Unpacking the Bitcoin L2 Narrative

What if Bitcoin could scale like Ethereum? That’s the tantalizing possibility of the Bitcoin Layer 2s narrative.

Bitcoin has been limited in its ability to scale letting Ethereum take the lead as the go-to for DeFi innovation.

Bitcoin has had an explosion in development. New primitives like Ordinals, Runes, and BRC-20s are taking center stage. This marks a big shift in the vibe of the Bitcoin ecosystem. Bitcoin is evolving from being laser-eyed on BTC as an asset to a more dynamic ecosystem that has different things for people to use, build, and speculate on.

Within the Bitcoin ecosystem, L2s are now the new hot thing. Everyone wants a piece of the Bitcoin L2 pie. But what’s this narrative all about?

We’ll be answering key questions for those new to the concept of Bitcoin L2s: the necessity of L2s, their present condition, what lies ahead, and their eventual end state. Let's dive in! 👇

Why Bitcoin Needs L2s

The Bitcoin network is designed to prioritize security and decentralization, making tradeoffs around its scalability and expressivity as a blockchain. While this makes BTC a more valuable asset, it also means that the network is not the ideal infra for building financial apps, as seen on Ethereum.

For almost a decade, the Bitcoin community has grappled with scalability issues, with transactions costing tens of dollars during peak network traffic. And today, the demand for Bitcoin’s block space is exploring new heights, driven by experiments like Ordinals, Runes, BRC-20s:

- Ordinals caused Bitcoin fees to rise by up to 280% year-to-date in December 2023.

- Runes transactions comprise 68% of Bitcoin's total transactions since its inception.

- BRC-20s have caused Bitcoin transaction fees to spike at times in the past year, and at one point, these fees made up 74% of the block reward.

The vision for Bitcoin is to be universally accessible and adopted. To make that happen, it must scale to handle more traffic without costing a fortune per transaction. The rising demand for Bitcoin’s block space underscores the need to scale Bitcoin, reflecting demand for Bitcoin L2s.

The Current State of Bitcoin L2s

The Bitcoin community has been actively working to improve transaction scalability for many years. A key development in this area is the Lightning Network – a payment channel protocol aimed at enabling faster and more affordable transactions by processing them outside of the Bitcoin L1.

While the Lightning Network has long been the flagship solution for Bitcoin’s scalability vision, the community is increasingly recognizing its limitations. There’s a consensus forming that the Lightning Network might not be the definitive scaling solution for Bitcoin, and there’s a need for better Bitcoin L2s.

Eric Wall discussed this need for improved L2s on a recent Bankless episode, suggesting that the future of Bitcoin's scalability may lie beyond what the Lightning Network currently offers.

But where does this bring us? How can we build more effective Bitcoin L2s?

BitVM's Trust-Minimized Promise

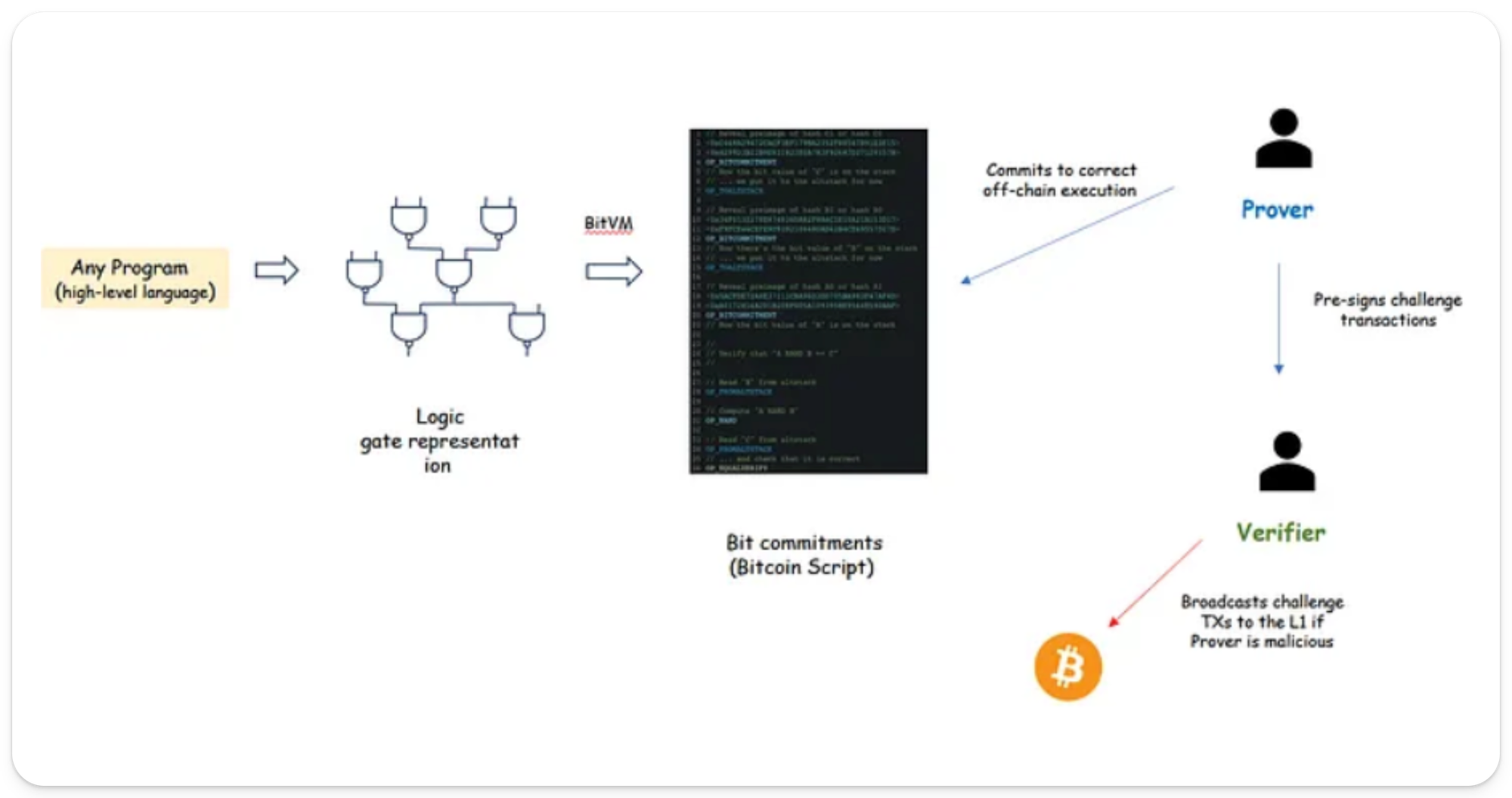

Currently, the spotlight is on BitVM, a new model for executing Turing-complete contracts on Bitcoin that could pave the way for optimistic rollups on Bitcoin.

The main reason why the community is rallying behind BitVM over any other approach stems from its compatibility with the Taproot upgrade. This means BitVM can be deployed without further modifications to the Bitcoin network — preserving the network's existing rules. A win-win for all types of people in the Bitcoin community.

BitVM's approach involves off-chain execution of transactions with the functionality to verify them onchain within the challenge window through fraud proofs, a mechanism akin to Ethereum's optimistic rollups.

This system can operate even with a single Prover but has the trust assumption that there must always be at least one honest verifier in the system that can detect and broadcast malicious transactions. However, this also means that if all Verifiers were compromised, the integrity of Bitcoin would be at risk since the attacker could post fraudulent transactions on the network.

BitVM only allows the creation of trust-minimized Bitcoin L2s like optimistic rollups, and not trustless Bitcoin L2s like ZK-rollups. Moreover, similar to optimistic rollups on Ethereum, BitVM faces challenges such as lengthy dispute resolution times and the necessity for operators to lock up significant capital to ensure liquidity for potential withdrawals.

Consequently, there’s a degree of skepticism in the Bitcoin community regarding BitVM’s practicality. But it’s worth noting that BitVM is still in its early stages of development and holds promise for scaling Bitcoin through optimistic rollups.

Zero-Knowledge Dreams

This brings us to the main question – what’s the end-state of Bitcoin L2s? The answer is, ZK-rollups!

But building ZK-rollups on Bitcoin isn’t easy, or even technically possible right now… this would necessitate changes to the Bitcoin network through a soft fork, and we all know that’s easier said than done.

The soft fork would add a new opcode to Bitcoin, which would enable it to natively recognize and verify zero-knowledge proofs, allowing for trustless interactions between Bitcoin and the rollup. However, as mentioned above, this is a major technical hurdle and its feasibility remains uncertain.

But, wait a minute. Given that BitVM is still early, and neither optimistic nor ZK-rollups are currently possible on Bitcoin, how do we have so many Bitcoin L2s in the ecosystem already?

Well, the reality is that, technically, real Bitcoin rollups don’t exist yet. What we’re seeing is a bunch of dedicated teams laying the groundwork for future Bitcoin L2s.

For example, some rollup teams, like BOB, are taking a phased approach. They’ve started by bootstrapping an ecosystem as an EVM rollup, attracting users, liquidity, and applications. Then, they plan to transition to an optimistic rollup using BitVM once the technology matures, and eventually, they aim to evolve into a zk-rollup, contingent on if Bitcoin undergoes a soft fork to add the necessary opcode.

Closing Thoughts

With great hype comes great potential for scams. Amid the buzz, there are many projects falsely claiming to be Bitcoin L2s, so it's important for investors and users to remain cautious. The jury is still out on whether many self-proclaimed projects are actually L2s or if they are merely using buzzwords to attract venture capital and retail investment.

Nonetheless, these are exciting times for the Bitcoin community. From the launch of the Bitcoin spot ETF, which marks a milestone in institutional adoption, to primitives like Ordinals, BRC-20s, and Runes, the Bitcoin ecosystem is experiencing unprecedented growth and innovation.

The prospect of Bitcoin L2s adds to the excitement about the future of Bitcoin.