Dear Bankless Nation,

Want to see something awesome (and a bit scary)?

ETH is on its 8th green month in a row. It’s now 2.25x higher than its 2017 all-time high of $1440.

This is pretty historic. ETH has never seen 8 straight months of green.

Naturally, when prices start to move with this degree of magnitude, communities begin to get extremely loud and excited. Big price movements feels like vindication and validation for those who were forced to grit their teeth through the pain of the bear market—it gives them permission to be loud about how they’ve been right.

Through this this excitement, we’ve seen increasing conversation about The Flippening.

The Flippening is when the ETH market cap passes the BTC market cap. Most Bitcoiners think that this is an absolute fantasy, while some convicted Ethereum community members have been discussing the inevitability of the flippening before Ethereum was even alive.

Some Ethereum community members have even gone so far to make ‘Flippening’ websites:

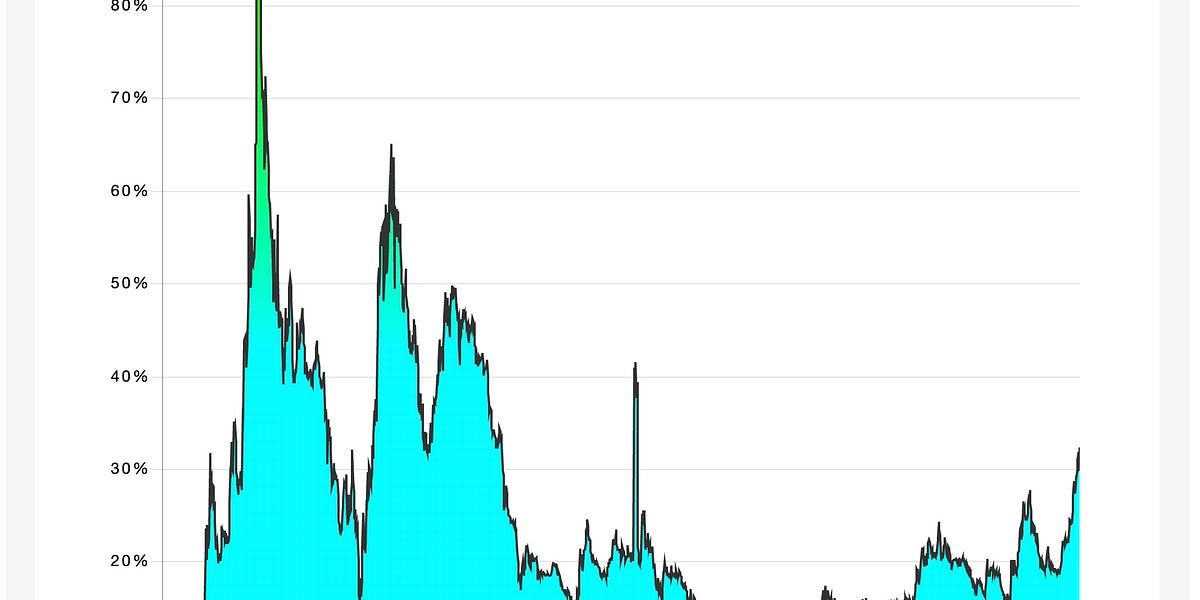

In early 2017, ETH came very close to flippening Bitcoin, where it reached a high of 0.1535 ETH/BTC—it was 83% of the way there.

At the current ETH/BTC ratio of 0.0565, ETH is now higher in BTC terms than it has been since the middle of 2018.

Is the Flippening even possible?

Many in the Bitcoin community believe that the flippening is not within the laws of physics. It can’t happen. It’s impossible.

But there’s nothing written into the laws of the universe (or the laws of crypto) that says one asset can’t flippen another, or that ETH can’t flippen BTC.

There’s a non-zero chance that the flippening will happen. Whether or not you want to believe it is up to you. It’s perfectly fine to think the flippening is unlikely. But it would be irrational to think it’s out of the realm of possibility.

How likely it is to happen is up to you to consider.

Here’s my perspective on both sides of the argument.

Arguments Against

The arguments against Bitcoin getting flipped by Ethereum, or any other crypto-system, lies in a few core characteristics that are unique to Bitcoin:

Fair Launch

No one knew that Bitcoin would become what it currently is today. Everyone who participated in the early bootstrapping of the system did it purely based on intrinsic curiosity, not because of early profit motives. No one knew that Bitcoin would become a multi-trillion dollar asset.

People say that Bitcoin can’t/won’t be flippened because the value of this fair launch system cannot be replicated by anything, and this initial fairness is what gives Bitcoin some of its best properties. It would be pretty much impossible to achieve.

Bitcoin has a monopoly on fairness, and this will protect it from any secondary chain. Bitcoin proved that crypto-systems have value, and therefore all crypto-systems that come after bitcoin are ‘tainted’, because the profit motive naturally corrupts the system.

Anything that has a ‘pre-sale’ cannot be considered fair, and won’t be able to capture enough value, because humans value fairness, and Ethereum’s ‘premine’ bars it from ever being able to flippen Bitcoin.

Unchangeable

Bitcoin is the most unchangeable crypto-system that our industry has ever created, and likely ever will. According to the Bitcoin community, this is where the real value lies. It’s a credibly neutral system based on code, not people, that you can depend on for years, decades, and centuries. Math is never wrong, and humans are folly. This is true.

Ethereum’s human-managed hard forks and centralized dev teams are a farce to what crypto promises the world; a system governed by math and not people. According to Bitcoiners, committing to system upgrades and hard forks is also committing to never flippen Bitcoin.

There are other arguments on the Bitcoin side, but these are the ones I hear echoed the most and are specifically what separates Bitcoin from the rest of the market.

Other arguments include things like the intrinsic fairness of PoW, and the importance of BTC being strictly deflationary while ETH could be either, and the importance of fixed supply over any other model.

If you want to dive into this argument from the words of the Bitcoin community read John Light’s response to our Ultra Sound Money episode. It’s actually pretty good.

Arguments For

If you’ve been paying attention to our Ultra Sound Money episodes recently, you’re familiar with the fundamental case for ETH not only as the most sci-fi money humanity has ever created, but also why ETH has the potential to flippen Bitcoin.

PoS + EIP1559 = Maximally sustainable scarcity

PoS issues the least possible amount of ETH to provide Ethereum security. EIP 1559 burns ETH as a function of Ethereum’s economic volume, and Ethereum has a ton of economic volume.

These arguments are grounded in code and market demand, where most Bitcoiner anti-flippening arguments are grounded in human values and subjective interpretations as to what should be valuable.

Do you think that the #1 crypto-asset should be determined by human subjectivity as to what should be valuable? Or do you think that the #1 crypto-asset will be determined by technological innovations in crypto-economics.

Ethereum is the settlement layer for the digital economy

I’ve said for a while that the extent to which ETH is money is a function of how much Ethereum is the economy.

Right now Ethereum is the global economy for only very specific use-cases. NFTs, DeFi, and even settlement for select VISA payment networks and investment banks.

But slowly, and over a very long time, I expect the global economy to become synonymous with the Ethereum economy. Eventually, everything will find its way to Ethereum.

As Ethereum becomes the canonical economy, ETH becomes the canonical store of value asset. At this point in time, it will be not just higher than BTC, but higher than all other assets in the world.

There’s also the conversation that Bitcoin must hard fork in the future to overcome the quantum computing obstacle, and this happens within 20 years. Bitcoin overcoming this without coordinating a hard fork doesn’t seem likely though.

But personally, I expect BTC to largely be an ERC20 token on Ethereum by that time ¯\_(ツ)_/¯

- David

P.S. Get paid to appraise NFTs! Upshot just launched a closed beta & Bankless gets exclusive early access—Badge holders get in automatically. You can fill out the form if you don’t have your badge. Check this out. 💪