The Biggest Threat to the Merge

Dear Bankless Nation,

As we draw closer to the Merge, rumblings of an Ethereum Proof of Work (let’s call it ETHPOW) hard fork are surfacing.

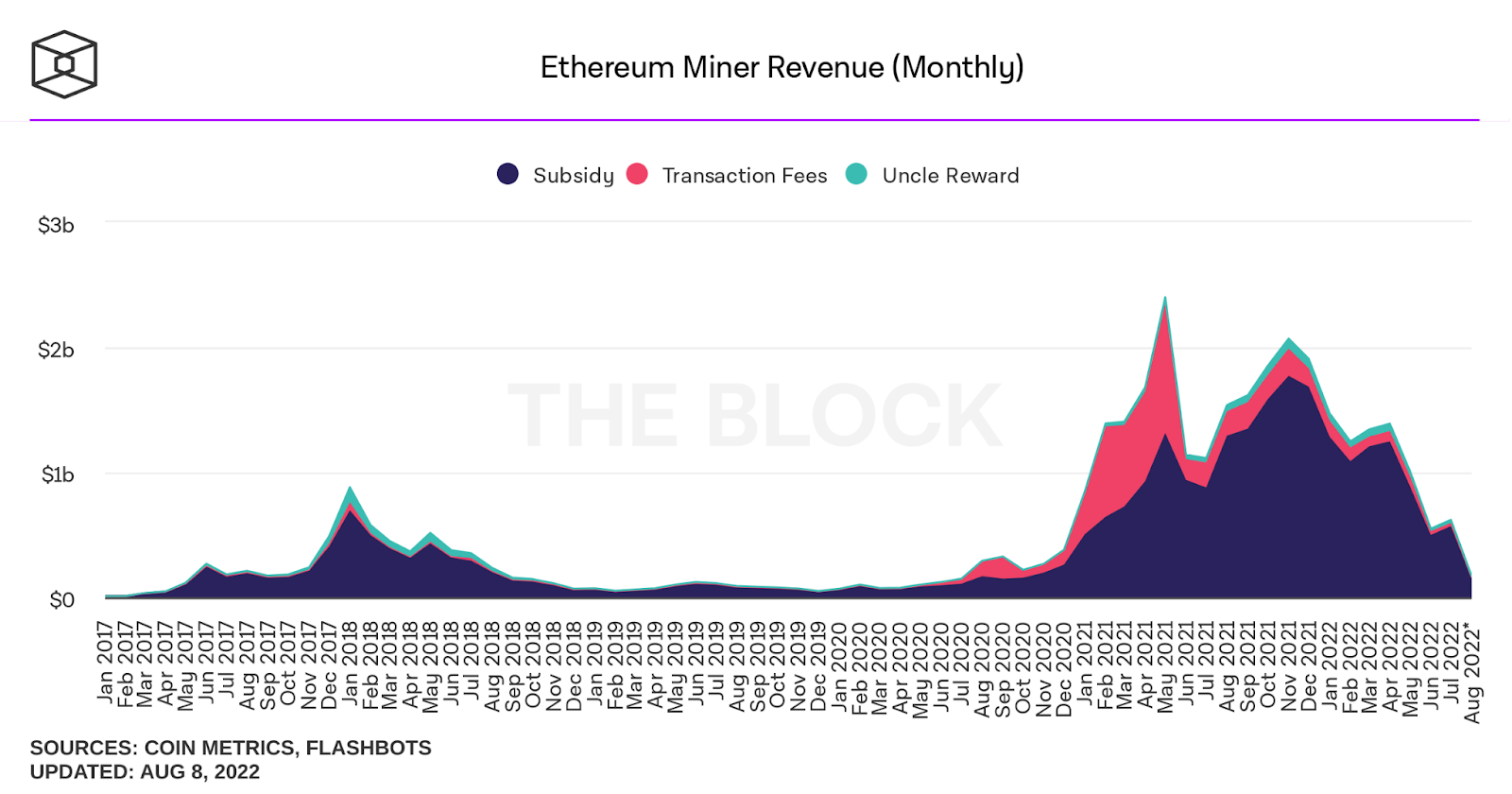

There’s plenty of reason for this. Ethereum mining is a multi-billion dollar industry, generating hundreds of millions of dollars in revenue (sometimes billions) to hardware miners every month.

Unfortunately for them, once the Merge is completed, hardware miners are effectively bricked. They’re useless ☠️

To think that these miners will simply just shut off their machines after the Merge, give up billions of dollars, and go quietly into the night is unrealistic.

They’re going to fight to keep their business alive. They’re going to fork (read “copy”) Ethereum and push for a PoW alternative.

In fact, it’s already happening. There’s already an EthereumPoW camp spawning and making noise on Twitter.

We also just saw Bitmex launch a futures contract on ETHPOW, allowing investors to speculate on the future price of these tokens.

Whether or not Ethereum-PoW is valuable is one question, but this hard fork does present a very unique (and potentially chaotic) dynamic for the Ethereum ecosystem.

Let’s unpack.

Free Money For Everyone

Back in 2017, Bitcoin saw a myriad of hard forks following Bitcoin Cash, where a material amount of the Bitcoin Community didn’t agree with the SegWit proposal which increased the network’s block space. As a result, the Bitcoin blockchain was forked and BTC holders received tokens 1:1 for every new chain (BCH for Bitcoin Cash, BCD for Bitcoin Diamond, etc).

While most of these chains have faded into irrelevancy, they did create billions of dollars of wealth for Bitcoin holders. People received these new tokens, which had a market value, and either chose to dump their freshly minted tokens for more BTC or decided to hold on to them in alignment with the vision.

It was the OG airdrop, and it was fairly lucrative during the 2017 mania.

So the same will happen with Ethereum, right?

After the Merge, every ETH holder will receive ETHPOW tokens 1:1 for every ETH held at the time of the Merge.

There’s a key difference though between Ethereum and Bitcoin. Hard-forking Bitcoin is simple. It’s just the native token, BTC, that lives on the network.

In contrast, Ethereum has a whole economy built on it. There are thousands of assets and hundreds of protocols all on the network. If it’s hard forked, all those same tokens and protocols also now technically exist on the new PoW chain, without having direct support from the entity/community that’s building on it.

If this happens, it creates a truly unique situation that may cause a lot of volatility in the market around the Merge.

Economic Chaos

As mentioned, when Ethereum hard forks, everything on the network is copied over.

Problem: Not every asset, protocol, or piece of infrastructure will be supported by every company building it. Sure, you can copy the tokens and the contracts on-chain, but you can’t duplicate the off-chain things supporting them (humans, infrastructure, etc.).

Here are two major examples:

Fiat Stablecoins (USDC, USDT, etc.)

Fiat stablecoins like USDC and USDT will be copied one for one, exactly like every other token. The problem is that the cash in USDT’s and USDC’s bank accounts does not double (obviously), and both issuers will not be honoring any stablecoins on the PoW-chain. Maybe they will in the future, but with a re-issued stablecoin on the PoW-chain.

The old stablecoin tokens are going in the trash 🗑

All of the USDC and USDT that you’ll receive in your Ethereum PoW wallet are effectively valueless.

And given that USDC becomes valueless, DAI — a decentralized stablecoin backed by 40% USDC — also loses a significant amount of the collateral backing it.

Right off the bat, this combines for over $120B of stablecoins that will go to zero on the PoW chain unless the cavalier comes in (the issuers).

Spoiler: they won’t.

So…All the fiat stablecoins on ETHPOW are dead. 💀

Liquid Staking Tokens (stETH, rETH, etc.)

The other major fallout is with liquid staking tokens (Lido’s stETH and Rocketpool’s rETH).

Given that this new Ethereum chain intends to run on PoW in perpetuity, ETH staking will never happen.

This sends the billions of dollars of liquid staking tokens on Ethereum PoW to zero as they’ll never actually be redeemable for anything.

RIP again 💀

The Rest of the Tokens

These are just two key examples. There’s plenty of other f*ckery that could happen.

What’s the value of an NFT on the PoW chain versus the PoS chain?

This is hard to tell. If I decide to sell a CryptoPunk on the merged PoS chain, but still own it on the old ETHPOW chain, am I still allowed to display it as my Twitter PFP?

What about DeFi protocols?

Which ones will support the PoW version and which will continue to stay completely aligned with Ethereum PoS?

You could assume that protocols that already have a strong multi-chain presence would support the new PoW chain. But even if they want to, it gets complicated as there’s another token (i.e. AAVE and AAVE-POW) where the POW token actually has the rights to the protocol on the network—whether it’s governance, economic, or both.

A specific example is Sushiswap. If there’s substantial volume on Sushiswap-PoW, SUSHI-POW holders are earning the revenue from staking, not the PoS holders.

There’s some conflict here given Sushiswap’s multi-chain approach. Based on Sushiswap track record, they would definitely support the PoW chain and direct all that revenue to xSUSHI holders.

Instead, there will now have to be governance processes to smooth this over if the Sushi community decides to take this version under its wing.

Dominos Start Falling

One of the big problems that arise here is around the 5-10 blocks before and after the Merge. There’s an unknown amount of Miner Extractable Value (MEV) present when hundreds of billions of dollars of capital should go to zero on one chain and not the other.

There will be chaos.

MakerDAO relies on USDC to maintain DAI’s peg.

Aave has billions of dollars of stETH being used as collateral for loans.

Given the level of composability on Ethereum, it’s easy to imagine a lot of liquidations, volatility, and stuff that will happen because of this.

The good news is that a lot of smart people already know this. And due to MEV bots, all of this volatility is going to happen within a few blocks before and after the Merge.

That said, the end state is still unclear.

The Saving Grace

A saving grace from all of this chaos is if the primary Ethereum Proof of Work fork doesn’t copy the full state of Ethereum.

Meaning, that it doesn’t copy all of the applications, tokens, etc.

Instead, as Muneeb proposes, the ideal scenario is that the hard fork just copies the economic distribution of ETH and there’s a clean slate to allow builders to opt-in and deploy their application on Ethereum-PoW (just like every other chain).

This would save the Ethereum ecosystem from a lot of MEV and economic f*ckery that might happen around the Merge.

But whether it happens or not is still up in the air. 🤷

The Market Opportunity

The question you’re probably wondering is: “How can I profit from the chaos?”

On the surface, you might be thinking of shorting USDC or stETH or any of the tokens that would lose their value.

The bad news is that this idea is becoming ubiquitous (hence why we’re writing about it). As mentioned, MEV bots will be lined up and ready to arb all of this within blocks of the Merge.

Therefore, it’s probably unwise to try and get fancy with anything here. It’s likely not worth shorting stETH or USDC and putting any of your collateral at risk. There are too many unknowns and you’ll likely just lose to the bots.

The easiest thing you can do to capitalize on the potential fork is to stack as much ETH as possible ahead of The Merge (in a safe manner pls).

This is because while it’s unclear how each individual token will perform on the PoW chain, a legitimate version of ETHPOW will probably retain some value—at least in the short to medium term.

A Quick Bull Case for ETHPOW

A lot of people want to brush off the Ethereum-PoW chain. There’s merit to this given the track record of other forks and importantly, that this isn’t a contentious Ethereum fork (unlike Bitcoin & Bitcoin Cash).

Outside of miners, the Ethereum community is fully aligned on Proof of Stake.

However, there are two key points that drive a basic bull case for ETHPOW.

First: If there’s a fork that successfully becomes a Schelling Point for all miners, the Ethereum-PoW network becomes very decentralized and secure, providing high settlement assurances for users.

In fact, the Ethereum-PoW chain would actually become the third most secure blockchain behind Bitcoin and Ethereum-PoS. This doesn’t make the chain inherently valuable, but it does provide a critical foundation for it to become so, especially when it’s already been battle-tested.

Second: Ethereum Proof of Work has a long history of success. It has supported trillions of dollars of economic activity over the last 7 years without fail. We know Ethereum PoW works—there’s evidence for it. On the other hand, we’re only pretty sure Ethereum PoS works.

There’s no official track record yet, adding a degree of risk with the Merge.

So, if the Merge does go belly up for any reason, Ethereum PoW will continue chugging along without fail. As a result, you can almost view ETHPOW as a hedge against the Merge if you have any concerns.

Grab A Pint & Relax

This is a unique event within the crypto industry that no one has ever seen before.

There are a lot of variables to account for.

If you’re confused by this situation, that’s totally ok. The good news is that you don’t actually have to do anything.

The Merge is going to happen, Ethereum will shift to PoS as intended, and everything is going to be alright.

There might just be a little chaos that ensues for a brief moment.

My recommendation?

Happy Monday.

- Lucas