Credit Suisse drama

Credit Suisse is the 54th largest financial institution with roughly ~$1.5T in assets under management. The Swiss bank has dominated the financial news cycle this past week as the social media rumor mills continue to spin furiously with speculation of its insolvency.

It started with a now-deleted tweet from an ABC reporter this past Saturday.

That was enough fuel to light a social media frenzy across Reddit and Twitter.

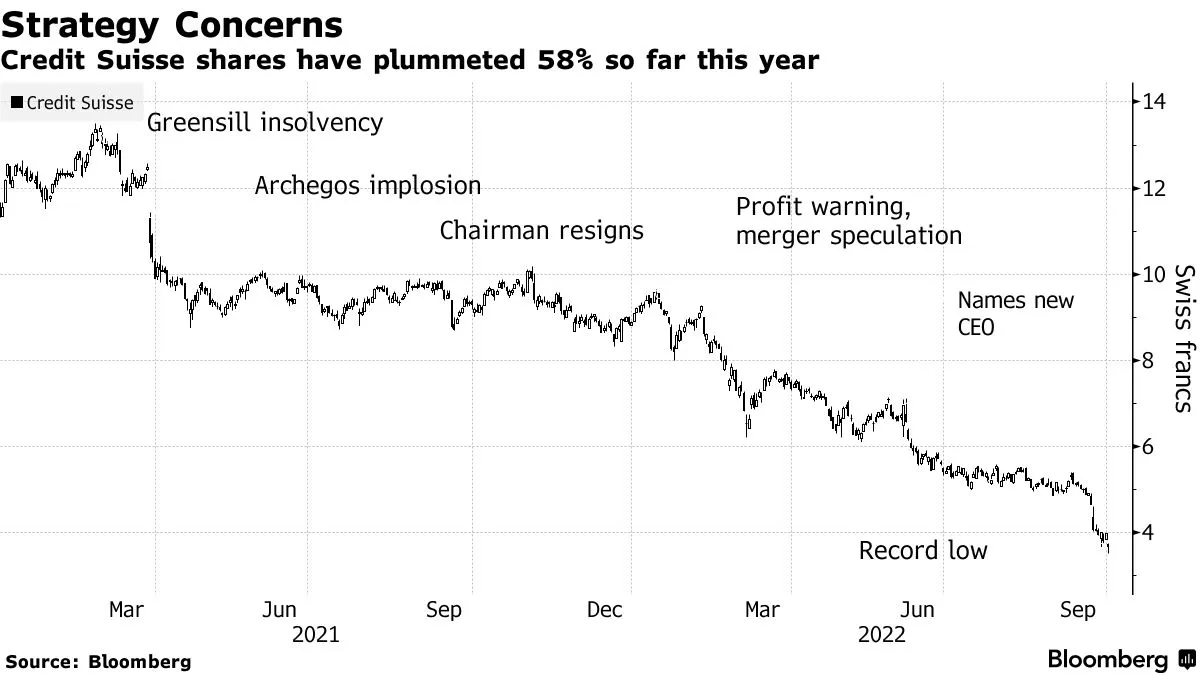

This fresh episode of drama comes off the back of Credit Suisse announcing a cut of thousands in headcount last month, and recent scandal episodes with GreenSill and Archegos.

As a result of everything, Credit Suisses stocks are tanking even lower from previous record lows to even lower record lows. Bonds issued by Credit Suisse have plummeted, while the costs of buying its credit default swaps – a financial derivative that acts as insurance against Credit Suisse defaulting on its debt – has soared by more than 100 basis points.

Source: Bloomberg

But prices of shares and credit default swaps indicate investor sentiment of a bank’s financial health at best, and don’t definitively diagnose its financial health.

In response to the rabid rumors, Credit Suisse executives have attempted to fan out the flames ( unsuccessfully ). CEO Ulrich Koerner is assuring investors that the bank keeps a “strong capital base and liquidity position”, with a near-$100 billion capital buffer and a healthy equity capital ratio of 13.5% as of June, in large part due to post-2008 Basel III regulations that mandates minimum capital reserve requirements for big banks.

The counter-narrative is coming not only from the horse's mouth itself, but also a range of analysts from within the industry that have questioned the rationale behind the rumors. Bloomberg’s Paul Davies pointed out in a piece titled No, Credit Suisse Isn’t on the Brink that “the bank has more than enough capital to run its business”.

The Financial Times reports that “When it comes to the bank’s liquidity levels, Credit Suisse has a liquidity coverage ratio of 191 per cent, which is significantly higher than most of its peers.” Axios sums it up:

Credit Suisse's bonds are trading as though they carry a non-negligible chance of default. In order for a default to happen, the bank would first have to burn through 37 billion Swiss francs of tier-one capital, 15.8 billion Swiss francs of "contingent convertible" bonds that automatically convert to equity if the bank becomes stressed, and 44.2 billion Swiss francs of “going concern capital.” That's almost $100 billion of loss-absorbing capital in total. Credit Suisse might be facing losses and restructuring charges, but nothing of remotely that magnitude.

It appears that some investors are at least paying attention to the fundamentals rather than Reddit rumors. Credit Suisse’s shares have seen a rebound of 17% since the start of the week, while the price of its credit default swaps have dropped. Citi is calling Credit Suisse shares a “ buy for the brave ”.

Who has it right? No one really knows. It’s a game of he say, she say. The entire story is a trade based on speculative rumors with dusted fragments of truth. Markets are a kind of truth machine, but they explode not only objective truths like unsustainable Ponzi’s but also subjective truths i.e., fleeting rumors. The facts of the social sciences are what people believe and think they are.

Unlike DeFi where the system is built atop a transparent blockchain, there really is no way to verify definitively. Take for example the now bankrupt Celsius: a centralized crypto bank making decentralized on-chain trades. Leading up to its demise in June , definitive signs of Celsius’ demise were clear. As I previously wrote :

… Celsius’ troubles were first exposed when there were clues of its insolvency in a range of on-chain loans. Thanks to its on-chain exposure, crypto observers were able to examine the weather forecast for an impending storm. These included a stake of 17,900 WBTC in a Maker vault that Celsius rushed to top up to avoid liquidation from a fall in Bitcoin prices (the loan was fully paid on 7th July), a stake of 458K stETH on Aave (as that price was deviating from ETH), and more on Compound and Oasis .

At the center of the Credit Suisse story is an upcoming “strategic review” by the end of month, where investors await with bated breath to hear how its CEO Ulrich Koerner plans to restructure and overhaul the bank’s direction.