The Ethereum Q2 2023 Report

Dear Bankless Nation,

Today, we dig into one not-so-simple question: How is Ethereum doing?

Below, we've presented a digestible deep dive into Ethereum's financial performance over Q2 2023, unpacking the metrics that matter most in judging the growth of Ethereum at the protocol-level and in its various ecosystems.

- Bankless team

How ETH performed in Q2 2023

Bankless Writer: William M. Peaster | disclosures

We’re now halfway through 2023, and Ethereum has been showing considerable resilience amid the ongoing cryptoeconomy 🐻 market compared to other alt-L1s. The below report examines top-line metrics for the second quarter of 2023 (ending June 30th) for the Ethereum network and its ecosystem as broken down into four categories:

🟦 Protocol

🟩 DeFi Ecosystem

🟥 NFT Ecosystem

🟪 Layer 2 Ecosystem

After digging into the above, we’ll then move you through our top ecosystem highlights and our forward outlook for the protocol. The full ETH Q2 2023 Report is available only to paying subscribers of Bankless. Thank you for your support!

Now, let's get to the analysis 👇

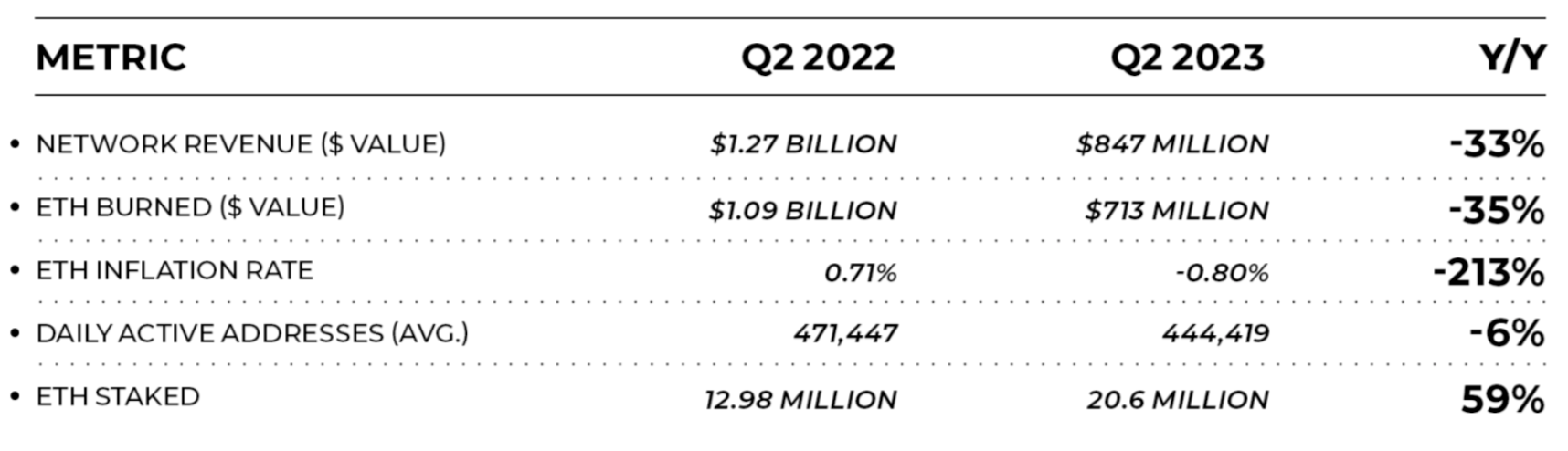

These numbers compare Ethereum’s performance in Q2 2023 against Q2 2022.

🟦 Protocol

🟦 Network revenue dropped 33.3% from $1.27B to $847M. The USD value of ETH burned fell 35% from $1.09B to $713M

Network revenue measures the total value of transaction fees paid by users to Ethereum validators, as well as the portion of said fees that is burned (i.e. removed from the circulating supply of ETH via EIP-1559 burning).

Considering the bearish conditions we’ve seen in crypto in recent months, it’s somewhat surprising that there wasn’t a larger revenue decline year-over-year. Ethereum has held up well activity-wise in this regard. That said, the decline we’ve seen here still showcases the bearish conditions lately. As demand for blockspace has dropped, so have Ethereum’s earnings and burnings for now.

🟦 ETH Inflation Rate decreased 213% from 0.71% to -0.8% on average

The ETH Inflation Rate tracks the growth in overall supply of ETH over the course of the quarter. This growth rate turned negative as the EIP-1559 fee burning mechanism is now chugging along at full steam ahead.

🟦 Average daily active addresses declined 6% — from 471,447 to 444,419

This metric tracks the average number of wallet addresses to transact on Ethereum each day over the duration of the quarter. As with network revenue, it’s fairly surprising this figure hasn’t dropped further amid the current bear market.

🟦 Staked ETH increased 59% from 12.98M to 20.6M

This figure measures the amount of ETH staked on the Beacon Chain to help secure Ethereum’s Proof Of Stake (PoS) consensus system. Roughly 17% of the total supply of ETH was staked by the end of this Q2.

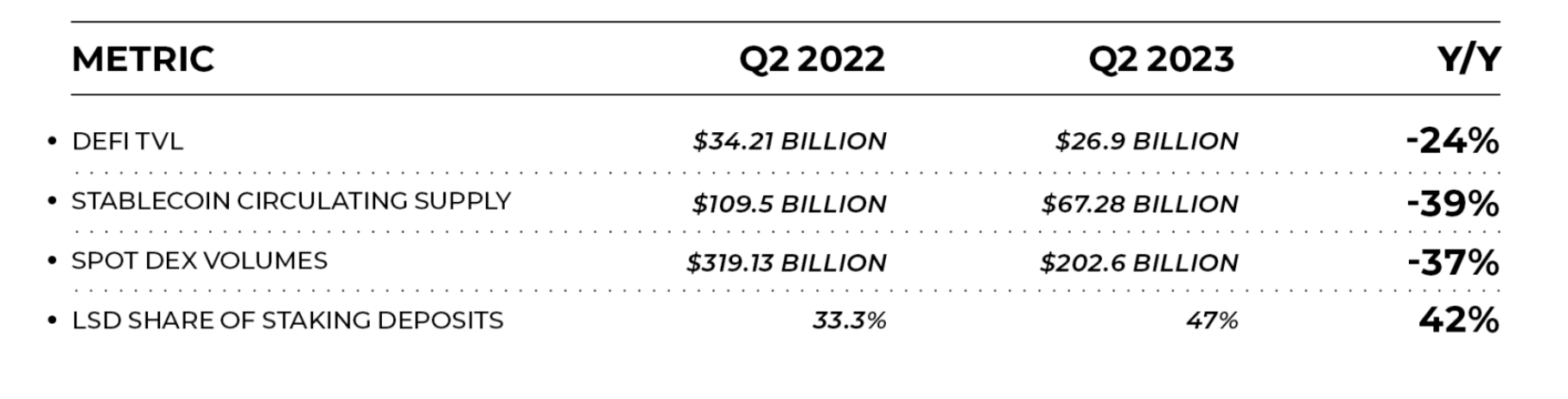

🟩 DeFi Ecosystem

🟩 DeFi TVL fell 24% — from $34.21 billion to $26.9 billion

DeFi TVL (total value locked) tracks the value of the assets deposited into DeFi protocols deployed on Ethereum. This dollar-denominated decline undoubtedly stems from the lower appetite for risk and the lower yields seen across DeFi lately.

🟩 The stablecoin circulating supply decreased 39% — from $109.5 billion to $67.28 billion

This metric measures the amount of USD-pegged stablecoins issued and circulating on Ethereum. With less speculative activity occurring onchain amid the bear, demand has declined for stablecoins compared to this point last year.

🟩 Spot DEX volume fell 37% — from $319.13 billion to $202.6 billion

Spot DEX volume measures the total trading volume on decentralized spot exchanges live on Ethereum over the course of the quarter. The decline in spot volume is undoubtedly due to market conditions, as trading volumes are highly correlated with bullish price action.

🟩 LSD share of staked ETH deposits rose 42%, to 9.6M out of all 20.6M ETH currently staked

This figure measures the share of ETH that is staked with non-custodial protocols that issue liquid staking derivatives (LSDs). The year-over-year growth comes from a surging interest in ETH staking in the wake of Ethereum’s Shapella upgrade and the ease-of-use of LSDs.

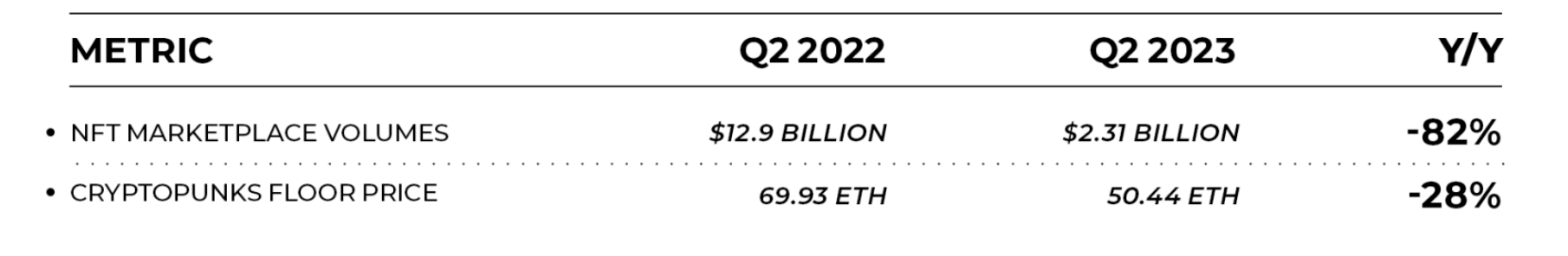

🟥 NFT Ecosystem

🟥 NFT marketplace volumes cratered 82% — from $12.9 billion to $2.31 billion

This metric tracks trading activity across all of the most popular NFT marketplaces on Ethereum, including Blur, OpenSea, LooksRare, X2Y2, and beyond. While crypto majors like BTC and ETH have held up reasonably well this year, the NFT space is undergoing its first major bear market, and NFTs have sold off much harder accordingly.

🟥 The CryptoPunks floor price dropped 28% — from 69.93 ETH to 50.44 ETH

CryptoPunks is arguably the most prized collection in the entire Ethereum ecosystem, and while at times some have joked it has traded like a stablecoin, i.e. without volatility, the ‘Punks ETH-denominated floor price is still down on the year by nearly 30% amid the wider washout in PFP NFT collections in 2023.

🟪 L2 Ecosystem

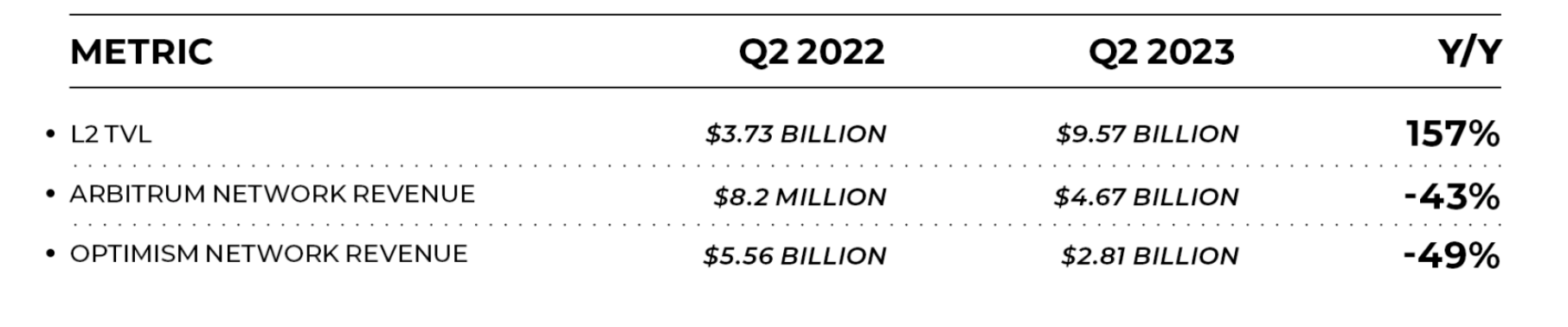

🟪 TVL on L2s climbed 157% — from $3.73 billion to $9.57 billion

This TVL metric denotes the value that has been bridged into Ethereum’s L2 ecosystem. The big rise on the year comes as this scene has expanded considerably thanks to a growing number of apps and liquidity on top of scaling solutions like Arbitrum, Optimism, and zkSync Era.

🟪 Arbitrum’s network revenues dropped 43%, Optimism’s down 49%

While Arbitrum and Optimism brought in $8.2M and $5.56M worth of revenues in Q2 2022 respectively, we saw these sums decline to $4.67M and $2.81M in Q2 2023.

🏆 Ecosystem Highlights 🏆

🥇 Shapella arrived

In Q2 2023, Shapella — Ethereum's latest hard fork — introduced a withdrawal feature for stakers, allowing them to access their previously locked consensus layer rewards and their initial 32 ETH initial node collateral. This was a major development as it provided liquidity to stakers for the first time since the inception of Ethereum’s Beacon Chain.

Despite concerns about potential sell pressure from the Beacon Chain post-Shapella, the reality has been very positive. The exit queue size has remained small, the net validator count has increased considerably, and the state of the liquid-staking derivatives (LSD) market has only grown in strength, suggesting confidence all around.

Zooming out, centralized staking providers have been the clear net losers from post-Shapella withdrawals, with many stakers opting for decentralized solutions to mitigate network centralization vectors. This shift towards decentralization has been another one of the highlights of this upgrade.

🥈 New scaling frontiers

In Q2 2022, Ethereum's scaling solutions witnessed significant advancements, opening up new frontiers for the network. One of the key developments was the emergence of Polygon zkEVM and zkSync Era as the newest major players in the L2 scaling scene. Their “zkEVM” approaches are next-gen zero-knowledge proof systems that allow for the execution of Ethereum smart contracts in a very scalable and very secure fashion.

Beyond these major players, there are a handful of young and rising L2s that have been making strides toward mainnet. These include Base, Fuel, Linea, Scroll, and Taiko. Each of these L2s brings unique features and capabilities to the table, and are preparing to expand the Ethereum ecosystem's scalability and efficiency that much further.

Additionally, projects like Base and Zora Network are beginning to break ground in using the new modular “Superchain” framework of OP Mainnet, formerly Optimism. Lastly, over the past few months we’ve also seen the emergence of Layer 3 (L3) systems, e.g. Arbitrum Orbit and zkSync’s ZK Stack, take shape and offer new scalability horizons altogether.

🥉 The Restaking Era begins

Q2 2023 also marked the beginning of Ethereum’s "Restaking Era" via the introduction of EigenLayer. This new protocol is expanding earning possibilities for ETH stakers by enabling something called "restaking,” which allows ETH stakers to validate a wide range of software modules, like external consensus protocols, thus extending the security of Ethereum across these systems. This not only enhances the security of apps that rely on these modules but also opens up new revenue streams for ETH holders through additional validation fees.

While EigenLayer has started out with a phased “guarded launch,” it has also recently expanded its deposit caps in a bid to bring in more early restakers. On the flip side, Ethereum co-founder Vitalik Buterin has warned that while there is nothing inherently wrong with using Ethereum’s validator set for other purposes, these applications should not rely on a fork or chain re-org to recoup potential losses.

Go direct to DeFi with the Uniswap mobile wallet. Buy crypto on any available chain with your debit card. Seamlessly swap on Mainnet and L2s. Explore tokens, wallets and NFTs. Safe, simple self-custody from the most trusted team in DeFi.

👁️ Forward Outlook

Looking ahead, Ethereum's journey continues with two significant updates that could serve as catalysts for the network as early as Q3 2023. These are the upcoming EIP-4844 “Cancun” hardfork and the anticipated arrival of distributed validator technology (DVT).

The EIP-4844 Cancun hardfork, also known as "proto-danksharding," aims to split Ethereum into different databases, increasing the space for millions more transactions on Ethereum. This process, a form of "sharding," will help Ethereum blocks store up to 2 megabytes of data, significantly reducing the costs of using rollups by an estimated 20x.

Another key technical innovation to look out for in Ethereum’s near-term future is the rise of distributed validator technology (DVT). Today, operating an Ethereum node is a technically burdensome solo venture that requires the operator to solo stake 32 ETH, so DVT will enable a kind of independent "squad staking," where a group of individuals can collectively stake different amounts of ETH and run a node. This could go a long way in reducing the market concentration of ETH staking that has accumulated today in Lido and centralized exchanges.

Action steps

- 👁️ Review the previous State of Ethereum Q2 2022 Report

- 🌠 Catch up on our previous primer 8 NFTs That Will Survive