Dear Bankless Nation,

The Banking crisis of the past several weeks has wreaked havoc on the confidence that depositors have in their banks. That's bad for the Fed. And while regulators have been thirsty to blame crypto for any emerging risks facing traditional banks, their desire to punish crypto-friendly institutions likely made everything worse.

- Bankless team

P.S. Bankless has launched a collaboration with Push Protocol to bring subscribers web3-native notifications. Sign-up to get notified when new Bankless episodes or articles drop. More info here.

The Fed Did This

Bankless Writer: Donovan Choy

Milton Friedman once famously wrote: “No major institution in the U.S. has so poor a record of performance over so long a period as the Federal Reserve, yet so high a public reputation.”

It’s true. There are many ways to measure the Fed's performance, but consider just the chief concern of the past couple weeks: the frequency of banking panics.

Since the introduction of a central bank, the American economy has been characterized with higher rather than lower macroeconomic instability, exactly the phenomenon that the Fed was meant to thwart. The past week of copious banking panics sees the Fed continuing to chalk up more red on a scorecard that's performance already reads abysmal.

First was Silvergate ($12B AUM), which voluntarily liquidated on 8th March. Silvergate’s turmoil tipped over into a bank run to SVB ($209 billion AUM), prompting the FDIC to halt the “contagion” and take over all its deposits on 10th March. Then, the banking panic spilled over to Signature ($110B AUM) and was shut down by regulators on 12th March. This weekend, more fallout surfaced as we saw the fire sale of Credit Suisse, a bank which ended last year with $435 billion AUM. For a full recap, see here

For the former three US-based banks, each served some degree of crypto clients, Signature and Silvergate more so than SVB. This has given birth to the conspiratorial idea among some in Crypto Twitter that regulators orchestrated an elaborate plan to gut a sector they never liked in the first place.

Dear God. Barney Frank openly admits that Signature was arbitrarily shuttered despite no insolvency because regulators wanted to kill off the last major pro-crypto bank. Colossal scandalhttps://t.co/Sa25w6Au7b pic.twitter.com/gLuiybHepS

— nic carter 🌠 (@nic__carter) March 13, 2023

There is some truth in the idea that regulators want to de-bank crypto, but even policymakers do not have the ability to modulate the economy with the kind of pinpoint accuracy that conspiracy theorists believe. Real world markets are far too complex to control.

The more plausible explanation is that the Fed bred a highly unstable market environment by severely distorting the information signals of prices. Unprecedented rate cuts and hikes over the past few years inevitably resulted in a gross time-preference mismatch of long-duration bond yields, precipitating a bank run. When the bank run emerged in a highly volatile sector like crypto, regulators simply struck while the iron was hot and closed down crypto banks under the pretext of serving the public good.

After all, the collapsed banks were pursuing relatively safe asset management. Not only were they simply following the textbook business model of a bank – borrowing short to lend long – but they were lending it to the safest entity in the global economy: the U.S. government.

Silvergate’s money was tied up in boring and safe, long-dated “held to maturity” U.S. Treasuries and mortgage-backed securities. When rate hikes commenced, the interest yield on those assets went down, and Silvergate was forced to off $5.2B of bonds at a loss amidst a November bank run (thanks to FTX), incurring a whopping net loss revenue of $948.7M in 2022.

As for SVB, 56% of its assets were similarly held in long-dated government securities. The tide of increasing interest rates magnified the interest rate risks on those assets, causing the value of those long-dated bonds to fall by $15 billion and bringing it dangerously close to insolvency. In short, SVB was too dependent on its bond securities and failed to diversify its revenue model. If a bank run occurred, SVB would easily tip over the edge, and it did.

The SVB panic led to a bank run on Signature, with an outflow of $10B deposits over the weekend. It’s not clear that Signature’s balance sheet was in the red. The majority (90%) of Signature’s deposit base was in uninsured deposits from other businesses, but unlike Silvergate and SVB, it wasn’t insolvent. Its unrealized losses from its held-to-maturity securities were not big relative to its overall assets.

The closure of Signature bank seems unwarranted as their HTM unrealised losses aren't that big compared to its overall asset base.

— Arthur (@Arthur_0x) March 13, 2023

Some other factors likely at play here. #OperationChokePoint2 pic.twitter.com/vRhUd3jjUX

But everyone shouting “bank run” and “contagion” was sufficient pretext for regulators to shut it down. As quoted on CNBC, Dodd-Frank Act architect Barney Frank said that Signature’s seizure was potentially motivated by regulators wanting “to send a very strong anti-crypto message… we became the poster boy because there was no insolvency based on the fundamentals.”

Ethereum is undergoing a period of rapid infrastructural development. The upcoming Shanghai/Capella upgrade will simultaneously upgrade the blockchain’s execution and consensus layers to enable staked ETH withdrawals. What does this mean for stakers and the web3 ecosystem?

The Fed caused this

In hindsight, it’s easy to say that the failed banks were stupid and made bad risk management choices. But that doesn't explain why banks were incentivized to make those choices beyond the universal assumption of greed.

All three banks did pretty standard banking stuff, nothing like the extraordinary financial degeneracy of FTX which collateralized its (illegal) loans in its own illiquid FTT token, or Three Arrows Capital which made leveraged trades on volatile crypto collateral. Banks ignore the kinds of unrealized losses on Silvergate and SVB’s “risk-free” government bond portfolios all the time. Why then are normal banking activities blowing up in their faces?

The Fed’s topsy-turvy monetary policy of the past years explains why. Market prices serve a basic function in a market economy. They convey information about scarcity, which enables the mutual coordination and adjustments of demand and supply between billions of market participants.

When the Fed disrupted market prices by flooding the economy with easy money in 2019-2020, the information being conveyed was that “capital is cheap”. People deposited that money in their banks, and bank deposits went up dramatically.

This presented a profit incentive for banks like SVB and Silvergate to take on long-term bets. Artificially low interest rates reduced the perceived riskiness of these securities.

When inflation happened, the Fed reversed course and reined in its ultra-loose monetary policy. The fictitious new money disappeared and price signals now told markets that “capital is now getting pricey”.

Unfortunately, banks who already bought into long-dated “risk-free” securities had no way out but to sell their bonds at a loss to pay back depositors. Unrealized losses on bank’s balance sheets means a higher difficulty to meet the future need for unexpected liquidity. This is not unique to Silvergate and SVB. The estimated unrealized losses of U.S. banks’ held-to-maturity securities totaled $620B at the end of 2022.

Noah Smith puts it well:

… the Fed, by raising interest rates, is reducing the value of banks’ assets, and thus is making our banking system less stable. Under normal circumstances, the Fed would respond to this week’s events by simply cutting rates — just like it did for 40 years. But there’s a reason it can’t easily do that this time — inflation hasn’t gone away.

We’ve seen this happen before. In the years leading up to the 2008 housing crisis, the Fed similarly flooded the economy with easy money, even driving the federal funds rate to negative levels, effectively paying banks to borrow money! Even though the real savings rate of Americans had not increased, banks had an abundance of counterfeit money to lend out. This inflated money supply incentivized banks to take on more risk than they actually could by lending to everyone and anyone. It’s the same state of affairs today, except the borrower is the Fed, not homeowners.

And the U.S. government continues to exacerbate the issue. Laying off workers and letting businesses fail is painful, but it’s an essential part of the market process for correcting the misallocation of resources caused by artificial interest rate signals. But the collective decision by the Treasury, Fed and FDIC to guarantee all customer funds in the collapsed banks, the FDIC’s arbitrary raising of its $250K insurance limit to unlimited, and the Fed’s decision to extend a swap line to foreign central banks, serves to postpone the consequences of these mistakes.

It also puts in place a classic moral hazard. Other potentially insolvent banks who have made similarly bad bets are now being told that their mistakes will be subsidized, and to carry on with business as per usual in a highly unusual environment.

In a miraculous attempt to travel back in time, the Fed's newly-created Bank Term Funding Program (BTFP) even offers to buy bank’s bad bond assets at the original value, rather than the currently depressed market values. Government securities that were thought to be “risk-free” turned out not to be so, so politicians are doubling down in the only way they know how – turning on the money printer – to ensure its risk-free status.

kind of incredible, but US Fed's emergency lending to US banks was higher over the past week than during the global financial crisis/Lehman moment in 2008 pic.twitter.com/bzYcUrWZBt

— Daniela Gabor (@DanielaGabor) March 16, 2023

Crypto is a centerpiece in this theater of the absurd, but this play was not orchestrated by crypto. This crisis is a classic case of our regulatory overlords sticking its interventionist arm too far into the market economy. As they say in Westworld, “These violent delights have violent ends”. We’re only starting to reap them.

Action steps

SEC Commissioner Hester Peirce had some hot takes on this week's Monday podcast! Listen and collect the episode -- only 100 editions available. Bankless Nation is minting now...

MARKET MONDAY:

Scan this section and dig into anything interesting

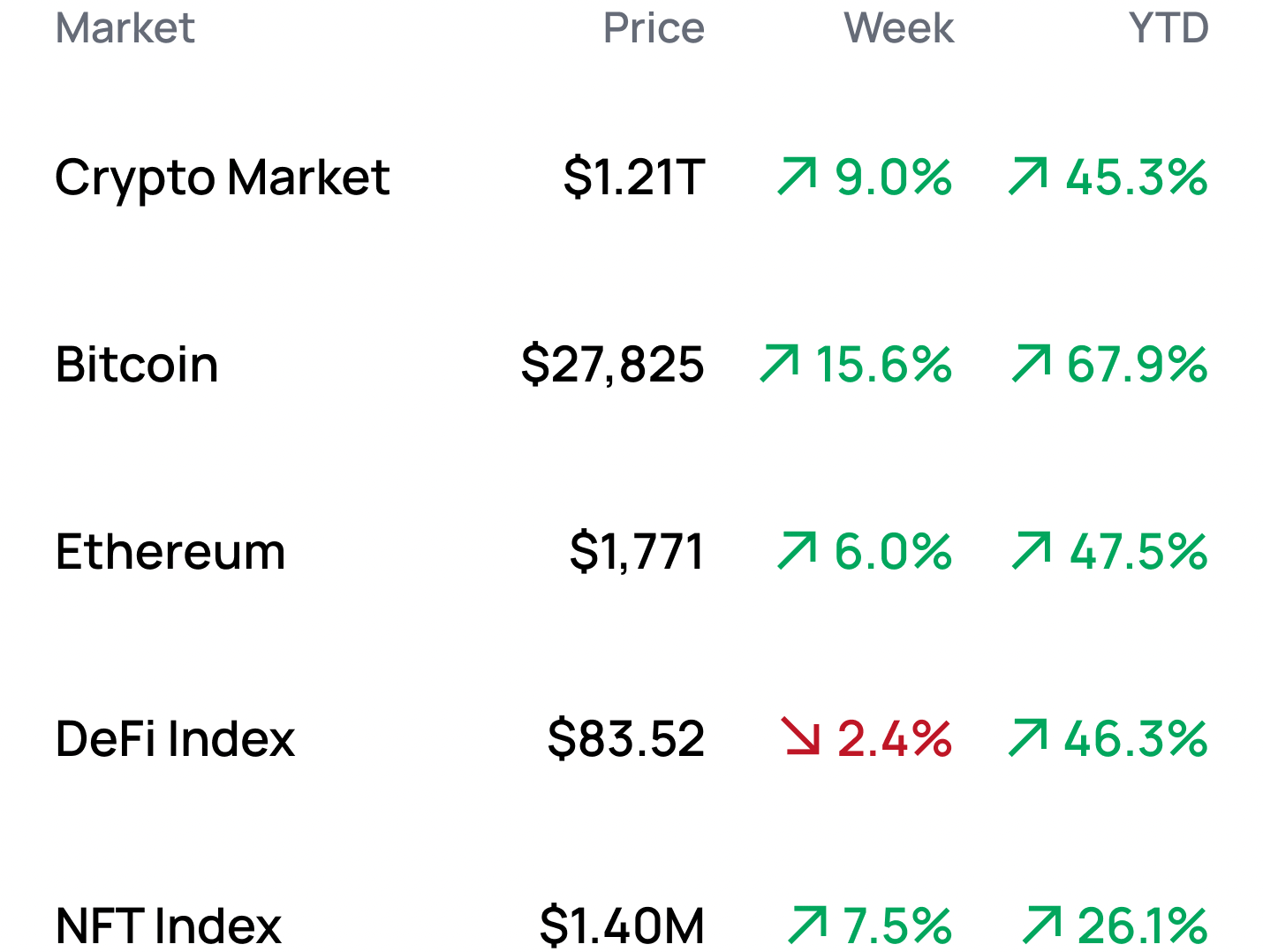

Market Numbers 📊

*Data from 3/20 1:00 pm EST (DeFi Index = $DPI, NFT Index = $Blue-Chip-10)

Market Opportunities 💰

- Earn OP rewards LPing with Arrakis Finance on Optimism

- Check your Arbitrum airdrop allocation

- Analyze MEV Data with EigenPhi

- Assess the risks of different yield strategies with Exponential

- Review code with Contract Readers GPT-4 powered Smart Contract Reviews

Yield Opportunities 🌾

- ETH: Earn 24% LPing Balancer’s frxETH-ETH pool on Polygon

- ETH: Earn 14% LPing the rETH-ETH pool in Beethoven on Optimism

- USD: Earn 18% lending USDC in Sturdy Finance on Ethereum

- USD: Earn 14% market making in Gain’s Networks DAI vault on Arbitrum

- BTC: Earn 9% LPing Curve’s Tri-Crypto pool on Ethereum

What’s Hot 🔥

- Arbitrum announces its token and airdrop

- Uniswap volumes hit their highest level since December 2021

- LinksDAO buys a Golf Course

- Uniswap deploys on BNB Chain

- Epic Games says it expects to add 20 “crypto-enabled games” within the next year

Money reads 📚

- Kaiseki - Arthur Hayes

- Treasure Times Trove Recap: Feb 26th - March 19th - Treasure Times

- Letter to the FDIC Chairman - Tom Emmer

- An on-chain distribution model for the Arbitrum Community - Auriele Barthere

- In which Balaji gives away at least a million dollars - Noah Smith

Governance Alpha 🚨

- MakerDAO votes to implement emergency risk parameters

- Aave considers deploying on Metis

- Ribbon weighs funding an insurance fund for Aevo

- Aave considers adding GMX to V3 on Arbitrum

- 1inch weighs buying $1 million of Index Coop’s dsETH

Trending Project: GMX 📈

Analyst: Ben Giove

- Ticker: GMX

- Sector: DeFi - Perps

- Network: Ethereum

- FDV: $1.1B

- Hotness Rating: 🔥🔥🔥🔥

- GMX is a decentralized perpetual futures exchange deployed on Arbitrum and Avalanche. GMX uses a liquidity pool model, where traders can take leveraged long or short positions by borrowing from a basket of assets known as GLP. GLP is an index-like token which holds primarily ETH, wBTC, and stablecoins and acts as the counterparty for traders on the platform, and accrues 70% of trading, borrow, and liquidation fees. GMX is governed by the GMX token which can be staked to earn 30% of fees generated by the protocol.

- The price of GMX has risen 19.2% and 6.8% against USD and ETH respectively over the past week. The token’s outperformance can be attributed to the announcement of ARB, the governance token of Arbitrum. GMX is one of Arbitrum’s leading protocols, as it accounts for a whopping 27.4% share of all DeFi TVL on the network.

- GMX’s outperformance is likely due to anticipation around Arbitrum’s airdrop. On March 23, Arbitrum will airdrop 11.6% of the ARB supply to early users of the network, with the token, and subsequent liquidity inflows, expected to provide billions in stimulus for the L2’s economy. Although it is not yet live, ARB futures contracts on Bitmex are trading for $1.3, implying an FDV of $13B. At this valuation, the airdrop is set to be worth more than $1.5B in total value.

- GMX is also set to receive a direct allocation of ARB from the ArbitrumDAO, as 1.1% of the total ARB supply will be airdropped to DAOs on the network. Although the exact amount has yet to be confirmed, given that it accounted for a 22% share of transaction activity on Arbitrum, it’s likely the project will receive upwards of eight figures in ARB tokens that they can use to further attract liquidity and fuel growth.

Hotness Rating (🔥🔥🔥🔥/5): GMX has soared over the past week in anticipation of the launch of ARB. While traders may be pricing in some of the expected inflows and increase in liquidity on the network, GMX is still ikely to see significant growth in trading volumes, and therefore an increase in the yield for stakers, over the coming months. Because of this, investors looking for blue-chip Arbitrum exposure should continue to keep GMX on their radar.

Meme of the Week 😂

Banks rn pic.twitter.com/dqF3rpl4Tl

— Bankless (@BanklessHQ) March 15, 2023