Fighting for the Bull Market

View in Browser

Sponsor: MetaMask — Bridge more assets. Save time and gas.

📈 ETH Joins the Fun. Ethereum broke above $2,100 on Thursday after BlackRock, America’s largest asset manager, filed for a spot ETH ETF. Approval of spot ETFs for crypto's top two assets is imminent! Still, Bull Market gains are not being evenly distributed.

| Prices as of 10am ET | 24hr | 7d |

|

Crypto $1.42T | ↗ 1.6% | ↗ 9.2% |

|

BTC $37,278 | ↗ 0.5% | ↗ 7.1% |

|

ETH $2,087 | ↘ 0.3% | ↗ 13.7% |

Notable movers

SOL 7d

↗ 48.9% |

MATIC 7d

↗ 24.3% |

1️⃣ The bulls are back.

A wave of price rallies has brought a euphoric atmosphere back to the crypto market, igniting talks of a new bull run.

Solana is still riding high with an impressive run that keeps going. But both Bitcoin and Ethereum are no slouches, either. Not to be outdone, native tokens for Chainlink, Polygon, and Cosmos also rallied significantly. This market-wide surge is a blow to the bears, yet only time will tell if it’s actually the start of a new cycle.

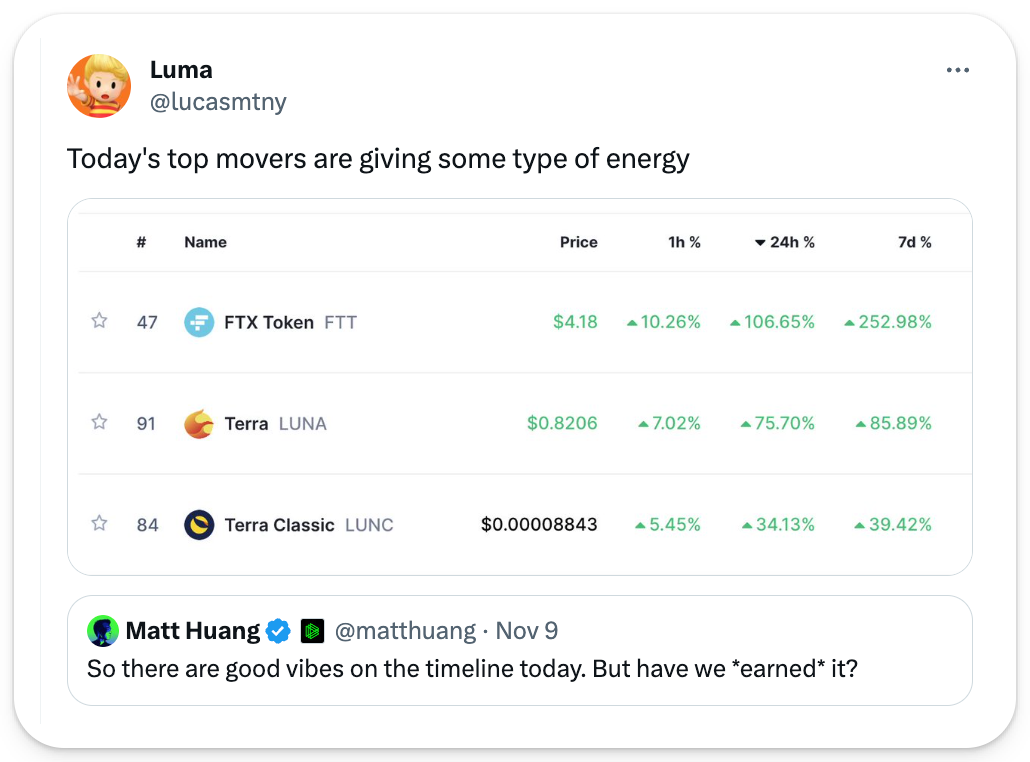

As expected, there were some stinkers among the week's biggest winners.

2️⃣ The ETF craze picks up steam.

This week, crypto has been abuzz with a flurry of ETF-related developments, fueling bullish sentiments across the market.

Notably, we’ve seen:

- The SEC open talks with Grayscale over its application to convert its flagship fund into a spot bitcoin ETF.

- Ark Invest preparing to launch a new suite of crypto ETFs with 21Shares.

- BlackRock, the world's largest asset manager, file for a spot Ethereum ETF named the iShares Ethereum Trust.

These movements indicate growing acceptance and institutional interest in crypto as a valuable asset class. Now, our space awaits more news here with bated breath!

3️⃣ Polygon powers up.

Polygon has been making headlines this week with two major developments.

First, Polygon Labs and NEAR Foundation announced a collaboration to build a zero-knowledge (ZK) prover for Wasm blockchains. This prover aims to bridge Wasm-based chains (e.g., Near, Polkadot, etc.) with the Ethereum ecosystem for more options and scalability.

In another significant move, Kraken, a leading crypto exchange, is reportedly considering launching its own L2 network and is in talks with Polygon, among others, for this venture. We’ll see where things go from here, but it could be another big score for Polygon.

4️⃣ Circle prepping for IPO?

Circle, the issuer of USDC stablecoin, is reportedly considering a public offering in early 2024.

The company, last valued at $9 billion in a blank-check deal that fell through in 2022, is in talks with advisors to prepare for a potential IPO. However, a decision and new valuation remain uncertain for now.

The potential IPO would be a pivotal step for Circle and could be a landmark event for the crypto industry, bridging the gap between digital assets and mainstream finance. Keep your eyes peeled here accordingly.

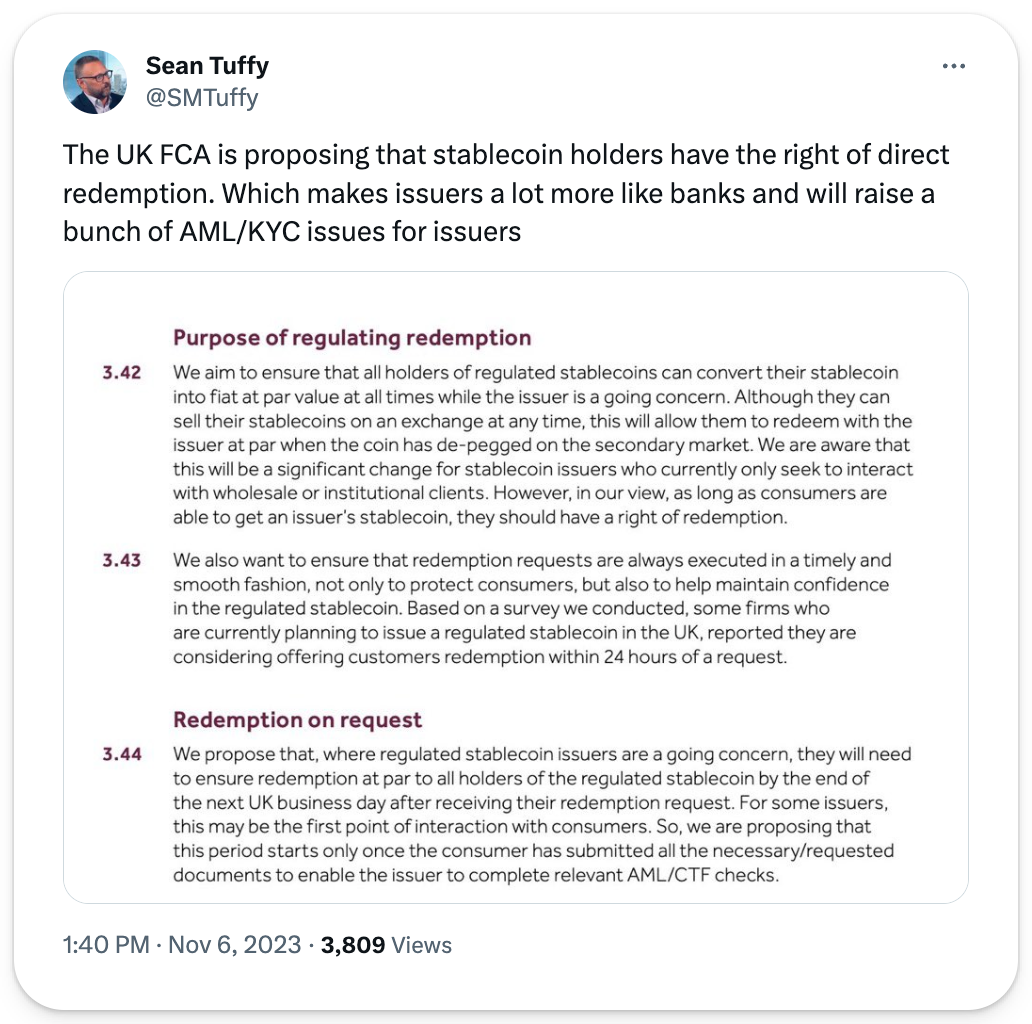

5️⃣ Fed & BoE eye regulating stables.

Stablecoins are under increasing scrutiny as both the U.S. Federal Reserve and the UK's financial regulators eye new regulatory frameworks.

In the UK, the Bank of England (BoE) and the Financial Conduct Authority (FCA) are seeking feedback on proposals for regulating stablecoins, particularly in systemic payment systems, over potential financial stability risks.

Meanwhile, in the US, Michael Barr, the Federal Reserve's vice chair for supervision, just called for a strong federal framework for stablecoins. These developments in both the UK and the US indicate a concerted move towards tougher regulation on stables, reflecting the growing importance of these assets in the global financial system.

More supported tokens and less gas! You can now use the Bridge feature on MetaMask Portfolio to not only move your tokens to a different network, but swap them into a different token of your choice, all as part of the same transaction.

Prices are climbing, but don't forget these timeless lessons!

This week, we welcome back Morgan Housel. Morgan has written "The Psychology of Money" and, most recently, "Same As Ever," which discuss the dynamics and psychology around money and markets.

In this episode, Morgan drops lesson after lesson that you can apply to your own investing strategies – and life broadly. It's a masterclass that is sure to have you reflecting on your decisions as we enter what may be the next bull market.

Bankless Citizens get Early Access to our Monday podcast and an exclusive Debrief conversation unpacking the episode👇

📰 Articles:

📺 Shows:

You're on the free version. Unlock the benefits of Bankless Citizenship.

Thousands of crypto's sharpest investors trust Bankless to bring the alpha via exclusive articles, ad-free podcasts, and tools like our Claimables wallet tracker and Airdrop Hunter app.

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. Additionally, the Bankless writers hold crypto assets. See our investment disclosures here.