The Best Barbell Strategy for Crypto Natives

Dear Bankless Nation,

Crypto has been the greatest equitable wealth-generation event in history.

If you’ve subscribed to this newsletter, chances are you’ve earned at least four figures on our airdrop guides alone.

But let’s not forget that with every bull market, there’s an impending bear market. We don’t know when or how bad the next one will be, but a prudent investor is always prepared. Many reading this are first-time investors—you don’t have to learn about bear markets the hard way! You can be ready for them. You can benefit from them!

We’ve been fortunate enough to gain wealth…let’s keep it too.

Today, Lucas introduces us to his preferred Barbell Investment Strategy:

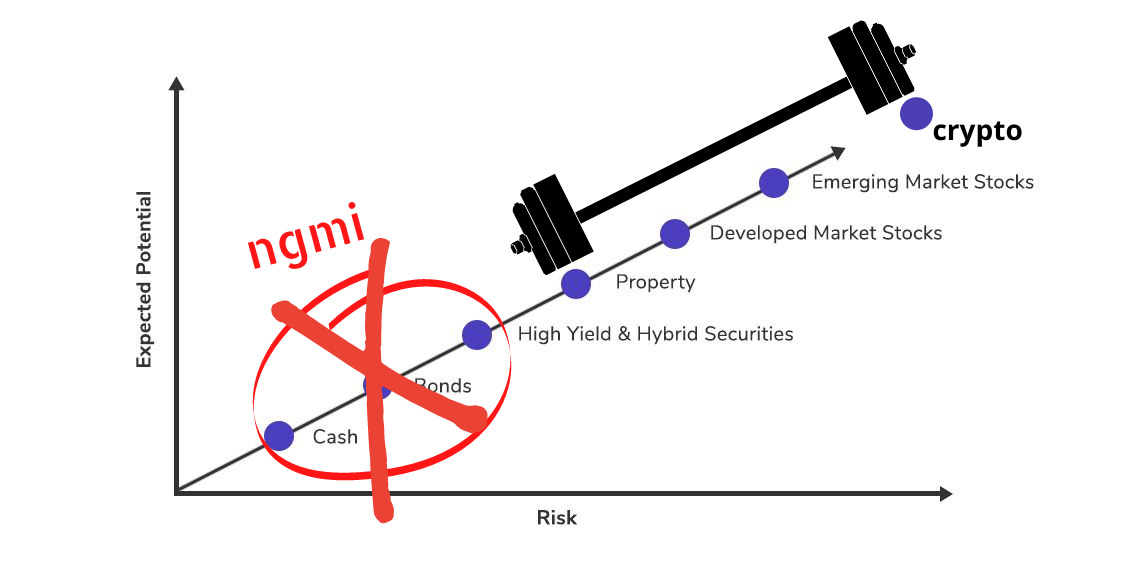

The barbell strategy is an investment concept that suggests that the best way to strike a balance between reward and risk is to invest in the two extremes of high-risk and no-risk assets while avoiding middle-of-the-road choices.

Going through the various investment asset classes, Lucas outlines reasons why cash, bonds, and stocks no longer cut it in the current market and sets his eyes on real estate, the optimal investment strategy to balance against crypto.

Let’s dive in.

- RSA

A lot of crypto natives have a disproportionate amount of their wealth in this asset class.

We’re talking about 90% or more of their well-being reliant on the performance of magic internet money. While it’s great that we have this level of conviction on the future crypto and concentrated bets are a great way to grow wealth, as an intelligent investor, it’s worth considering a hedge against the volatility in the instance of another bear market. Anyone that has been through one knows the pain—you don’t want to go through it again. And if you haven’t been through a bear market before, it’s best to prepare before you get blindsided.

The problem is that many of us are all lost on the same question: “Where else would I put my money?”

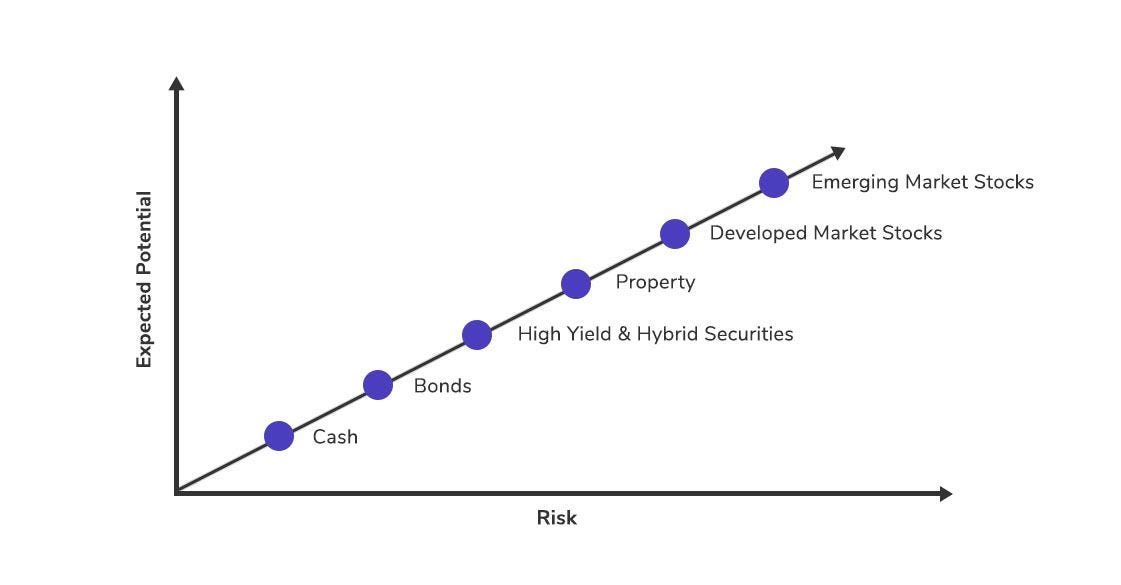

Let’s run through a couple of the options available based on this simplified risk curve.

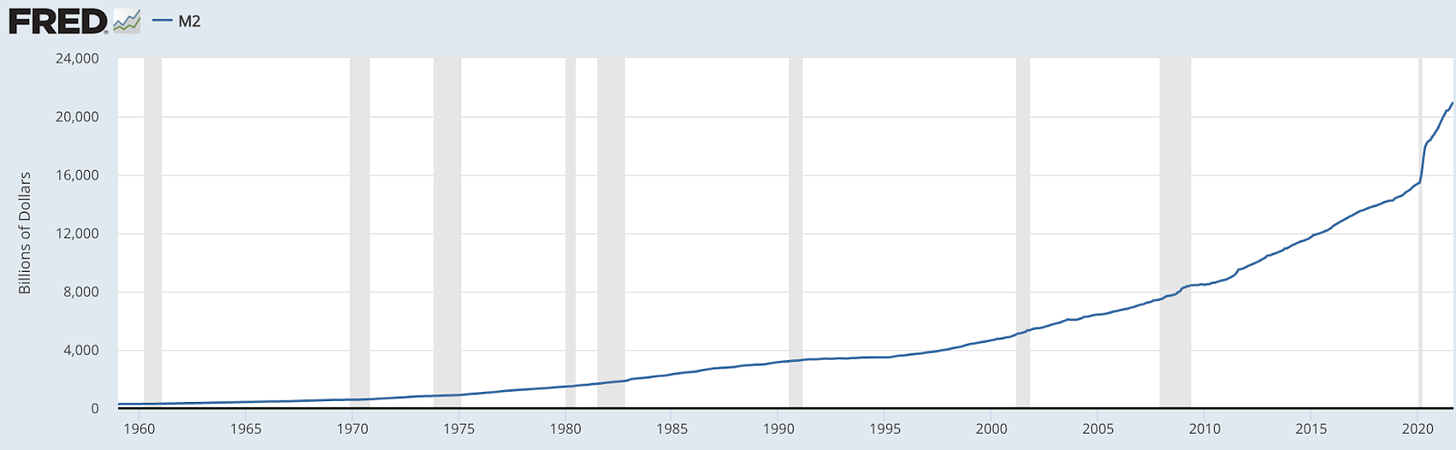

The “safest” option is cash. Historically, storing cash in a high yield savings account would provide steady passive income, but this strategy doesn’t cut it anymore. The average interest rate on a savings account is 0.06% APR. But worse, the total amount of US dollars in circulation has increased by 37% since 2020. This has caused inflation to bubble as the narrative has gone from “it won’t happen” to “it’s transitory” to “it’s running hotter than expected.”

There’s no denying that inflation is heating up. Governments are printing fiat currencies at an unprecedented rate. Today’s cash strategy is to hold what you need for living expenses and perhaps a few months in liquid cash in your “oh-sh*t fund.”

So, if you’re storing away greenbacks under your mattress to preserve your wealth, you’re ngmi in the coming decade. Sorry.

Alright, so cash isn’t a viable option anymore—what’s next?

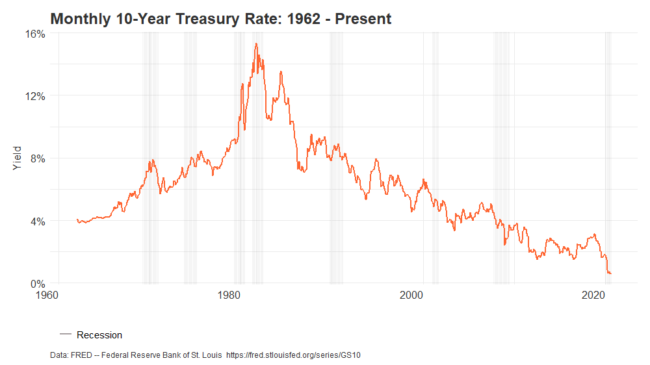

A step up from cash on the risk curve would be the bond market. (I literally laughed when I typed this.) I’m not sure if anyone under the age of 30 is investing in this market anymore. It’s a joke. 1-Year U.S. treasuries offer 0.1% APR, the 5 year offers maybe 1.0%, the 10 year sits at a lofty 1.5%, while the 30 year sits at 2.0%. Even 10Y Treasury Inflation-Protected Securities (TIPS), the government’s offering that’s supposed to protect investors against this exact scenario, net -1% (yes that’s negative).

Looking at the trend, it doesn’t look like rates will be increasing by any meaningful amount in the future either (truth be told the U.S. government can’t afford to do it anyway).

Also, let me repeat myself: M2 money supply (cash and cash equivalents) has increased by 37% in less than two years. If your net worth did not increase by the same amount in that period, you lost to Jerome and the money printer. Yes, this is an oversimplified take but it gets the point across—you need to generate a higher return than the rate the M2 money supply is expanding. Therefore, if you entrusted the U.S. government to preserve and grow your purchasing power with 10Y or 30Y treasuries, just as the boomers did for decades, you're down by -23% against inflation. Tough luck.

So you can’t rely on the “risk-free return” that the government offers anymore. What else do we have?

The next option is hybrid and high-yield securities. This is stuff like corporate bonds. We’ll gloss over this, but the average Corporate A yield is 2%. Not enough.

That brings us to equity markets.

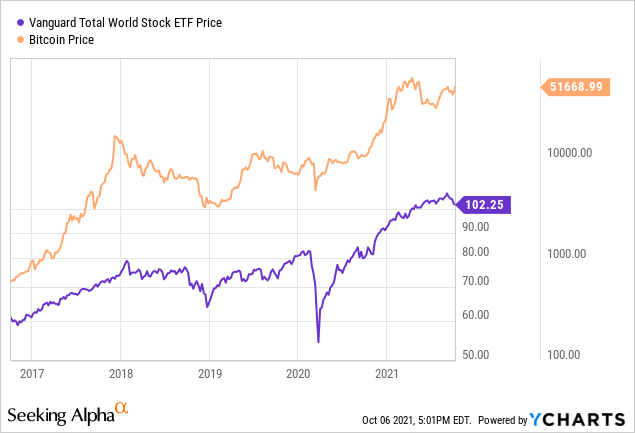

The U.S. stock market has a long history of sustainable and moderate returns, so it may feel like the most natural alternatives for many crypto natives. The problem is that it doesn’t really fit into the barbell strategy. You have the high-risk box already checked off with crypto. You want something lower risk and uncorrelated.

See GME, AMC, TSLA, and the debacles that have occurred over the past year or two since the money printer started going brrr. Warren Buffet-esque investing strategies based on fundamentals will still net you decent returns, but they will inevitably be dwarfed by meme and tech stocks.

The stock market has become a similar casino, just slightly less volatile than crypto markets. And in this risk-on environment, correlations are largely the same. If there’s some major market correction (see the COVID crash), crypto and stocks are likely to go down together. They’re both risk-on assets. As mentioned, this really isn’t what you want to be looking for.

You’re getting lower returns with the same correlation. Not worth it.

Ok... so cash, stocks, and bonds are largely out of the picture. What’s left?

The best answer that I’ve found is real estate. And I think when paired with crypto assets, this could be the best barbell strategy heading into the next decade.

Let me explain.

The Tale of Two Scarcity Games

Real estate, gold, and Bitcoin are all hard assets that have scarcity games. A scarcity game is effectively a money game with a fixed supply asset where the goal is to accumulate as much as possible.

Borrowing from Michael Saylor, Bitcoin is digital real estate. There’s a fixed amount of BTC (21M) in existence, meaning only 0.0025 BTC per person on the planet. No individual or entity can create more of it either. I don’t think we need to dive into this one much more given the audience of this newsletter, but if you’re interested, I’d recommend reading David’s article “The Bitcoin Scarcity Game” to understand why the Bitcoin Scarcity Game is worth playing (and how ETH and other crypto assets play into this scarcity game).

The thesis for real estate is oddly similar: There are roughly 15 billion acres of habitable land on the planet. That equates to roughly 2.3 acres per person. However, there’s a significantly lower amount of valuable real estate in the world. Unlike Bitcoin, this is a bit tougher to verify the exact amount. But as the old adage goes, real estate is all about “location, location, location”. As a result, there’s not enough property to go around for individuals. Importantly, like any good hard asset by the Austrian definition, no one can make any more land on Earth—at least not a material amount.

The throughline is that, like Bitcoin, real estate is a non-sovereign scarce asset.

The key difference is that one is digital and the other is physical.

This brings me to my point: The best barbell strategy for the coming decade is playing the two scarcity games, digital real estate (bitcoin) and physical real estate (property).

Given the audience here, we’ll assume that we all understand why Bitcoin is a good investment for the coming decade. But why real estate?

Why real estate is a good investment

1. Stable Returns with Flexible Leverage

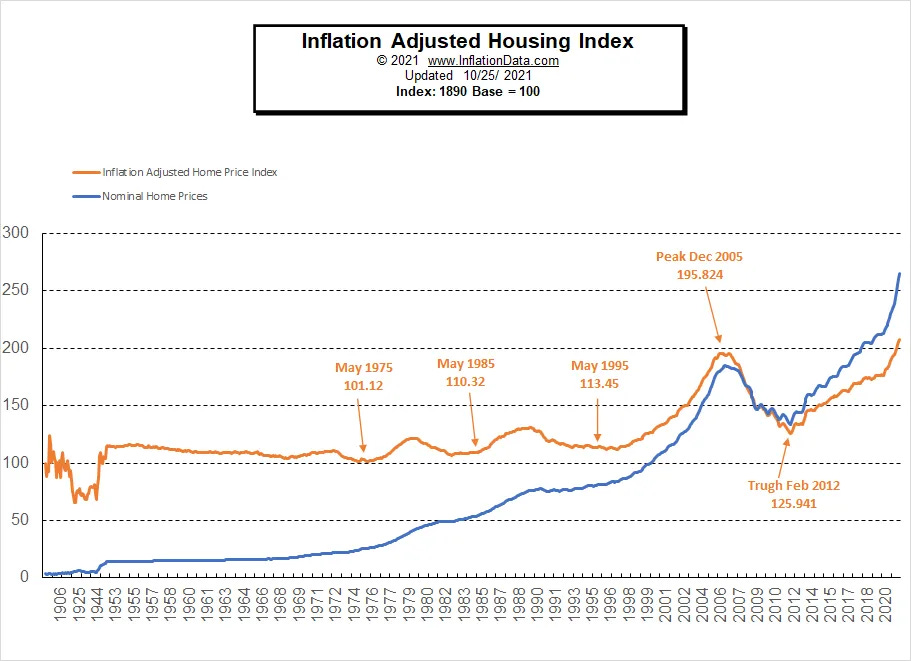

Prior to the 2008 financial crisis, real estate was largely regarded as one of the safest investments—especially in the United States. It only went up. However, the financial crisis reshuffled the narrative and since then, people have been highly skeptical about investing in real estate (for arguably a good reason). But when you zoom out, real estate has been a consistent, reliable performer that has held well against inflation over decades. I think this will hold true for the coming decades, despite the crypto bear market-like PTSD you may have from 2008.

With that said, the past year or two has treated crypto people very well. This puts a lot of individuals in a great position to have the flexibility on the risk they want to take with their real estate investment. Some people can just outright buy property cash—no questions asked. Interestingly, if you decide to purchase real estate by taking on debt (a mortgage), this also increases your leverage for returns on the property.

Let’s say you put the standard 20% down on a $500,000 property. You’re in for $100,000 and some change to account for closing costs, moving costs, furniture, etc. On the other side, you took out a $400,000 fiat loan from the bank at some of the lowest interest rates in history. In return, you have price exposure to a $500,000 asset for $100,000, representing 5x leverage. The U.S. national average property returns 3.5-4% per year. This means that in one year on your $500K property, you earned $17K-20K in property value.

That’s a 17.5-20% annualized return on your $100K investment minus the interest you paid—not the boring 3.5-5% that’s advertised. Taking it a step further, if you’re a first-time homebuyer, you can truly become a degen with as low as 3% for the downpayment.

This is why real estate can become so powerful—it’s flexible leverage on a relatively low-risk, stable asset. You can massively increase your potential returns by taking on “good debt” as you have a hard asset to back the loan (unlike credit cards where you just have the liability and no asset). That said, you're obviously increasing your risk by taking on the debt.

There are two important things here worth noting though. The first is that property values are increasing much faster than 3-4% a year given our current economic environment, especially if you find the right places.

Properties in San Jose, California increased by 10% last year. Boise, Idaho jumped 9.1% while Seattle, Washington rose by 9.7%. Smaller vacation-destination places, like beach and mountain towns, increased substantially more than that given the shift towards remote work, allowing people to live anywhere. Why live in a crowded city when you can go post up on a beach all year?

If you invested in any of those locations with the above scenarios, your returns over the past two years have been insane. We’re talking >50% annualized returns. This dwarfs any U.S. treasuries, the S&P 500, and feels in line with crypto to some degree (especially for an asset on the other side of the barbell).

Equally as important, inflation is heating up. So what’s the value of that $400,000 loan on a multi-year horizon when:

- The purchasing power of the dollar is going down

- The value of your loan stays fixed over time

- The property value continues to climb year over year

2. Tangible Utility

Not only is property an attractive lower-risk investment, but unlike our jpegs, there’s real utility in it. You have the option to live in it while continuously build ownership in the property.

When you rent, you’re effectively burning cash for short-term utility. You get to live in the house for that period and that’s it (you get a bit more flexibility and no liability though). With that said, you’re missing the most important part: No ownership.

But when you own the property you live in, you get a marginally increasing slice of ownership on every payment. You build more equity over time in the property, compounding your returns in the investment and tying back into the first point above (higher cash denominated returns every year).

But what if you don’t want to live in it?

3. Option for cash flows

The best part about real estate is that there’s always an option to generate cash on the property. Whether it’s short or long-term renters, there are plenty of avenues these days to start earning. Especially in popular areas, most people don’t have issues with finding people to fill the space at any point or for any duration.

Even in the worst-case scenarios, where the property owner puts the minimal viable cash down on the property, you can usually break even on your mortgage while still accumulating ownership in the asset. This is important because the money with this strategy is having inflation-protected exposure via the equity in the property. If you’re able to generate a profit on it, that’s the ultimate cherry on top.

That said, when you have no loan or a small loan on the property and the rent is largely profitable, the fun begins. Owning the first property cash is the first step in dominating the real estate scarcity game. Once this happens, you can have the first property pay for the mortgage on the second property, and the second home is “free” (whether you want to live in it or rent it). Rinse and repeat.

🏠 The downside here is that you’re taking on liability with renting. You’re responsible for dealing with the damages, upkeep, etc. of the property. There are options to minimize this (like cutting in a property management company) but it’s worth highlighting as a legitimate risk when taking the option for cash flows.

But Ser?

There’s obviously risk with this barbell strategy. It’s not perfect. With that in mind, here are some high-level answers to common concerns:

What if the market crashes?

There are a couple of points to touch on here.

First, a lot of people have PTSD with real estate from the 2008 financial crisis—and rightfully so. Global wealth was decimated on a real estate bubble.

The thing is that on a macro scale, real estate has been a consistent performer over decades, if not centuries. Just like the stock market, despite setbacks, number goes up in the long term. Moreover, the majority of risk with buying real estate and this barbell strategy largely lies in taking on excessive debt. If you’re concerned about it, take on less debt and put more cash down (easier said than done).

Second, if there’s a black swan event that drives down asset prices, outside of the 2008 financial crisis, real estate tends to be a relatively safe place to be. It’s an illiquid asset so it’s usually the last to go. It takes a lot to sell (and buy) a house. Instead, people will turn to sell their liquid, risk-on assets like crypto and equities to weather the storm.

The other thing worth noting is that your wealth is already the riskiest asset of all time, so how much worse could real estate be if markets go south? :)

Why not just allocate into high-yield stablecoins?

This seems to be the most common strategy for crypto natives—and I think it could work. The problem here is that you're still exposed to the broader crypto ecosystem and the associated risk.

What if regulators start coming after DeFi or any of the stablecoin issuers? What if they make it illegal to old USDC or DAI or use high yield lending products (see lawsuits and threats to BlockFi, Coinbase Lend, etc.) What if there’s a smart contract bug that rugs you? Real estate offers an avenue that’s not associated or correlated with the crypto markets to any degree.

What about property in the Metaverse?

No.

Metaverse assets are farther up the risk curve, not down.

Building Wealth in the Coming Decade

If you’re sitting here with a significant amount of your wealth in crypto, and are looking for ways to diversify, real estate might be the best avenue. This doesn’t mean you need to sell all of your crypto or even a majority of it. You can sell a small portion to cover a small down payment, take on the mortgage payments, and be off to the races.

Stocks, bonds, commodities, cash—all of these are becoming increasingly less attractive by the day, especially for those with significant exposure to crypto. Either the returns are too low or the correlations are the same.

Investing has changed. With the government beginning to abuse the money printer, you can’t rely on the same investments that made the previous generations their wealth. You have to get creative, and arguably more risk-on to survive and thrive in this new environment.

While I’m extremely bullish on crypto in the coming decade, there’s a point for every crypto investor where they might have too much in it. Sometimes it’s good to take money off the table and make meaningful investments elsewhere so you’re protected in the instance of another multi-year bear market.

In an environment that is rewarding risk-investors, real estate strikes an interesting balance for those on the crypto journey. It plays beautifully into the two scarcity games: Digital and Physical Real Estate.

The investors that can play these two games well may likely become some of the most successful individuals in the world in the coming decade.

But we’ll have to wait and see.

Action steps

- 📖 Read the Ultimate Guide to Airdrops (full version for subscribers only!)

- 🎧 Listen to Layer Zero with DC Investor, a seasoned investor

- 👀 See how your peers are allocating their total investment portfolio in crypto