Dear Bankless Nation,

Ethereum's would-be competitors are discovering that life is easier as a rollup.

Today, we take a look at three projects – including the freshly debuted Eclipse – that are embracing Ethereum for settlement as they evolve with an eye towards sustainability. Let's dig in!

-Bankless team

Paying for consensus is an expensive endeavor, and while bull market mania can help projects easily justify it, today's bear market dynamics are forcing crypto projects to get more pragmatic.

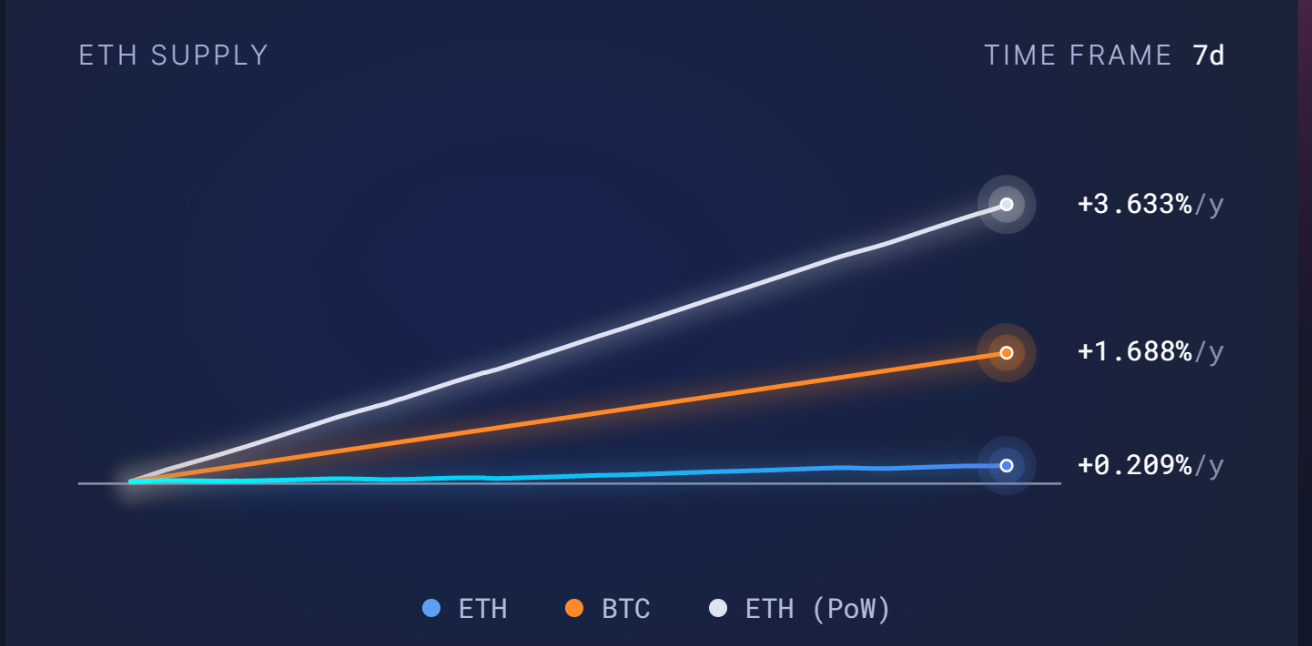

Most blockchains – including Ethereum at the moment 👀 – simply do not earn enough in transaction fees to offset token inflation, an expense incurred to subsidize the incomes of validators (or miners) who secure the chain.

Not every network requires customizability at the consensus layer, and flexibility at the execution layer suffices for most blockchain experiments! For chains that don't need to customize consensus, it makes sense to reduce expenses by offloading the burden of securing the chain to Ethereum, whose sole purpose is increasingly evolving toward becoming the credibly neutral settlement layer for many chains.

Users and liquidity exist on the Ethereum L1, but increasing transaction costs that scale alongside adoption will naturally push users toward the L2.

Blockchains are now lining up to serve this market and become users' L2 destination of choice, and while the dominant Ethereum scaling solution has yet to be found, the influx of projects hoping to create it is validating Ethereum's rollup-centric scaling roadmap! Their construction rebukes the inflationary tokenomics that come hand-in-hand with appchains, a cornerstone of the Cosmos ecosystem. It demonstrates that blockchain projects require the flexibility offered by rollups, a trait that monolithic chains like Solana cannot duplicate.

Today, we explore the designs of three blockchains that have wisely announced their decisions to outsource settlement to Ethereum over the past week!

🌓 Eclipse

Modular blockchains are here, and Ethereum (unsurprisingly) was the first choice for the settlement layer!

Yesterday, Eclipse unveiled its mainnet architecture. It uses Ethereum for settlement, the Solana Virtual Machine (SVM) for execution, Celestia for data availability (DA), and RISC Zero for fraud proofs.

While certainly an abomination of crypto nature, Eclipse is a serious contender for the title of Best Ethereum Rollup.

Um excuse me @neelsalami pic.twitter.com/zYOYtRa2DK

— DavidHoffman.eth🦇🔊 🏴 🔴 (@TrustlessState) September 19, 2023

Executing transactions in parallel enables the Solana Virtual Machine (SVM) to enjoy better efficiency compared to the single-threaded Ethereum Virtual Machine (EVM), which can only process transactions in sequence, allowing Eclipse to offer improved performance compared to alternative rollups. Additionally, by taking advantage of Celestia's DA solution, Eclipse can undercut the fees of the L2s that depend on Ethereum for DA.

Essentially, Eclipse takes the best parts of Solana (the tech and the low fees) and plugs it into the strong monetary layer that is Ethereum, a lethal combination.

🐸 Canto

Alt-L1s are frequently detested for being little more than Ethereum derivatives with higher TPS. However, the same cannot be said for Canto, an independent L1 constructed using the Cosmos SDK that launched in 2022 as an experiment with onchain public goods.

As part of its public goods mission, Canto pioneered free public infrastructure primitives (i.e., a community-owned DEX, lending market, and overcollateralized stablecoin) built to eliminate rent extraction, and implemented contract-secured revenues that share gas fees back with developers!

On Monday, the chain announced it would abandon Cosmos and migrate to Ethereum as an L2 built on Polygon's Chain Development Kit (CDK)!

We're thrilled to announce Canto is building with @0xPolygonLabs to migrate to a ZK L2 on Ethereum– powered by Polygon Chain Development Kit (CDK).

— Canto Public (@CantoPublic) September 18, 2023

This ZK chain will be dedicated to Real World Assets in support of the next wave of application-layer adoption via neofinance. pic.twitter.com/x04dMIHsg7

Canto's pivot to Ethereum will be accompanied by its adoption of "neofinance." While essentially just an RWA rebrand, neofinance will allow Canto to natively support offchain assets, providing an infinitely scalable source of high-quality yield-bearing collateral to reserve its stablecoin.

✨ Astar

This Polkadot parachain claims to be Japan's most popular smart contract and fosters ambitions to become the alt-L1's "smart contract hub." Last week, the Astar team announced it would expand to Ethereum with the Astar zkEVM!

💥 Supernova is here! 💥

— Astar Network (@AstarNetwork) September 13, 2023

We are excited to announce that we will work with @0xPolygonLabs!

Together, we will deliver Astar zkEVM: the Ethereum Layer 2 scaling solution powered by Polygon's CDK.

Here, @WatanabeSota & @sandeepnailwal share this groundbreaking announcement. pic.twitter.com/23hSlvUu1G

This Astar L2 will inherit the security from Ethereum and is built using Polygon's CDK. While Astar maintains in its zkEVM FAQs that the network has not given up on the Polkadot vision and instead remains wholeheartedly committed to it, moving to establish the chain as an L2 on Ethereum is certainly far from a vote of confidence in Polkadot.

Integration with crosschain messaging platforms, like LayerZero, will enable Astar to pass traditional assets, arbitrary crosschain messages, and remote smart contract calls between the chains. This will enable native interoperability to exist on day one between the Astar Network – composed of both Wasm and EVM execution environments – and the new Astar zkEVM.

Takeaway

While alt-L1s have long positioned themselves for the demise of Ethereum, builders have begun to recognize that this day may no longer be coming…

Blockchains that want to survive through this bear and thrive during the upcoming bull must position themselves for adoption now. The easiest way to do this is by tapping into Ethereum's network effects and becoming a rollup!

Action steps

- 📺 Watch our interview with Eclipse's Neel Somani

- 💚 Check out A Beginner's Guide to Canto