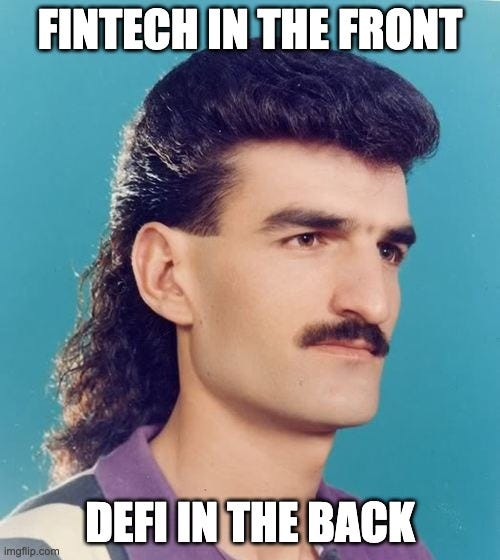

The DeFi Mullet

Dear Bankless Nation,

FinTech will betray the banks, the original sin of the internet will be corrected, and everyone will start sporting DeFi mullets. You ready for a journey today?

Let’s start with betrayal.

I think FinTech will betray the banks and become crypto’s greatest ally.

I’m not talking a Shakespearean betrayal. No ‘Et tu, Brute?’ moment with FinTech stabbing the banks in the back. More like…a gradual drifting away…

The Original Sin of the Internet

Do you ever wonder why the internet did so much to disrupt media, music, and e-commerce but absolutely nothing to disrupt the banks? It’s because the internet protocol was missing something.

Marc Andreessen founder of Netscape calls this the internet’s original sin:

I think the original sin was that we couldn’t actually build economics, which is to say money, at the core of the internet. - Marc Andreessen

The internet was missing a money layer.

So instead of a leap frogging banks, we got 30 years of incrementalist FinTech—Stripe, RobinHood, Plaid, Ant, Square—this is how millennials do banking. THiS iS tHe FuTure.

Except it’s not the future. It’s good user experience built on legacy bank ledgers.

It’s an interim step. It’s lipstick on a pig.

Replacing the Pig

But now something new is happening in FinTech.

Look at the top finance apps in November 2020:

Two things to notice:

- The top five apps are now FinTech not banks—FinTech owns user acquisition.

- The FinTech apps are now crypto onramps—and accelerating in crypto support.

As proof of the second point take a look at developments over the last year…

- Cash App grew to over $1 billion in Bitcoin sales each quarter

- PayPal now allowing users to purchase with crypto from 26m merchants

- Crypto support was just announced for Venmo

- RobinHood adding crypto education material for traders

- Coinbase becoming more FinTech every day—releasing a Visa card in the U.S.

FinTech is moving toward crypto. And last week some of the biggest FinTech and Crypto news of all was released…

Visa integrating USDC.

A network of 60 million merchants, 3.3 billion credit cards, 16k financial institutions, and $11T in volume is starting to use Ethereum to bypass traditional banks.

Unthinkable a year ago—stablecoins barely existed. Now every FinTech needs a stablecoin strategy. What’s going on?

This is FinTech getting ready to onboard millions of users and billions of dollars into crypto. This the start of a decade long process of swapping out banking infrastructure for crypto infrastructure. This is the protocol sink thesis in action.

This is FinTech replacing the pig.

Ok, now let’s talk DeFi mullets. (👈 as promised)

Party in the Back

After hearing the Visa news above a critic said this to me “Users will care about Ethereum no more they care about TCP/IP, sorry.”

What do you mean sorry?

Users not caring about Ethereum is a design goal.

The goal is billions of people using Ethereum and DeFi protocols without even knowing it. Just as they use TCP/IP without knowing it today. Through FinTech in many cases!

FinTech will embrace the DeFi Mullet strategy—FinTech in the front, DeFi in the back.

Users will embrace it too. The UX of FinTech and the open financial infrastructure of crypto will lead to apps that are 100x better than alternatives.

Banks left in the dust. The internet of money unlocked.

If you look you can see it already…

FinTech is growing out its DeFi Mullet.

- RSA

P.S. We published a video with Vitalik Buterin discussing “Why Proof of Stake”. Tons of good info in this one on the the design decisions behind Eth2 PoS. Watch it.