The Flippening is Inevitable

Dear Bankless Nation,

The common definition of The Flippening is the point in time at which ETH’s market cap exceeds BTC’s market cap.

Some think the flippening won’t happen.

Some think it’s possible.

Others think it’s inevitable.

It’s a widely controversial topic in the crypto community.

Some people think even talking about it is too tribal. I disagree. What kind of crypto investors would we be if we didn’t try to predict the trajectory of the two most important crypto assets? Bitcoin is still an excellent asset even in second place.

Others think it’s premature. ETH sits at a $320B valuation while BTC has a comfy lead of $720B. A $400B difference!

But here’s what’s interesting…

Ethereum has already flippened Bitcoin on the three other most important metrics for any public blockchain.

When you see this…the flippening starts to feel inevitable.

Is the flippening the most obvious trade in crypto right now?

Lucas lays out the argument.

You decide.

- RSA

THOUGHT THURSDAY

Guest Writer: Lucas Campbell, Editor & Analyst for Bankless

The Flippening is Inevitable

The Flippening is arguably one of the most controversial events in crypto. Bitcoin has held the throne for most valuable crypto asset by market cap for over a decade now. And the idea that Ethereum, or any other competitor, will overtake the #1 spot naturally sparks debate among the crypto community.

It’s often touted that BTC is the hardest, soundest money the world has ever seen up to this point. This is likely true; the digital asset has an immaculate conception that arguably can never be replicated again paired with a strict, programmatic monetary policy (which is enforced by a strong social contract).

However, many in the Ethereum community believe otherwise. In fact, some believe that The Flippening is inevitable.

Ethereum is a generalized, programmable settlement layer for anything of value, which expands well beyond Bitcoin’s core capabilities. Ethereum’s upcoming Eth2 upgrade and EIP 1559 implementation transitions ETH to a productive asset with a potentially deflationary monetary policy. While there’s still a fair amount of execution risk left with this transition, the combination of this scalability + economic upgrade should not be underestimated.

While for some it seems impossible to envision a scenario where Bitcoin cedes its throne, the truth is that Ethereum has already flippened Bitcoin in arguably the three of the most important fundamental on-chain metrics for any public blockchain.

These 3 metrics are:

- Value Settled: How much economic value is being settled on the blockchain.

- Transaction Fees Paid: How much are people willing to pay to have that value settled on the blockchain.

- Settlement Assurances: How secure is that value once it has been settled on the blockchain.

These three concepts largely encapsulate the core purpose of any blockchain: provide a secure (and ideally public) ledger to facilitate peer to peer value transfer.

1. Value Settled

Blockchains are settlement layers. The amount of value settled on a blockchain indicates whether or not the network is actually being used for its core purpose: facilitating economic activity. Generally the more value settled on the blockchain, the better. It shows that people are actually willing to trust and use the network to accurately record and secure their value (whether this be ETH, BTC, USD, etc).

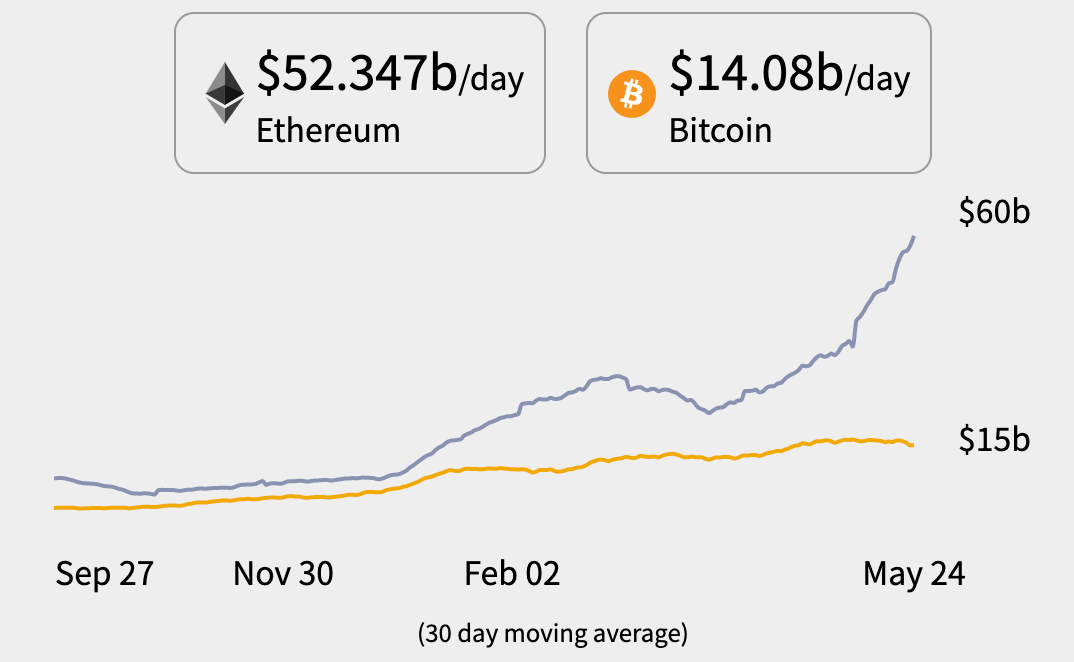

And Ethereum is dominating this metric on all fronts. According to Money Movers, Ethereum is settling over ~$52B in value per day compared to Bitcoin’s ~$14B.

However, the Bitcoin community may be quick to highlight that it’s an apples to oranges comparison (which are both fruit btw!) as Ethereum’s settlement layer can process any value while Bitcoin’s largely only supports BTC, inherently limiting the network’s available economic bandwidth to just one asset rather than thousands.

But even when we strictly view this in the amount of value transferred between BTC and ETH, Ethereum has already taken the lead as of early May. Bitcoin is settling a similar $13.9B in BTC per day while Ethereum still settles over $20B in ETH-denominated value per day.

Despite having over ~$400B more in economic bandwidth, Ethereum is still settling more value than Bitcoin in terms of their own respective native assets. Ethereum now settles more trustless value per day than Bitcoin.

Does this mean ETH is used more as money whereas BTC is used more as a store of value (which is also what Carl Ichan said yesterday)?

The argument against this is obviously that BTC isn’t meant to be used on a daily basis. It’s meant to store value over time (which it has historically done very well). Both serve their purposes.

2. Fees Paid

Public blockchains are in the business of selling block space. A good blockchain has blocks filled with activity that people are willing to pay for. To me, this is one of the core indicators to determine how valuable a blockchain is as it literally translates to how much people are willing to pay to use the ledger.

And again, Ethereum is crushing Bitcoin under this measurement. The current 7 day average fees for Ethereum sits at $32M per day. Compare this to Bitcoin with $4M per day and the competition isn’t even close at this point—Ethereum is dwarfing Bitcoin by roughly 8x in transaction fees paid. Why is this?

Simply put, Ethereum offers an attractive ecosystem filled with economic and social opportunities that are worth paying for.

If you can earn 20% APY on USD and have $100K to deploy, you’re probably willing to pay a sizable fee to make that transaction happen. If you’re looking to buy a cryptopunk for millions of dollars to show off in the Metaverse, you’re probably willing to pay a significant fee to make sure that your transaction goes through. If you there’s a new Uniswap gem that you think is going to 10x, you probably don’t care what the gas fee is. You get the idea.

On the other hand, the main opportunity on Bitcoin is simply sending it to another address. Maybe it’s to your BlockFi account to start earning interest. But regardless, there’s less economic opportunity on the Bitcoin network, making it less desirable to pay a higher transaction fee.

More and more people are rushing to fill Ethereum’s block space, waving their gwei around, telling the miners to shut up, take their money, and include their transaction into the next block.

The numbers speak for itself: people are willing to pay more to use Ethereum than Bitcoin.

3. Settlement Assurance

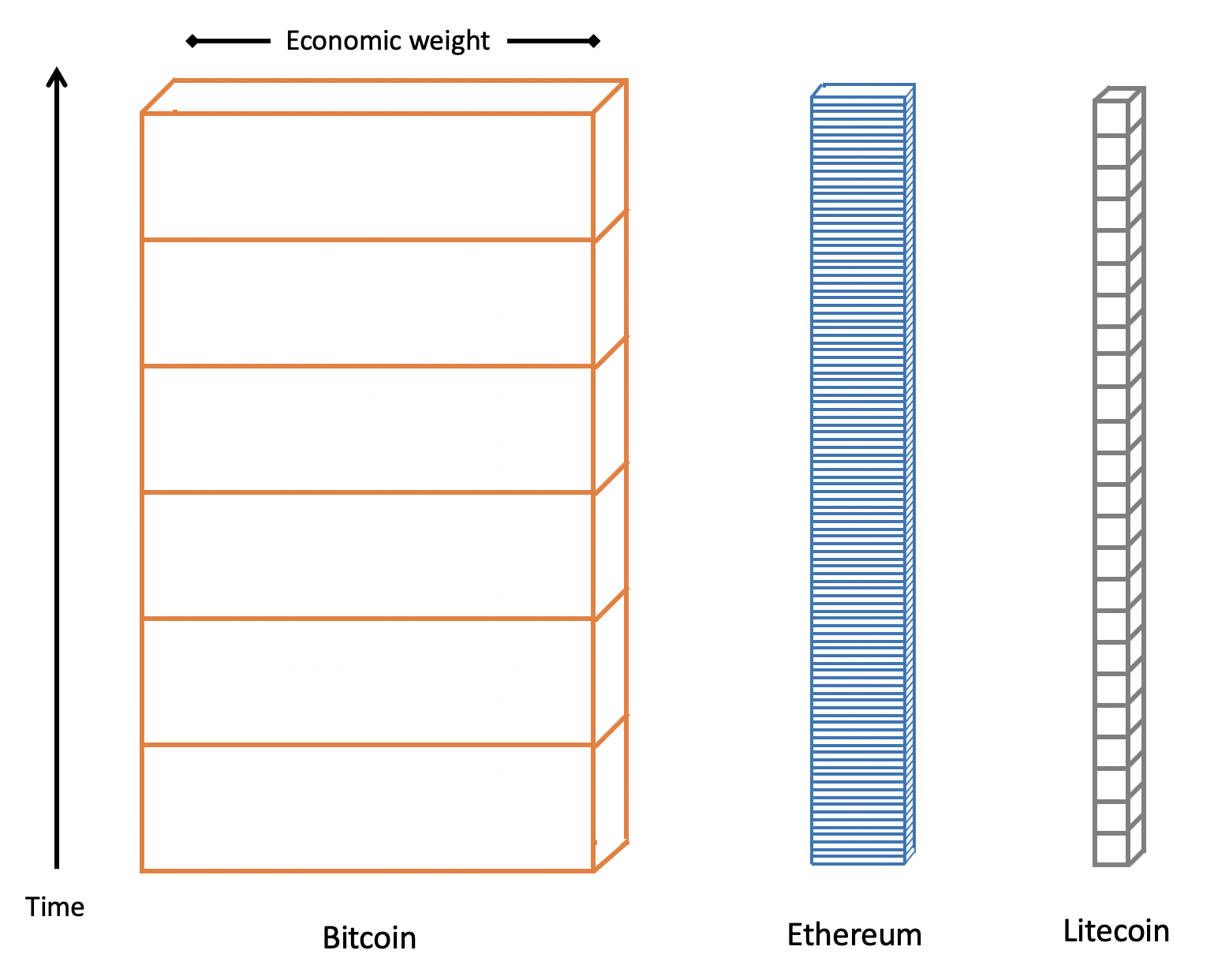

The final metric we’ll dig into is settlement assurances. Nic Carter wrote a detailed post on this back in 2019. He believes that this is one of the primary things to consider when evaluating any public blockchain. This is because settlement assurances directly translates to the security of a blockchain.

It’s how confident you can be that your transaction won’t be reverted once it’s verified on-chain. This is really important, especially for those aligned with Cypherpunk ideals! People want an economic system that is resistant to rollbacks, reversions, etc.

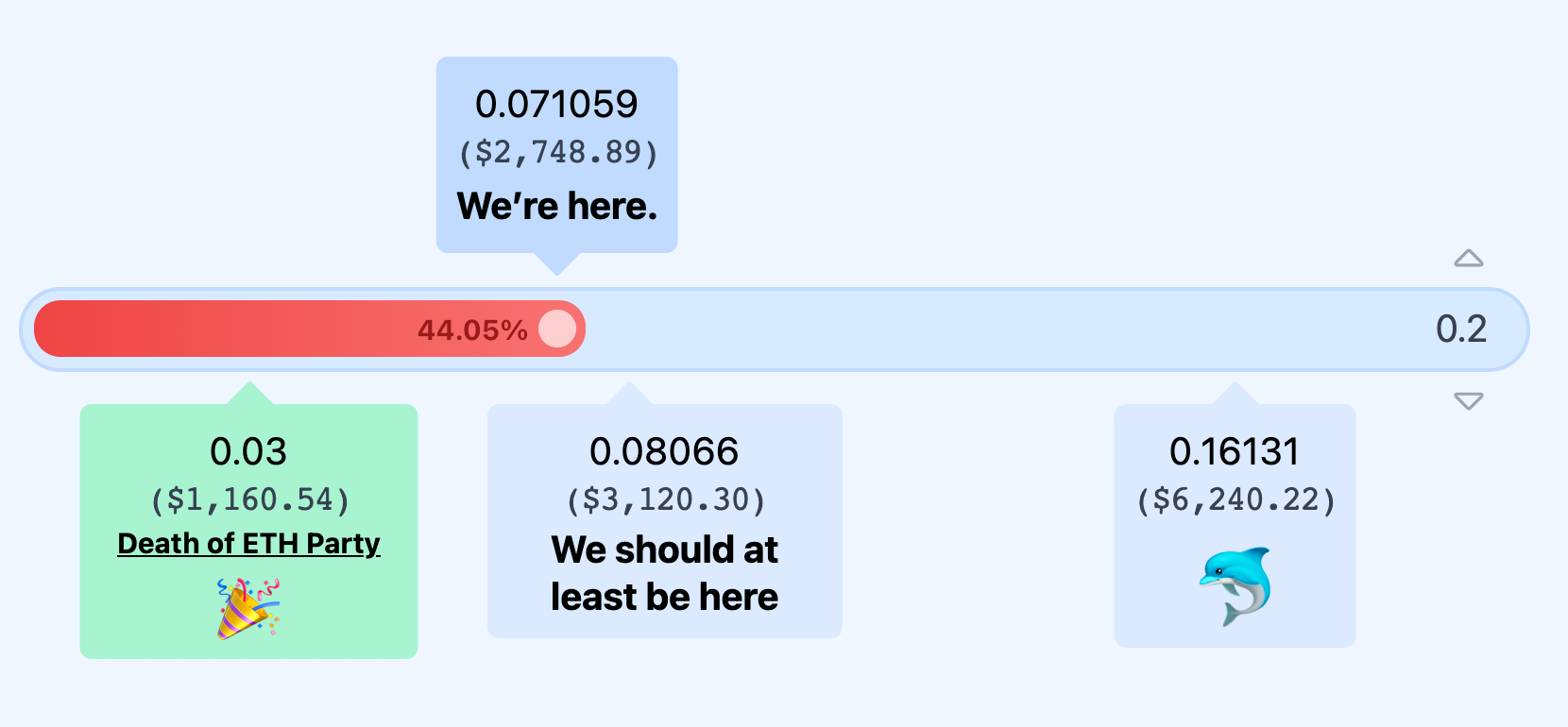

One way to measure settlement assurances is to calculate the number of block confirmations required for the transaction to be as settled as one on Bitcoin.

✍️ Writer’s Note: For Bitcoin, this has historically been 6 block confirmations. Meaning once a BTC transaction reaches 6 block confirmations, it’s considered final and it’s unlikely that the transaction will ever get reverted.

Now it’s not currently true that Ethereum is more secure than Bitcoin strictly in terms of number of block confirmations, as calculated by howmanyconfs. However, a few weeks ago this was not the case. For a moment in time, Ethereum was actually more secure than Bitcoin! This was an inflection point for the crypto ecosystem as it was the first time in crypto’s history (afaik) that another network had greater settlement assurances than Bitcoin under this measurement.

But we can take this a step further. In Nic’s post, he mentions that ledger costliness is one of the quantifiable measurements for settlement assurances. And how do you measure ledger costliness?

Put simply, it is equivalent to the amount paid to validators/transaction selectors per unit of time

This means that the more you pay miners per year—in a combination of fees plus block rewards—the less likely they are to attack the network. In other words, the ledger is more secure as miners are more incentivized to be honest actors instead.

After some quick napkin math, we can calculate how much is being paid out to miners per year:

- Bitcoin is paying out roughly ~$14.25B per year to miners (based on 900 BTC per day + $3.8M in daily tx fees with BTC at $40K)

- Ethereum is paying out roughly ~$18.5B per year to miners (based on these block reward and block time metrics)

Yup that’s right. Ethereum is currently paying more money per unit of time to miners than Bitcoin. Ethereum has higher ledger costliness than Bitcoin, meaning it has higher settlement assurances under this measurement.

What’s Stopping The Flippening?

Ethereum settles more value, people are willing to pay more to settle that value, and Ethereum is more secure than Bitcoin (under certain measurements).

So what’s stopping Ethereum from flippening Bitcoin?

To me, it comes down to two words: monetary premium.

Today BTC is more widely understood than ETH, which is a key component in accruing a monetary premium. Decentralized monies like BTC are built on collective belief after all! People understand Bitcoin more. It has a simple narrative as digital gold. Retail investors understand that. Institutions are starting to understand that. And as we’ve said ad nauseam, the most bullish thing for crypto is to be understood.

People understand Bitcoin. They don’t understand Ethereum….yet. Investors had over a decade to understand Bitcoin. They’ve had half of that time to understand Ethereum (which is significantly more complex).

But make no mistake: If Eth2 and EIP 1559 are implemented, ETH’s narrative can stabilize. All of the value that is being generated on Ethereum will directly accrue to ETH. The attractiveness of the asset for institutional investors will click—they just need time to learn this new industry. Once they do, ETH’s narrative can leak into the mainstream.

Ethereum settles more value, that value is more secure, and people are willing to pay more for that value to be settled than Bitcoin.

On-chain numbers don’t lie. Ethereum is becoming the better settlement layer for all of the world’s value.

When you look at it like that, the flippening starts to seem inevitable.

Action steps

Review the data yourself!

Read Nic Carter’s post on Settlement Assurances