do their hardest to convince users from main Ethereum to come use their apps and not their competitors. DeFi apps are going to issue token-rewards to incentive migration and settling in their app.

Layer 2’s are going to tokenized and distribute tokens via the DeFi apps as a way to decentralize the control over the Layer 2.

It’s going to be DeFi summer all over again, except this time an order-of-magnitude larger because we’ll have dual App-Layer 2 token issuance, and the Layer 2 real estate is going to be so incredibly valuable over the long term.

This is what I see on the horizon.

Bankless Nation… it’s time to pack your bags. We’re going West, because there’s gold out there. There’s new, unsettled land, and pioneers gonna do what pioneers do best.

Time to settle on new lands.

See you there 🚀

David