The ETH Bond Market

Dear Bankless Nation,

I love it when a good plan comes together.

What’s happening?

ETH is becoming the bond for the digital age. We’ve been predicting this for a long time now, but now with The Merge on the horizon, we can frame this evolution into the global macro demands that we see unfolding.

Here are four recent signs the era of the ETH bond is here…

1. Dollar Distrust ATHs

Distrust in the dollar is at all-time highs. There is no going back from rugging the world’s 11th largest economy from the global financial system, no matter how morally justifiable it is. The freezing of Russia’s foreign assets has exposed the weakness that all foreign countries have when they use the US Dollar system; you’re at the whim of U.S. politics.

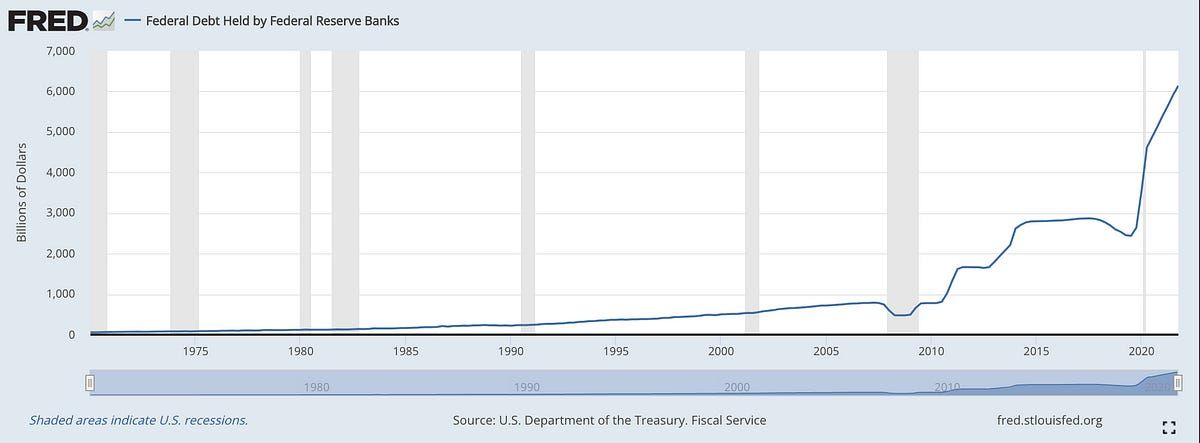

This is coming on top of the insane levels of debt held by the Fed.

…which is coming on top of record-high inflation rates not seen in decades.

Jim Bianco helped us understand this on a recent show, where he painted a very bearish picture for the U.S. treasury market.

“No one wants to be the bag holder on U.S. treasuries,” he said.

With so much debt on the books, and with inflation running hotter than ever, it’s no wonder that the U.S. treasury yield curve is inverting, signaling that investors have less tolerance for holding U.S. treasuries over longer time frames.

People are looking for alternatives.

Ethereum is stepping into the void being created by the lack of confidence in the $14T US treasury market.

The properties of the Ethereum ETH staking market vs the U.S. treasuries market illustrate exactly what is ‘in-vogue’ in the 2020s.

While the Federal Reserve has ATHs in debt, Ethereum can’t hold debt. While inflation is threatening the real returns of U.S. treasury holders, ETH is set to go deflationary. While the U.S. cancels the world’s 11th largest economy, Ethereum is credibly neutral.

There’s a changing of the guard coming; the $14T U.S. treasury market is on its way out, and the $0.5T ETH staking market is on its way in.

Greatest wealth transfer event in human history. Initiate.

2. ETH bonds offer higher real returns

But the U.S. dollar is stable, and ETH is incredibly volatile! You can’t compare the U.S. bond market to ETH staking! That’s ridiculous!

First off, this decade is ridiculous. Everyone is changing their understanding of the paradigm we’re in. The investors of this decade who aren’t open to new ideas are ngmi.

Second, yes the dollar is ‘stable’ and ETH is ‘volatile’. But you can compare the yields received with ETH staking to yields received in the US treasury market, and measure how much ETH capital depreciation investors could take before ETH staking would be economically non-viable.

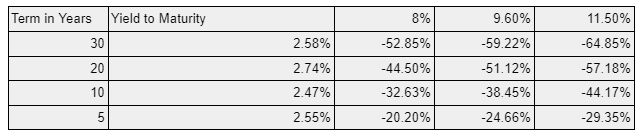

Above is a table from Arthur Hayes’ recent article Five Ducking Digits, illustrating how much value ETH could lose and investors still break even vs. the U.S. bond market.

If the ETH stake rate is 8%, ETH could go down 32.6% in value, and still be equal to a 10 year 2.5% interest bond.

Completely discounting the potential for ETH’s capital appreciation to $10k and beyond, according to Hayes, the rational U.S. bond investor would still be highly incentivized to find yield in the Ethereum staking market rather than the U.S. bond market.

So yes, ETH is volatile. But the ETH staking yields are so good that it almost doesn’t matter.

And then if you get them fundamentally bullish on the asset, it becomes a no-brainer.

3. Traditional Investors Get this Narrative

We’re seeing TradFi wake up to this.

- “Increasingly Clear That The Future Of Finance Runs On Ethereum" - One River Asset Management. We had CEO and Founder Eric Peters on to discuss this last October.

- “Ethereum Transitions to Global Asset” Bloomberg Intelligence.

I think my favorite quote comes from Marcel Kasumovich (also out of One River):

"Ether is being transformed into a low-risk bond asset, and it is cheap”

Low-risk isn’t something you hear about cryptocurrencies often, and especially not out of institutions. But they’re starting to get it.

High volatility, yes, but the Ethereum protocol:

- Can’t hold debt.

- Has programmatically controlled issuance.

- Is a global credibly neutral yield source; Ethereum isn’t going to cancel like how the U.S. canceled Russia.

It’s also worth noting that volatility can work in your favor just as much as it works against you! Historically in crypto, the longer you hold, the more volatility has worked in favor for you:

4. The New Risk-Free Rate

From the Wikipedia page for “Risk-Free Rate”:

The long-term yield on the US Treasury coupon bonds is generally accepted as the risk-free rate of return. Government bonds are conventionally considered to be relatively risk-free to a domestic holder of a government bond, because there is by definition no risk of default.

There is also the risk of the government 'printing more money' to meet the obligation, thus paying back in lesser valued currency. The result to the investor is the loss of value according to his/her measurement, so focusing strictly on default does not include all risk.

The dollar has been slowly losing value for a long time, but up until now, it’s been so slow that people generally haven’t noticed or cared.

People are definitely noticing now.

As Ray Dalio says, we are in a period of burdensome sovereign debt, massive money printing, and large wealth gaps that will likely become further exacerbated.

Is the ‘Risk-Free Rate” really all that risk-free when money printing is basically guaranteed? Sure, you have the risk-free rate, but it’s only because the government can’t default when it can print the money to cover the debt instead.

But the real Risk-Free Rate is negative. Does it really count as ‘risk free’ if you know it’s going to result in a loss?

The financial situation for the dollar isn’t looking good. This is setting up the possibility that the world could change the denominator that they’re measuring risk in.

Could ETH be the new risk-free rate?

- Ethereum can always issue ETH, but can’t hold any debt.

- ETH ‘money printing’ is controlled by an algorithm programmed to do what’s best for Ethereum, rather than what’s best for the elites.

- ETH staking is globally accessible and permissionless; no one can prevent you from getting your yield.

As the world goes through the phase-change of the 2020s, we’re going to emerge with new meaning as to what a ‘risk-free rate’ actually is.

Get ready for a new paradigm of trust, purpose-built for the digital age.

Get ready to stake your ETH.

- David