“The Debasement Trade” - Luke Gromen on Gold, Bitcoin & The 100 Year Reset

Luke:

[0:00] When is the debasement trade in? The answer is never.

Luke:

[0:03] It's never, you know, it's a good time maybe takes them on a dip. Sure. Can you have 20, 30% corrections? Sure. So if 20, 30% corrections a stock market all the time, no one's ever like, oh, it's over. You know, the stock market's over. No, it's a currency issue. It's a currency issue. The choices we have made over

Luke:

[0:22] The last 30

Luke:

[0:23] Years with borrowed money, they're coming home to roost. And what that looks like is, is it's not a debasement trade. It is a debasement secular trend. And, you know, the behavior is very big. You don't sell rallies, you buy dips.

Ryan:

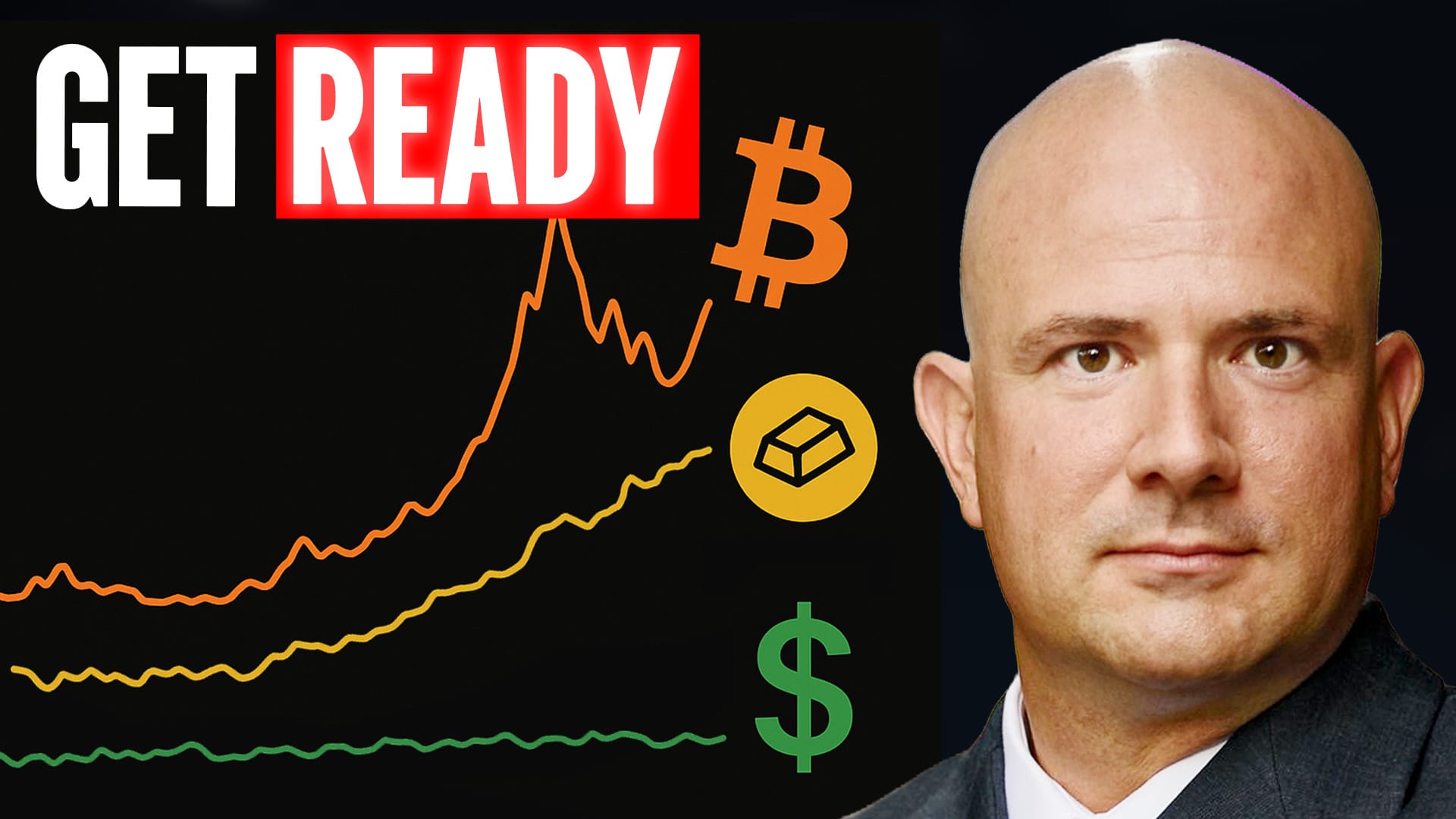

[0:41] Luke Groman, I want to start with a chart. This is a chart that you put up not too long ago. And this is a chart of the S&P in various denominators, let's say. One is a denominator on dollars, so cash, the way investors tend to view their portfolio. The other denominates stocks in the S&P in gold terms. And the third kind of denominates it in Bitcoin terms. Now, in US dollar terms, over the last five years, it seems like everything is booming. We've got stocks up triple digits, we've got homes up double digits, like everybody is more wealthy, right? But then you start to look at this in gold terms, and you realize that stocks and homes, they're flat to negative, that real wealth is actually stagnating. Then, of course, you look at it in Bitcoin terms and it's like, oh, my God, what happened? This is bleeding in Bitcoin. What's the story here? What is the big story? Is this debasement?

Luke:

[1:41] In a word, yes.

Luke:

[1:43] This is the big story of our time, I think. You know, the chart shows, you know, S&P, NASDAQ and home prices in dollars, gold and Bitcoin. And it's telling you the use case of gold and Bitcoin, right? How often do we hear? What's the use case of gold? Gold isn't used for anything. Bitcoin isn't used for anything. When sovereigns find themselves in a

Luke:

[2:04] Position where they need

Luke:

[2:07] To have negative real rates to keep their debt nominally money good, this is what happens. They have a printing press. And so they call it whatever they want to call it, right? And we've seen it this time. I think, I can't remember, that was from COVID, right? So obviously we had pretty obvious money creation during COVID, but you can run the same chart. In fact, I have since It's BTFP, right? The Fed's, you know, whatever, bond, bank term funding program, whatever it was. It was by the effing paper, more colloquially known. The purists all said, well, BTFP isn't QE. It's not money creation. And the chart looks exactly the same from BTFP, which is to say, you can say, well, maybe there's some lag defect from COVID, whatever. In the end, I don't care. I don't care. My clients don't care. What is happening here is we have a, you know, what is, we've gone from the denial stage that there isn't a problem to now somewhere between anger and bargaining, right, of consensus, which is.

Luke:

[3:11] There's a debasement trade.

Luke:

[3:13] But if you read the paper over like the last week and a half, they've sort of finally acknowledged that there's a debasement trade. So, you know, good on consensus moving out of denial. But now they're into like somewhere between anger and bargaining, which is like, oh, the debasement trade is stupid. Why are you buying gold? And the, you know, in bargaining, right? The next stage of grief, which is, well, it's not going to go on forever. And we still have to get through bargaining. We still have to get through depression. We still have to get through the acceptance phases of grief. And I think by the time all is said and done, you know, that chart that you showed, I think, you know, the prices of the S&P and the NASDAQ and homes are going to be a lot higher in dollars. And I think they're gonna be a lot lower in gold. And I think it'd be a lot lower in Bitcoin. And so that's where we are. You know, it is what it is.

Ryan:

[4:05] When people call this a trade, I think in many cases, they are thinking that it's something short-term of this aberration in 2025 where gold is up 60% on the year. It's a trade. It's just a trendy thing that some traders, some investors are doing. It won't last. Is this a trade or is this something that's more measured in years, let's say, or decades? Is this a long-term investment trend?

Luke:

[4:34] I think it is a critical and a super astute question because the first principle off which almost everybody, every American investor is operating is, well, this will be just like 1980 when, you know, this would be like the 70s,

Luke:

[4:54] Right?

Luke:

[4:54] So we had, we went off the gold standard 71 and gold went up a bunch and then Volcker came in and raised rates and gold went back. It was just a trade. There was a debasement, but Volcker took care of it all. Well, Volcker took rates to 15%. If the Fed did that to stop that, if the Fed took rates to six today, they would literally blow up the entire, not just stock market, but housing and the treasury market. We know this. This is not speculative. We've seen empirically the treasury market dysfunction multiple times well before 5% over the last five years on the tenure. So there's the first principle view that most investors are investing on is that, oh, well, there will be a reversion. And something we wrote for clients a few weeks back was... Let's look at the debasement trade in Indian rupees. And if you call up a log chart of gold priced in Indian rupees going back to 1985,

Luke:

[5:54] It looks like this.

Luke:

[5:57] And there's like little dips along the way. But in the end, it looks like Apple. If you go and you look at Brazilian real, gold priced in Brazilian real back to 2000, log chart looks like this up and to the right with little dips along the way. So am I saying gold's never going to dip again? No, of course not. I mean, it's probably a little corrective action now. What I'm saying is that the most important thing to determine to answer that question is to look at the fiscal situation of the US and ask yourself, is it really the same as the US in 1980, as the US in 1970, as the US in 1960?

Luke:

[6:36] It's not even close. It's not even close. And it looks much more like Brazil in 2000. And oh, by the way, those aren't my words. Those are the words of former Dallas Fed economist, John Welch, who wrote a piece right after the Fed did BTFP in 2023. And he goes, this looks like fiscal dominance. This reminds me of Brazil around 2000. And it was probably the best Fed call of this decade so far. All you needed to hear was that. And he's not there anymore. He ran LATAM for, I forget which big bank, right? So he wasn't just sort of talking out of the side of his mouth. He had experience being there. He's like, wow, this is so familiar. So that to me is, I think, something, one of the big variant perceptions. I think 99% of US investors are investing in the debasement trade based on this assumption, well, we're the USA. We look like Brazil in fiscal debt, domestic politics in 2000. Again, not my words. Former Fed economists and Dallas Fed's works. And if that's the case, when is the debasement trade in?

Luke:

[7:49] The answer is never. It's never. It's a good time maybe to take some on a dip. Sure. Can you have 20%, 30% corrections? Sure. So if 20%, 30% corrections are stock market all the time, no one's ever like, oh, it's over. The stock market's over. No, it's a currency issue. It's a currency issue. The choices we have made over the last 30 years with borrowed money they're coming home to roost. And what that looks like is, is it's not a debasement trade. It is a debasement secular trend. And, you know, the behavior is very big. You don't sell rallies, you buy dips.

David:

[8:26] Luke, there's a chart that has been circulating around Twitter pretty aggressively over the last week. And it is the, just two, two charts, two lines, the foreign central bank reserves,

David:

[8:36] percentage of treasuries versus percentage in gold. Now, up until 1995, gold was dominant, but then between 1995 and 2025, so 30 years, treasuries were the dominant reserve asset inside of central banks. And that, as of just this month, has flipped. So gold is now the dominant reserve asset in foreign central bank reserves instead of US treasuries. And I think this kind of goes to your point. It's just like, is this a trade? Is this the debasement trade? Or is this just debasement? Just remove trade. Is this kind of like a before, after moment? Like in 2025, gold flipped US treasuries and foreign reserves. Is this like when we look forward, we go forward in time, 5, 10, 20 years, we'll look back on this year when gold flipped treasuries and kind of understand it. Like this is kind of when world powers re-equalized. There's a new equilibrium? What would you say is the significance of this moment?

Luke:

[9:34] I think it is possibly hugely significant. I think it depends on It depends on events and two events in particular, right? So if we think the United States is going to change its mind and suddenly say, you know what, we're okay with having China make more and more of the critical components of our military. Let's just go back to the way things were. Then that chart, in theory, could reverse.

Luke:

[10:02] If, the second question,

Luke:

[10:04] Are China and Russia going to say, you know what, we think the U.S. Was just kidding about trying to choke us out, trying to break us up, trying to tip us over, trying to regime change us. We actually think that we want to go back to the way things were. And so we are going to start stockpiling treasuries at real rates that are wildly negative. So basically, the Americans will be stealing our real wealth by us buying treasuries at negative real rates.

Luke:

[10:33] And we're going

Luke:

[10:34] To replace our leaders with Yeltsin-like, Boris Yeltsin-like leaders who basically position our countries as economic vassals to the Americans and proceed to sell off the wealth and companies of our country to pennies on the dollar to US Western interests. If the answer to either of those questions is no, let alone both, then that chart I think is monumental because I think it is telling you, what is happening, which is there's no chance the Chinese and Russians are going to say that. And there's no chance the US military, especially after this last year, is going to go, you know what, it's a good idea. Let's finish soul sourcing. We're already too heavily sourced to China. Let's soul source to China for all the stuff, all the weapons that we want to use to point at China. So neither of those, in my opinion, the odds of either of those things happening is zero or very close to it. And if that's the case, then we're going to see gold continue to rise in reserves as a share of treasuries. And it's just sort of de facto.

Ryan:

[11:40] Luke, can we talk about that chart a little bit more? And can you give us the history of how this even happened? So the world used to be on the gold standard. This was not too long ago. even under Bretton Woods, it sort of held. At that time, as you saw in the chart in the 1970s, into the 1980s and into the early 1990s, the share of central bank foreign reserves was skewed towards gold. If you're a central bank, what's the main reserve asset that you hold? Well, it's a hard asset. It's a sound money. It's gold. It's not a fiat. But then in 1995, This is almost the flippening that's weirder to me. In 1995, it started to be the case that treasuries exceeded gold as a share of central bank reserve. And that number continued to increase and gold continued to go down. And so even my home country of Canada, where I was born, was looking at their balance sheet. they went from top 15 countries in the world in terms of their gold holding to now they have zero, Luke. They sold all of it, not even 1%. They have nothing left. And so...

Ryan:

[12:53] What was the motivator here? What was the force that was in play, the secular trend, I guess, in the 1990s that was in play to get central banks to hold treasuries, another country's fiat debt, as their foreign reserve rather than gold?

Luke:

[13:14] I think it was a combination of triumphalism around the Berlin Wall coming down, the USSR collapsing, right? 1989, 1992, I think it was. We had Fukuyama's book, The End of History, right,

Luke:

[13:26] Which that was

Luke:

[13:27] Sort of captivated the mood, right? That was it. It was over. It was it. So there was some triumphalism around that. There was some dogma around that. There was some hubris around that. And there was also, look, some mathematical reality. The fact is, is.

Luke:

[13:39] The U.S.

Luke:

[13:40] Was the most powerful nation in the world. We still had a huge industrial base. We had all this technology that we were sort of expanding and letting out of the military into consumer markets. We were growing really rapidly. You know, Russia was on its rear end, a collapsing backwater. China was a backwater. Europe, you know, we still had U.S. troops all over. Japan, we still had U.S. Troops all over. So it was sort of like peak empire at the end of the day, combined with the mathematical reality of is, look, from 97 on, 97 through 01, we ran surpluses, fiscal surpluses. So the treasury market was a much smaller instrument, or much smaller market. Global FX reserves were smaller, right? So FX reserves really began exploding after the 97 Southeast Asia crisis, because basically Southeast Asia and the world's creditors all saw how fast Southeast Asia ran out of out of dollar reserves. And they all said, we're never doing that again. And China had a front row seat to it. And they were like, we ain't doing that because that means, you know, we have this currency crisis and the Americans come in with the IMF and they sort of get the pick and choose what assets they want to buy and how they get the restructure. And so that was really, you know, Now, FX reserves were always a thing, but they weren't that big until after that crisis.

Luke:

[15:06] And at that moment in time, we need more FX reserves. Well, you weren't going to do anything to piss off the Americans. And buying gold was going to piss off the Americans. And so Southeast Asia was in crisis. Russia was a backwater on its butt in crisis. I wouldn't even say it was a backwater. It's not fair. It was in a moment in time where it was. though. It was, it was, you know, it was in collapse, you know, coming out of the, you know, in collapse, Southeast Asian collapse. Japan was only eight years into its, you know, 30 years of, of lost decades. China was nowhere. Europe was basically occupied by the American military and certainly defended. We had just bailed out Mexico. Latin America was sort of on the back end of 20 years of crises, starting in the early 80s. That was when there was no alternative. And so when you start ramping FX reserves, it's an independent choice. You don't buy gold, you buy treasuries. So that's that's sort of how it happened. And it was at a moment in time, it made sense. And regulatory actions certainly supported those choices. But that's how it happened.

Ryan:

[16:19] Let's talk more about gold. So there was this clip earlier in the month. I think it was on the Bill Maher show. We have Mark Cuban. You have, I think, Andrew Sorkin from Bloomberg. And they're talking about the price of gold. And there's some comment of gold is probably just shot up above all-time highs this week. And they were kind of laughing about it. Like, why would you hold gold? This sort of thing. But there was also underneath it sort of a sense of alarm, maybe. There was like, oh, well, should gold be doing that? Like, almost seemed like they were nervous about it. And I guess my question to you is, should we be alarmed at the aggressive price action of gold on the year? And maybe if you have gold, you're not alarmed. So who should be alarmed by this if someone should be alarmed?

Luke:

[17:03] Depends which side of the American fence you're on, which side of the world economic fence you're on. Look, if you are part of the American fence where you want to go back to those grand old days of the late 90s and early 2000s where treasuries were the reserve asset and we were offshoring our industrial base as fast as we could to China. And basically American policy economically was do whatever, subjugate the working and middle classes of America and subjugate the defense industrial base to China in order to support the bond market and Wall Street and Washington deficits. Yeah, if you think that was a good thing, if you liked that outcome, if that was good for your paycheck, yeah, you're very alarmed about what gold's doing. I would put Andrew Ross Sorkin into that camp. Now, if you are of the view that you want the defense industrial base to come back, you want wage growth in this country, you want to inflate away our debt to put us on a sustainable competitive footing with China because we went way too far with that past monetary regime, then you're rooting for gold to go higher.

Luke:

[18:18] And that's the camp I'm in. And I think it's the camp most, you know, most Americans should be in. Most of the world should be in. And it's definitely the camp that the BRICS are in. Actually, what China and Russia are doing with gold, they're literally trying to do us a favor. We'll see if our leaders let us let them. But, you know, it's I think

Luke:

[18:38] The administration in

Luke:

[18:39] The office today, I think, is happy to let them bid it up. But, you know, there's there's, of course, look, you don't want to go on four thousand, ten thousand, twenty thousand. And boom, that's that can begin to risk confidence. So there is a rate of assent. But like, it's got to go way higher if we want to do, you know, if you ask Andrew Sorkin, is it a good idea to reassure the defense industrial base, get less reliant on China? He would say yes. But it tells me how early we are in gold still that he doesn't make the connection. He's a very smart man. He's written some very good books. He's very well connected. He doesn't get that, but they're starting to get it right. Because literally the week after he said that, Jamie Dimon came out and said, I could see gold at $5,000 or $10,000. And look, why is Jamie Dimon suddenly thinking gold at $5,000 or $10,000 is a good idea? Certainly not something to be afraid of. So that's how I think about it. I mean, I think it's just a sign of how early we are, that A, that they're making fun of it, and B, that they're not making the connection of higher gold. There's not a

Luke:

[19:38] World where the US

Luke:

[19:38] Can win against China. Again, maybe too absolute.

Luke:

[19:44] It is highly

Luke:

[19:45] Unlikely the US can win against China in the great power competition it is engaged in, unless gold probably is way higher than where it trades today at 4,000.

David:

[19:54] Luke, I've got a second chart for you. This one I actually got from your Twitter. The tweet reads, in 1970, the amount of gold reserves were equal to currency reserves. This chart is inclusive of the United States Federal Reserve. And then it follows saying, today, currency reserves are six times the gold reserves. Will the gap close? The gap meaning, will we just simply have much more gold reserves to maybe get to par with currency reserves in the United States Federal Reserve? I think my big question, maybe the big question, is what is the implied gold price? If that does happen, if we do think that gold reserves in the central bank are accelerating, our central bank are accelerating, how much buying pressure does that represent on gold?

Luke:

[20:39] 6x.

David:

[20:41] 6x of what though?

Luke:

[20:42] Yeah, I think it's going over 20,000. I mean, look, I think that chart is super interesting for a number of reasons, not least of which is there was other charts by people whose work I very much respect out there pointing out that, well, you know, the gold US or sorry, all above market global gold is now equal to, I think, USM2 money supply. And to me, that was like comparing like apples and like octopuses. You're like, what? Like if you're going to use all above gold supply, you should use all global M2 supply. If you're going to use US M2 supply, you should use US official gold supply. You're mixing them. And the point was that that post was like, well, $4,000 gold's about it, right? Like those two numbers was like 4,000, that's about it. And that to me, eh, like that, A, it makes no sense. You know, it struck me as a bit disingenuous. That reserve chart, that second one, You know, it suggests they're going to continue to buy and, you know, there'll be there'll be tonnage increase and there will be price increase. But I think a lot of this, you know, there's always been there's not enough gold. Right. How many times over the last 20 years, you know, there's not enough gold to use gold as a reserve. And every time I hear it, I just want to facepalm because I'm like gold's price rise can rise infinitely. There's plenty of gold. It's just a question of price. It's just here we're watching in real time. Right. Central banks are buying gold. They have bought a lot of gold in the last five years and over the last 10 years.

Luke:

[22:09] And the price

Luke:

[22:10] Is rising a lot. And so, you know, I think ultimately those numbers will move to par over time. Now, are they going to move to par in the next two years? Probably not. I mean, it could, but that would be a bit of an interesting scenario. But over time, I think those two numbers are going to par for two reasons. Number one, I don't think currency reserves are ever rising again. You have the Americans who have come out and said, all right, we hyperinflated Iran in 2012 by kicking them out of the SWIFT system or making the Europeans do it.

Luke:

[22:40] The Chinese were like,

Luke:

[22:41] Holy cow. The Russians were like, holy cow. That's unacceptable. 2013, the Chinese came out and said, we're done buying treasuries. They said it in their Chinese way, right? It's no longer in China's interest to continue to grow FX reserves. That was, we're done buying treasuries. And they haven't won any cents on that. None. In fact, they've net sold. Russia was done around the same time. 2013, you had a treasury official, former treasury official, Juan Zarate, come out with a book called Treasury's War. And it was maybe the most hubristic piece of writing I've ever read. But it was just like, hey, we just hyperinflated the Iranians. And here's how we're going to use a dollar to hyperinflate everybody else to make them do what we want. And you're like, hey, Alabama, we know you're pretty tough, but we're just going to run the ball. Left every time because we think we have a really good left tackle.

Luke:

[23:29] And so guess what? The world stopped buying treasuries. In 2014, Global Central Bank holdings of treasuries stopped rising. I don't think they're ever going to rise again. Again, unless we go back to those two questions. Is the US willing to offshore its entire defense industrial base to China? If yes, then yeah, maybe treasury reserves will start rising again globally. Are China and Russia willing to become total US economic vassals and sell off their countries and impoverish themselves? Then if yes, then sure, maybe they'll start to rise again. But failing those two being answered yes, treasury reserves are never rising again. Why would you put your money in treasuries? Oh, by the way, we then sanctioned the Russians in 14. We sanctioned the Russians in 2022. We froze their sanctions. You've got the Europeans saying they're going to take the trick. You would have to be a galactic moron to store the wealth of your country, the surpluses of your country in

Luke:

[24:20] Western sovereign debt.

Luke:

[24:21] People say, well, don't invade another country. Like, okay.

Luke:

[24:26] Like Iraq? Yeah.

Luke:

[24:28] Right. Like, like, like whatever. So I think that those charts are going to continue to converge over time. You have to have control of your FX reserves and knowing the fiscal situation of the West, which is they have to have negative real rates to make their debt not implode. It's a double whammy, right? You're going to, surpluses occur naturally. It's just, you know, some countries sell, buy and sell more. It's usually around oil and commodities. You're going to have some level of surpluses over time. Those are not going back into Western sovereign debt. I don't think ever again, unless those two conditions are satisfied. If they can't go into Western sovereign debt, they're going to go into gold. And as more people understand that, Why would you sell your gold? There's a tidal wave of money coming

Luke:

[25:14] For the next

Luke:

[25:15] 30 years of surpluses every year, relentless buying a gold. You would have to be an idiot to sell your gold in front of that. Hey, sovereigns are going to buy a trillion dollars worth of gold for the next 30 years. How much would you like to sell today?

Luke:

[25:28] None.

Luke:

[25:29] I'm going to buy more. I'm going to participate alongside them as the system rebalances through gold.

Ryan:

[25:34] I'm wondering to what extent, Luke, that if we get a 6x in the price of gold and gold is above, $20,000, it's heading towards $30,000, and the central bank reserves kind of switch back to the 1970s in favor of gold. At what point are we on a gold standard?

Ryan:

[25:51] And this is an interesting question because I think, at least in the U.S., and maybe I'll speak to the typical investor in the U.S., we have been conditioned to believe that gold is, I think Keynes' words in 1924 were a barbarous relic. Basically, it's an anachronism of a distant past that we have evolved our monetary policy in our nation states above the need for gold. Oh, and by the way, the gold standard, that was responsible for elongating and worsening the Great Depression. And the chief innovation of central bankers was to move beyond this barbarous relic. And I'll just add another perspective here, which is earlier you were making the case that actually more of a gold standard would be good for America. I think most investors or maybe among the American elite, they think the opposite is true. They think that they'll lose their ability to sanction foreign adversaries like Russia. They think that it's a good thing that treasuries are the world reserve asset because then we get 30-year fixed rate mortgages in the US. And it's a good thing to maintain that dominance and supremacy. Talk about that. Are we just basically moving towards a gold standard?

Luke:

[27:07] How is that

Ryan:

[27:08] Not a de-evolution of our financial system? In what ways is that really an upgrade for America?

Luke:

[27:16] So it's interesting because a gold standard implies the gold being pegged to a value of currency and then the gold moving as it was structured for many, many years, centuries, with a few exceptions up to call it the 30s. And so the people that rail against the gold standard, they are fond of pointing that out. And they're fond of using Keynes' words. And I think it's very disingenuous that they do that. They know exactly what they're doing.

Luke:

[27:48] And why do they do that? Because they want to maintain control of the system that they have. I understand it. If I was in their shoes, I'd probably want the same. And so they lie by omission about that period in history. they lie by omission that Keynes proposed something called the Bancor

Luke:

[28:08] At Bretton Woods, which was a neutral reserve asset made up of commodities that you would settle, that would rise in price to balance imbalances. And so what I'm describing is not a gold standard. What we would be on is not a gold standard. It would be Keynes's Bancor. It's a neutral reserve asset. And it would fluctuate in value in every currency to reflect inflation expectations, reflect trade balances, right? So America runs massive, massive deficits. The world's just not going to stockpile treasuries anymore. They're going to start buying gold. Oh, by the way, this is what the world has been doing for the last 10 years. That puts upward pressure on gold in dollar terms. The more deficits America runs, the more the dollar is going to fall versus gold. The more gold the other currencies have and the price still going up in their currency, just maybe more slowly than in dollars, you're going to end up getting, say, for example, the yuan rising against the dollar. What is it that the American government wants the Chinese to do? They wanted them to strengthen the yuan versus the dollar, right? So step one in which it is beneficial for the US is what does American policymakers want China to do? They want them to strengthen the yuan, stop with mercantilist policies, check. And

Luke:

[29:28] They want the Chinese

Luke:

[29:28] To consume more of their own production. Well, the Chinese government paradoxically has been encouraging the Chinese people to buy gold for the last 25 years, right? So it's a paradox because they're authoritarian and communist, except their government's been encouraging them to buy gold while our government's been encouraging us to buy the paper of central control, which are treasuries. Can't make this stuff up. So as the price of gold goes up, Chinese balance sheets are going to improve. Chinese consumers are going to have more money to buy their own production. The move in gold year to date has improved Chinese balance sheets by over a trillion dollars in one year based on their holdings. One year. Over the last five years, it's like four or five trillion dollars that their balance sheet has improved. So at a high enough price of gold, China consumes more of its own production. Its balance sheet issues are fixed vis-a-vis real estate. It strengthens the yuan relative to the dollar. And then sort of the other thing, yeah, it takes away our sanctions. But this is, I think, one of the things that so many Western commentators miss. Behind sanctions is a perceived threat. Let's call it what it is. We're going to put dollar sanctions on you. And if you don't play ball, we're going to do to you what we did to Saddam. Everyone forgets we had sanctions on Iraq for like 10 years.

Luke:

[30:50] And then when they started breaking down and Saddam went to the, you know, he left the dollar and went to the euro. He announced that in October of 2000. And you can find articles about an early 03 about how much money that had made him moving to the euro from the dollar as he had supported the euro because it was 5% of world oil production. The threat was, we're going to come and kick your head in. The problem with the dollar system that these people leave out is it's become a victim of its own success. There is no threat to kick your head in anymore because guess who makes all the weapons that we're going to use to kick your head in? China. China makes critical components of the weapons we're going to use. Why is that the case? Because of the dollar system. We literally, there's, you know, there is the only place there's still a threat that we're going to come kick your head in is on Western Wall Street investors. In the real world, US policymakers, US military people, U.S. Military strategists, the Chinese, the Russians, they all know.

Luke:

[31:48] The U.S.

Luke:

[31:49] Ran through 15% of its high-end air defense missiles in 11 days of medium combat in June, helping defend Israel. What do we got? A month, two months, three months? And oh, by the way, these missiles take years to replenish. Everybody knows this. And oh, by the way, China makes critical components in these missiles across services, like a startlingly high percentage of these missiles. So like literally, if China should, and I knew this ahead of time, when you look at how the American administration has reacted to the shutdown of military grade rare earths. Have you ever seen the American administration react this way to anything? Anything. Why? They're acting like an addict who just had a supply cutoff.

Luke:

[32:37] You ever try to take booze away from an alcoholic? It's the same reaction. The American dollar system has gone too far. It has become a weapon against America. Why would I be in favor of a weapon against America? Why would anyone be in favor of a dollar system that has left American national security in a position where we literally, everyone knows we can't do it for any extended period of time. Everyone knows the Russians can last longer. The head of NATO came out earlier this year, said the Russians outproduced all of NATO, four to one. Everyone knows China, like everyone, but a certain class of, you know, Western and US investors who start with the first principle of China can't win. America always wins. America hasn't won this one, guys, like wake up. And I don't say that to you. I say that to these consensus guys, but that's why I think it's, you know, why would anyone want gold? Well, if you're in favor of America not being beholden to China to make weapons, and if you're in favor of rebalancing trade in the way that we've been trying to get the Chinese to rebalance trade for 10 years with no success, then you should be in favor of this. And if not, then I would question where your loyalties lie.

David:

[33:44] It'd be one thing if we are transitioning from just a US dollar based system to a gold based system. And really the only significant repercussions of that were the treasury charts went down and the gold charts went up. If that's all that would happen, that would be just a fun topic for all the people in the world of finance and econ. But when something so fundamental shifts from one phase to another, there's collateral damage just like left and right. And to your point, what happens when you take away booze from an alcoholic, they're probably going to lash out. It won't be the most safe thing that you ever do in your life. And so there's like the happy case where there's just like kind of fair and orderly transitions. You know, the Indiana Jones swaps the bag of sand for the gold, for the gold icon.

David:

[34:34] But then there's like very disorderly transitions that are also possible. Where are you on the spectrum between a fair transition, a fair and orderly transition to a disorderly transition from one phase to the next?

Luke:

[34:47] It's a good question. It depends on events, but I would say that every day that the administration does not take its medicine and just do a big, you know, there's something in financial accounting called the big bath theory, right? Like you're the new management team, you come in and you, you know, if they were engaging in fraud or bad, the best thing you can do is like day one, you come in, you sit down with investors, you say, listen, the old management screwed this up. We're taking a huge charge to write off all of the bad stuff they had done. And we are going to reinvest and do this. So give us 12 months. My hope was that the Trump administration would come in and do that day one. They didn't. They came in with like fantasy land. We're going to doge $2 trillion and wasted three months and then had to admit, well, it's actually 160 billion. And oh, by the way, one of the most brilliant industrialists of our era fought Washington and couldn't win, right? So sort of hurt, you know. The credibility of future statements from the administration.

Luke:

[35:56] Next up, we get Liberation Day. And we get the Treasury Secretary, who Wall Street, by and large, still thinks is sort of the ace at the table in these negotiations. And he says, we have all the cards. As the debtor, we have all the cards. And China has no cards. And Trump repeats it. And seven trading days later, our bond market essentially blows up. And they do the first episode of Taco, Trump always chickens out. Let's save the bond market. And then we get into June and we're, you know, our ally in Israel, you know, attacks Iran while we're negotiating a deal, which is a really bad look for us, no matter how you slice it, and then needs us to help bail them out, basically. So now we've delayed again. So my point here is, is it's October 27th as we're doing this. They've been in office for nine, over nine months now. The optimal strategy and when I was most optimistic that we can get out of this without severe disruption was, hey,

Luke:

[37:00] President Biden, President Trump, myself, President Obama, President Bush, President Clinton grew up. And here's how. And here's what happened. And I am standing here today as President Trump asking you from both sides of the aisle, we are going to take the big bath. We are going to write down this debt. What does that look like? That looks like gold at $10,000 or $20,000 an ounce. And we are going to put it into the Treasury General account. We're going to buy down our debt. We're going to invest massively. We're going to ask our partners to step in and we're going to decouple from China. And listen, we want to manage a peaceful transition. We will even allow the Chinese to invest in parts, but maybe in certain parts, only in certain non-critical parts. And we want to do this multilaterally. That had a real chance of being successful. And every day that has passed that they have not done that, Their odds of success and their odds of, hey,

Luke:

[38:03] You know, we switched the bag of sand for the gold icon goes down and down. And it's reached the point now where we've added in a complicating factor of AI. You know, we came into this year and AI was kind of like still a little bit. Out there on the horizon. It ain't out there on the horizon anymore. Last week, New York Times came out and said, there's 160,000 people we would have hired that we're not going to hire because of robots. And that number is going to be 600,000 by 2033. And you're seeing big banks say, we're not hiring because AI. And so now you've got this further complicating factor of an exponential deflationary technology arriving faster than you think. And that is going to hurt receipts. That's going to make the fiscal picture worse. That's going to make political stability worse. And so, you know, to answer your question, I'm not that optimistic anymore that this can be done without severe, you know, severe disruption, severe chaos. And I wish that wasn't the case, but it is what it is.

Ryan:

[39:02] Can you help me understand this, Luke? One thing I have not understood about central banks accumulating gold is really how it works. And so if a lot of the gold price here recently has been driven by foreign bank, central bank accumulation, namely Russia and China. They're always the top of the list. It seems like the Western countries have not got the memo on this. Some are still selling their gold.

Luke:

[39:28] But say Russia, China,

Ryan:

[39:30] If gold appreciates in the way that you're talking about, how does that position kind of the countries around the world? So on paper, if you just ask Chad GPT, you know, the United States owns 8,100 tons of gold. Most of anybody. So one would assume the U.S. does fairly well. I mean, it loses treasury bills as the world reserve asset, but we got the most gold in the world and have since World War II, even though we're not buying more. We still have a lot. It's Fort Knox, New York. I don't know where it is. Then you've got Germany. They have 3,300. Then you've got Italy and France in the 2,000 range. Now, China's listed at 2,200, and that's their official estimates. Are these numbers accurate? How do we really know how much gold these countries actually have? And what are the dynamics behind this accumulation gain?

Luke:

[40:25] Yeah, the audit side of it, I think, is a question for everybody involved on some level. And it's fascinating. The only area that I see China hawks taking China's word at face value is on what they have in gold, right? China lies about everything, except their gold. The 2,200 tons, that's exactly what China has.

Ryan:

[40:42] And we've got- So you think they have a lot more? You're assuming they have a lot more. Why would they lie about this? Why wouldn't they tell us? wouldn't that just like play yeah well i guess what's the game theory of why they would underplay the amount of gold that they hold

Luke:

[40:54] Uh it's still a form of biden hide right the old chinese bide your time you know hide your strength and bide your time hide and bite why tell us till they need to tell us it is a political statement right you once you surpass the americans like that is so why why stick it in their face why i would if i was doing it i would do exactly what they're doing, which is they're buying it left and right. I mean, I have people very, I have talked to people that have, that have very long-term relationships in that country. And when you tell them, Hey, they have 2,200 tons of gold, it's all they can do to not laugh. Like, yeah, they've got 2,200 tons of gold. So I think I think it's a form of hide and bide because of the political nature of it. The other thing, too, is like, look, if you flash what you're doing, you know, the New York traders are just going to front run you and make you pay more. The London traders is front run you and make you pay more just for the stake of sticking it to you and to get on a momentum trade. So it's that's the other side of it, like just market sort of practical, you know, practical trading dynamics, because while, you know, it's very easy to buy. Buy lots of, you know, $100 million in paper, done. It's actually hard to buy physical gold in real size. Like it takes some real planning, lead times, et cetera, which then gets to sort of the first part of your question of like, what are they doing?

Luke:

[42:17] Ultimately, they're probably buying from some of their own domestic mines, certainly in the case of Russia and China. And then, yeah, I mean, Westerners are willing to sell gold for their currencies. And so, you know, to the extent Russia and China end up with Western currencies, hey, we'll take gold and we'll take delivery. You know, some of it, there's probably some barter aspects to it with all the sanctions regimes in place where, you know, you can go back in time to 2014, something called lawmakers look for the golden loophole in Iran sanctions. And they're just going straight gold for oil. And it was hundreds of billions of dollars with, you know, Turkey was facilitating it. The Iranians were getting gold and the Chinese and others were getting oil. And so there's lots of different ways they can do it. But yeah, the Chinese $2,200 or 2,200 ton, 2,300 tons, wherever they are now, like that's a joke. That's not the real number.

Ryan:

[43:13] Do you think they could have more than the U.S. does right now? I think they absolutely have more than the U.S. does. Oh, my God. Okay, so in this whole gold accumulation story, how does this position in the U.S.? Because maybe the Chinese have more than us. We don't know. But the U.S. Still has a lot. You were mentioning one thing that you would have loved Trump to have done is you said something like reprice the gold and use that money to pay off debt. Now, I'm a little bit fuzzy here, Luke. I think the U.S. Has all of that gold that I was mentioning on the balance sheet, on its balance sheet, but at a much lower price, not the market price. This is all from memory.

David:

[43:50] Valued at a much lower price. Yeah, it's like.

Ryan:

[43:52] Valued at a $40 per ounce or something in this rate.

Luke:

[43:56] $42. $42 now.

Ryan:

[43:58] Why in the world? Don't we mark everything up to mark to market? Why is that still on the balance sheet at $4,200?

Luke:

[44:06] Why indeed.

Ryan:

[44:07] So why don't we just do that? Why don't we just reprice? That's completely honest. It's completely rational to just kind of reprice. And that's what you were advising Trump to do. Why haven't we done this already?

Luke:

[44:18] You know, I think it's, I can't, well, I think in prior regimes, look, if we would have done that, that would have said, look, gold's the reserve asset. That's a voice saying gold is a reserve asset, not treasuries. At a time we were trying to convince the world, you know, after 70, that was a price in 71. It was at 42.

Ryan:

[44:34] Okay. I was wondering, the 42 is the price in 71. It just froze in time at that amount.

Luke:

[44:38] Right. So I think for, from 71 through, I don't know, 2010, 2012, 2020, we kept it there because we didn't want to encourage anybody to buy gold because we wanted them to buy treasuries. And so if we just, we have demonetized gold, you hear all these sort of former IMF ands and saying, well, we demonetized gold. That was part of demonetizing gold. Just leave it there. Fast forward today, the Chinese are like,

Luke:

[45:04] We're a culture with 5,000 years of history and we've been around 5,000 years or 2,000 years, sorry, not 5,000 years. We don't have 2,000 years of history. And like out of 2,000 years, you know, the number of fiat currency systems that haven't gone to zero against gold. They're like, it's like the Steve, the Steve Eisman, the Steve, the Mark Baum thing. How many currency systems have not gone to zero against gold in 2,000 years? Zero. So the Chinese are like, all right, they've basically been calling bullshit on the gold price for 10, 15 years, right? Oh, you think it's 800? We'll take it. 1,000? We'll take it. 1,500? We'll take it. Just keep waving it in. So now, for all the reasons we highlighted early, strategically, it is in the interest of the US to revalue the gold. Now, in theory, they could come out and print dollars and set a price, and then they've got to defend that price, right? They have to, you know, hey, it's 20,000. Well, you've got to be a buyer and a seller at 20,000. Now, we could do that. You know, we have a printing press, you know? We defended levels on bonds. The Fed did QE, right? You know, Ben Bernanke, you go back to 2002, he specifically cites how they used gold to devalue the dollar. You know, he specifically cites how the Fed has in its mandate the ability to buy foreign sovereign debt and gold. They could do that.

Luke:

[46:22] But that's...

Luke:

[46:23] That's a political choice. That is a treasury choice. Treasury handles the dollar. If the Fed was doing that, and Bernanke in his O2 deflation speech says this, I have to tread carefully because I'm dealing with the dollar now, and that is typically the purview of treasury. But we were very able to defeat deflation in 1933 when we devalue the heck out of the dollar versus gold.

Luke:

[46:48] Okay.

Luke:

[46:48] We could do that. So that's one way you could do it, but that would require, You know, that is essentially a statement. Dollars reserve status as it has been structured is done. Gold is now the new reserve asset. That's what that says. And that's why it's so political. And the DXY is going to get repriced way lower. And that's not the Fed's choice. That also presumes you have a Fed willing to try to do the right thing for the country in terms of rebalancing things. And you have seen an unwillingness of the Fed year to date to do that. And certainly earlier this year, there's been no connection between the strategic imperative of the United States, the country, and the Fed's mandate of inflation slash employment. Maybe that's shifting on the margin. To me, the whole Fed independence thing around Powell is Powell basically being given a gold or the lead discussion, like either you help us in doing this or we'll find someone who will. And he's maybe, you know, softening on this now with the rate cuts and what have you. So

Luke:

[47:52] They could do it up front, but it's tricky. Now, there's a lot of paper gold out there. You can read about that. And so in theory, an easier way to do it would just be basically yell fire in a crowded theater, strategically bid up gold using the exchange stabilization fund at key parts and for short squeezes higher and higher and higher and higher and let the market sort of take it there for you with you giving it nice little strategic gooses is at tactical pivot points. And then once the market's there, then say, hey, we are going to revalue it. Powell calls up, or Fed calls up Powell, says,

Luke:

[48:30] Treasury calls up Powell. Besson calls up Powell, says, okay, revalue it from 42 to 10,000. It's going to put, mechanically, you can find this in the financial accounting manual for Federal Reserve Banks. It's a public document online, section 2.10. Treasury can call the Fed and say, revalue the gold. It mechanically creates a deposit right into the treasury general account or TGA. It's literally money creation using the gold that Besson can do pretty much whatever he wants with. At $10,000, it's $2.5 trillion. At $20,000, it's $5 trillion. $5 trillion, you could buy back a lot of the treasury market. You could buy back, let me put it this way, you could buy back the entire long end at $5 trillion, all of it. And so paradoxically, most people would say, oh, if gold's at $20,000, there's no bid for treasuries. It wouldn't need to be. He could buy the entire long end. Treasury yields would go down. 10-year treasury yields would go down in that case, not up. Would it be inflationary? Eventually. Is that what we need? Yeah. If we wanted, again, we can either win and bring back our defense industrial base, or we can have low inflation and a bond market that requires China and all the two preconditions. We can't do both.

Luke:

[49:45] Inflation's in the case.

Luke:

[49:46] So that's why I think they haven't. That's what I think they are. I I think part of it was, hey, let's try the Doge thing first, right? Because we... Real politic is there's a bunch of people who thought they could doge like serious people. To me, it was like, guys, look at the math. This is like third grade math. Like, come on. But very serious people were like, oh, yeah, they can doge. And that's how we'll get out of this. I'm like, OK, well, have at it. Right. And it was like, oh, we can't doge. Like, oh, really?

Luke:

[50:15] That's a surprise. Huh. Interesting. So I think there were some political things they had to try first. But again, the debt doesn't care. The interest grows no matter what. Every day that goes on makes it more likely that this doesn't end in sort of a smooth sort of shift from icon to sand, but rather the big boulder running after us after we misjudge the amount of sand relative to the icon.

Ryan:

[50:39] I mean, the debt doesn't move. It is interesting that in contrast to like maybe Brazil in the 2000s, that the U.S. Does seem to have some of these aces up the sleeve, right? Like just like repricing gold and we just suddenly get, you know, $3 trillion, right?

Ryan:

[50:53] The size of the U.S. economy, the position as the world's reserve assets, some of these things are beneficial. I want to get back to a term that you used, which is like all this paper gold in circulation. And I think any bankless listeners come to this point in the conversation. Of course, they're probably predominantly crypto holdings. We'll get to crypto, Luke, in just a minute. But they might also be interested in gold, right? Because at this point in the cycle, what is the denationalized asset that central banks are buying? It's gold. It's not yet Bitcoin, maybe in the future, but it's not yet Bitcoin. It's gold. And so they might be thinking, okay, well, how do I go buy gold? They might go log into their brokerage account and see ETFs like GLD and go just market buy that. Paper gold, though, that's what that is. Can you talk about what are the different options for investors to actually hold gold? I think I've heard you say you prefer physical gold. But if an investor is doing that in size, it's not about stacking gold bars at their home. That can't be the solution here, right? We're used to, in crypto, this bearer asset that just like, you know, doesn't require, it does require some storage, but doesn't require kind of the volume of storage that gold bars do, certainly. So can't they just buy GLD? Like, or are there other options that you would sort of point people to, to recommend on the physical gold side of things? It just seems like a much more cumbersome asset than the digital gold assets that we're used to.

Luke:

[52:23] So paper gold is an all-encompassing term that actually has some sort of nuance to it that's worth digging into for one second at the risk of sort of boring people. So there's paper gold ETFs, right, which is a paper claim one-to-one backed by gold. And I think all those ETFs have all the gold they claim.

Ryan:

[52:43] And that gold sits somewhere? What is it, like in London?

Luke:

[52:45] It sits somewhere, usually in London, sometimes elsewhere. So that's sort of one form of paper gold. That's, you know, fully reserved paper gold. You get into things like gold futures, which are sort of levered, but there's for every buyer, there's a seller. But that is there's some amount of leverage in that. There's more paper, way more paper trading every day on the COMEX than there is physical gold that they have by a wide, wide margin. And but again, for in futures for every buyer, there's a seller where a lot of the leverage has historically been in that business is the what is called unallocated gold, right? centered in London. You've allocated gold, which is I buy gold from you, London Bank or London branch of an American bank, and it is fully allocated. In other words, it is mine. I've got a number. Here's the bar numbers. Boom. That is mine. There is a very long legal precedent that that is my goal. Then there's unallocated gold, which is Buy me $100 million of gold. Done.

Luke:

[53:44] Okay.

Luke:

[53:45] And that is not gold. That is gold credit. And if anything happens to that bank, you are a general creditor of that bank. And at one point in time, that unallocated gold number was estimated to be 20X, 50X, 100X. Who knows? Nobody really knows. It's a big number. Within the context of all of this, that's the most risky sort of paper gold, right? Then futures, there's leverage involved, et cetera. That's puts and takes. But again, you don't own gold. You can get cash settled, right? In a crisis, go back to the Hunt brothers, right? When they tried to buy up futures to squeeze silver and then take delivery, what did the powers that be do to them? They turn the futures, sell only, so you could no longer buy futures, only sell, and they wiped them out. And so that's an example of if you don't hold it, you don't own it. And when you look at ETFs and various ones, again, I think they all have the gold they say they do. That's not the risk point. The risk point is it's sitting in London in a lot of cases, as in the case of GLD. And if there's a real monetary crisis, that unallocated gold market means there's way more, way more people than there are seats when the music stops.

Ryan:

[55:14] It's like fractional reserve.

Luke:

[55:17] It's fractionally reserved within the city of London itself. And then it becomes a political question. You as a GLD or ETF holder are one to one reserve. No question. What if the Saudis are shorted gold? Who's going to get that gold? The Saudis? The Russians? The Chinese? Or you, Mr. Retail GLD holder, retail ETF holder? That's why when you, and I don't know the answer to that question. Why I'm proposing that question is that is the question every investor in gold needs to ask themselves of their custodian. If you want to buy GLD, you want to buy any other gold ETF, great. The risk you are taking is in a real crisis. It is entirely possible. I'm not saying probable, but it is entirely possible that they say Friday, you know, we have a crisis over a weekend.

Luke:

[56:16] Sunday night, gold's trading at some really big number, and the ETF goes, due to unforeseen market circumstances, we're declaring force majeure, and all holders of this instrument, this paper instrument, will get cash, dollars, cash, your currency, whatever, at the Friday night close, closing price of where gold traded. And then you get to take that gold and go out and buy your own gold on Monday morning when it opens at the new price. How high is the risk of that happening? I don't know. But that is, is it a tail risk? Yes. Is it a fat tail risk? Yes. Do you trust the Canadian government not to do that to you after the last five years?

Luke:

[56:56] Do you trust the American government not to do that to you? The Russians? The Chinese? The Europeans? Who do you trust not to do that to you? so

Ryan:

[57:05] What do you do can you buy you can buy like this you can

Luke:

[57:08] Buy physical gold you should own gold that's that's what i'm saying here i like

Ryan:

[57:12] In size like in a vault that someone else maintains like kind of like the coinbase of gold there

Luke:

[57:17] Are private vault vaulting areas i mean you can you can do it in a bank security deposit box and there's some risk to that too because in 1933 fdr you know confiscated gold when it was money not private property like it is today and you were not allowed to open a bank security deposit box for decades without the presence of a treasury official. And if there was gold in there, they took it. So basically, you had to let it sit for years and years and years. There are independent vaults in various cities. And you'd have to call up where you are in yours, where they are outside the banking system. That is what I do, because I don't want to be in that banking system. There are allocated gold options held in different vaults around the world that I trust. That's how I would do it. The average investor buys it sort of this Western paper, you know, there's always some element of risk to it. But if you want to own gold, you should own gold and understand the risk you're taking. Most investors don't understand the risk they're taking. And misunderstand, oh, well, I can't, you know, I'm not saying these ETFs don't have the gold they do. I'm not saying I don't trust the managements of them. I absolutely do. I think they're honest, good people trying to provide an investment option. What I'm saying is I don't, it's not their choice. In a real crisis, do I trust the Western and Eastern governments not to grab this stuff? I don't trust anybody not to grab it.

David:

[58:38] Luke, a lot of listeners won't be holding gold, or at.

Luke:

[58:42] Least not a

David:

[58:43] Significant amount of gold because, you know, we're a crypto podcast. The closest we typically go is Bitcoin. And so there's also just kind of like a generational mismatch. Like I'm a younger millennial. There are like Zoomers are coming online into like, you know, substantial amounts of wealth. The idea of just holding gold just seems a little old school. Old school, I'll say that. And also a lot of people just kind of want to own internet stuff. You know, like we're internet kids, like our lives are on the internet. And so when I see gold just running, and here you talk about all like the macro transitions. To me, I'm like, yes, okay, I will let the war of nation state reserve assets unfold. You know, nation states operate at the law of the jungle. There are these titans fighting over the reserve currencies. And I'm just going to be patient. and I'm going to hold my crypto because that's the generation that I am and that's my preferred investment strategy. Will all of that, everything that we've talked about so far in this episode, the debasement trade, or again, not the trade, just the debasement, the gold appreciation to $20,000, how much of that do you think trickles down into Bitcoin? And how patient do you think I'll have to be in order to be on the receiving end of that?

Luke:

[59:55] Depends. My base case is it will trickle down into Bitcoin. And I think my base case on that is, my confidence in that base case is rising with how we've seen the U.S. Government effectively, to me, trying to marshal Bitcoin into helping it with the stablecoin side, right? They're not saying Bitcoin, you know, they're only talking about Bitcoin as a strategic Bitcoin reserve, but I think sort of implied in what they're trying to do with stablecoins, which is essentially just trying to find a large source of repressible balance sheet for the debt. What they're trying to do with stablecoins to me, I just don't see how it works without a much higher price of Bitcoin. And so I think a lot of it would filter into Bitcoin. I think there's a possible world where, look, what if we do get a hard break? And you end up with what is essentially a contest where the East is standing up gold and the West stands up Bitcoin. You know, that's a possibility to me. Is it a high degree of possibility? Not right now, but I could see something like that happening.

Ryan:

[1:00:57] Wait, so you think the East, like the China block, let's say, they could be hard money on the gold side and maybe the U.S. And some of its block might go hard money on the Bitcoin side.

Luke:

[1:01:10] Possibly. Possibly. I mean, I'm throwing out a scenario. It's not my base case per se, but, you know, I'm personally investing. saying like I've got gold and Bitcoin are my two biggest positions. The US very clearly understands that it is no longer in its interest to maintain the dollar system as it has been structured. That is absolutely the case. And that is bipartisan at this point, almost bipartisan. What I think there is still some question is around gold versus Bitcoin. I think the US administration sees gold as a means to an end, right? They can't write up Bitcoin and get a bunch of money in the TGA as a magic money machine. They can with gold. And they're still talking about Bitcoin too. The East is looking at this going, listen, we're not going to touch this Bitcoin thing because it doesn't have the history and the different rails and the

Luke:

[1:02:10] There is a, in theory, a theoretical risk around quantum and things like that to Bitcoin that doesn't really exist with gold sitting in our vault. And so there's sort of, you know, I think we could see it, those two compete that way. You know, it's very interesting to me that since 2021, gold and Bitcoin are basically the same performance, right? That's a very long time in Bitcoin years for gold and Bitcoin to have basically the same performance. That that's different. You know, when, when, when relationships change like that, that can often be the sign that something's happening. So I have, you know, I don't have a strong view on that. I have different theoretical ways it could play out that I've thought about, but I don't have a strong view on either one. I basically, I hold gold and I hold Bitcoin and you know, I've, I've been making money on both. So like, that's okay. I don't have to be right of making money on both.

Ryan:

[1:03:10] It seems to be the case, Luke, that if what David says plays out, it might take decades to play out. And it might be the case that until, say, millennials and younger generations are like the central bank gray hairs, right? It doesn't fully play out. Maybe that's an element of it. I think the case for gold that you're making is basically that's the here and now solve to the problem that we have here and now. So it's interesting if you just kind of run the numbers, you said if

Luke:

[1:03:38] The U.S.

Ryan:

[1:03:39] Revalued its gold to 20K per ounce or something like that. I don't know, it's like three to five trillion, right? Right now, the amount of Bitcoin the U.S. has is about 35 billion. Now, I'll note, they keep getting more Bitcoin. They're not buying it, but they are. Post-Trump Strategic Bitcoin Reserve, which was supposed to be budget neutral, they are seizing a heck of a lot of it. There's two weeks ago, they just seized 15 billion more. And to your point about China, who knows how much they have and what they're doing in the background. But if they're running the same play on Bitcoin that you seem to think they're running on gold, they're not going to tell anybody that they're acquiring. And so maybe this is what's happening in the background. But it's got to be the case that this is going to play out over many years and decades, because I'm trying to just think through a scenario. Right now, Bitcoin is almost 99% retail owned. Even institutions that own it kind of filters into pension funds. It's not central bank owned. How does that flip? How do we get to the scenario where the majority of Bitcoin is central bank owned? Does that have to play out over decades?

Luke:

[1:04:52] Probably, probably. It's interesting. The US government seizes Bitcoin and they don't sell it, right? Right. They don't seize Beanie Babies. And if they do, they certainly sell them. You know, they don't they don't have a classic car reserve. Right. They turn around and they flip it right away. Right. If you seize if you seize a boat or a car from a drug dealer, they don't have a you know, they don't have a boat yard somewhere, you know, down in Norfolk, Virginia, of all the seized drug boats that, you know, you can go rent from the U.S. government. It's not what they do. So it'd be an interesting cognitive dissonance triggering question to people like, oh, this is just tulip bulbs or Beanie Babies. Like, okay, well, when the U.S. Government seizes assets, they usually sell them. Why aren't they selling this if it has no value?

Luke:

[1:05:43] That's, I think, an important tell. It's a dog that doesn't bark. How long will it take? Yeah, it probably takes a long time in terms of, but here too, you know, it depends on events, right? I don't know that it'll take decades for the simple reason that AI isn't going to let it take decades. I think we're within two to three years at most of AI causing significant employment disruption. And when that comes, if when that comes, that's the mother of all crises. Because now everyone's like, oh, we're going to have all of this AI productivity and we're all going to live in harmony and everyone's going to self-actualize and they're going to do art and they're going to build architecture and they sort of right-translate all of these sort of human self-actualization goals. And having been in the Rust Belt for when China went into the WTO, which was the original AI productivity boom, right? You'll note that economists, ask a mainstream economist, do they call it the China productivity boom or do they call it the China shock?

Luke:

[1:06:57] They call it

Luke:

[1:06:58] The China shock. Why? Manufacturing jobs went down 33% in the United States in like a heartbeat, like five years. And then they got papered over with subprime mortgages for a cup of coffee till those blew up. And then when those blew up, the Fed stepped in and grew their balance sheet. And oh, by the way, a million Americans from 08 to 22 died at drug overdoses. And when you factor in suicides and alcoholism, the death rate rivaled that of Soviet Russia, post-Soviet Russia. So there's this happy time talk around how this is all going to play out with AI. It's not going to play out that way. Well, how it's going to play out is it's going to get here faster than we think. It's going to cause more job disruption than we think. It's going to cause it

Luke:

[1:07:37] among white-collar workers who all have mortgages, good jobs, mortgages, car loans. You're going to start to see car loans decline in value. You're going to start to see home loans decline in value. And all of a sudden, you start to see banks run into trouble in consumer loans. It's already starting on some level, arguably, perhaps. Certainly, you can see unemployment among bachelor degree 20 to 24-year-olds is 7%. You take overall unemployment in this country to 7% and the whole thing goes, and we know how they're going to react. When I say what that means, that is stocks down for a second, GDP down for a second, 10-year yields down for like two days, And then they take off like a scalded cat higher in a recession. And then the Fed comes in and goes, whatever it takes, we'll print it all. We'll just at some form of yield curve control. And when that happens, right, what we're really talking about here is why I say it'll happen faster than decades when I really think about it is –

Luke:

[1:08:27] The debt is an exponential doing this. AI is an exponential doing this. We put the two together. This spot in the middle is the amount of money they need to print to

Luke:

[1:08:39] Keep the banks

Luke:

[1:08:39] Whole when this goes like this. And because they're exponentials, the amount of money they need to print to keep the banks whole when AI does what it's going to do and the debt does what it's going to do is doing. It approaches infinity very quickly. And once that happens, then you get to a spot where it's like,

Luke:

[1:08:57] You better have gold,

Luke:

[1:08:59] You better have Bitcoin. And that's, you know, I don't think they'll be discerning at that point. That might force central banks to do it.

Ryan:

[1:09:06] Do you have any view on the cycle? So the here and the now. So you, I think, are very much in the mindset of a long-term investor and you're patient, willing to let this play out over years and decades. And you expect volatility along the way. Think in the mindset of the crypto investor. Right now, everything has played out in crypto in cycles. We get these four-year cycles. Looks like it's the end of a cycle, at least from the timeline perspective for Bitcoin. And people are looking at gold and saying, hey, that's the debasement trade. But we have Bitcoin over here and that's also a debasement trade. I'm using the term trade because people are looking at this in the short run too. And they're saying gold has just moved up to $30 trillion. It's time now for the Bitcoin catch-up trade. So do you think it's as simple as that? Do you think sometime in the next six months or so, given the move that gold has had, that Bitcoin is just bound to catch up as maybe it was more tightly correlated in 2020 and 2021? There are times when it's not been correlated, but there are times when it is correlated. Could this be one of those times you have a view on this?

Luke:

[1:10:11] Not a strong view other than just sort of as a patient investor. Or I have noticed it's sort of, you know, gold goes, then Bitcoin goes and gold goes and Bitcoin goes. And so I would be open to that happening again until proven otherwise, basically. I'm also, you know, not to, you know, I'm like the two handed economist, right? Like, you know, on the other hand, we are getting to that time of a four year cycle where historically Bitcoin hasn't done great, right? So in my own mind, it's something I do think about of like, hey, where, you know,

Luke:

[1:10:42] Now, which of

Luke:

[1:10:43] These two are we going to get that have tended to happen? Bitcoin chases gold after a big gold move or, you know, Bitcoin has a lousy nine to 12 months at the end of a four year cycle.

Luke:

[1:10:54] I don't have a strong

Luke:

[1:10:54] View either way. I'm open to both. Some of it depends on, again, on events, right? If we get some sort of big deflationary aspect, I'd probably shade more towards the latter than the former. But it doesn't look like we're getting that. So I'm still, you know, gun to my head. I think it's more likely that Bitcoin chases gold higher than it is, than Bitcoin sort of, you know, falls apart here for, you know, the next nine to 12 months like it did in whatever, I guess 2021, you know kind of peaked in what november december j of 2021 and then it was like you know 12 months of getting kicked in the nuts every day for you know for for 12 months but i it's it's not like i'm like oh i'm so confident it's gonna chase gold i'm not that confident i i hope it's my base case but any my base case by a lot so you know we'll

David:

[1:11:41] See luke there's gonna be a lot of listeners who are just gonna shut down this podcast and go look at options to buying gold probably. I know I am. Tokenized gold is a growing sector of the crypto world. There's like two pretty good quality products, tokenized gold products on Ethereum, one from Paxos, one from Tether. Just what's your first thought that comes to mind when you think about these tokenized gold products?

Luke:

[1:12:05] Look, I think they are really interesting products. I think they're good products. Again, I think to me, you still end up having that same risk ultimately, right? You're trading. It comes down to what you think your risk is. Your risk, your benefit of liquidity and ease of use, right? It's very easy to use and spend. And I think that's a good thing relative to your risk of risk. If we have a real crisis where you really need gold, where governments really need gold,

Luke:

[1:12:39] Like, you know, the guys with the guns are going to go knock on the doors of the vaults and go, you know, yeah, I know this is backing this centralized instrument, but cash settle, have a good day. And, you know, they'll be able to sue and this and that and the other, but suing the government in times of emergency, when you need to keep like the banks whole, when you need to keep the system whole,

Luke:

[1:13:00] Not a real long track record of success, like good luck legally. And at the very least, you're going to have, you know, years and years while you're waiting. So, you know, to me, again, I'm not telling people, Oh, they get rid of those things, anything like that. I just think as an investor, understand the risks you're taking, understand the game you're playing.

Luke:

[1:13:20] Like you were saying before, millennial Zoomers, and even I'm a Gen Xer, right? I've never really, a Gen Xer in America has never seen that type of environment. I have friends that are Ukrainian. They immigrated here 20 years ago and they tell me about 1998 And they're like, hey, we had enough money in the bank to buy five cars. We're the richest family in the village. And then the weekend, they closed the banks. And when they reopened them a week or two weeks later, the money that did buy five cars bought a month of groceries. And if I had gold, I did great. And if I had silver, I was fine. And if I didn't, they just stole my wealth. That was it. They accumulated wealth of years and years. This is something that Americans think can never happen, even though it has happened in this country. This is something Canadians think could never happen, even though they watched the whole trucker protest and this sort of increasing authoritarian creep of Western governments. You don't even get into the UK, right? Do I trust these governments not to do that?

Luke:

[1:14:30] Governments, for time immemorial, when they find themselves in a pinch, do that. That's what they do. And so I would just encourage people to understand we are off the reservation in terms of the Overton window of policy options because we are off the reservation in terms of crises and how bad and how quickly this could get. And so look, the answer might be, you know, if you're a sort of a crypto native person, you know, own something, you want to own gold, own some of that, but then buy some coins too. Like the, you know, what's the worst thing that's going to happen? Like, you know, you got to go sell the coins at some point. Oh, by the way, you know, you can sell coins to a coin dealer, American gold eagles or Canadian maple leafs up to 25 a year. And there's no reporting requirements in America to the, you know, for the dealer. So you get you know four thousand dollars in cash from a dealer it's like schrodinger's investment did you make money on gold did you have gold you know as long as you're not you know like the guys in goodfellas and go out and buy a fur and a car and all this stuff like you know you know that's not a solution for 20 30 50 million dollars of course but for like the average sort of you know millennial zoomer who's probably doesn't have 20 50 100 million dollars to invest in gold like look buy five gold coins stick them in your sock drawer and then when it's time to sell do what the old timers do right one of the gold dealers I talked to he's like oh yeah like where'd you source these one ounce coins you're like oh

Luke:

[1:15:59] There is an old timer

Luke:

[1:16:00] Around the corner and, you know, he bought gold every week for years at 200 or 300, 400, 600, 800,000. And now once a month, he comes in, he sells a coin, we give him his cash and he buys groceries and he pays for gas and he gives his grandkids some money. And you know what?

Ryan:

[1:16:20] Great.

Luke:

[1:16:21] So that's what I would, you know, I'm not encouraging anybody to cheat on their taxes. I'm not encouraging anyone to cheat on their tax. I'm simply telling you the rules. You make your own decisions. And I'm not telling people not to own centralized gold back derivatives. I'm simply telling you what the potential tail risks are there that I think you need to hedge because we're in sort of, you know, we're off the reservation in terms of where we are.

Ryan:

[1:16:43] There are risks like that, property rights risks in a debasement trend line for certain. And we've seen them in America. Just look at the 1933 FDR executive order, everybody turning your gold type of things. We could go on just about that alone. I want to maybe close with this, Luke. So I think you've called this a 100-year reset, right? And it does feel like the pendulum is kind of swinging back from treasuries and from the US dollar as the world reserve currency and treasuries as the world

Ryan: